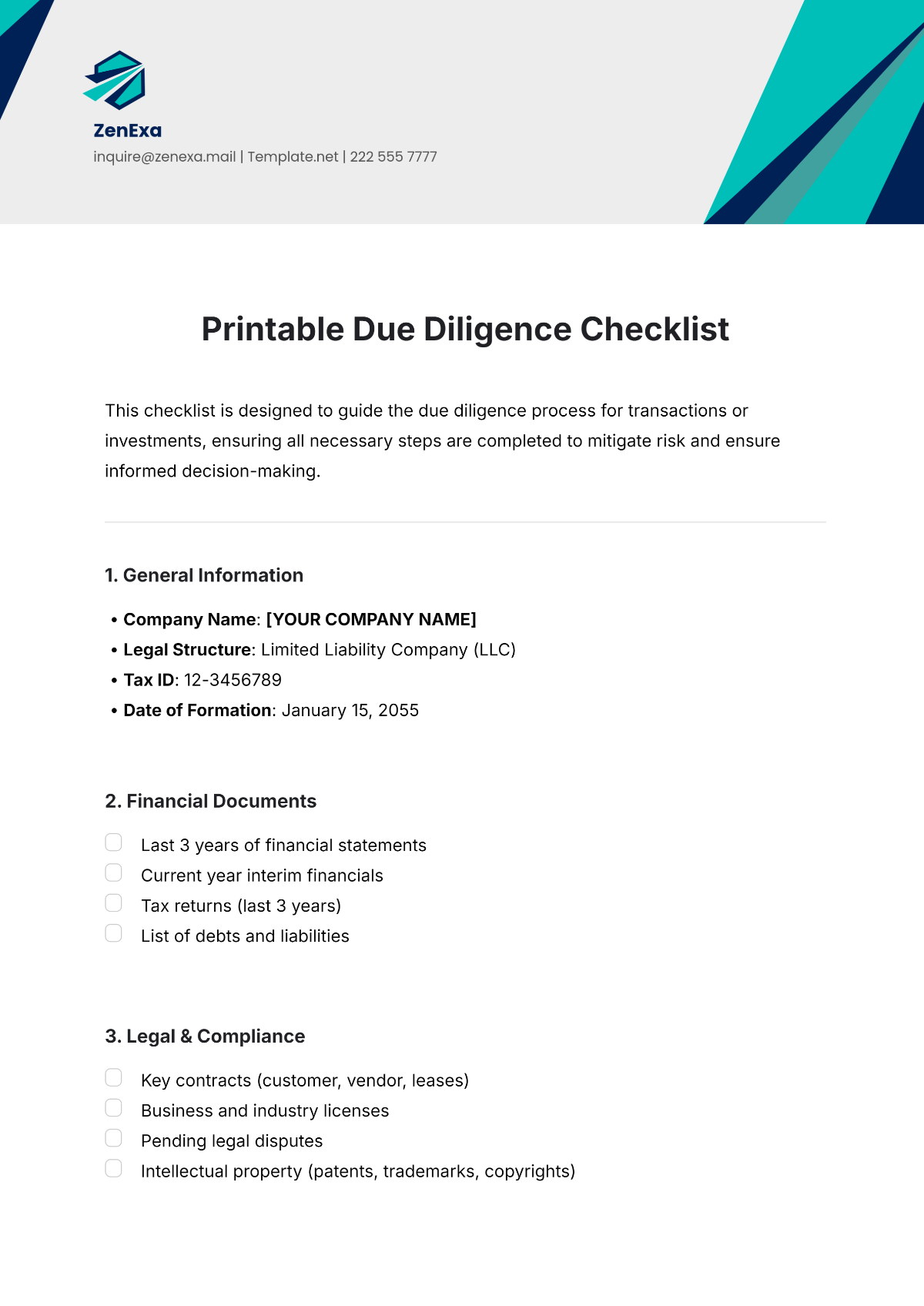

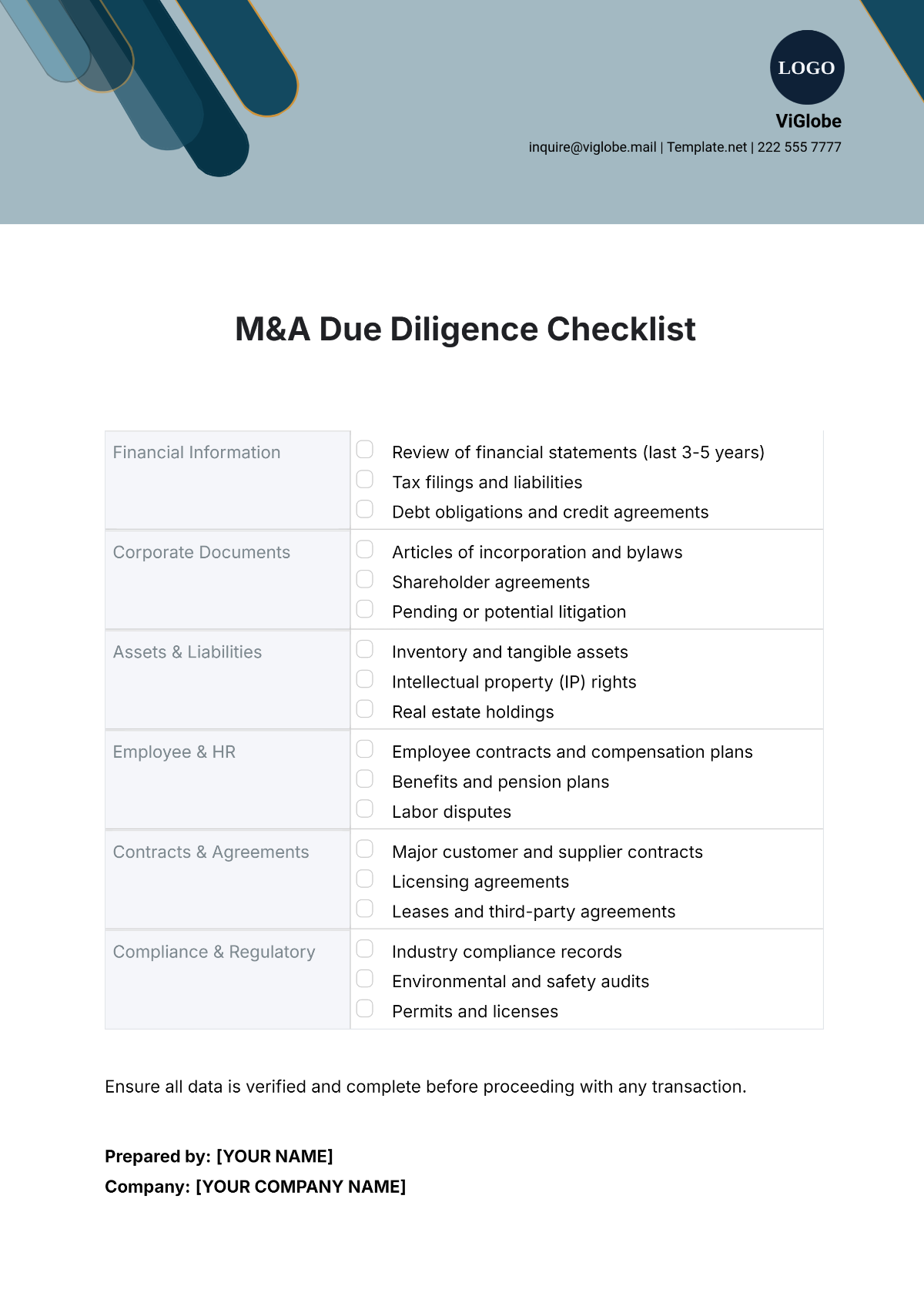

Customer Due Diligence Checklist Outline

1. Customer Identification

Collect and verify the customer’s full legal name, business address, and legal structure (e.g., corporation, LLC). Ensure valid identification numbers (e.g., tax ID, registration number).

2. Ownership and Control

Identify and document the ultimate beneficial owners (UBOs) and key management (directors, executives).

3. Business Activity and Financial Profile

Confirm the nature of the customer’s business, source of funds, and review financial statements from the past three years.

4. Risk Assessment

Evaluate the customer’s location for risks (e.g., high-risk jurisdictions), perform sanctions and watchlist checks, and verify whether the customer or any key individuals are Politically Exposed Persons (PEPs).

5. Compliance and Documentation

Verify adherence to Anti-Money Laundering (AML) standards and obtain necessary customer agreements and contracts.

This checklist ensures compliance with due diligence requirements for [YOUR COMPANY NAME]. All documents must be verified before onboarding. For more information, please contact [YOUR NAME] at [YOUR EMAIL].