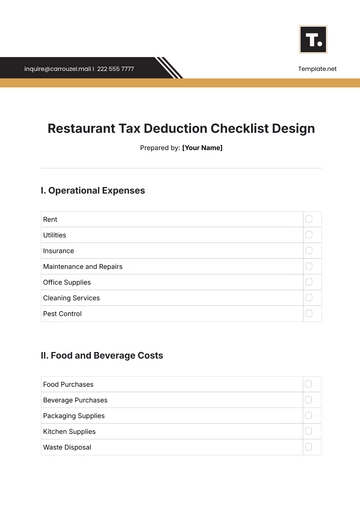

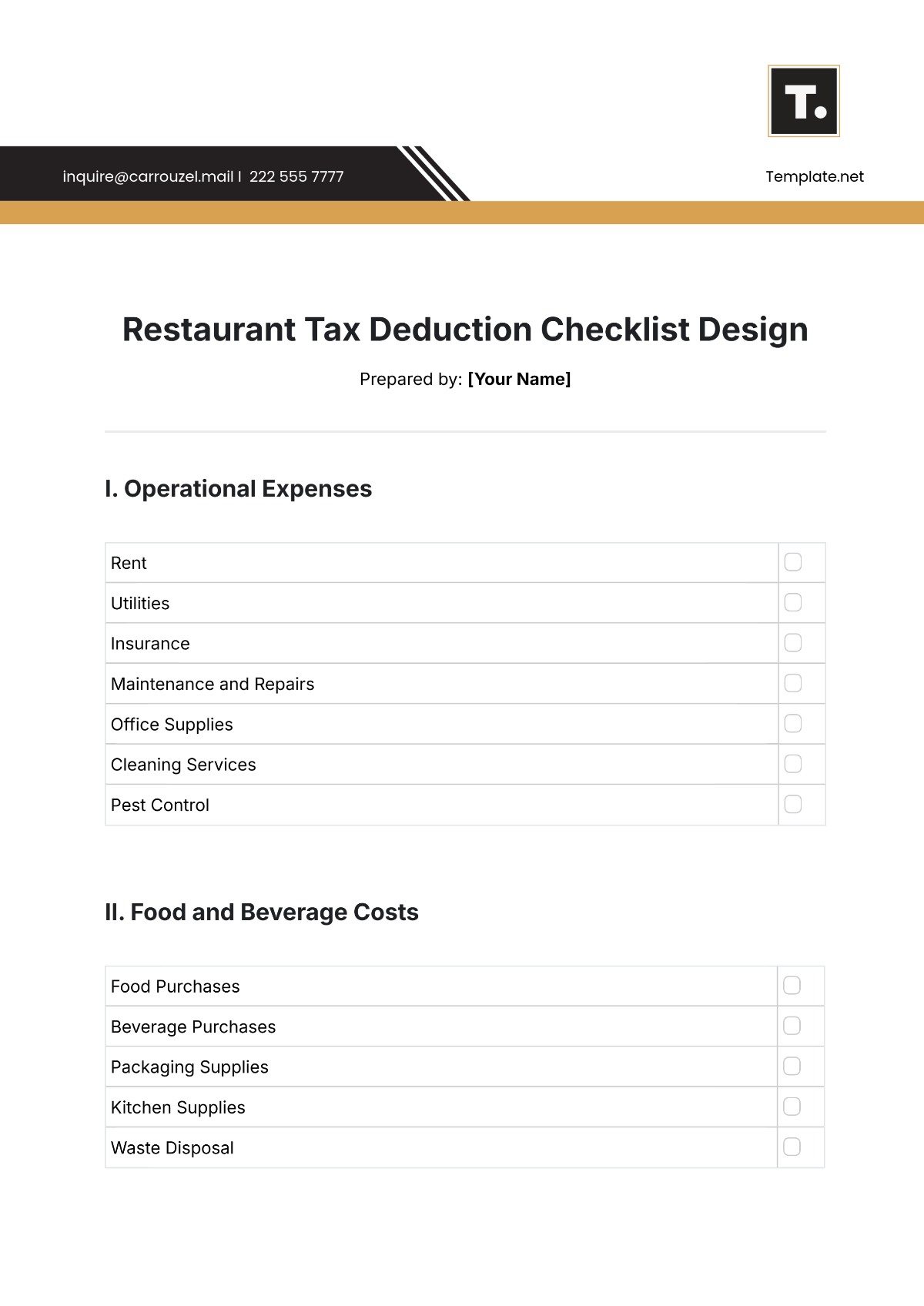

Free Restaurant Tax Deduction Checklist Design

Prepared by: [Your Name]

I. Operational Expenses

Rent | |

Utilities | |

Insurance | |

Maintenance and Repairs | |

Office Supplies | |

Cleaning Services | |

Pest Control |

II. Food and Beverage Costs

Food Purchases | |

Beverage Purchases | |

Packaging Supplies | |

Kitchen Supplies | |

Waste Disposal |

III. Employee Expenses

Salaries and Wages | |

Employee Benefits | |

Payroll Taxes | |

Training and Development | |

Uniforms |

IV. Marketing and Advertising

Advertising Costs | |

Promotional Materials | |

Social Media Campaigns | |

Website Maintenance |

V. Professional Services

Legal Fees | |

Accounting Fees | |

Consulting Fees |

VI. Miscellaneous Expenses

Licenses and Permits | |

Bank Fees | |

Interest Expenses | |

Depreciation |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize your savings with the Restaurant Tax Deduction Checklist Design Template from Template.net. This editable and customizable tool helps you track deductible expenses, ensuring accurate and compliant tax reporting. Fully editable in our AI Editor Tool, you can tailor the checklist to suit your restaurant’s specific financial needs. Simplify tax season with an organized approach to expenses like utilities, supplies, and employee benefits.

