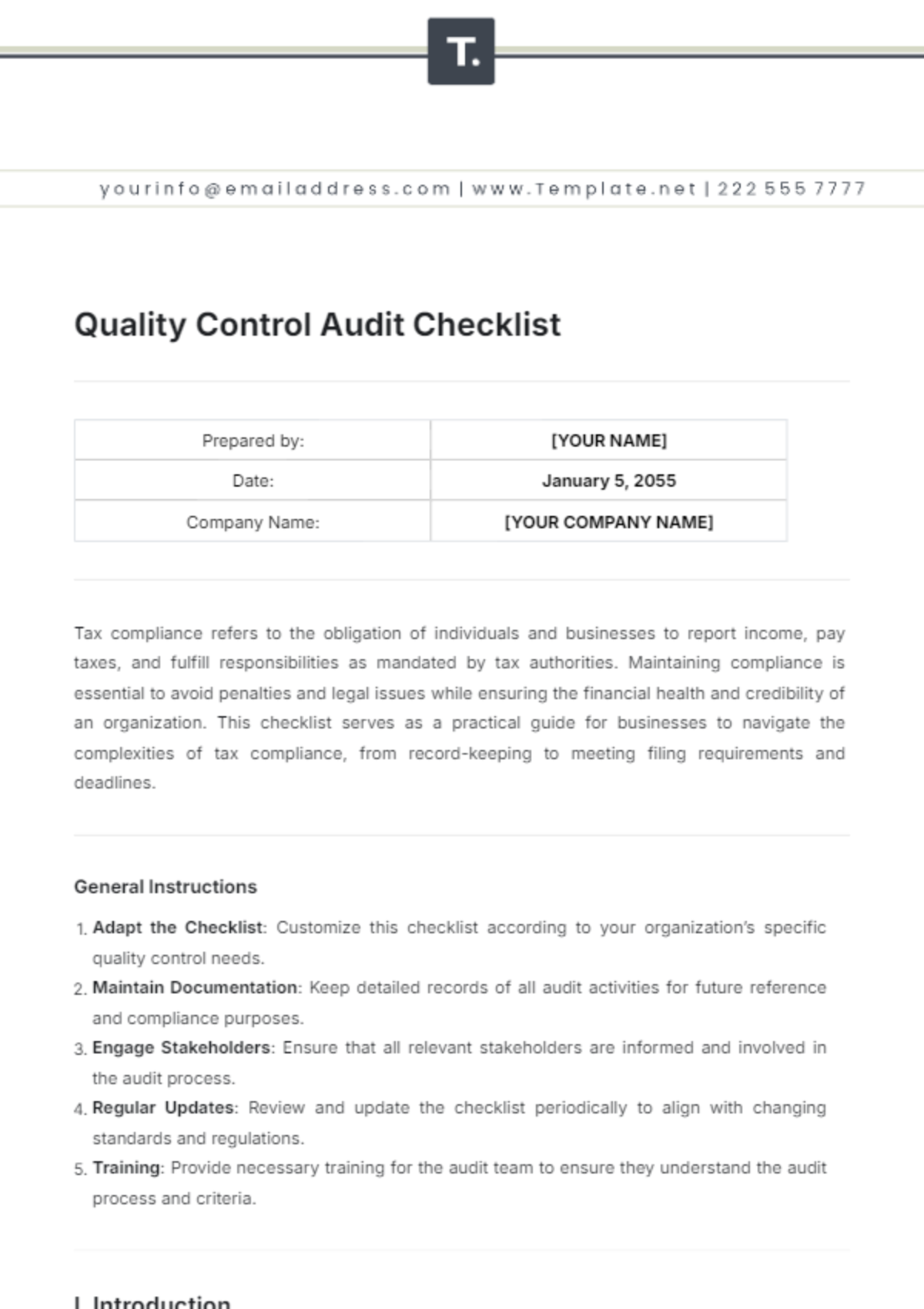

Quality Control Audit Checklist Outline

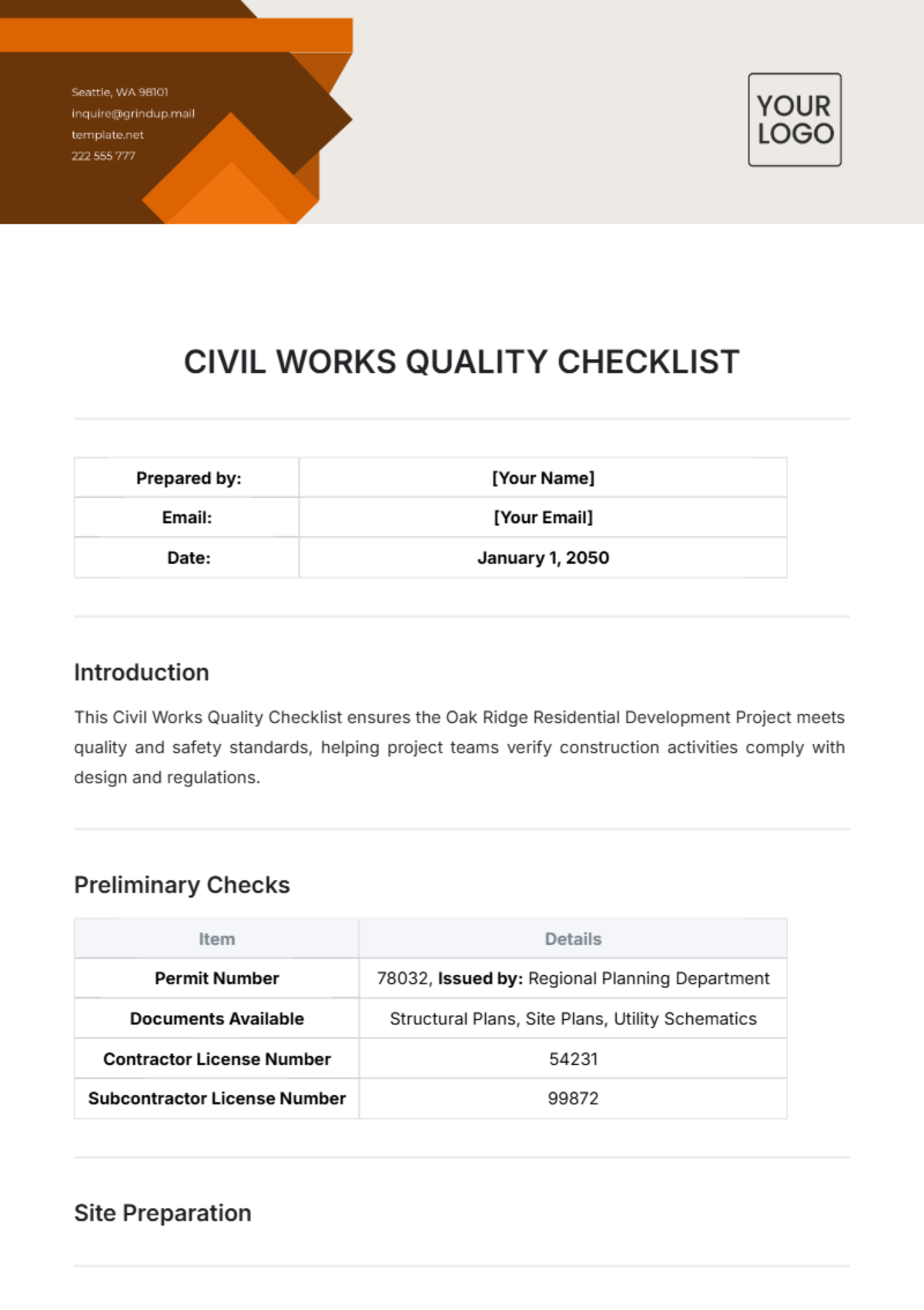

Prepared by: | [YOUR NAME] |

Date: | January 5, 2055 |

Company Name: | [YOUR COMPANY NAME] |

General Instructions

Adapt the Checklist: Customize this checklist according to your organization’s specific quality control needs.

