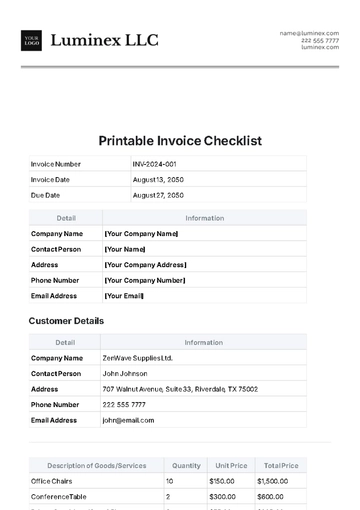

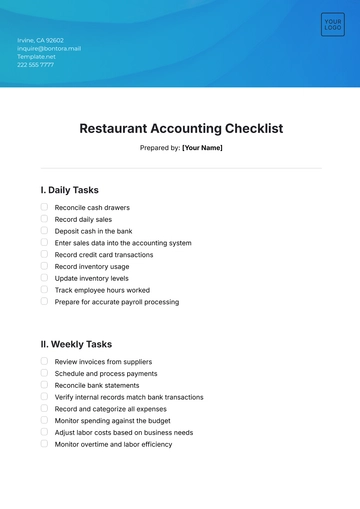

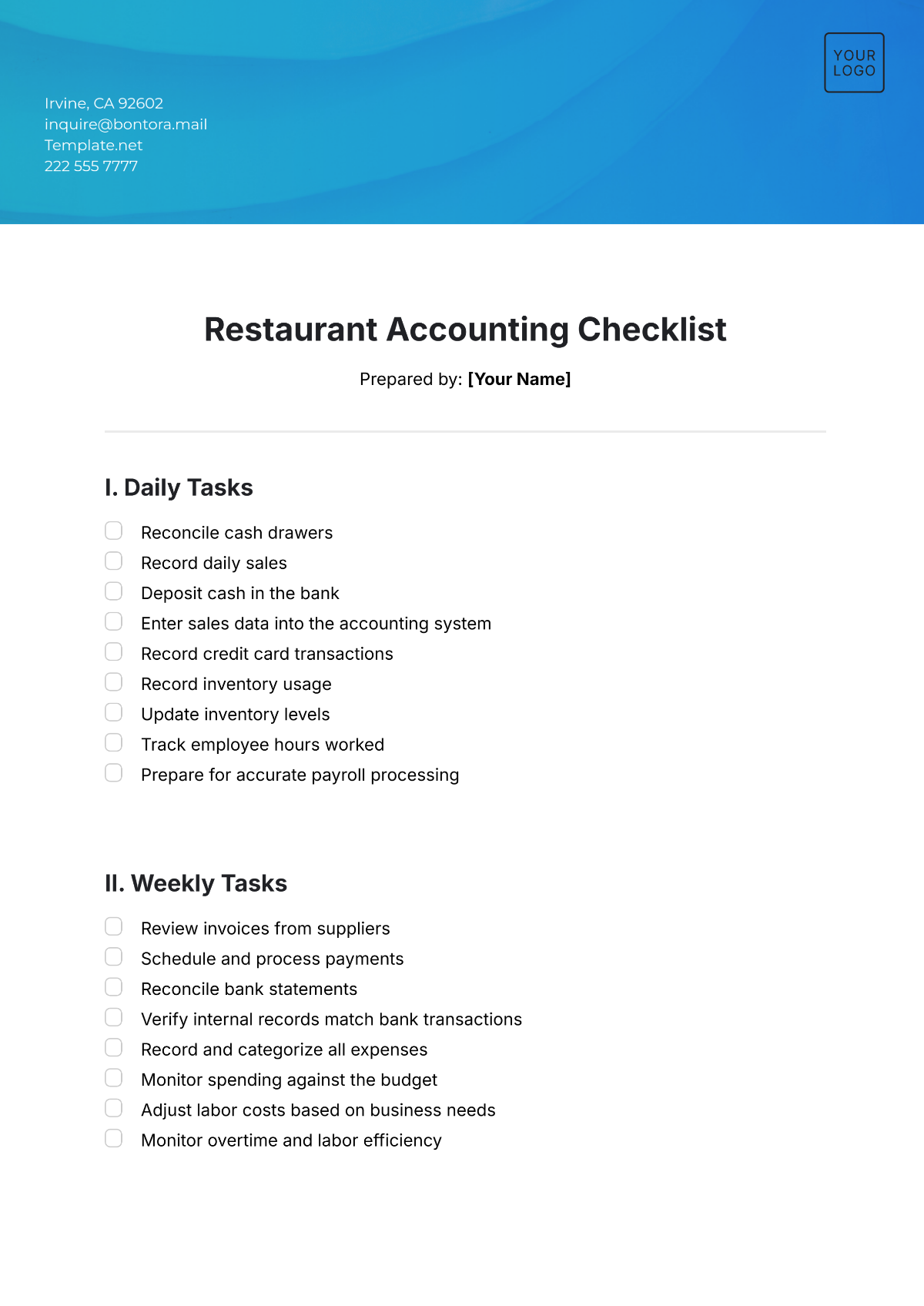

Free Restaurant Accounting Checklist

Prepared by: [Your Name]