You may also like

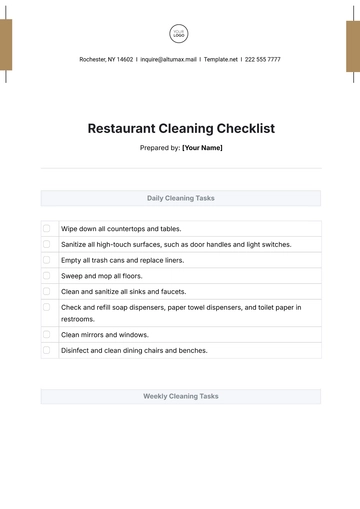

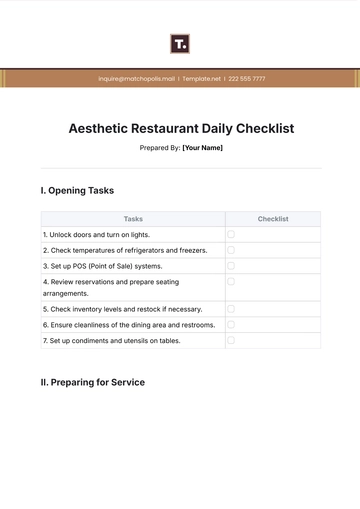

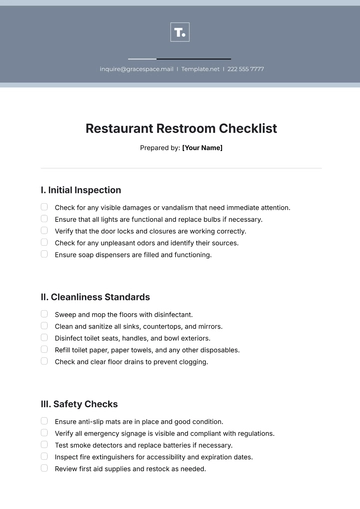

- Cleaning Checklist

- Daily Checklist

- Travel Checklist

- Self Care Checklist

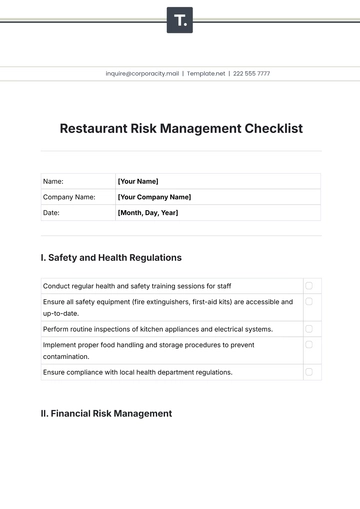

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

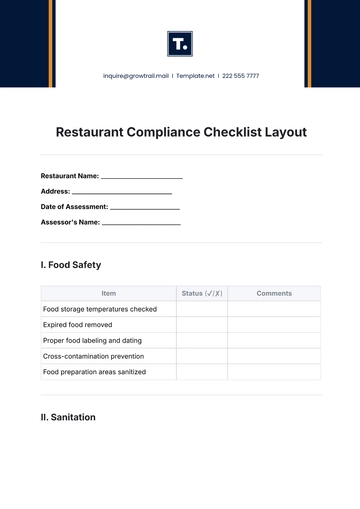

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

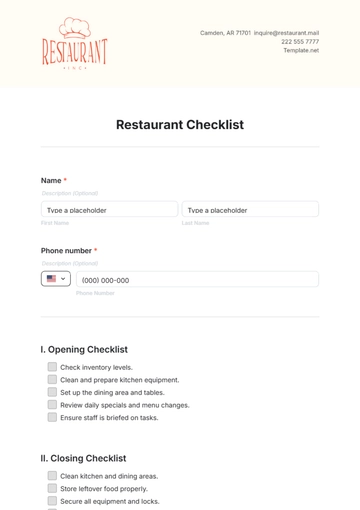

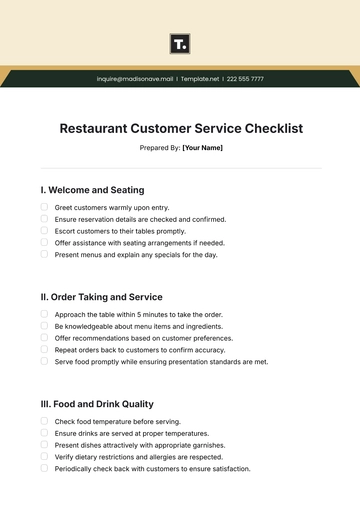

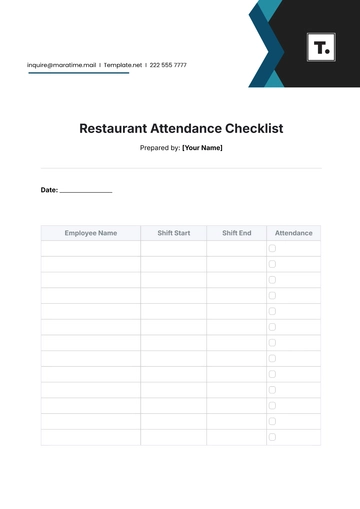

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

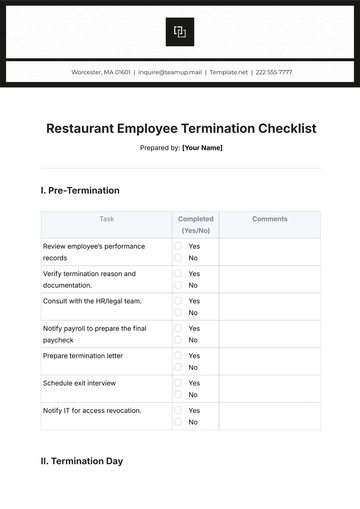

