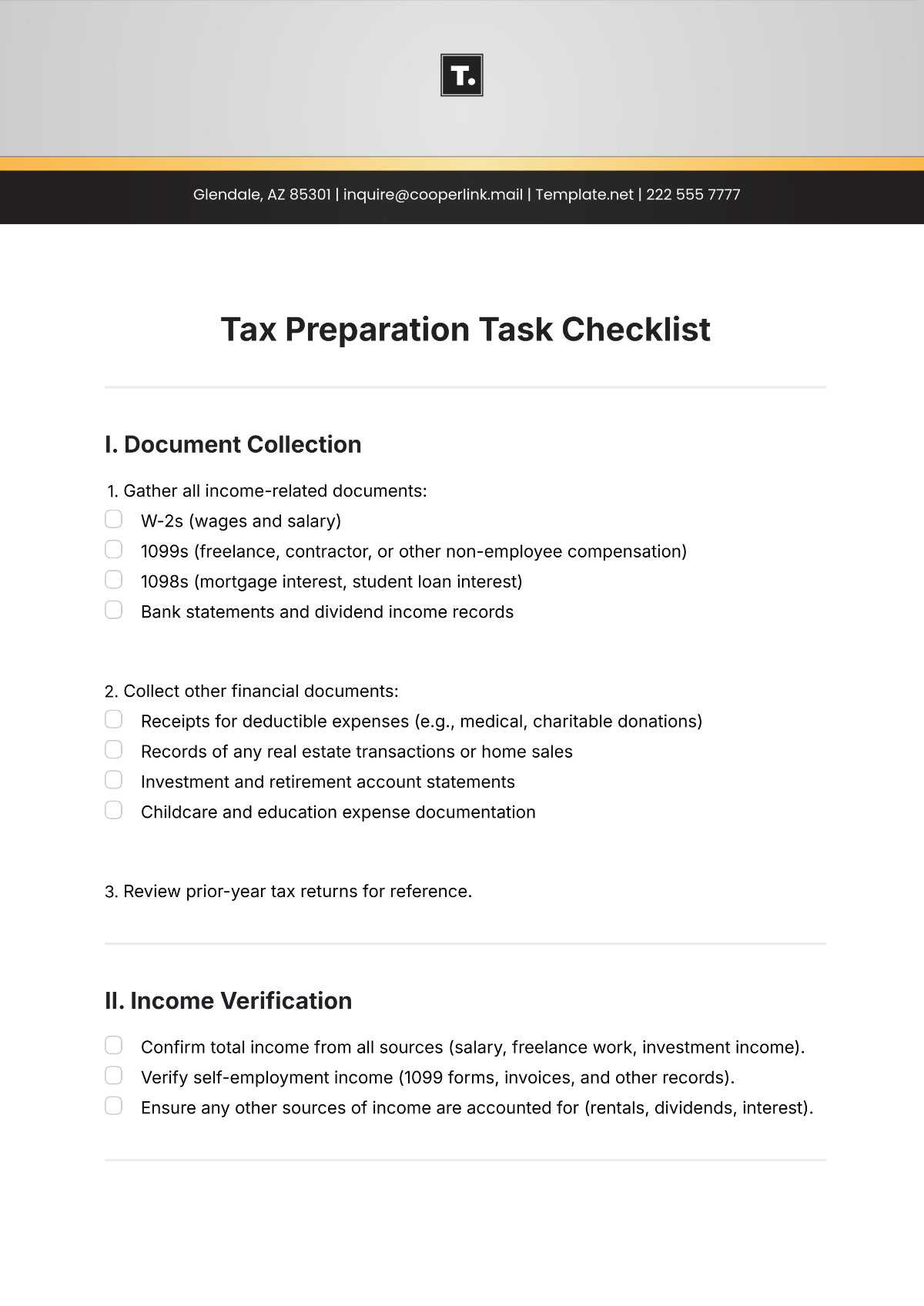

Tax Preparation Task Checklist

I. Document Collection

Gather all income-related documents:

W-2s (wages and salary)

1099s (freelance, contractor, or other non-employee compensation)

1098s (mortgage interest, student loan interest)

Bank statements and dividend income records

Collect other financial documents:

Receipts for deductible expenses (e.g., medical, charitable donations)

Records of any real estate transactions or home sales

Investment and retirement account statements

Childcare and education expense documentation

Review prior-year tax returns for reference.

II. Income Verification

Confirm total income from all sources (salary, freelance work, investment income).

Verify self-employment income (1099 forms, invoices, and other records).

Ensure any other sources of income are accounted for (rentals, dividends, interest).

III. Deductions and Credits

Identify and verify potential deductions:

Standard vs. itemized deductions

Medical expenses

Mortgage interest

State and local taxes

Confirm eligibility for available credits:

Child tax credits

Education credits (e.g., American Opportunity Credit)

Energy-efficient home credits

Earned Income Tax Credit (EITC)

IV. Tax Software or Forms

Choose a tax preparation software or professional service.

Gather required forms (e.g., Form 1040, Schedule A, Schedule C).

Ensure all tax software settings are configured correctly, such as filing status and dependents.

V. Review and Verification

Double-check all personal information (e.g., name, Social Security number, address).

Verify the accuracy of income and deduction amounts.

Cross-check any prior year tax carryovers (e.g., unused credits, losses).

Review any special circumstances (e.g., marriage, dependents, changes in income).

VI. Filing Deadlines

Mark tax filing deadlines (e.g., April 15th for individual returns).

If necessary, file an extension if unable to complete taxes by the deadline.

Confirm submission method (e-filing vs. paper filing) and ensure all payments are made on time.

VII. Final Submission

Ensure all required signatures are included.

Submit tax returns electronically or mail forms if filing paper returns.

Retain copies of all documents, including filed forms and supporting documentation, for your records.