Debt Reduction Method Sheet

Prepared by:

[Your Name]

[Your Company Name]

Purpose

This document outlines the strategies and steps to effectively reduce and manage outstanding debt. The goal is to offer a clear and actionable plan that can help achieve financial stability by lowering debt over time.

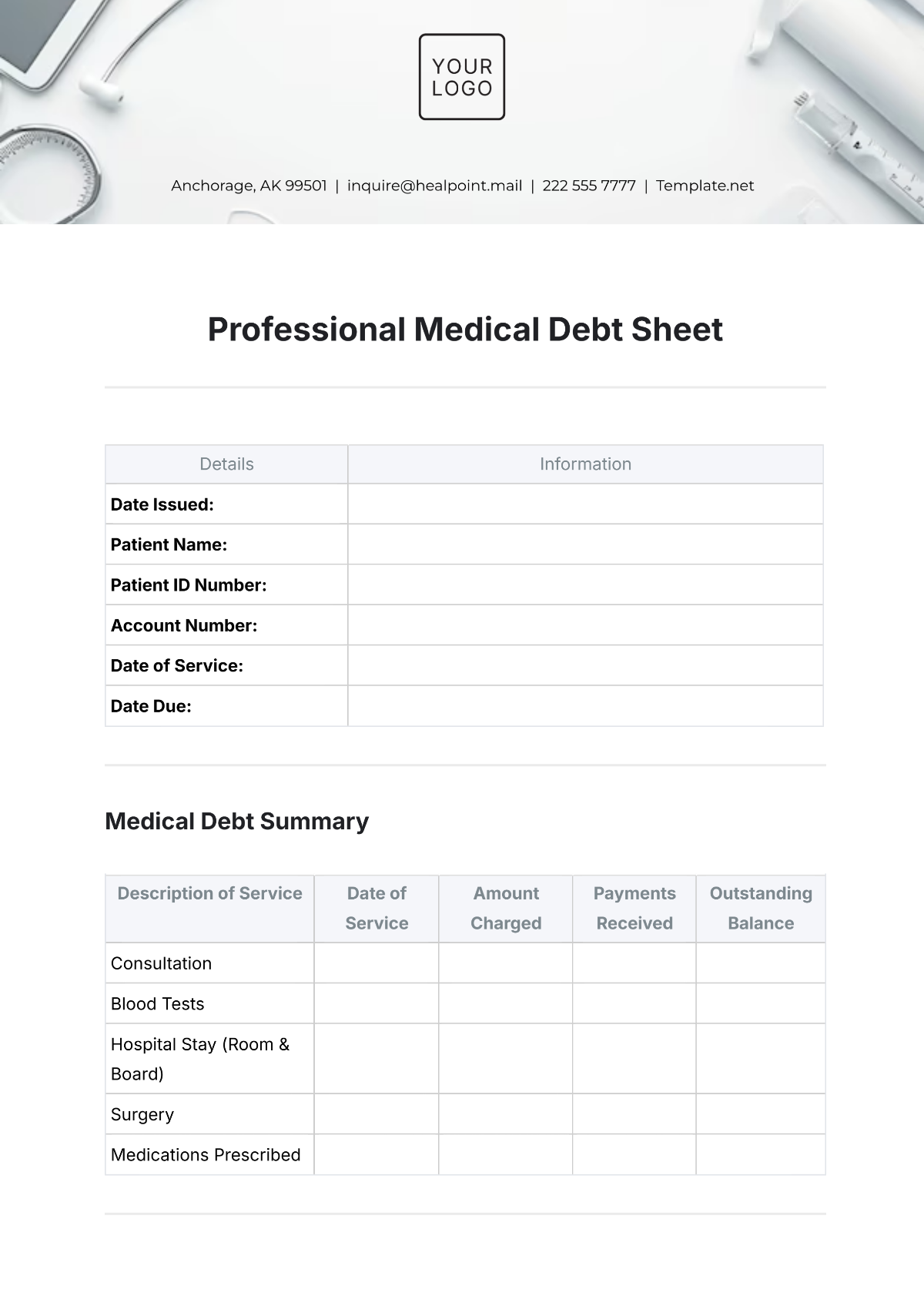

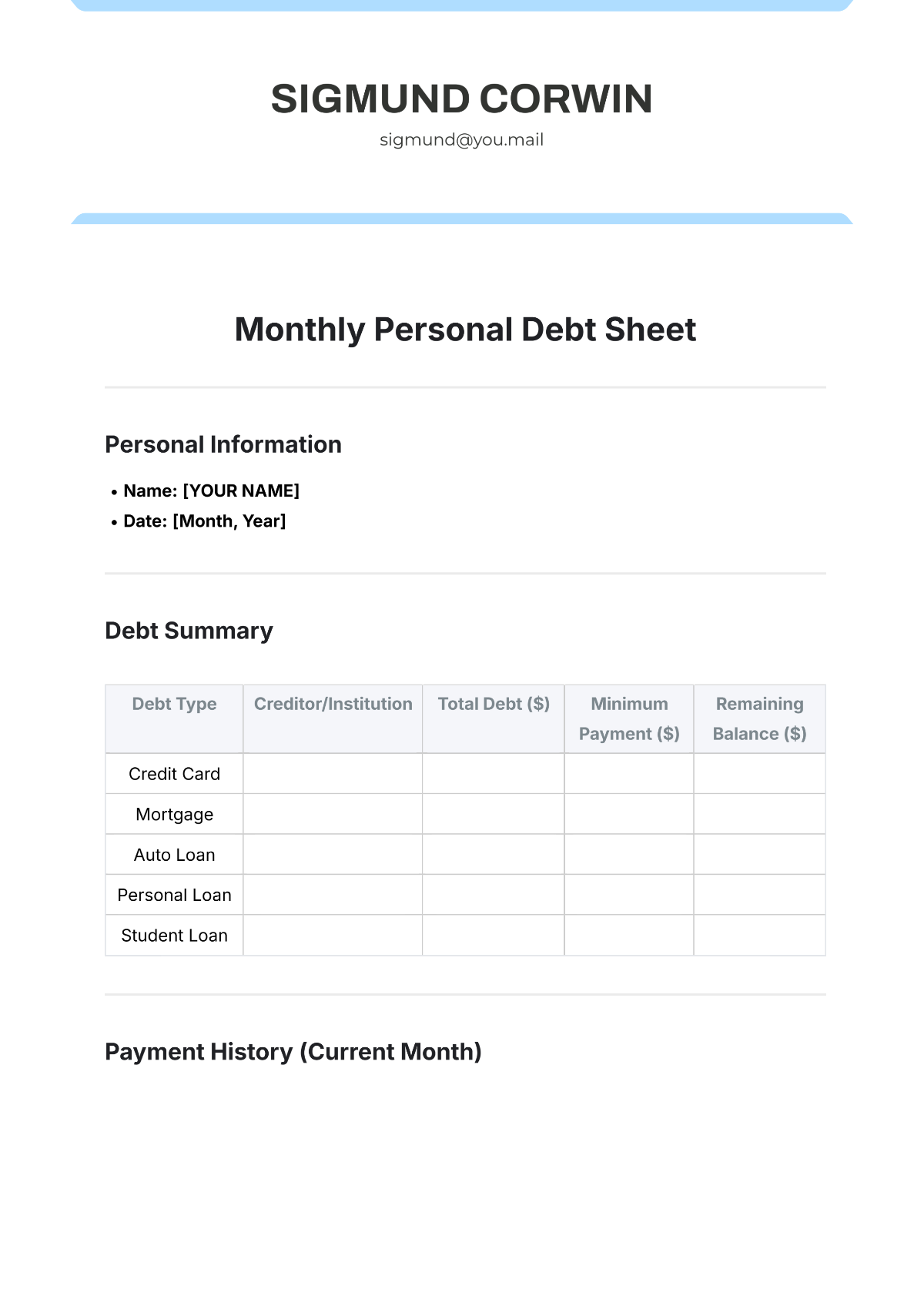