I. Daily Tasks

Reconcile cash drawers

Record daily sales

Deposit cash in the bank

Enter sales data into the accounting system

Record credit card transactions

Record inventory usage

Update inventory levels

Track employee hours worked

Prepare for accurate payroll processing

II. Weekly Tasks

Review invoices from suppliers

Schedule and process payments

Reconcile bank statements

Verify internal records match bank transactions

Record and categorize all expenses

Monitor spending against the budget

Adjust labor costs based on business needs

Monitor overtime and labor efficiency

III. Monthly Tasks

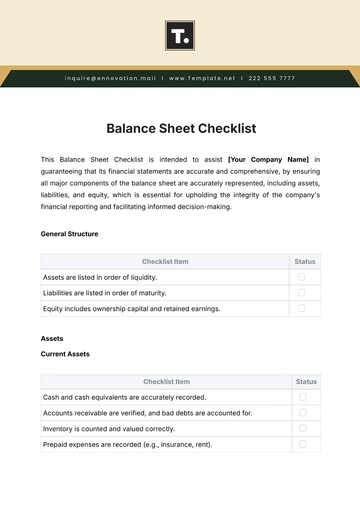

Prepare profit and loss statement

Create balance sheet

Generate cash flow statement

Conduct physical inventory count

Compared with recorded inventory levels

Compare actual performance with budgeted projections

Identify variances and take corrective actions

Calculate and process payroll

Deduct taxes and benefits accurately

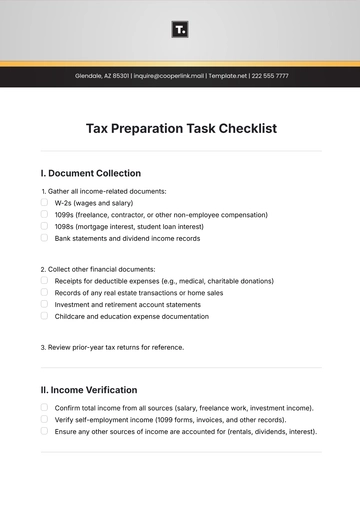

Calculate sales tax liability

Remit sales tax to appropriate authorities

IV. Annual Tasks

Conduct internal audit or hire external auditors

Review financial controls and compliance

Gather necessary documents for tax filing

Prepare and file annual tax returns

Develop a budget for the upcoming year

Incorporate lessons learned and future projections

Ensure compliance with local, state, and federal regulations

Update policies and procedures as needed

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

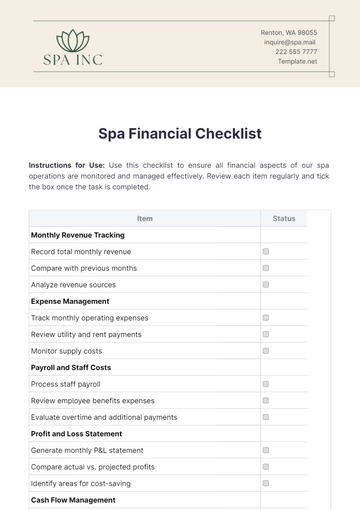

Simplify your restaurant's financial management with our Restaurant Accounting Checklist Template from Template.net. This editable and customizable template, powered by our AI Editor Tool, offers a comprehensive framework for daily, weekly, monthly, and annual accounting tasks. Ensure accuracy and efficiency in cash handling, sales tracking, payroll, and more with ease.

You may also like

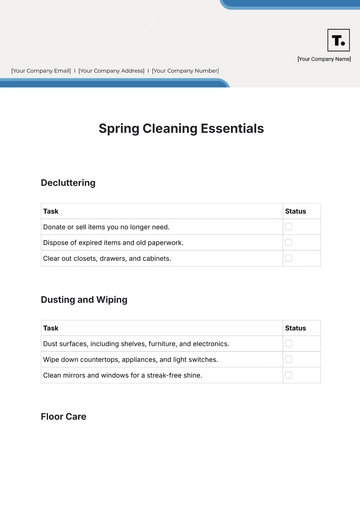

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

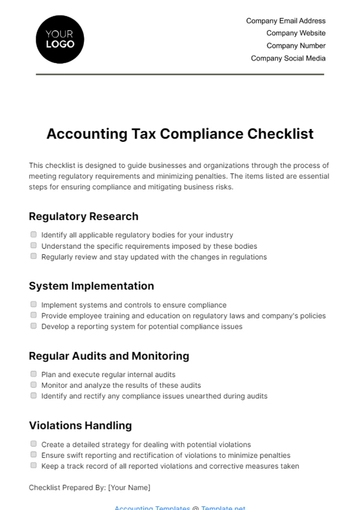

- Compliance Checklist

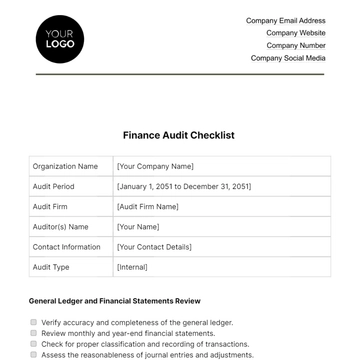

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

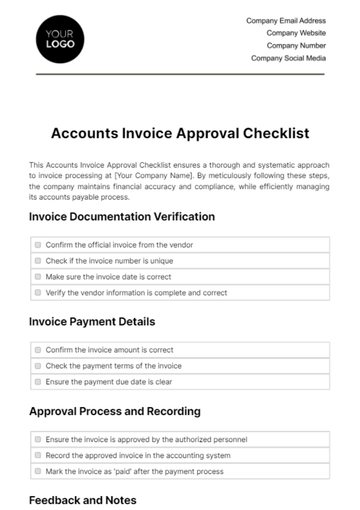

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

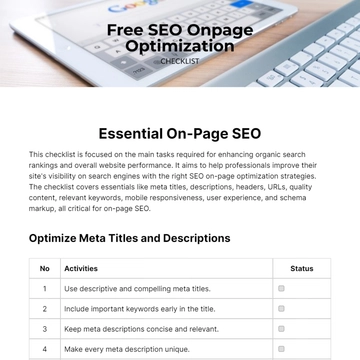

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist