Free Financial Datasheet

Executive Summary

This Financial Datasheet provides an overview of the projected financial performance for the fiscal years 2050 through 2055. It is designed to assist management in budgeting, forecasting, and strategic planning by presenting key financial metrics and projections.

Income Statement (2050-2055)

Year | 2050 |

|---|---|

Revenue | $12,000,000 |

Cost of Goods Sold (COGS) | $7,200,000 |

Gross Profit | $4,800,000 |

Operating Expenses | $2,000,000 |

Operating Income | $2,800,000 |

Other Income/Expenses | $200,000 |

Net Income | $3,000,000 |

Year | 2051 |

|---|---|

Revenue | $12,500,000 |

Cost of Goods Sold (COGS) | $7,500,000 |

Gross Profit | $5,000,000 |

Operating Expenses | $2,100,000 |

Operating Income | $2,900,000 |

Other Income/Expenses | $250,000 |

Net Income | $3,150,000 |

Year | 2052 |

|---|---|

Revenue | $13,000,000 |

Cost of Goods Sold (COGS) | $7,800,000 |

Gross Profit | $5,200,000 |

Operating Expenses | $2,200,000 |

Operating Income | $3,000,000 |

Other Income/Expenses | $300,000 |

Net Income | $3,300,000 |

Year | 2053 |

|---|---|

Revenue | $13,500,000 |

Cost of Goods Sold (COGS) | $8,000,000 |

Gross Profit | $5,500,000 |

Operating Expenses | |

Operating Income | $3,200,000 |

Other Income/Expenses | $350,000 |

Net Income | $3,550,000 |

Year | 2054 |

|---|---|

Revenue | $14,000,000 |

Cost of Goods Sold (COGS) | $8,200,000 |

Gross Profit | $5,800,000 |

Operating Expenses | $2,400,000 |

Operating Income | $3,400,000 |

Other Income/Expenses | $400,000 |

Net Income | $3,800,000 |

Year | 2055 |

|---|---|

Revenue | $14,500,000 |

Cost of Goods Sold (COGS) | $8,500,000 |

Gross Profit | $6,000,000 |

Operating Expenses | $2,500,000 |

Operating Income | $3,500,000 |

Other Income/Expenses | $450,000 |

Net Income | $3,950,000 |

Balance Sheet (As of December 31, 2050-2055)

Year | Total Assets | Total Liabilities | Shareholders' Equity |

|---|---|---|---|

2050 | $25,000,000 | $10,000,000 | $15,000,000 |

2051 | $26,000,000 | $10,500,000 | $15,500,000 |

2052 | $27,000,000 | $11,000,000 | $16,000,000 |

2053 | $28,500,000 | $11,500,000 | $17,000,000 |

2054 | $30,000,000 | $12,000,000 | $18,000,000 |

2055 | $31,500,000 | $12,500,000 | $19,000,000 |

Cash Flow Statement (2050-2055)

Year | Operating Cash Flow | Investing Cash Flow | Financing Cash Flow | Net Change in Cash |

|---|---|---|---|---|

2050 | $3,200,000 | ($1,000,000) | $500,000 | $2,700,000 |

2051 | $3,400,000 | ($1,200,000) | $600,000 | $2,800,000 |

2052 | $3,600,000 | ($1,500,000) | $700,000 | $2,800,000 |

2053 | $3,800,000 | ($1,800,000) | $800,000 | $2,800,000 |

2054 | $4,000,000 | ($2,000,000) | $900,000 | $2,900,000 |

2055 | $4,200,000 | ($2,200,000) | $1,000,000 | $3,000,000 |

Financial Ratios (2050-2055)