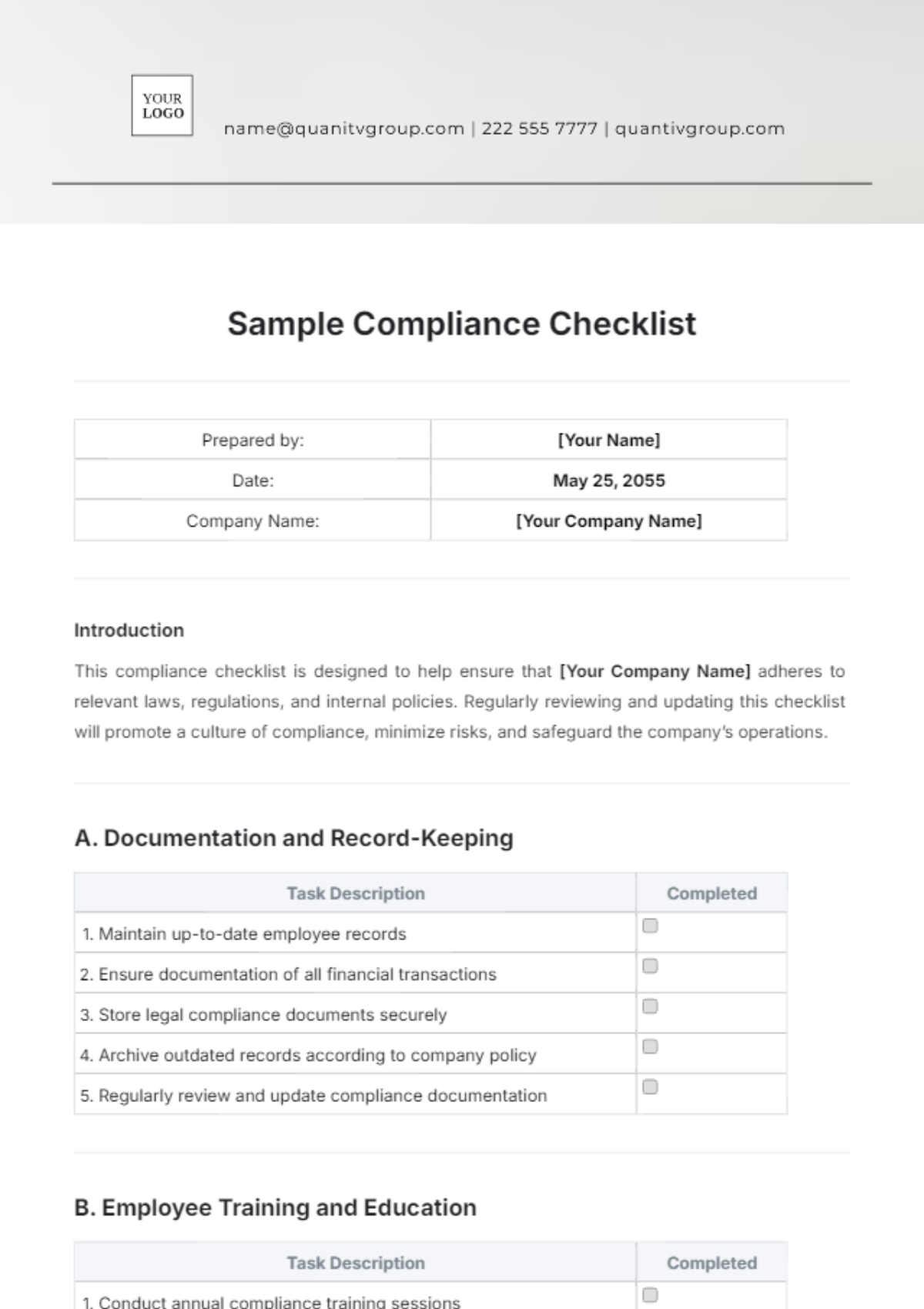

Maintain Documentation: Keep detailed records of all audit activities for future reference and compliance purposes.

Engage Stakeholders: Ensure that all relevant stakeholders are informed and involved in the audit process.

Regular Updates: Review and update the checklist periodically to align with changing standards and regulations.

Training: Provide necessary training for the audit team to ensure they understand the audit process and criteria.

I. Introduction

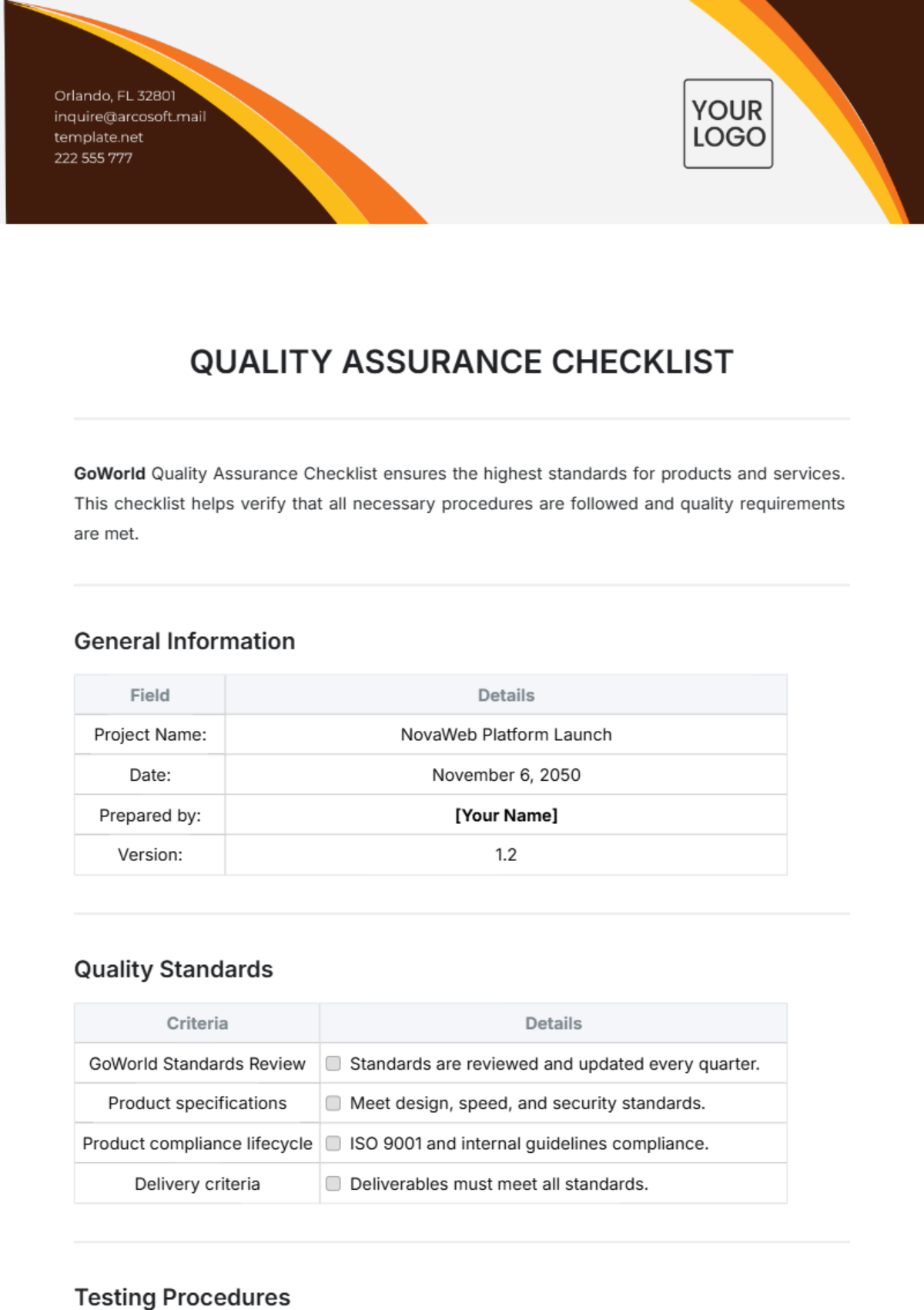

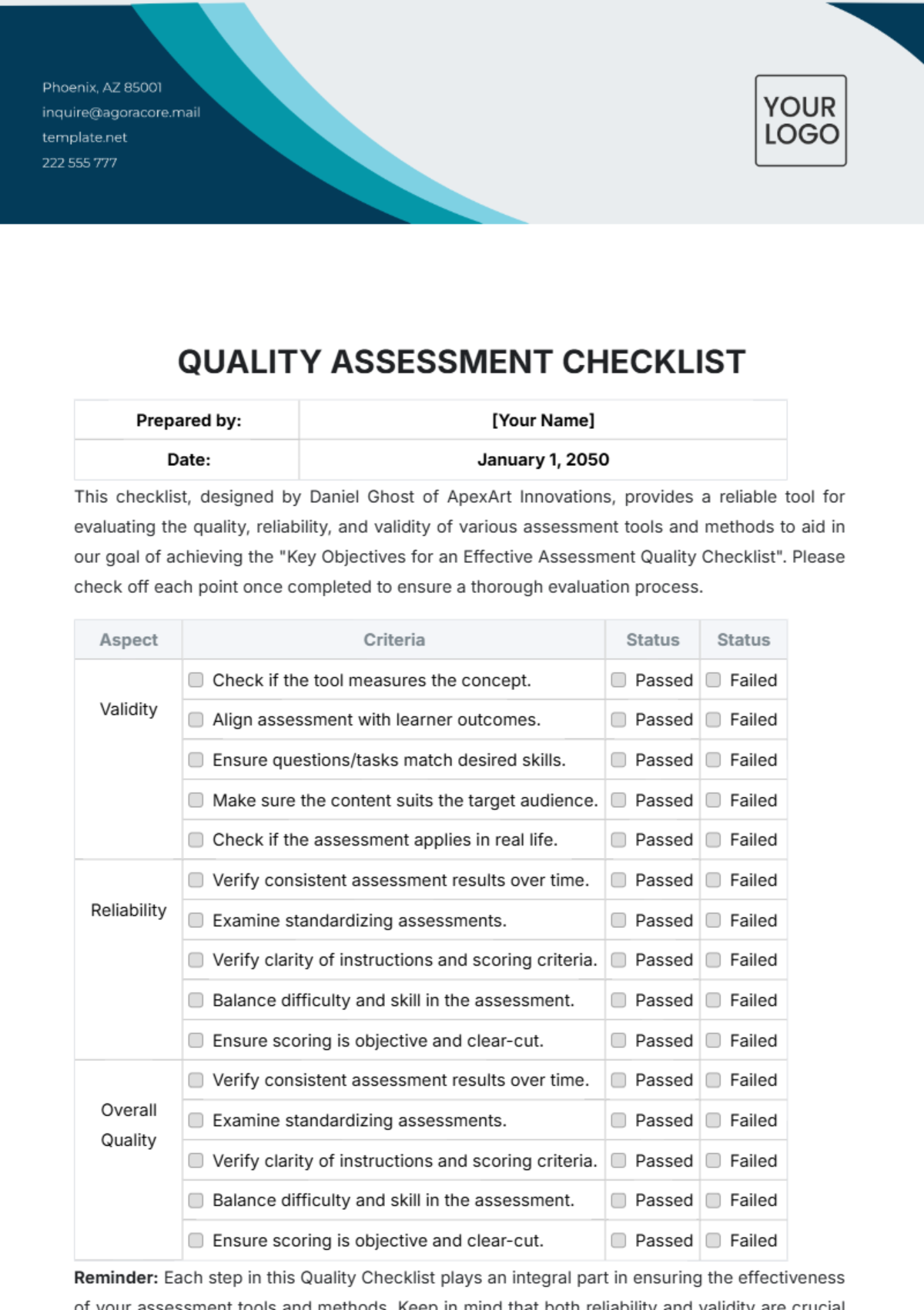

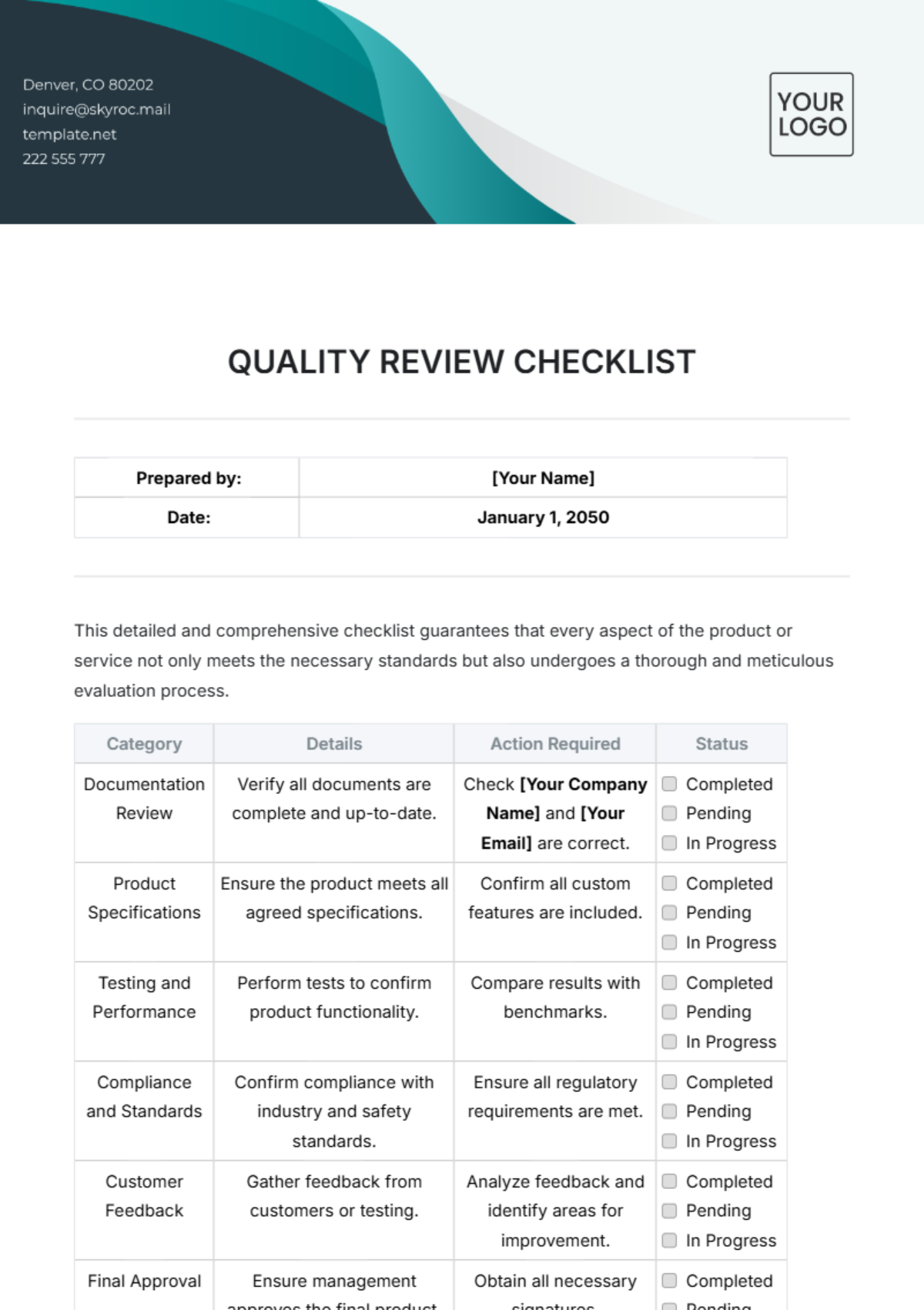

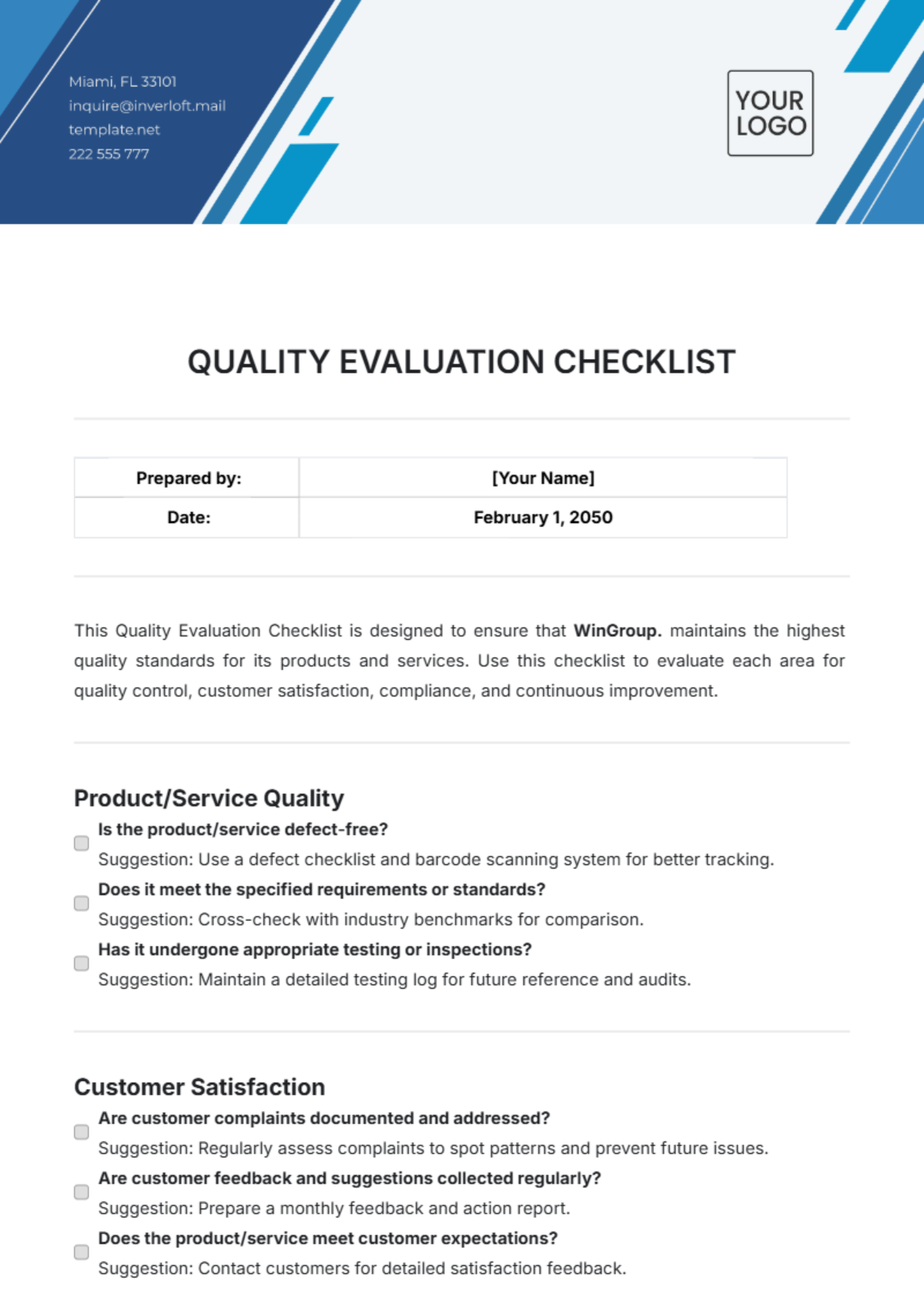

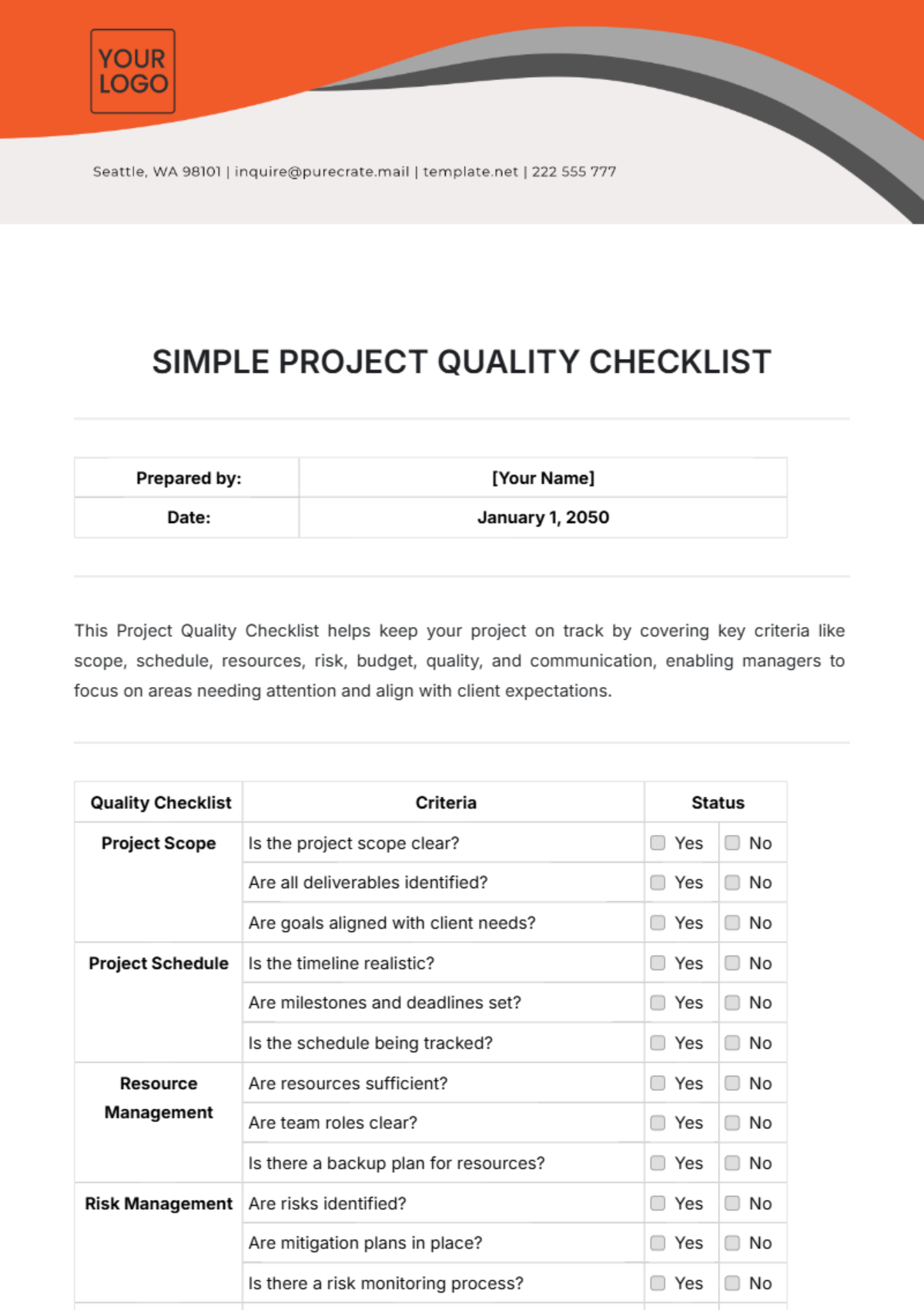

Purpose of the Checklist

Scope of the Audit

Definitions and Terminology

II. Audit Preparation

A. Pre-Audit Activities

B. Documentation Review

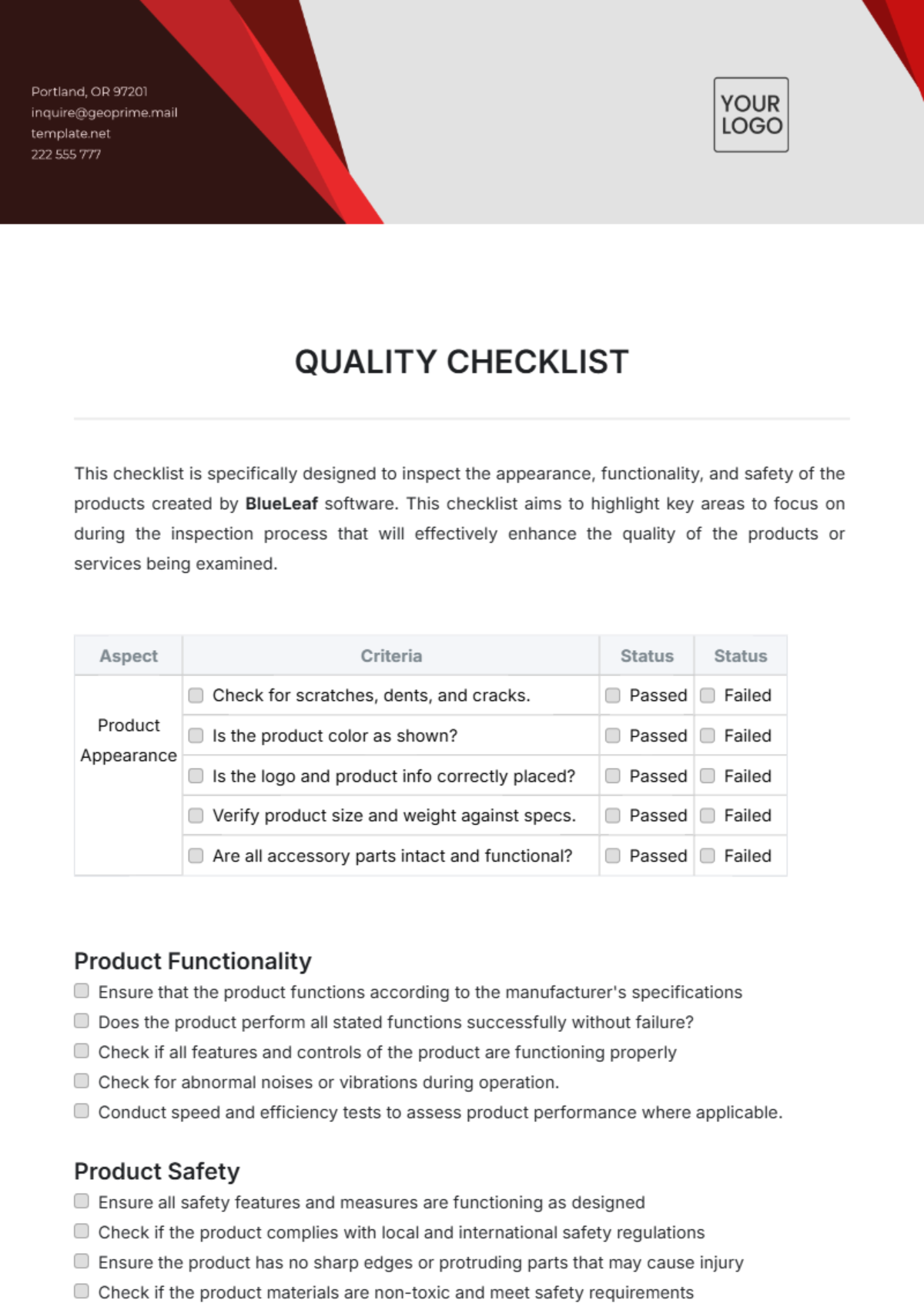