1. Debt Assessment and Analysis

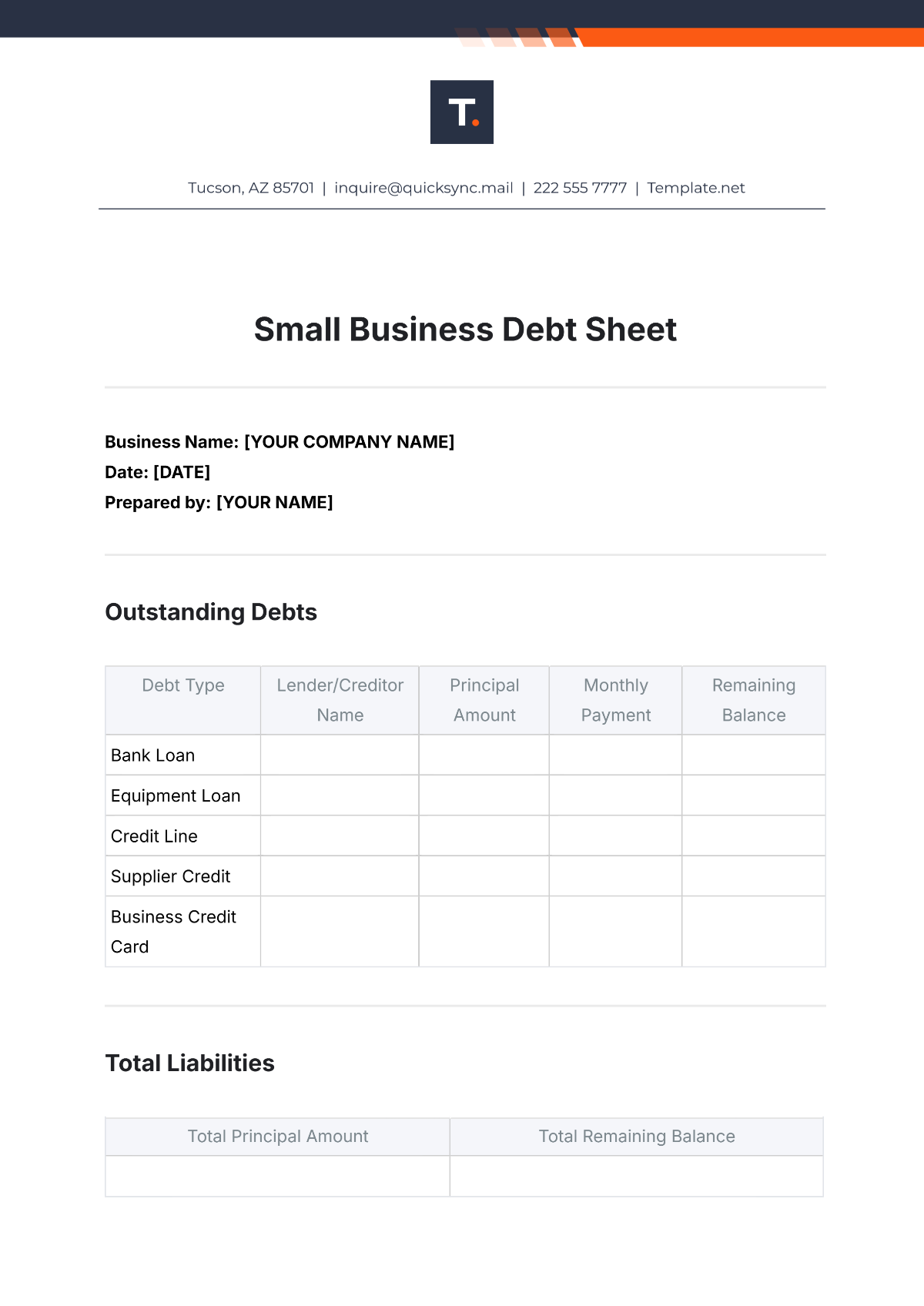

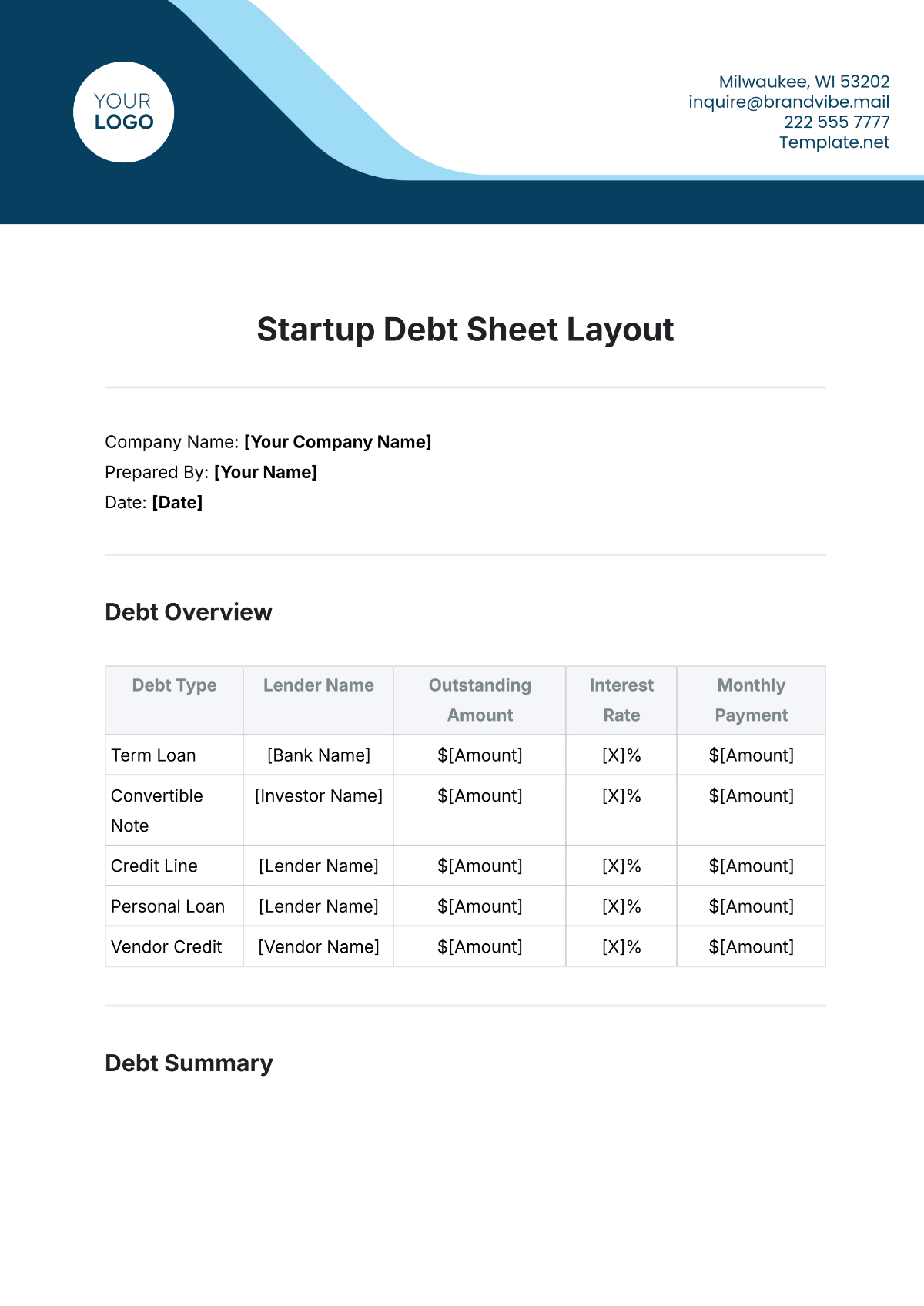

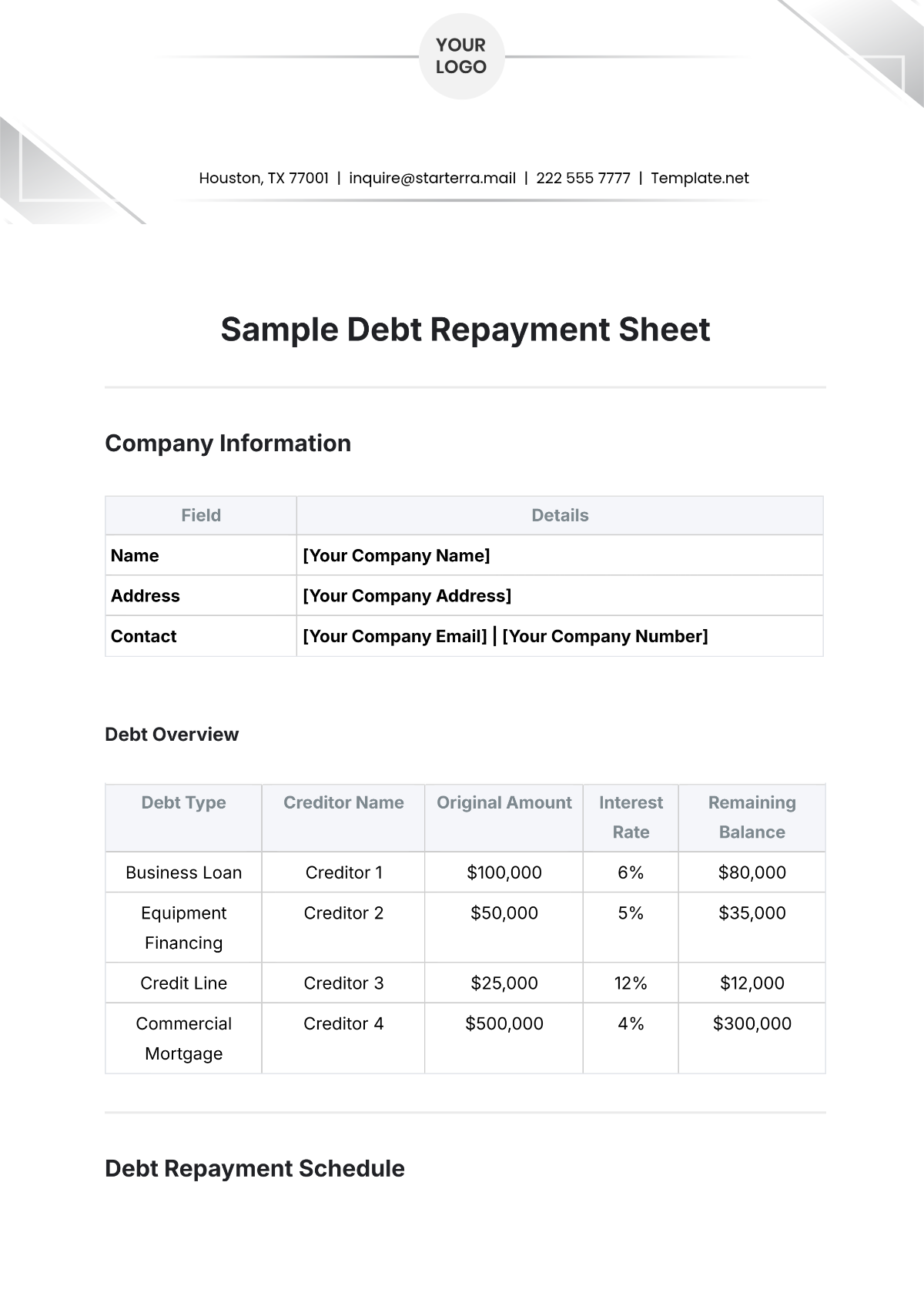

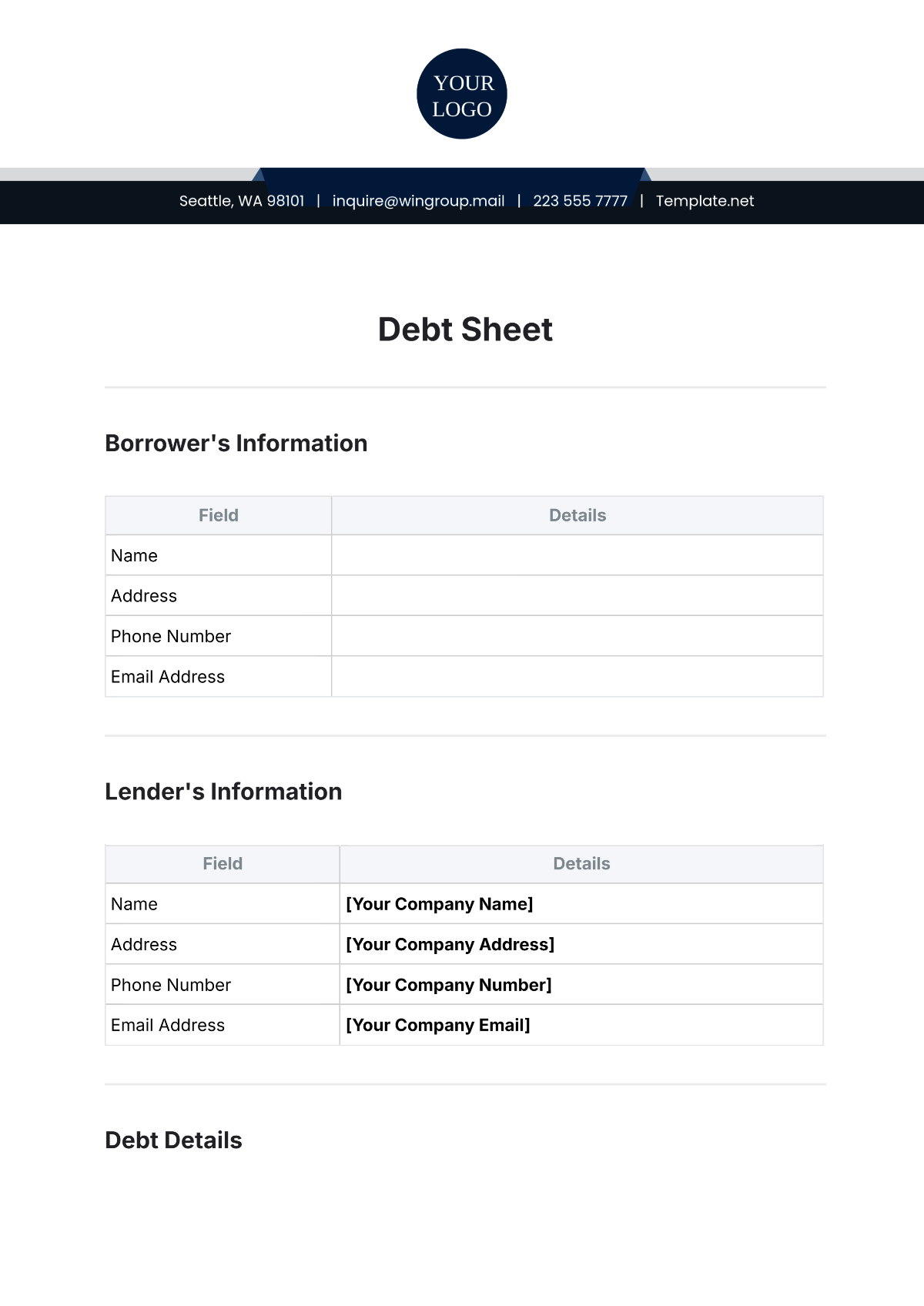

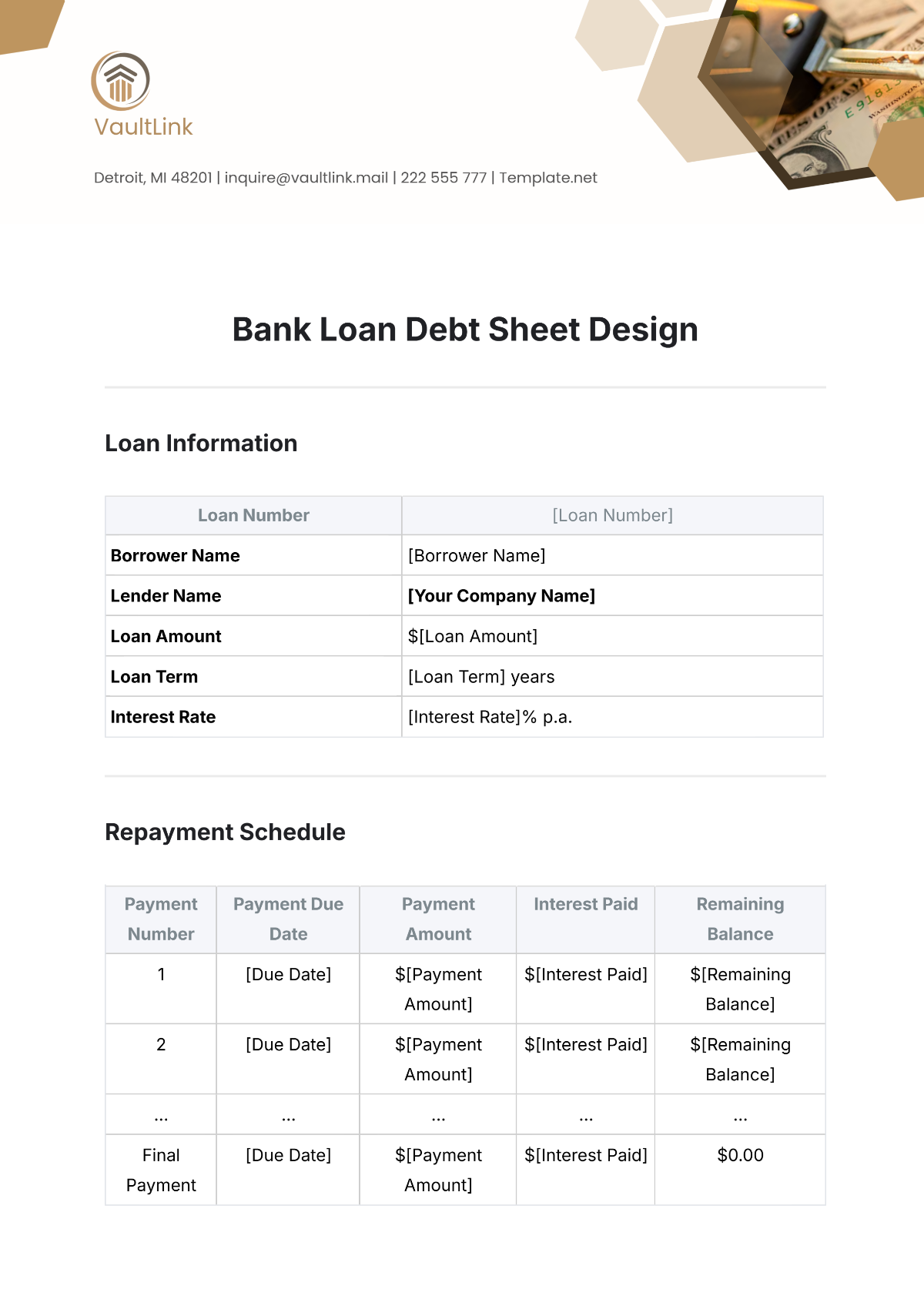

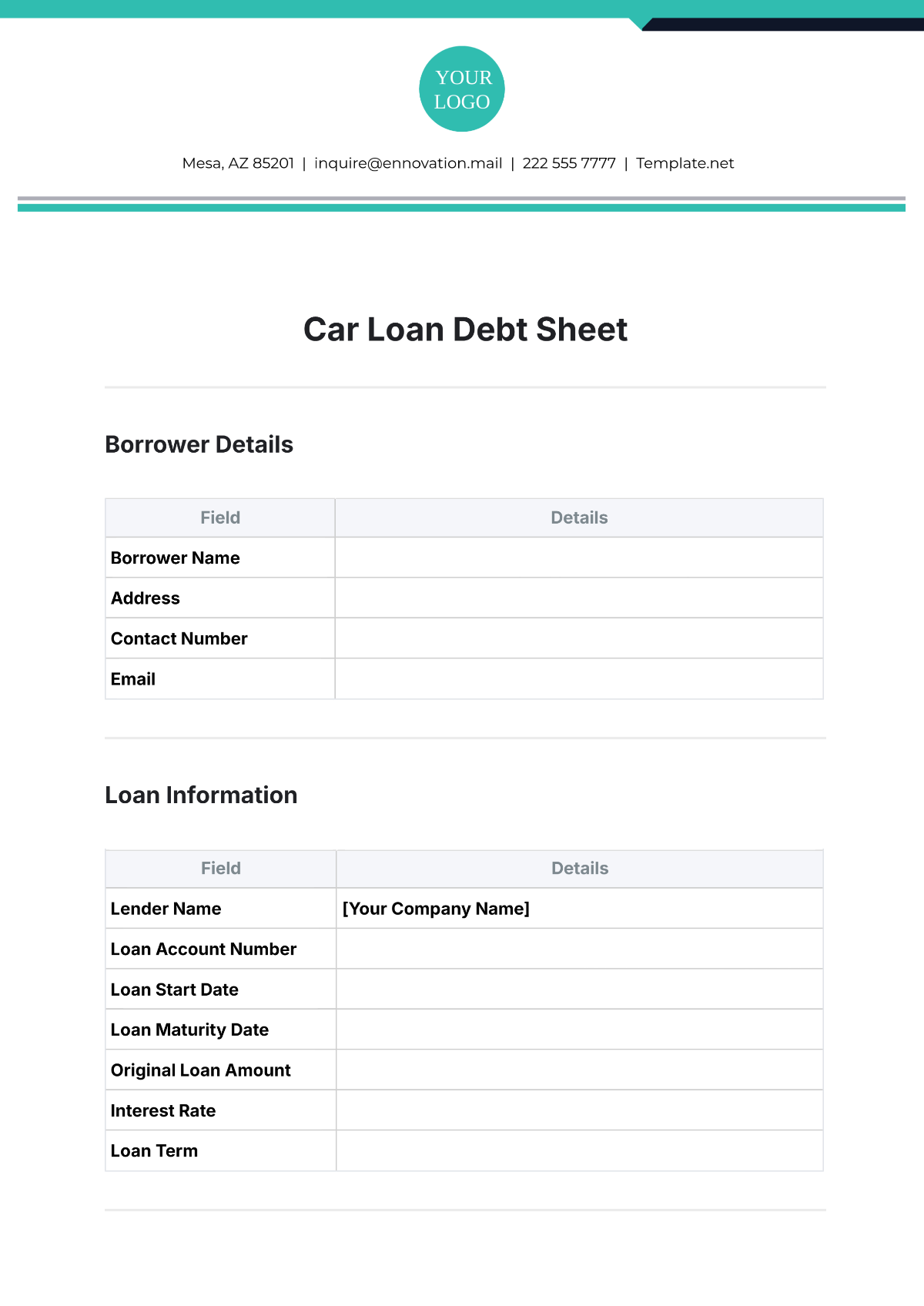

Step 1: List All Debts

The first step is to identify and categorize all outstanding debts, including credit cards, loans, mortgages, and lines of credit. It’s essential to gather statements from creditors to determine the total amount owed, interest rates, minimum payments, and due dates.