Year | 2050 |

|---|---|

Current Ratio | 2.5 |

Quick Ratio | 1.8 |

Debt-to-Equity Ratio | 0.67 |

Gross Margin | 40% |

Net Profit Margin | 25% |

Year | 2051 |

|---|---|

Current Ratio | 2.6 |

Quick Ratio | 1.9 |

Debt-to-Equity Ratio | 0.68 |

Gross Margin | 40% |

Net Profit Margin | 25.2% |

Year | 2052 |

|---|---|

Current Ratio | 2.7 |

Quick Ratio | 1.9 |

Debt-to-Equity Ratio | 0.68 |

Gross Margin | 40% |

Net Profit Margin | 25.4% |

Year | 2053 |

|---|---|

Current Ratio | 2.8 |

Quick Ratio | 2.1 |

Debt-to-Equity Ratio | 0.68 |

Gross Margin | 40.7% |

Net Profit Margin | 26.3% |

Year | 2054 |

|---|---|

Current Ratio | 2.9 |

Quick Ratio | 2.2 |

Debt-to-Equity Ratio | 0.67 |

Gross Margin | 40.8% |

Net Profit Margin | 26.7% |

Year | 2055 |

|---|---|

Current Ratio | 3.0 |

Quick Ratio | 2.3 |

Debt-to-Equity Ratio | 0.66 |

Gross Margin | 41% |

Net Profit Margin | 27.2% |

Historical Financial Data (2050-2055)

Year | Revenue Growth | Net Income Growth | Expense Growth |

|---|---|---|---|

2050 | - | - | - |

2051 | 4.17% | 5.00% | 5.00% |

2052 | 4.00% | 6.00% | 4.76% |

2053 | 3.85% | 7.58% | 4.55% |

2054 | 3.70% | 7.04% | 4.35% |

2055 | 3.57% | 7.37% | 4.17% |

Forecasts and Projections (2056-2060)

Projections assume a steady growth rate based on historical trends:

Revenue Growth Rate: 3.5% annually

Net Income Growth Rate: 7.5% annually

Expense Growth Rate: 4.0% annually

Notes and Disclosures

Assumptions: Projections are based on historical growth rates and market conditions. Actual results may vary.

Accounting Policies: Financial statements are prepared under generally accepted accounting principles (GAAP).

Risk Factors: Economic fluctuations, changes in market conditions, and operational risks may impact financial performance.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unlock financial clarity with Template.net's Financial Datasheet Template. This versatile tool is fully customizable and editable using our AI Editable Tool, allowing you to tailor it to your specific needs effortlessly. Designed for accuracy and ease, this template simplifies your financial data management, making it ideal for professionals seeking streamlined and efficient solutions.

