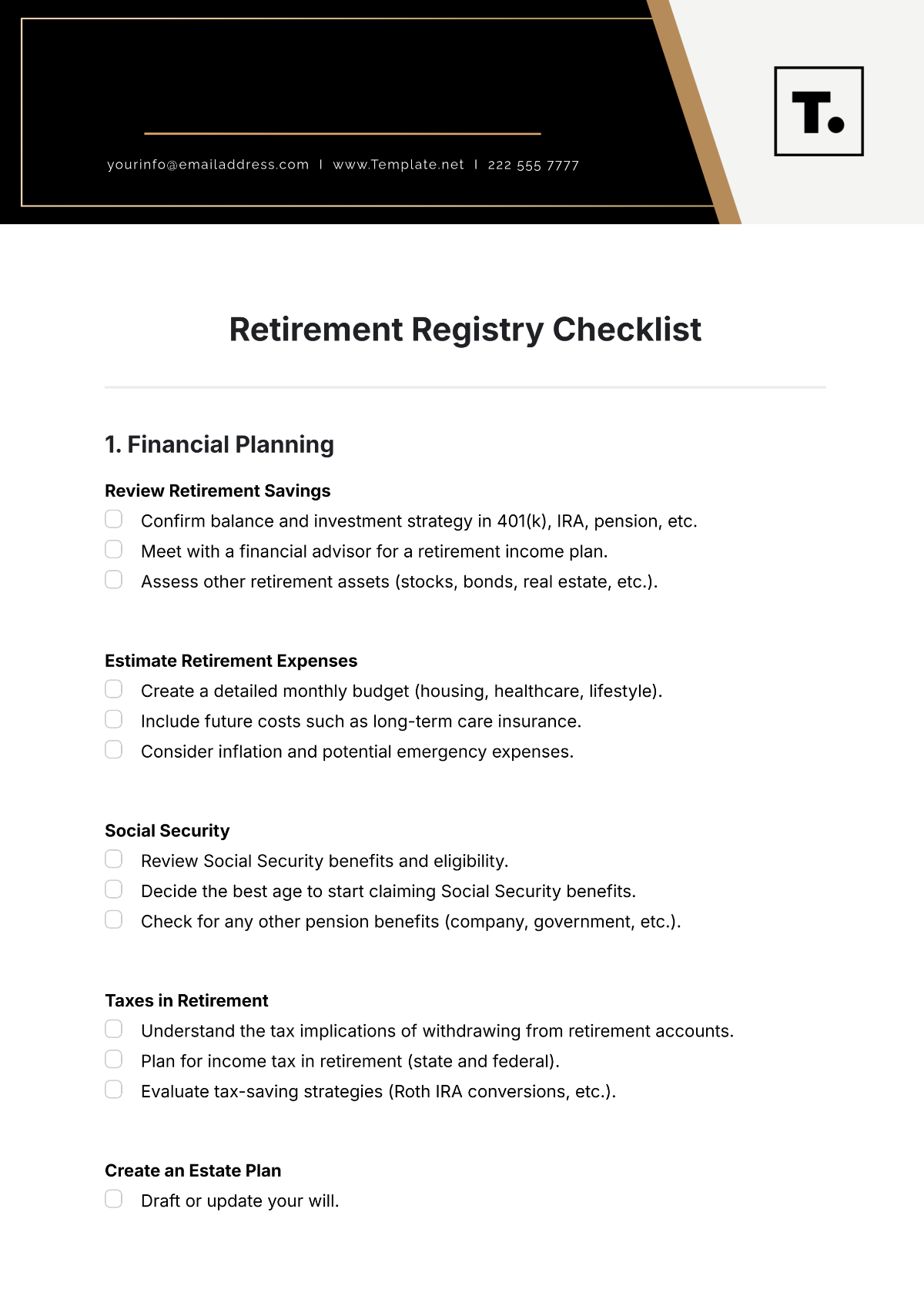

Retirement Registry Checklist

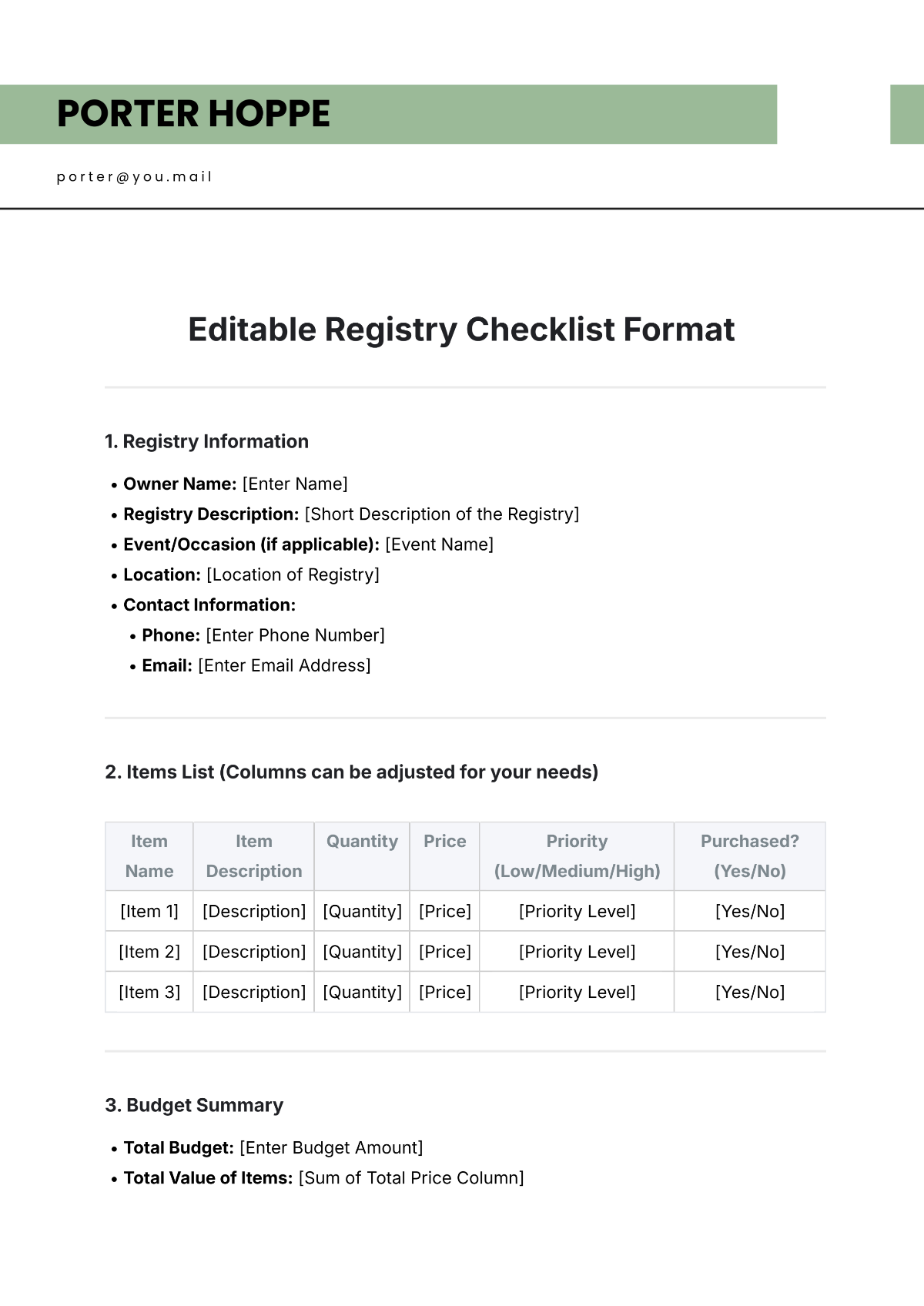

1. Financial Planning

Review Retirement Savings

Confirm balance and investment strategy in 401(k), IRA, pension, etc.

Meet with a financial advisor for a retirement income plan.

Assess other retirement assets (stocks, bonds, real estate, etc.).

Estimate Retirement Expenses

Create a detailed monthly budget (housing, healthcare, lifestyle).

Include future costs such as long-term care insurance.

Consider inflation and potential emergency expenses.

Social Security

Review Social Security benefits and eligibility.

Decide the best age to start claiming Social Security benefits.

Check for any other pension benefits (company, government, etc.).

Taxes in Retirement

Understand the tax implications of withdrawing from retirement accounts.

Plan for income tax in retirement (state and federal).

Evaluate tax-saving strategies (Roth IRA conversions, etc.).

Create an Estate Plan

Draft or update your will.

Set up the power of attorney and healthcare proxy.

Consider creating a trust if applicable.

Review life insurance policies.

2. Health and Insurance

Health Insurance

Confirm eligibility for Medicare (and supplemental insurance options).

Review current health insurance (through an employer or the marketplace).

Set up long-term care insurance (if needed).

Healthcare Providers

Review medical history and ensure records are updated.

Find new doctors or specialists if needed.

Prescription Medication

Ensure prescriptions are in order and explore Medicare drug plans.

Consider a medication management plan.

Vision and Dental

Review dental and vision insurance options.

3. Retirement Transition

Retirement Date

Confirm your official retirement date with your employer.

Notify your employer about your retirement plan (2-6 months in advance).

Prepare for an exit interview and offer any knowledge transfer.

Pension or Severance Plan

Review retirement or severance package options.

Confirm payout options for pensions or retirement plans.

Downsize or Relocation

Evaluate whether to downsize your home or relocate.

Begin decluttering and organizing important documents.

Consider moving closer to family or into retirement communities.

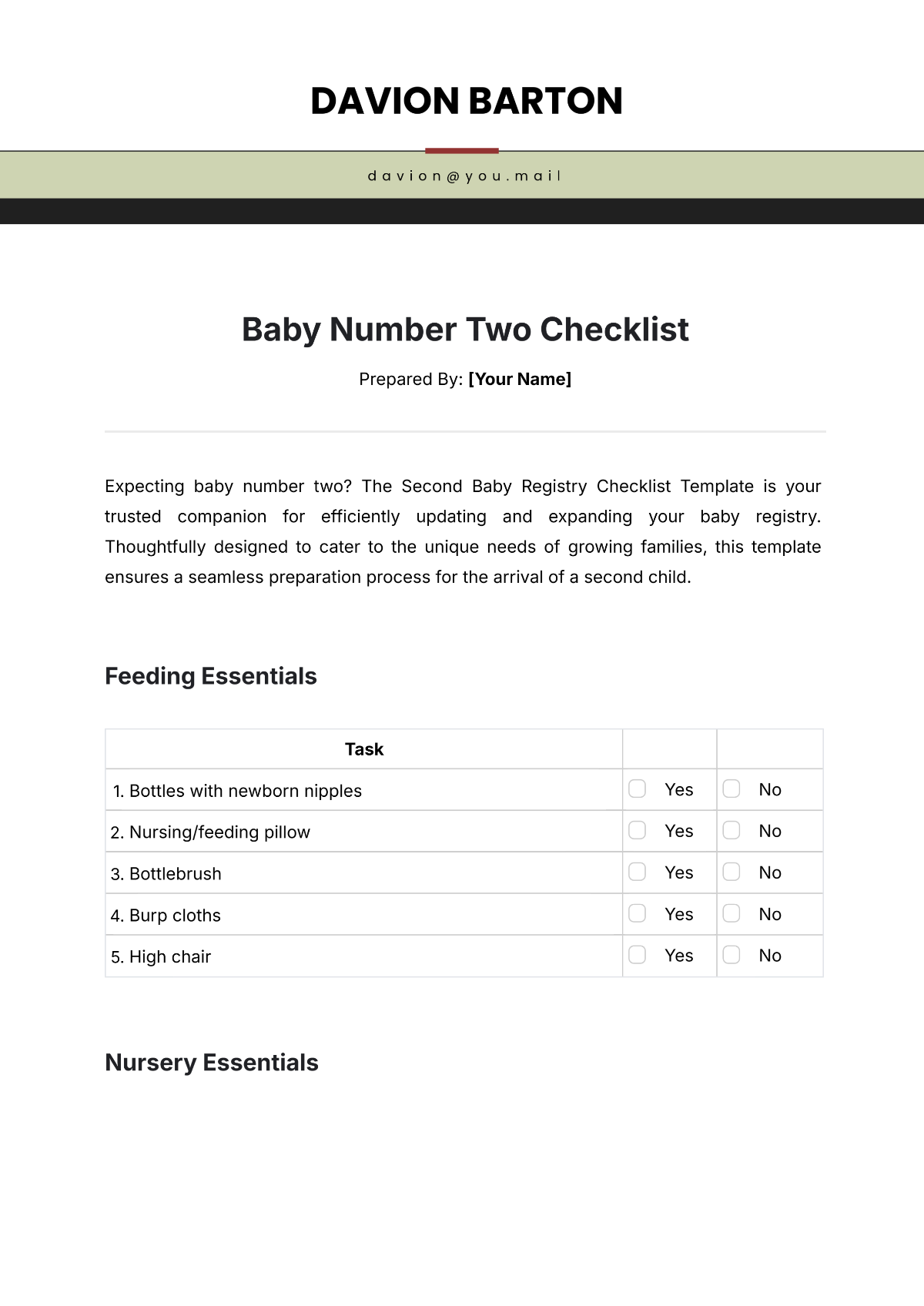

4. Personal Preparation

Social & Emotional Readiness

Reflect on your social life post-retirement.

Create hobbies or activities you’ll enjoy to fill your time.

Build a social network or consider volunteering.

Plan ways to stay mentally and physically active.

Time Management

Plan how you’ll spend your days (travel, hobbies, family).

Set goals for learning new skills or exploring new interests.

Look into part-time work or consulting if interested in staying active.