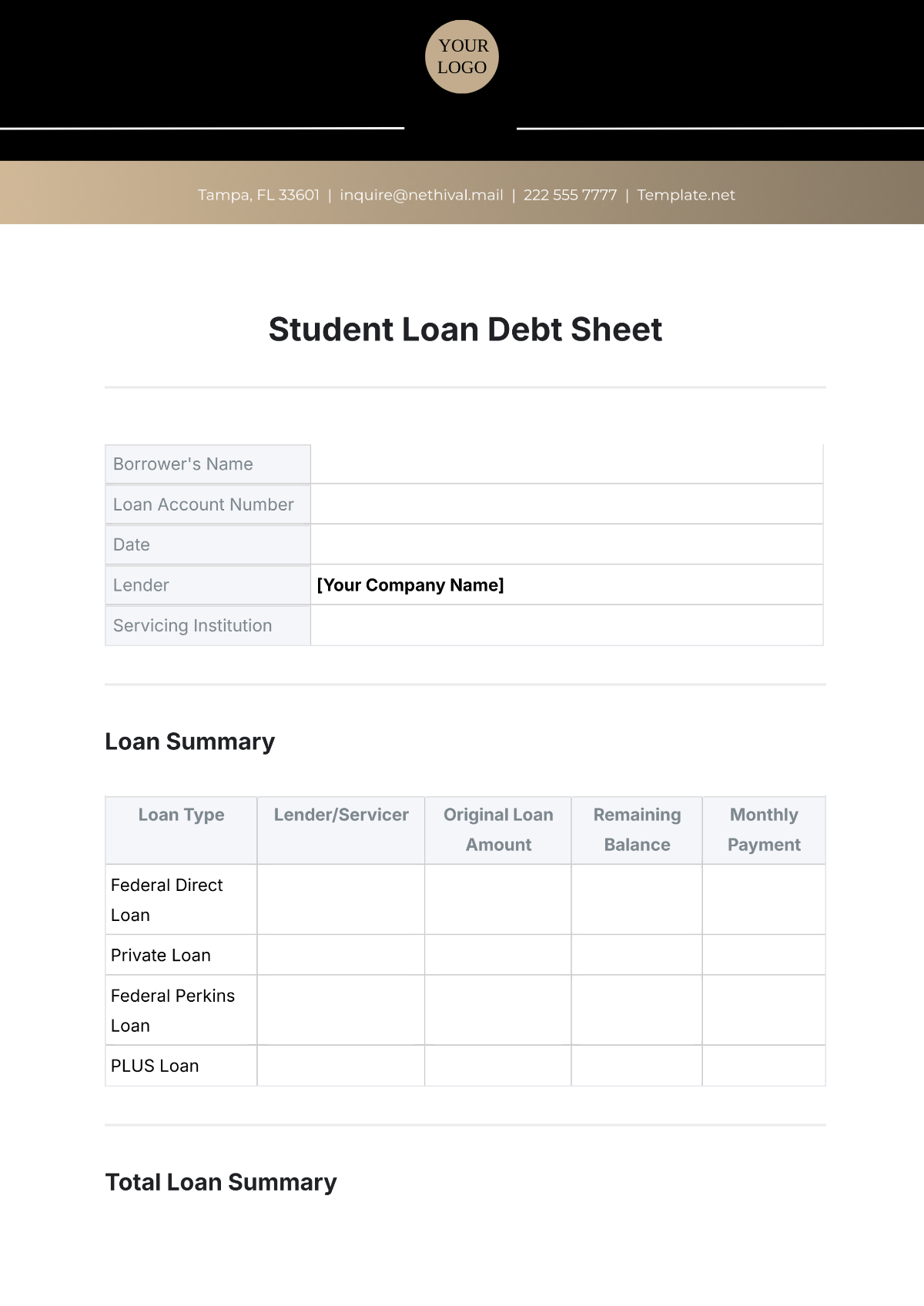

Step 2: Analyze Debt Types

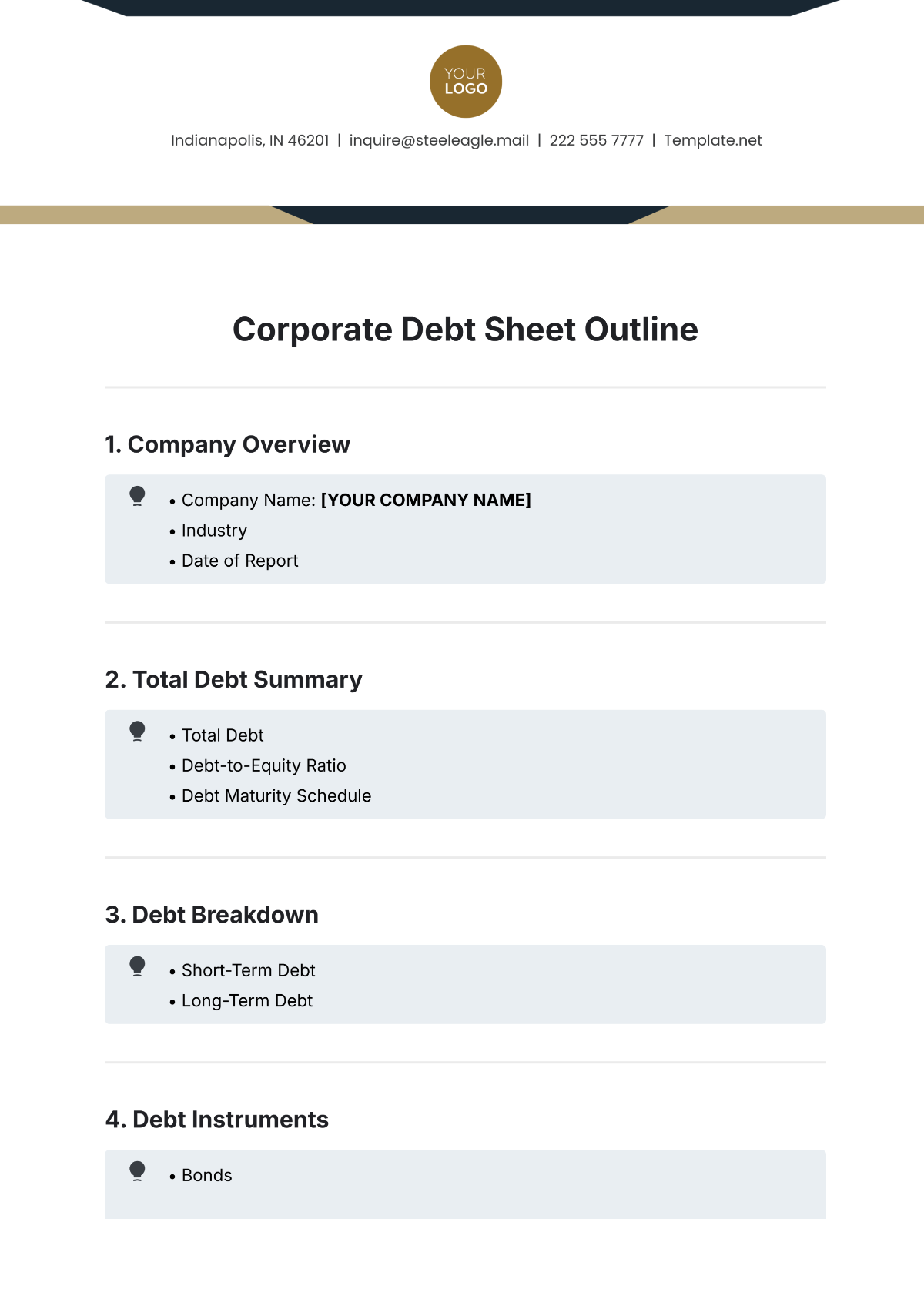

Once all debts are listed, it is necessary to prioritize them based on their interest rates and urgency. Debts should be categorized into high-interest, medium-interest, and low-interest groups to identify where the most significant financial burden lies.

2. Debt Reduction Strategies

Strategy 1: Debt Avalanche Method

This method involves paying off the high-interest debts first to minimize the total amount paid in interest over time. Focus extra payments on the highest-interest debt while continuing to make the minimum payments on other debts. Once the highest-interest debt is paid off, the focus shifts to the next highest-interest debt.

Strategy 2: Debt Snowball Method

The debt snowball method focuses on paying off the smallest debts first to build momentum. The extra payments should go toward the smallest debt while maintaining minimum payments on other debts. Once the smallest debt is paid off, attention moves to the next smallest, and so on.

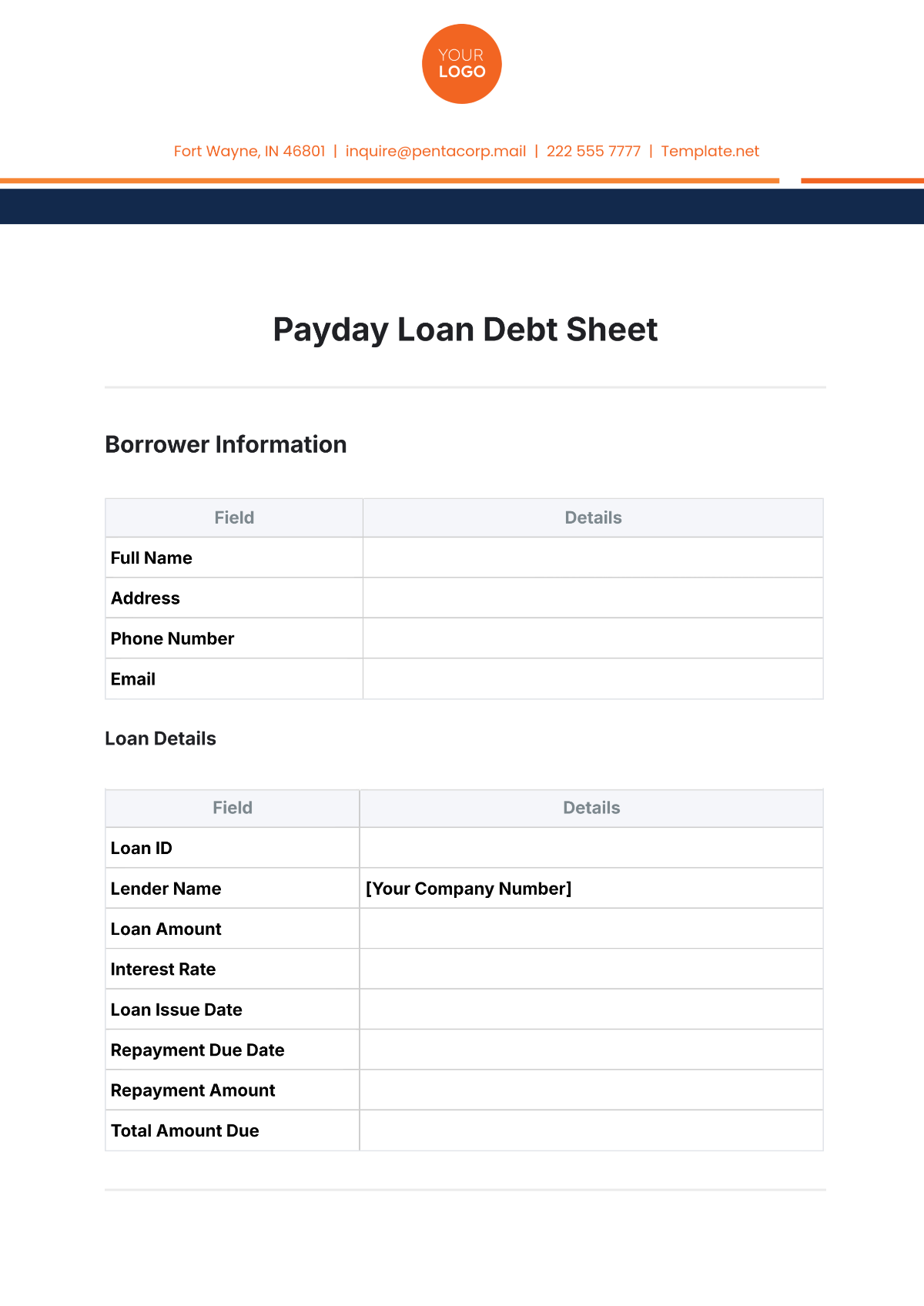

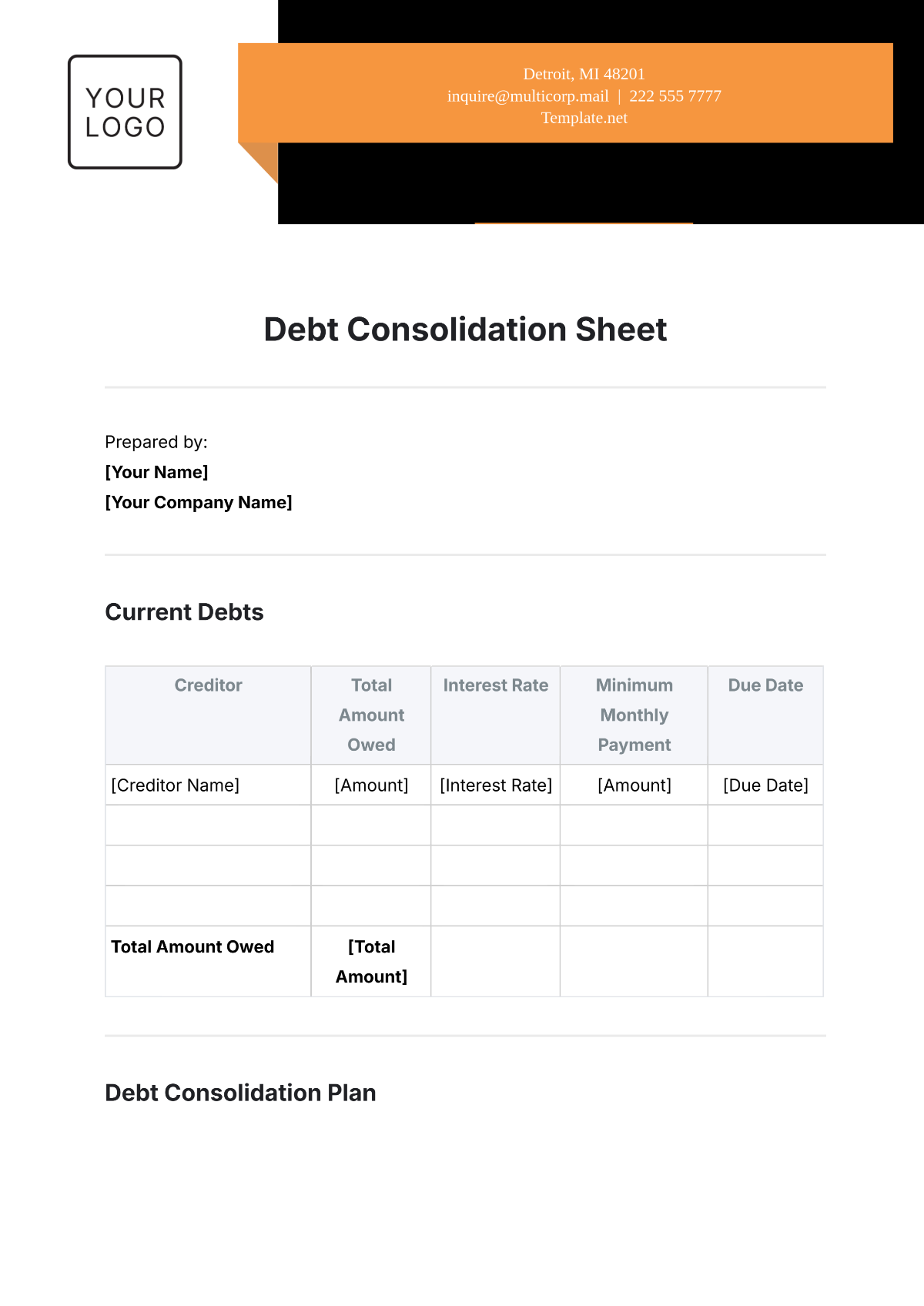

Strategy 3: Debt Consolidation

Debt consolidation simplifies debt repayment by combining multiple debts into one loan, ideally with a lower interest rate. Research available debt consolidation loans or balance transfer credit cards. The new loan can be used to pay off existing debts, leaving just one payment to manage.

