Free Blank Payroll Audit Report

Introduction

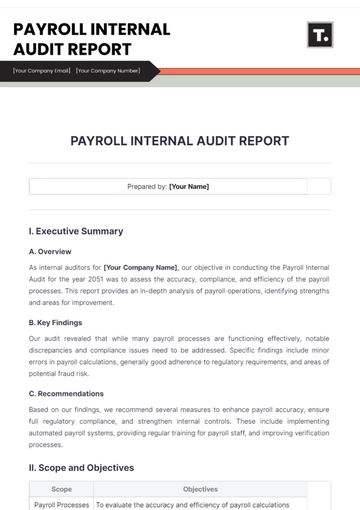

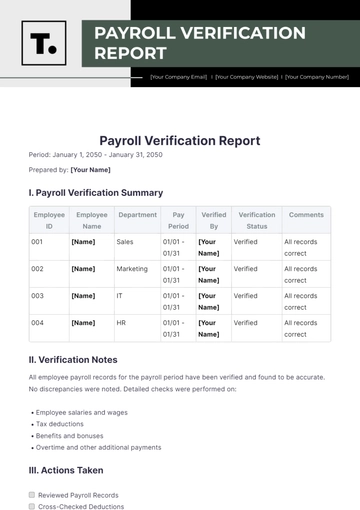

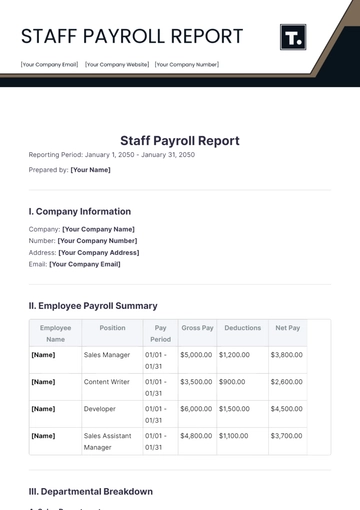

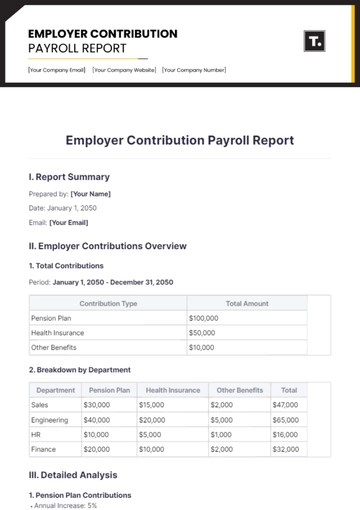

The purpose of this audit report is to examine and evaluate the payroll processes of [specific organization or process]. This audit aims to ensure compliance with applicable laws and regulations, assess the accuracy of payroll calculations, and review internal control mechanisms.

Scope and Objectives

The scope of this audit covers the following areas:

Accuracy of payroll calculations

Compliance with tax regulations

Assessment of internal controls

Timeliness and consistency of payroll processing

Methodology

The audit methodology involved:

Reviewing payroll policy documents

Interviewing HR and payroll personnel

Analyzing payroll data for a selected period

Conducting a risk assessment

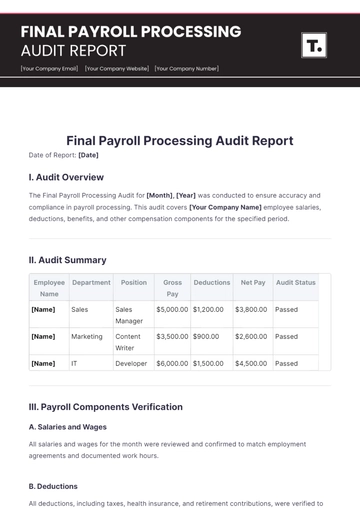

Findings

Area of Audit | Findings | Implications |

|---|---|---|

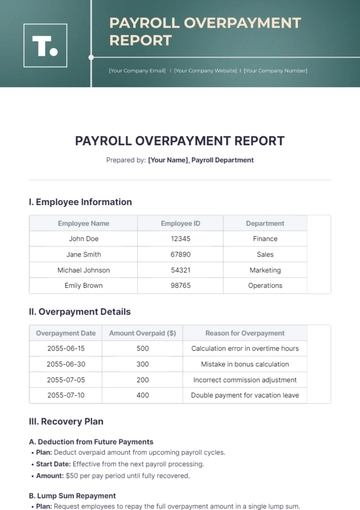

Payroll Calculations | Discrepancies in overtime calculation | Potential overpayment or underpayment |

Tax Compliance | Late filing of tax returns observed | Risk of penalties and interest charges |

Internal Controls | Segregation of duties not adequately enforced | Increased risk of fraud |

Conclusions

The audit of [specific organization or process] revealed several areas requiring attention to improve the efficiency and reliability of payroll operations. Addressing these issues will enhance accuracy, compliance, and risk management.

Recommendations

In light of the findings, the following recommendations are made:

Implement regular training for payroll staff on overtime rules.

Establish a calendar for timely tax return submissions.

