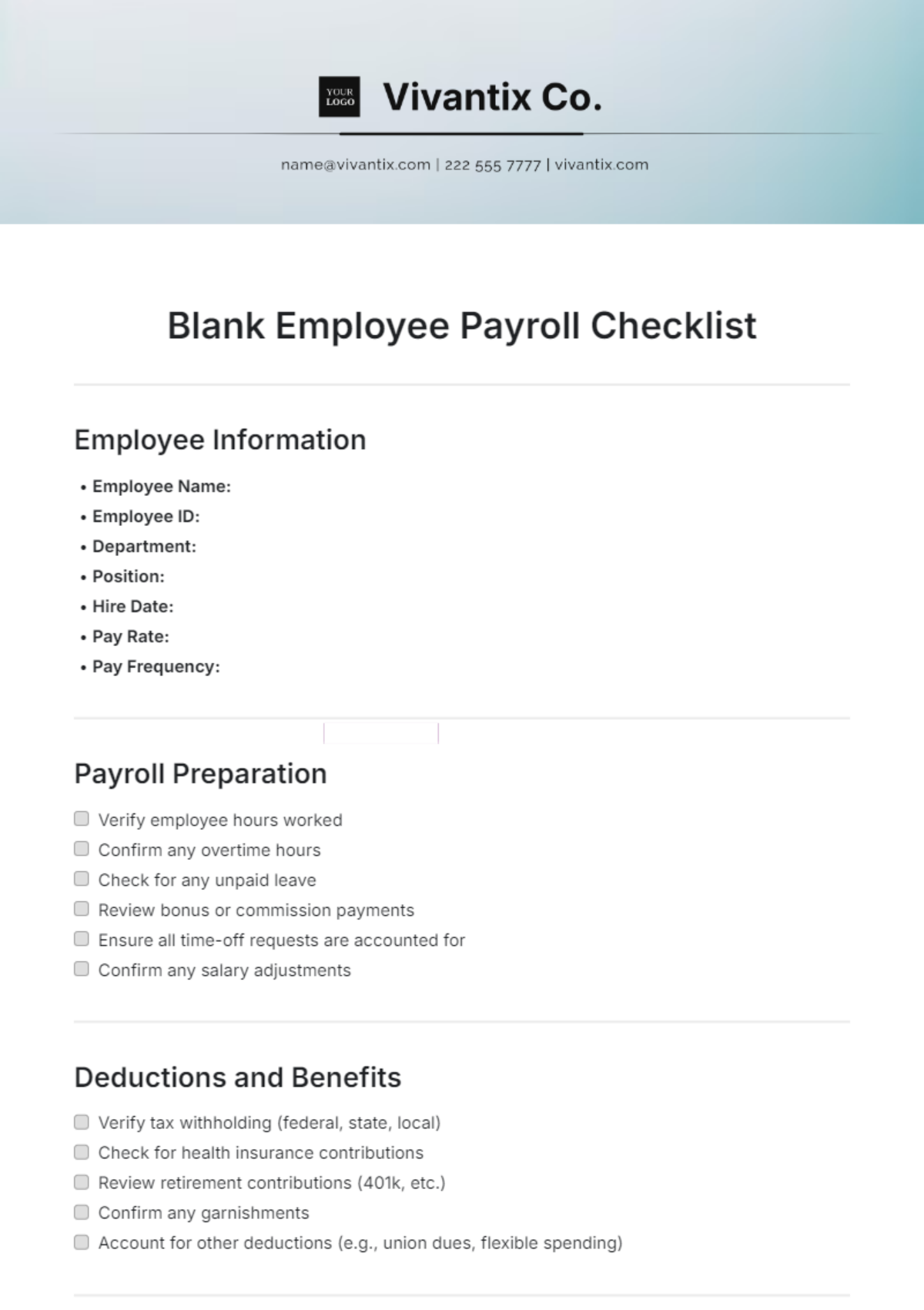

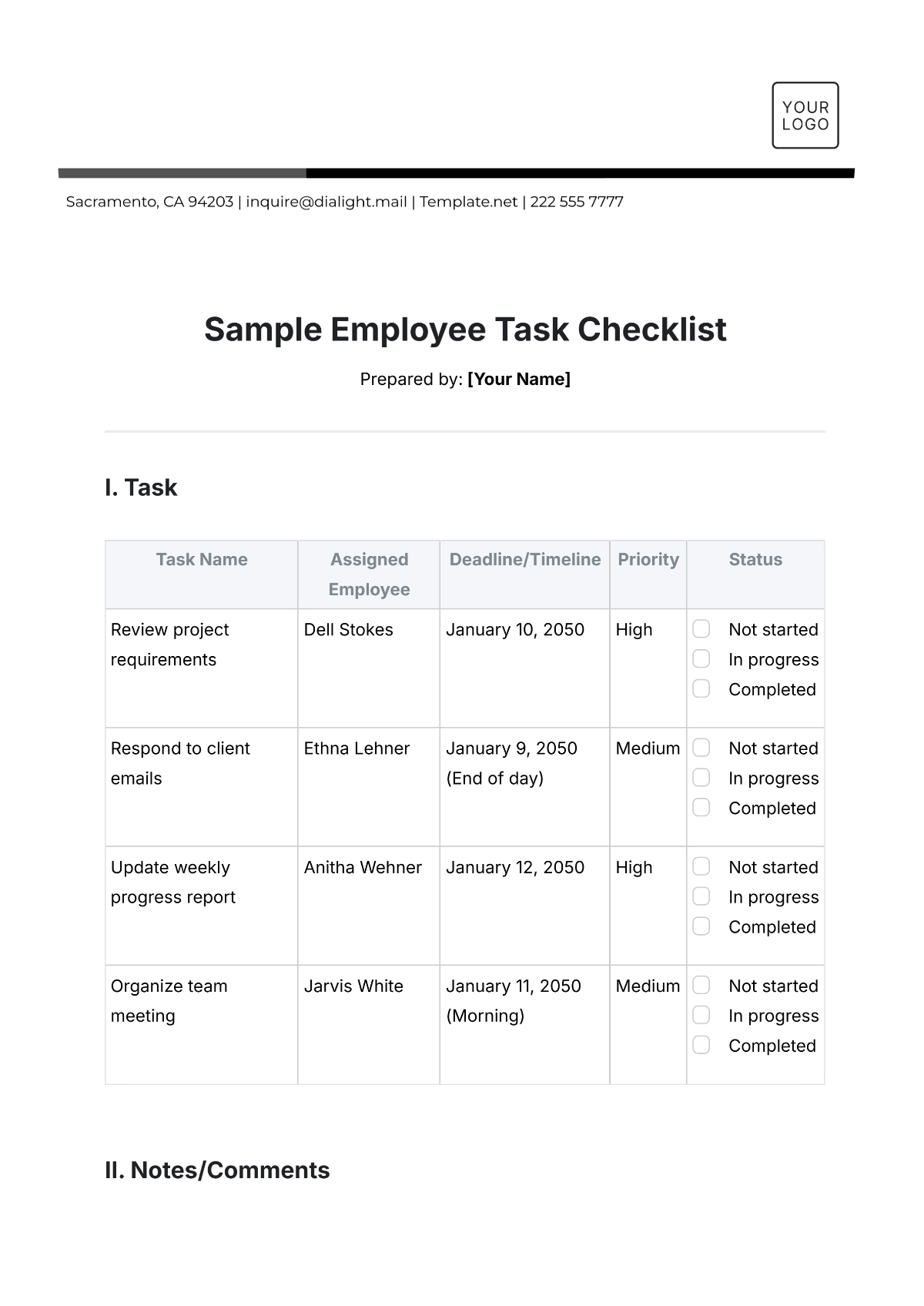

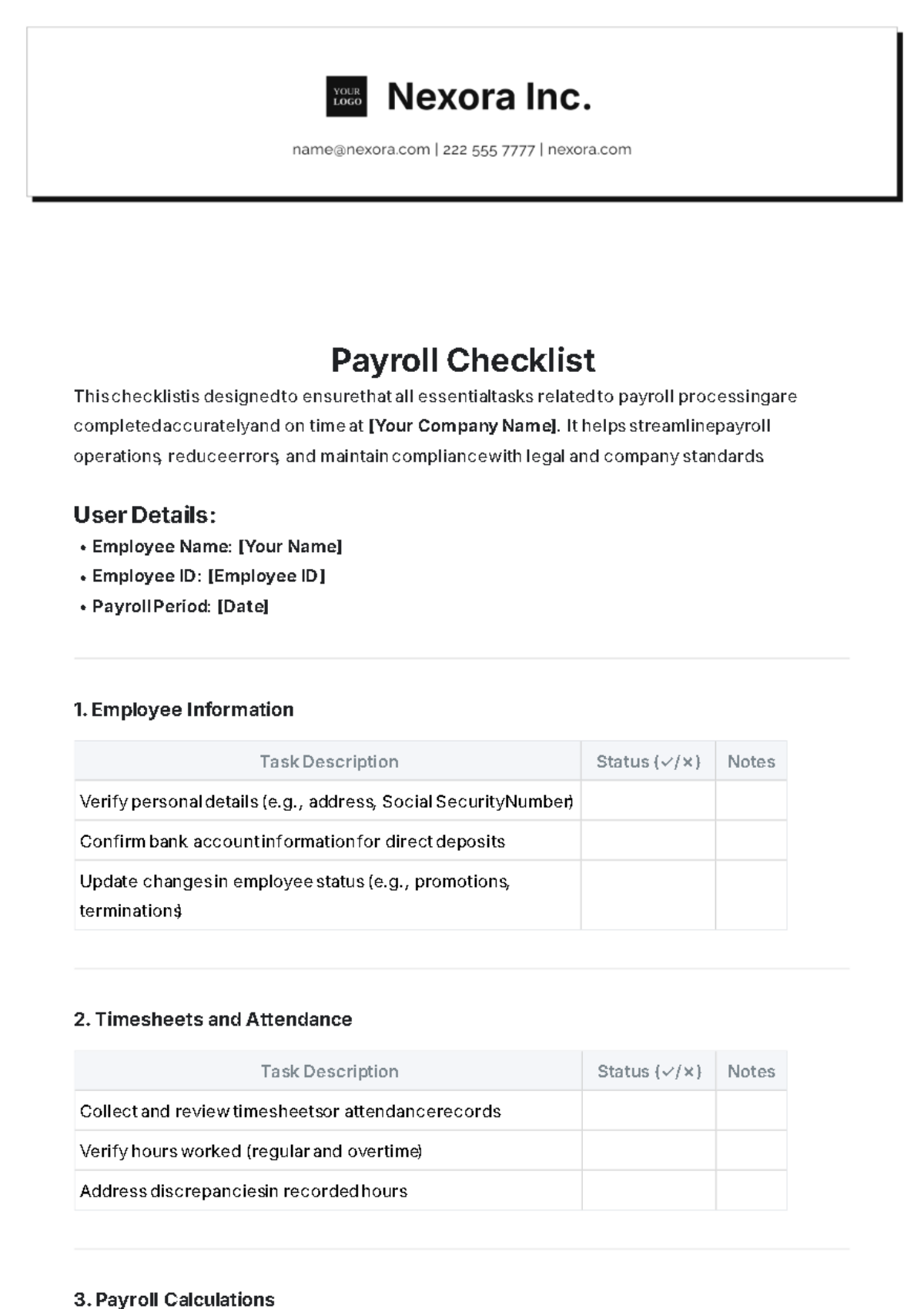

Blank Employee Payroll Checklist

Employee Information

Employee Name:

Employee ID:

Department:

Position:

Hire Date:

Pay Rate:

Pay Frequency:

Payroll Preparation

Verify employee hours worked

Confirm any overtime hours

Check for any unpaid leave

Review bonus or commission payments

Ensure all time-off requests are accounted for

Confirm any salary adjustments

Deductions and Benefits

Verify tax withholding (federal, state, local)

Check for health insurance contributions

Review retirement contributions (401k, etc.)

Confirm any garnishments

Account for other deductions (e.g., union dues, flexible spending)

Payroll Processing

Process payroll in the system

Generate payroll reports

Review payroll summary for accuracy

Submit payroll for approval

Make necessary adjustments if required

Post-Payroll Activities

Distribute paychecks or direct deposit confirmations

File payroll tax forms (if applicable)

Update employee records in the HR system

Archive payroll records as needed

Review feedback and resolve any payroll issues