You may also like

- Attendance Sheet

- Work Sheet

- Sheet Cost

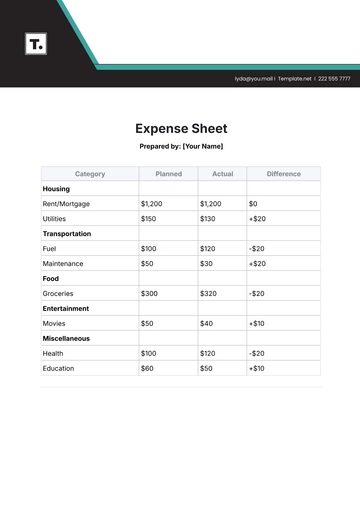

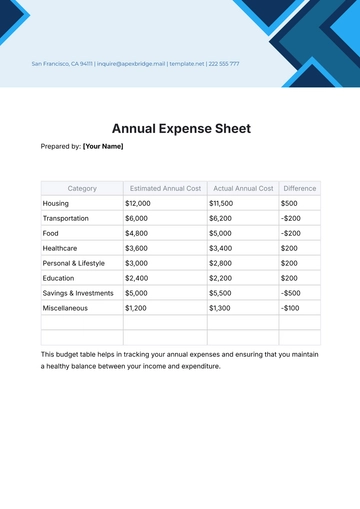

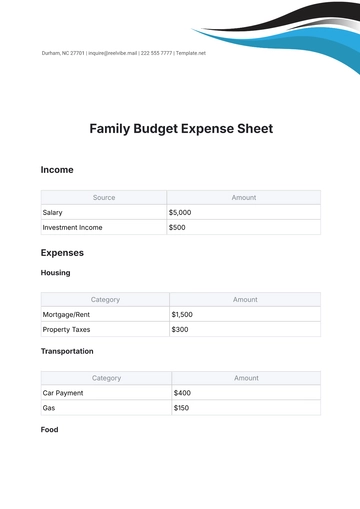

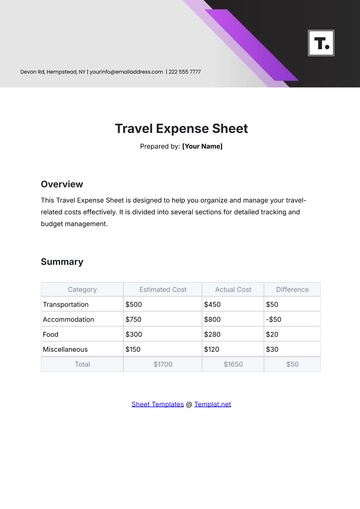

- Expense Sheet

- Tracker Sheet

- Student Sheet

- Tracking Sheet

- Blank Sheet

- Information Sheet

- Sales Sheet

- Record Sheet

- Price Sheet

- Plan Sheet

- Score Sheet

- Estimate Sheet

- Evaluation Sheet

- Checklist Sheet

- Bid Sheet