- Employee Checklist

- Moving Checklist

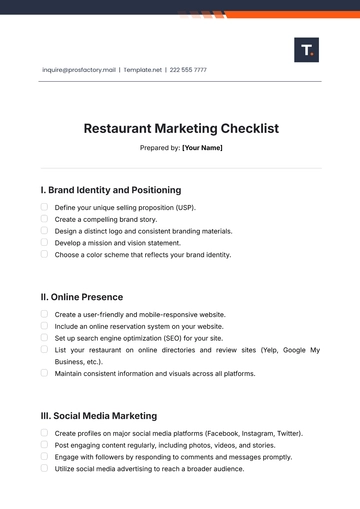

- Marketing Checklist

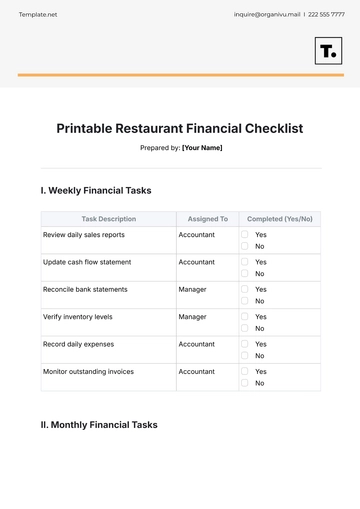

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

- Medical Checklist

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

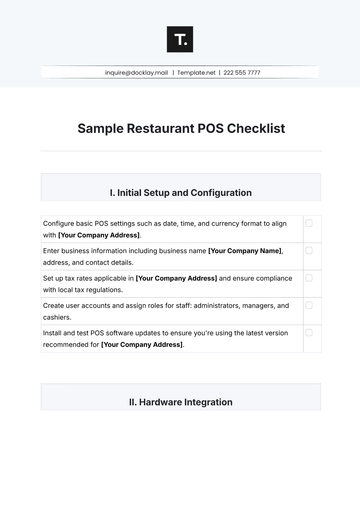

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

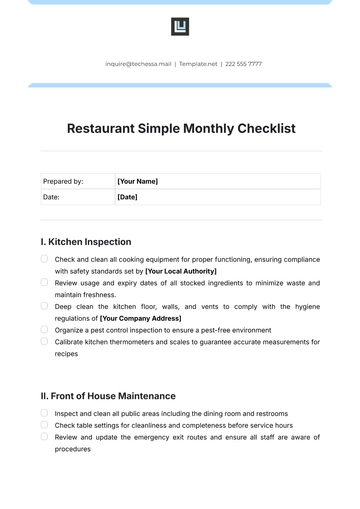

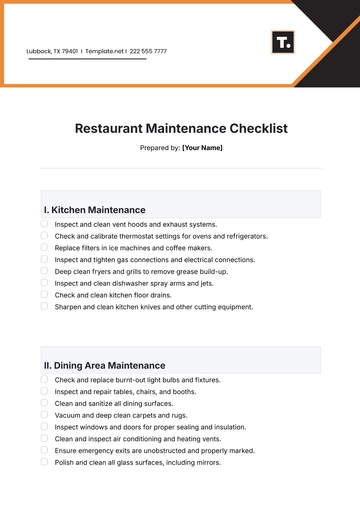

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

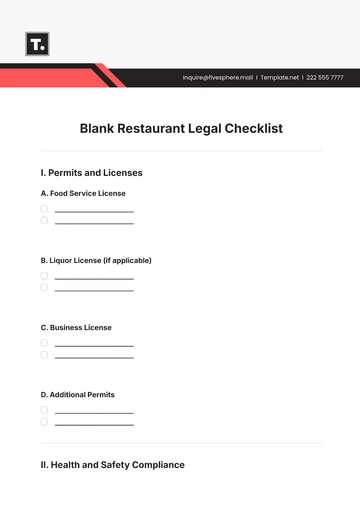

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist