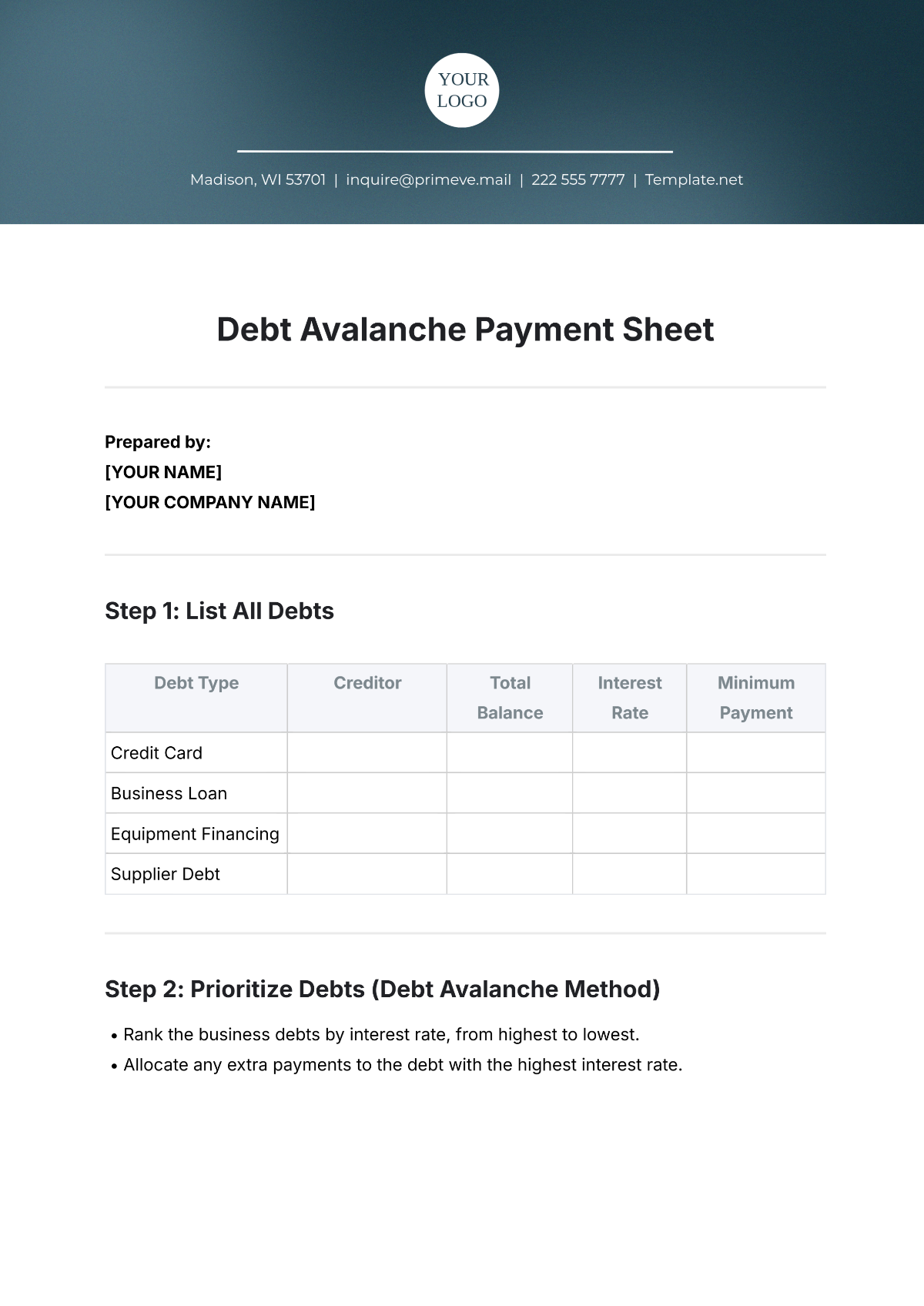

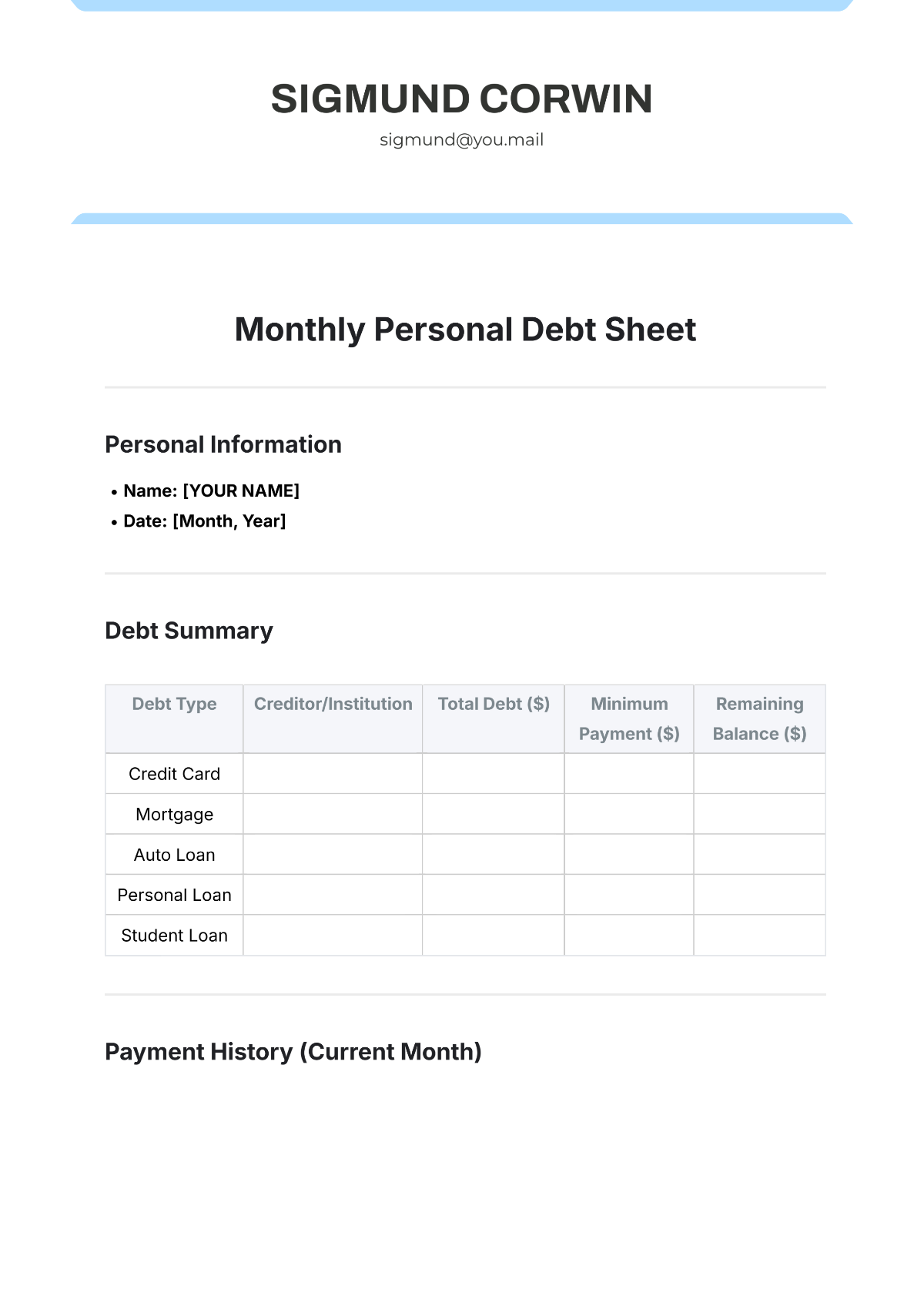

Debt Avalanche Payment Sheet

Prepared by:

[YOUR NAME]

[YOUR COMPANY NAME]

Step 1: List All Debts

Debt Type | Creditor | Total Balance | Interest Rate | Minimum Payment |

|---|---|---|---|---|

Credit Card | ||||

Business Loan | ||||

Equipment Financing | ||||

Supplier Debt |

Step 2: Prioritize Debts (Debt Avalanche Method)

Rank the business debts by interest rate, from highest to lowest.

Allocate any extra payments to the debt with the highest interest rate.

Rank | Debt Type | Creditor | Interest Rate | Total Payment |

|---|---|---|---|---|

1 | ||||

2 | ||||

3 | ||||

4 | ||||

5 |

Step 3: Debt Repayment Schedule

Month | Debt Type | Total Payment | Amount Paid | Remaining Balance |

|---|---|---|---|---|

Step 4: Progress Tracker

Month | Amount Paid | Total Remaining Debt | Debt Paid Off | Remaining Debts |

|---|---|---|---|---|

Tips for Success

Pay More Than the Minimum: Whenever possible, make extra payments on the debt with the highest interest rate to reduce it faster.

Stay Consistent: Maintain the payment schedule each month and adjust only when necessary.

Reassess Regularly: Evaluate your repayment progress every 3 to 6 months and make adjustments to your strategy as needed.