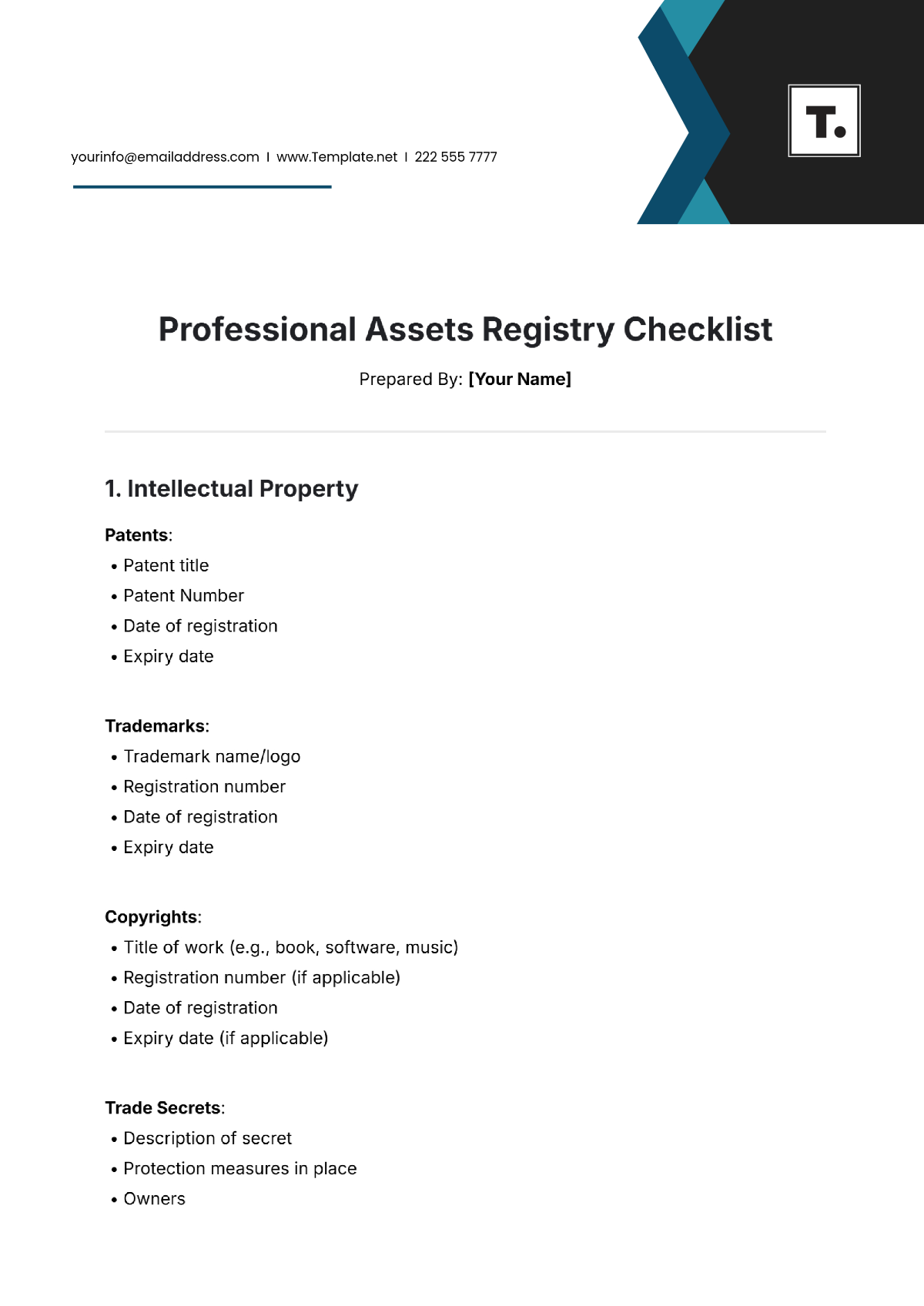

5. Legal and Documentation

Update Legal Documents

Review or create a living will, healthcare proxy, and advance directives.

Make sure beneficiary designations are current.

Store important documents securely (wills, insurance policies, etc.).

Update Identification

Ensure driver’s license and other identification cards are current.

Consider getting an ID card for senior discounts and services.

6. Final Steps Before Retirement

Retirement Party or Celebration

Plan a retirement celebration to mark the occasion (optional).

Final Employer Details

Confirm the last day of work and ensure all paperwork is complete.

Schedule an exit interview or meeting with HR for benefit explanations.

Post-Retirement Finances

Set up automatic withdrawals or direct deposit for retirement income.

Transition from employee benefits to retirement accounts (health, life insurance, etc.).

Review Your Will and Estate Plan Again

Ensure your estate plan reflects your current wishes.

7. Stay Engaged

Retirement Activities

Plan for active involvement in the community, volunteering, or travel.

Explore options for part-time work, consulting, or pursuing passion projects.

Continue Learning

Consider taking classes or pursuing new certifications or interests.