Enhance internal controls by clearly defining roles and responsibilities.

Appendices

For more detailed information, refer to the appendices which include further data analysis and procedural documentation.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Simplify your payroll audits with our Blank Payroll Audit Report Template available at Template.net. This editable and customizable template provides a structured format for documenting payroll audits effectively. Use our AI Editor Tool to modify the template to suit your specific requirements, ensuring comprehensive and professional reports. Get your payroll audit process started with ease!

You may also like

- Sales Report

- Daily Report

- Project Report

- Business Report

- Weekly Report

- Incident Report

- Annual Report

- Report Layout

- Report Design

- Progress Report

- Marketing Report

- Company Report

- Monthly Report

- Audit Report

- Status Report

- School Report

- Reports Hr

- Management Report

- Project Status Report

- Handover Report

- Health And Safety Report

- Restaurant Report

- Construction Report

- Research Report

- Evaluation Report

- Investigation Report

- Employee Report

- Advertising Report

- Weekly Status Report

- Project Management Report

- Finance Report

- Service Report

- Technical Report

- Meeting Report

- Quarterly Report

- Inspection Report

- Medical Report

- Test Report

- Summary Report

- Inventory Report

- Valuation Report

- Operations Report

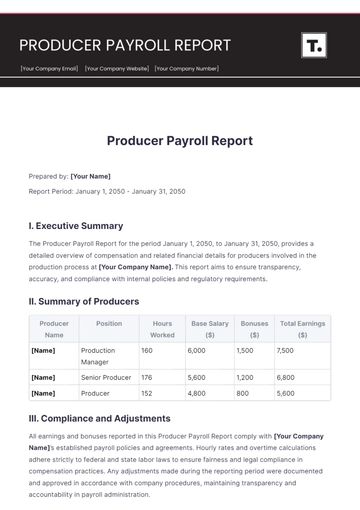

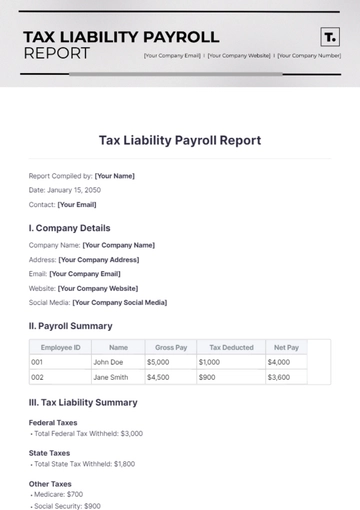

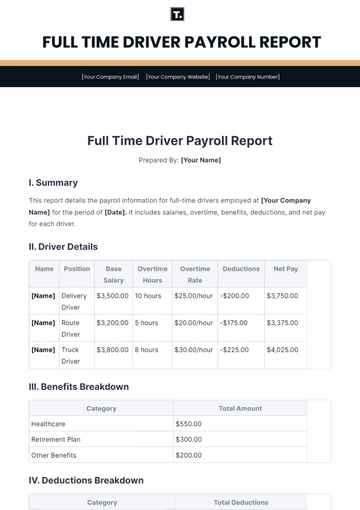

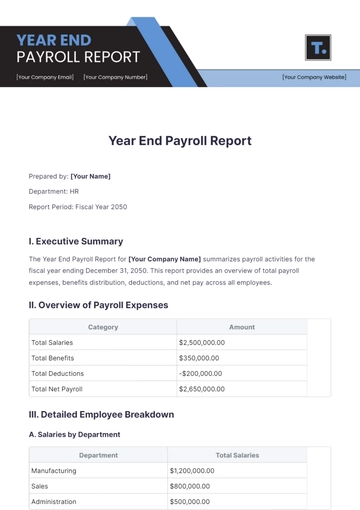

- Payroll Report

- Training Report

- Job Report

- Case Report

- Performance Report

- Board Report

- Internal Audit Report

- Student Report

- Monthly Management Report

- Small Business Report

- Accident Report

- Call Center Report

- Activity Report

- IT and Software Report

- Internship Report

- Visit Report

- Product Report

- Book Report

- Property Report

- Recruitment Report

- University Report

- Event Report

- SEO Report

- Conference Report

- Narrative Report

- Nursing Home Report

- Preschool Report

- Call Report

- Customer Report

- Employee Incident Report

- Accomplishment Report

- Social Media Report

- Work From Home Report

- Security Report

- Damage Report

- Quality Report

- Internal Report

- Nurse Report

- Real Estate Report

- Hotel Report

- Equipment Report

- Credit Report

- Field Report

- Non Profit Report

- Maintenance Report

- News Report

- Survey Report

- Executive Report

- Law Firm Report

- Advertising Agency Report

- Interior Design Report

- Travel Agency Report

- Stock Report

- Salon Report

- Bug Report

- Workplace Report

- Action Report

- Investor Report

- Cleaning Services Report

- Consulting Report

- Freelancer Report

- Site Visit Report

- Trip Report

- Classroom Observation Report

- Vehicle Report

- Final Report

- Software Report