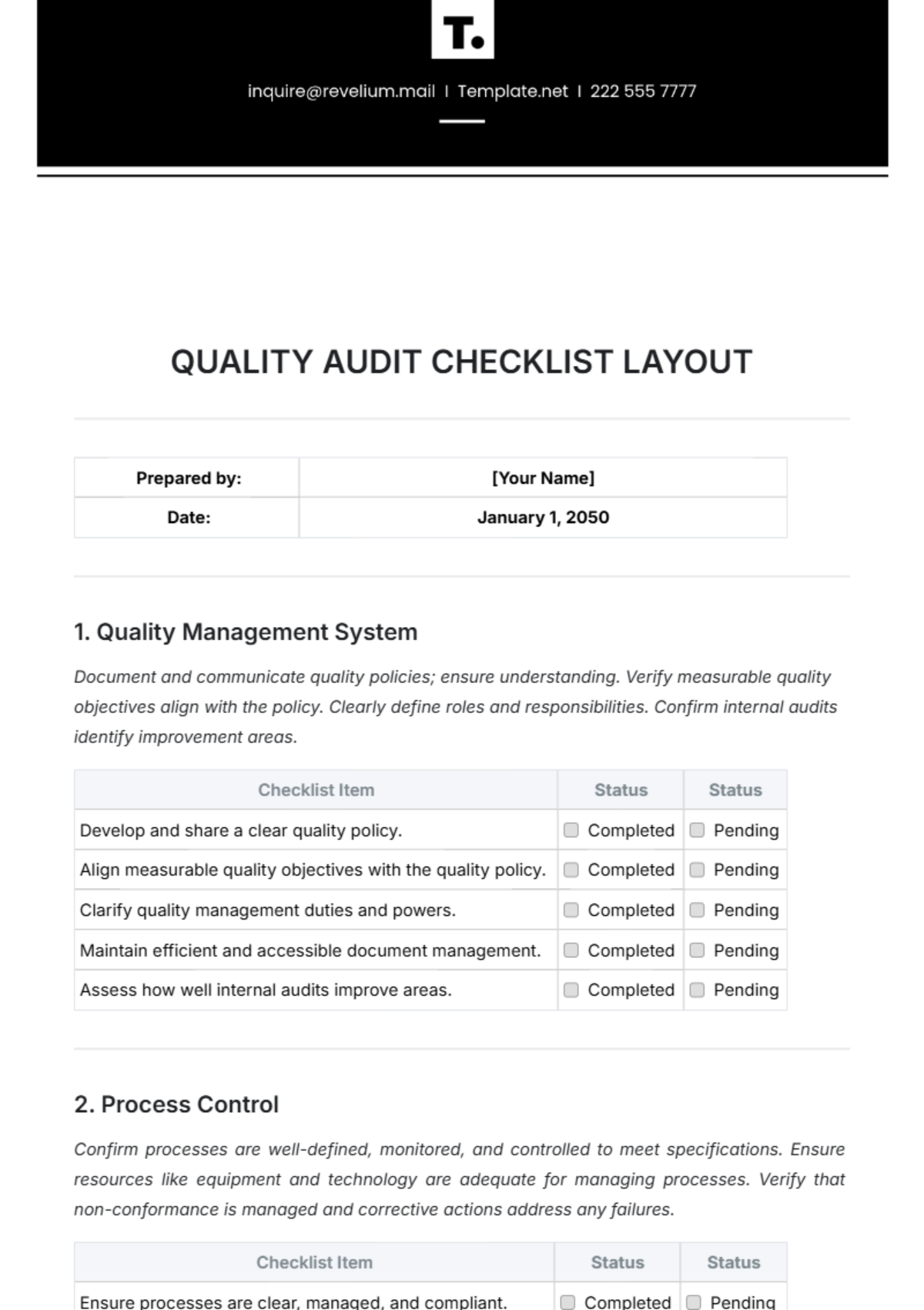

III. Audit Criteria

A. Quality Standards

B. Internal Policies and Procedures

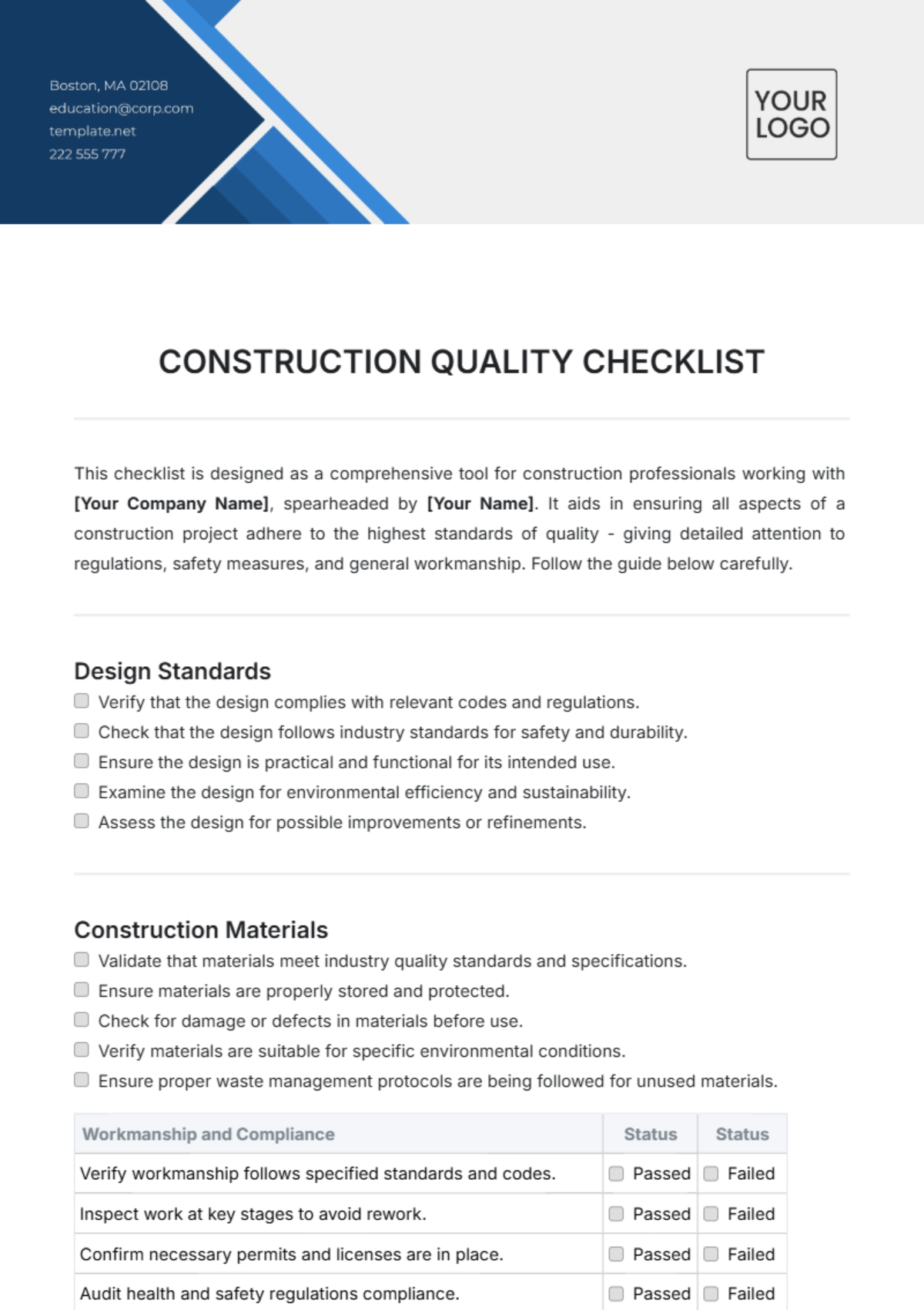