Strategy 4: Debt Settlement

In debt settlement, individuals negotiate with creditors to reduce the total amount owed. Contact creditors and attempt to settle the debt for less than the full amount owed. It is important to ensure that any agreements are formalized in writing to avoid future disputes.

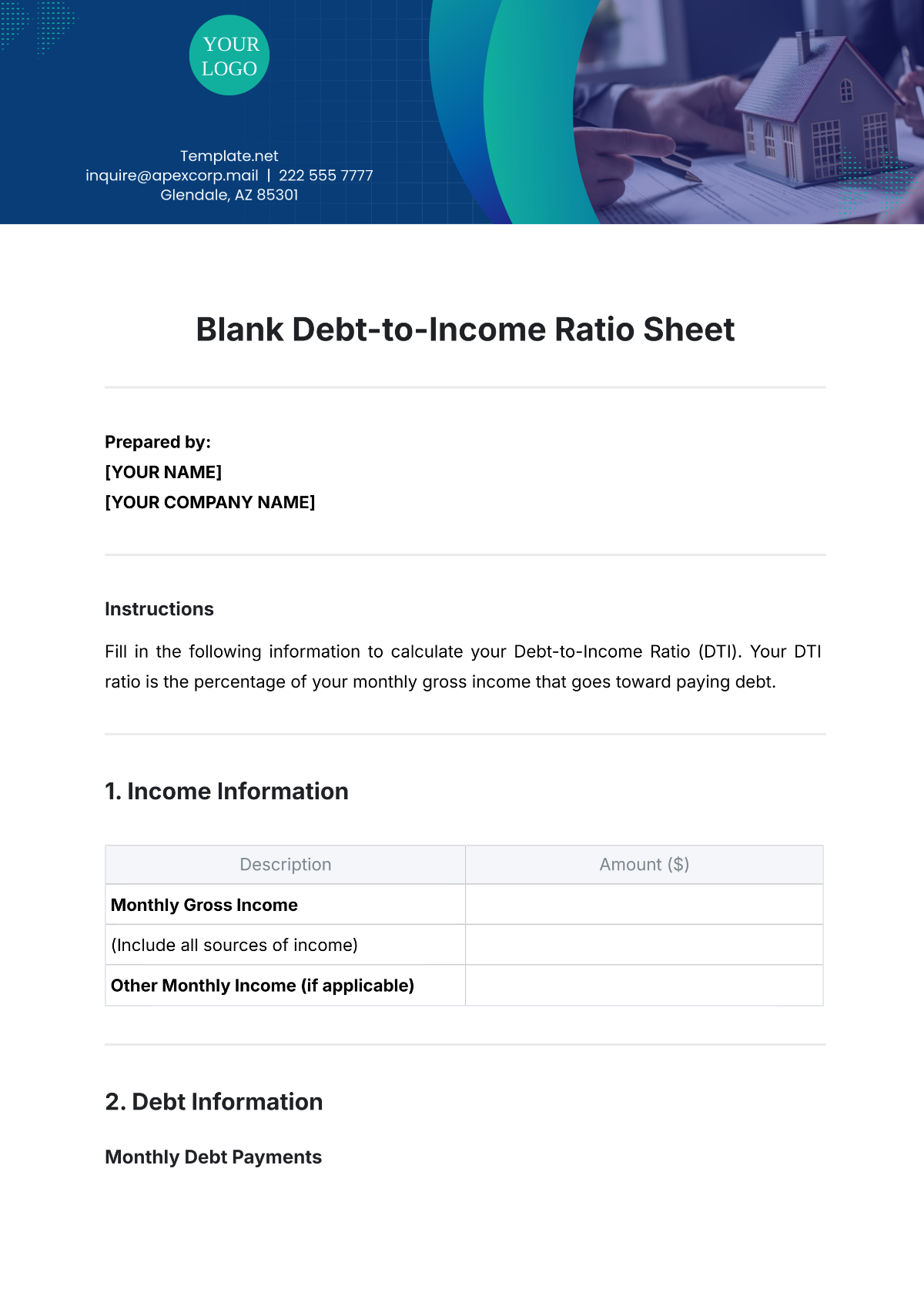

3. Budgeting and Expense Management

Step 1: Create a Monthly Budget

To ensure extra funds are allocated for debt repayment, creating a monthly budget is essential. All sources of income should be listed, and monthly expenses must be tracked. It’s important to identify areas where spending can be reduced, allowing more money to be directed toward debt repayment.

Step 2: Set a Realistic Payment Plan

A realistic payment plan is needed to ensure debt payments fit within the budget while maintaining financial health. Calculate how much extra money can be used for debt repayment each month and set a timeline for paying off specific debts, taking into account both the total amount owed and interest rates.

4. Negotiating with Creditors

Step 1: Reach Out to Creditors

To reduce debt, it may be necessary to seek lower interest rates or more favorable payment terms. Contact creditors to discuss options such as lowering interest rates, extending repayment terms, or negotiating for temporary forbearance if experiencing financial hardship.

Step 2: Explore Hardship Programs

Many creditors offer hardship programs to help individuals experiencing financial difficulties. It’s important to inquire about payment deferrals or interest rate reductions that can provide temporary relief and make debt repayment more manageable.

5. Monitoring Progress and Adjustments

Step 1: Track Debt Reduction Progress

Regularly tracking progress is crucial to staying motivated throughout the debt reduction process. Updating the debt list and monitoring payments will help gauge how much has been paid off. Milestones should be celebrated to maintain momentum.

Step 2: Adjust the Plan as Needed

The debt reduction plan may need to be adjusted based on changes in income or expenses. Periodically reassess the budget and payment plan, and if extra funds become available, consider increasing payments to accelerate the process.

6. Additional Considerations

Emergency Fund

It is crucial to build an emergency fund while working on debt reduction. Having 3-6 months' worth of expenses set aside can provide financial stability and prevent further debt accumulation during unexpected situations.

Financial Counseling

If debt becomes overwhelming, seeking professional advice can provide valuable guidance. A financial advisor or credit counselor can offer personalized strategies to manage debt more effectively.

Conclusion

By following these structured steps, you can gradually reduce and eliminate debt, ultimately achieving greater financial security and peace of mind.