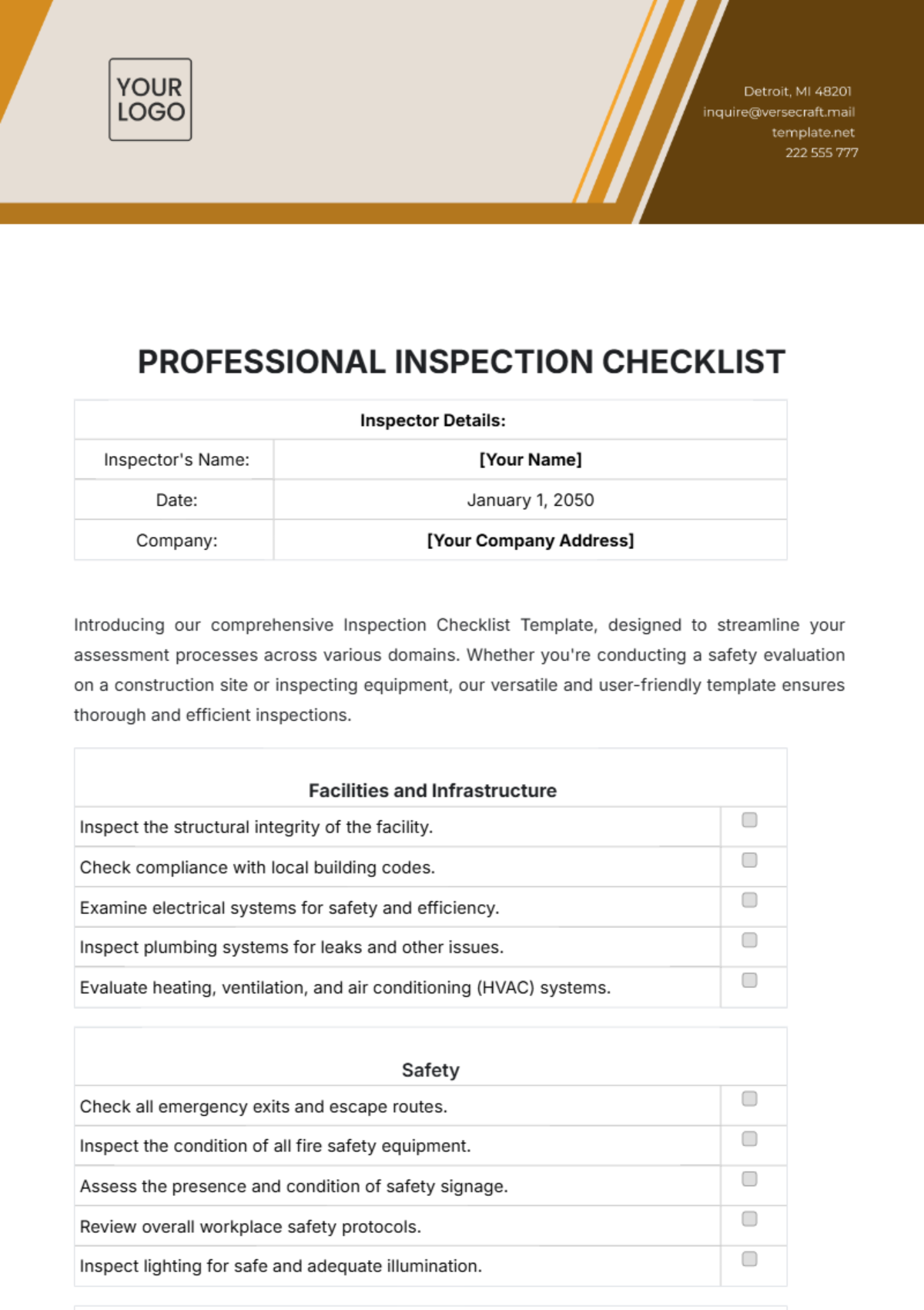

IV. Audit Areas

A. Management Commitment

B. Quality Planning

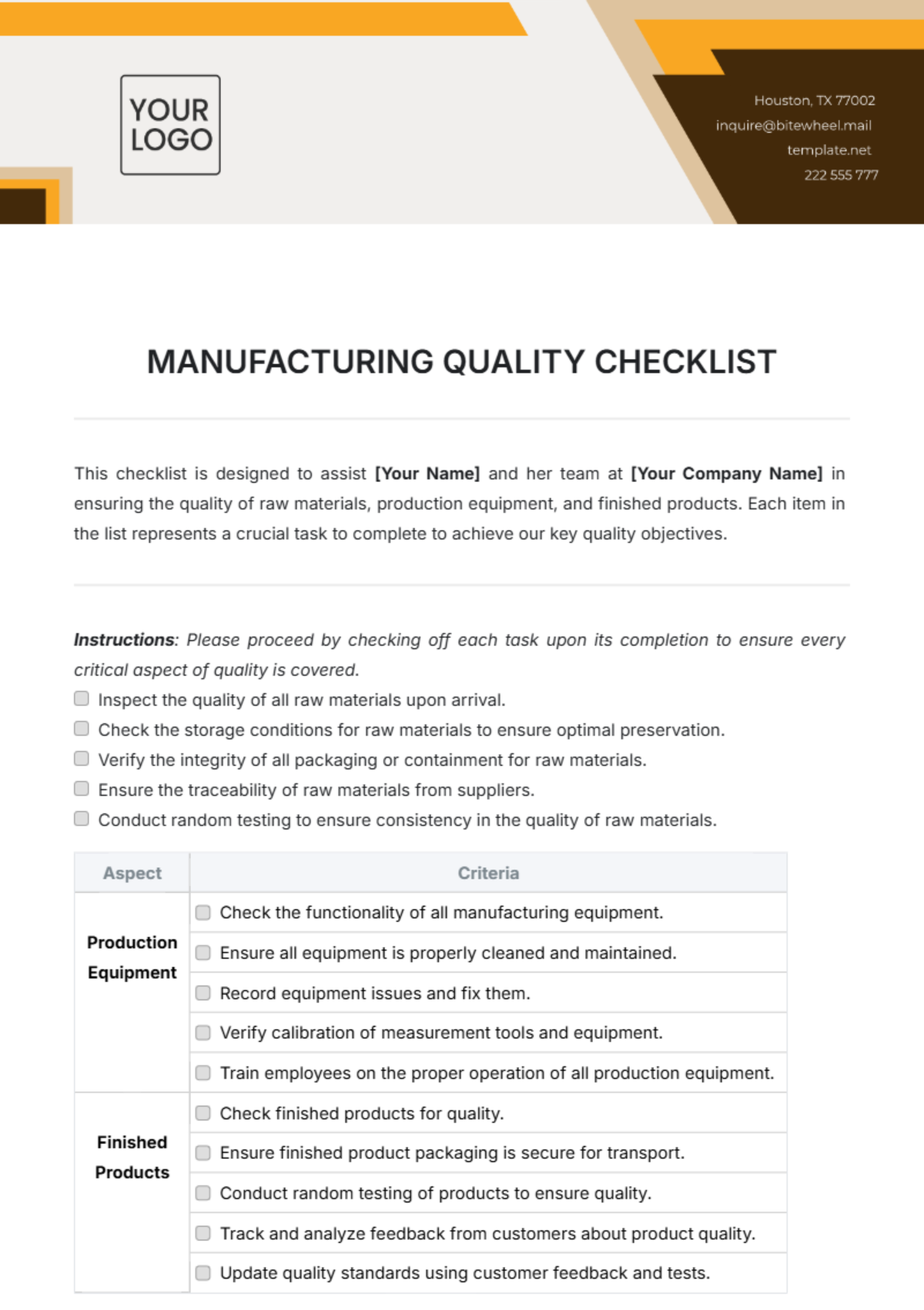

C. Process Control

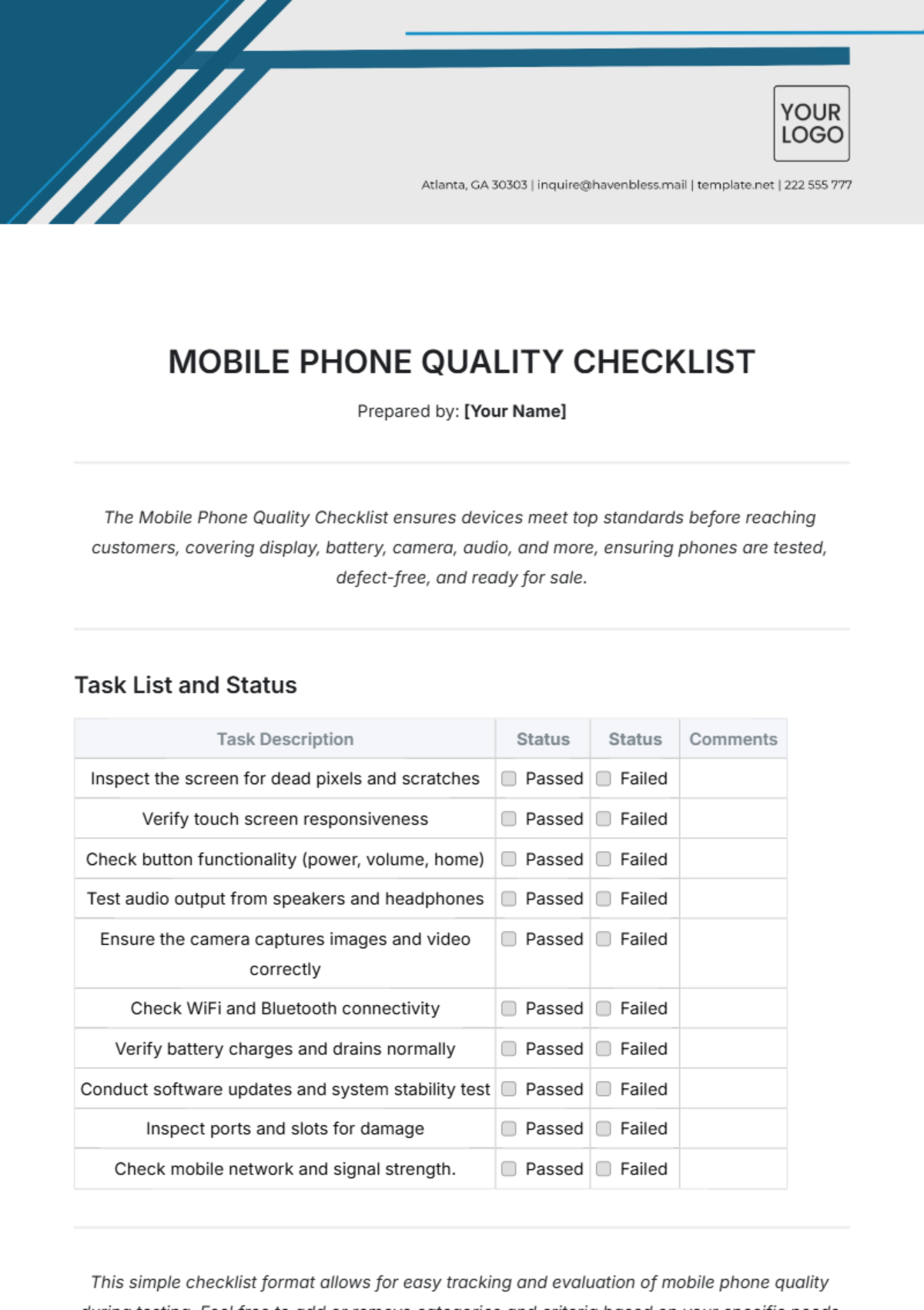

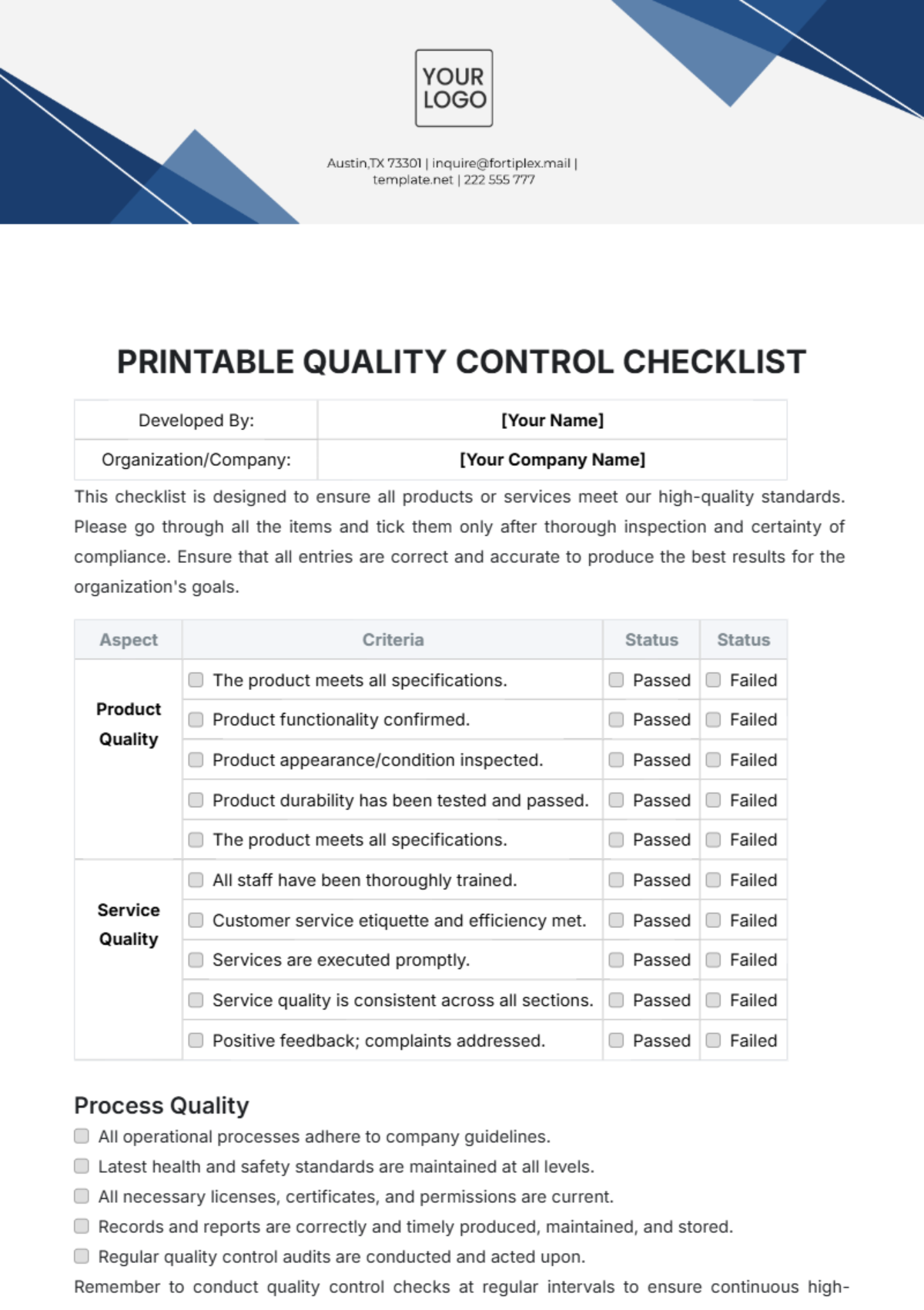

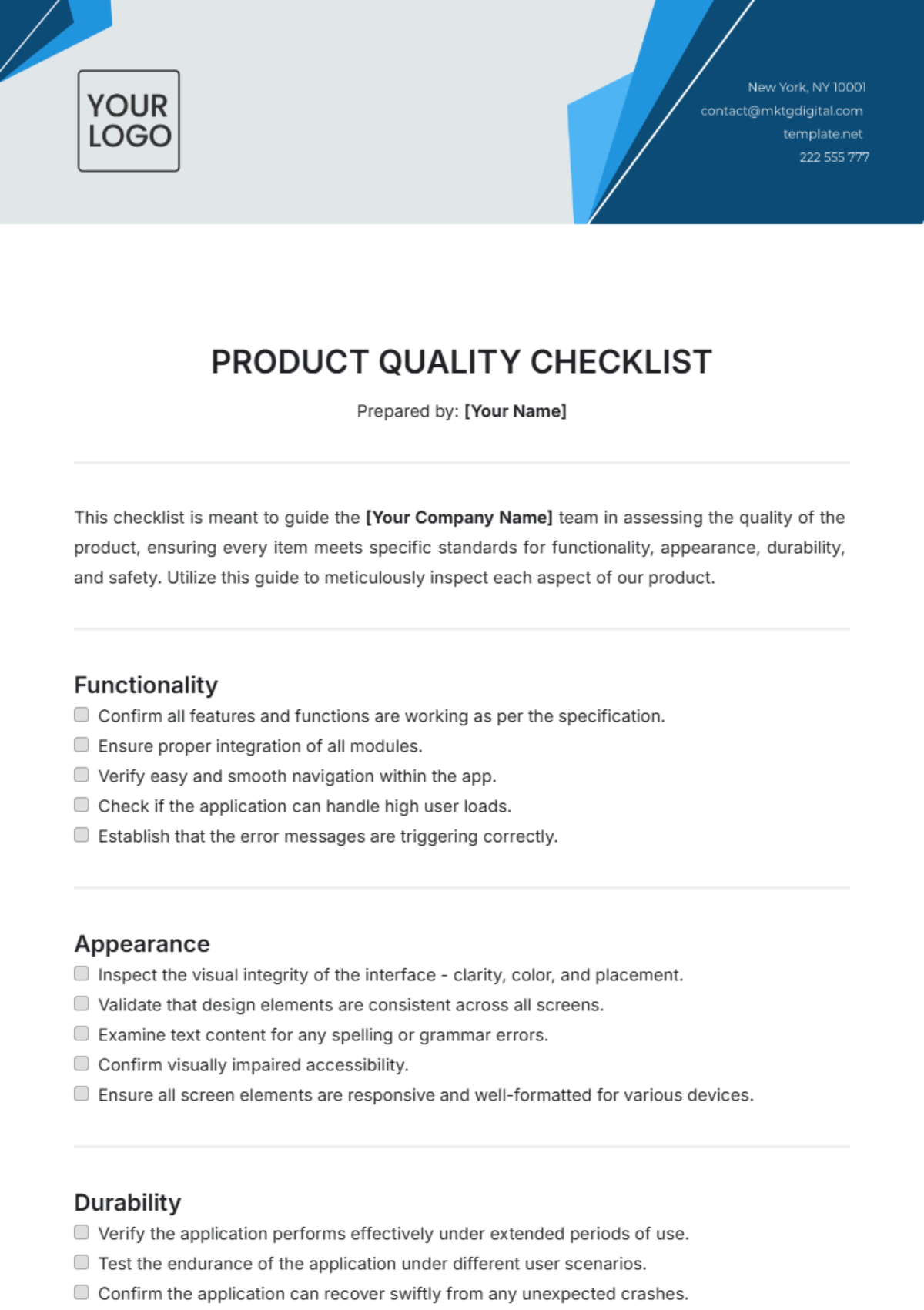

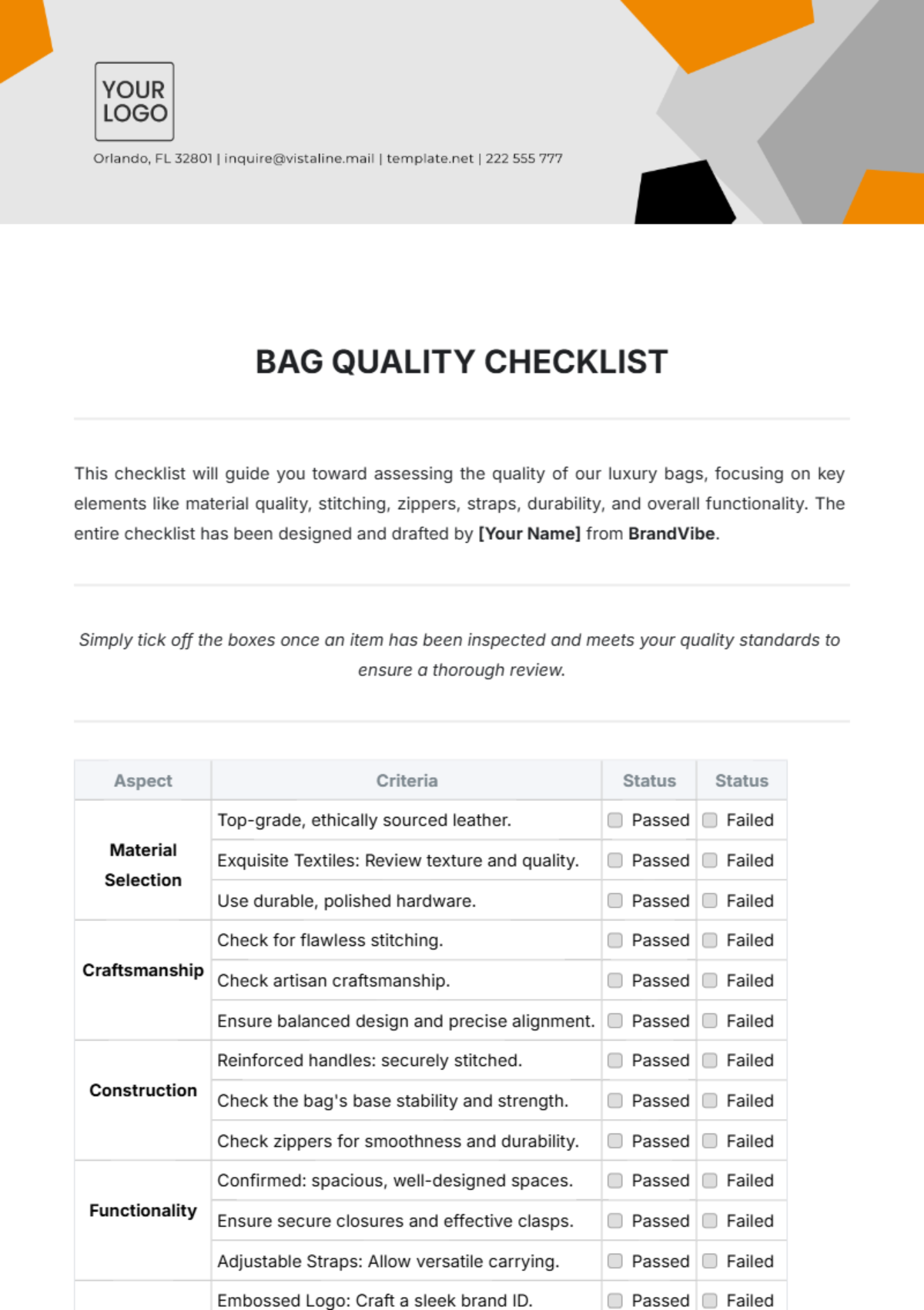

D. Product Quality

E. Training and Competence

F. Continuous Improvement

V. Audit Execution

A. Conducting the Audit

B. Data Collection

VI. Audit Findings

A. Reporting

B. Closing Meeting

VII. Follow-Up Actions

A. Corrective Action Plans

B. Review of Effectiveness