- Call Log Sheet

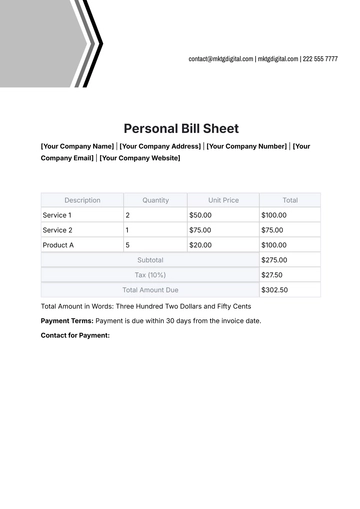

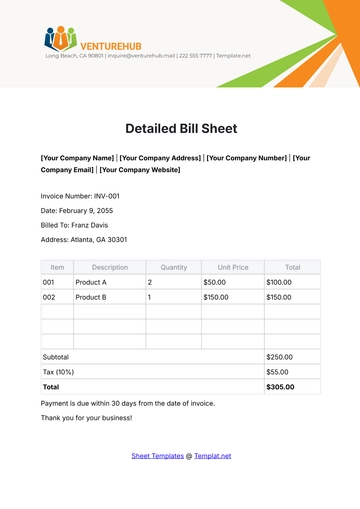

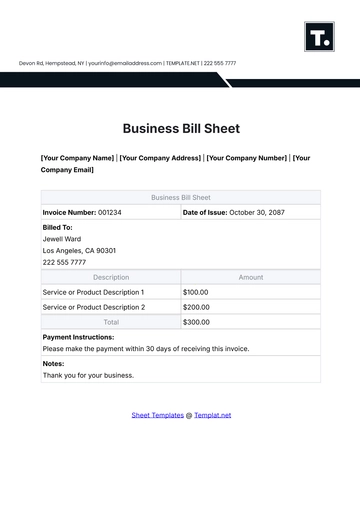

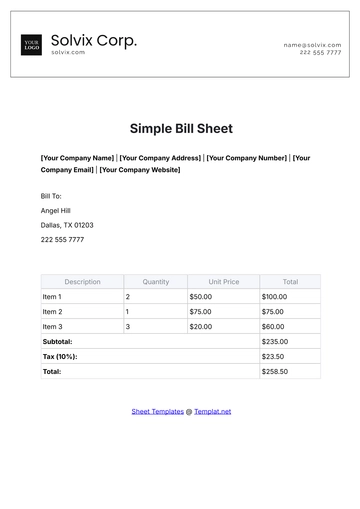

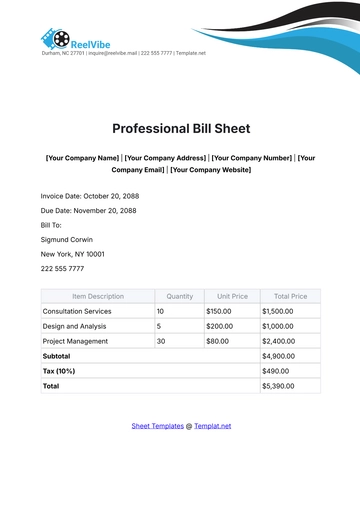

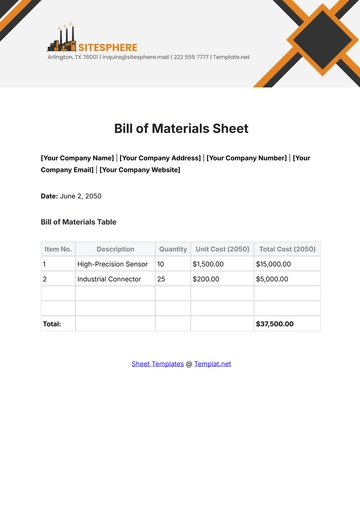

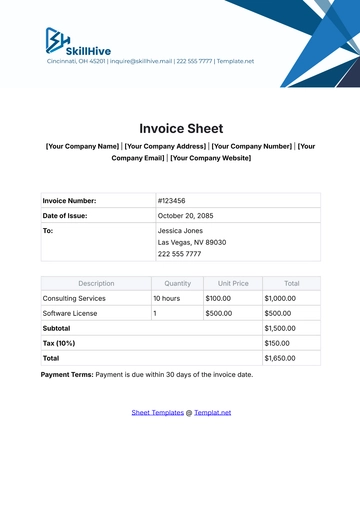

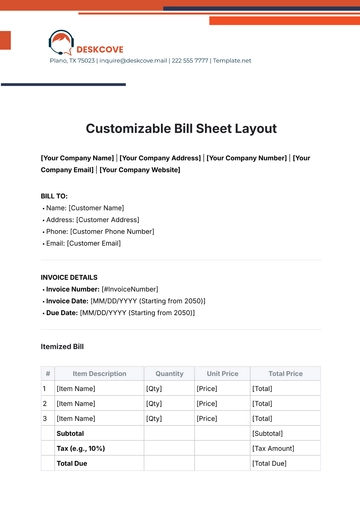

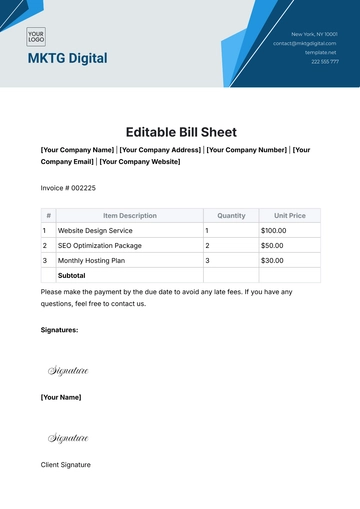

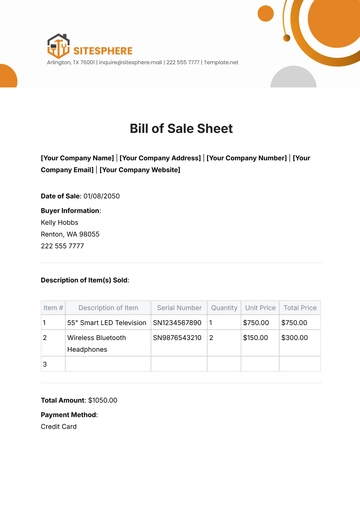

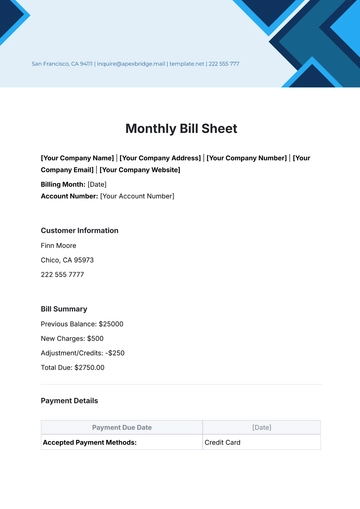

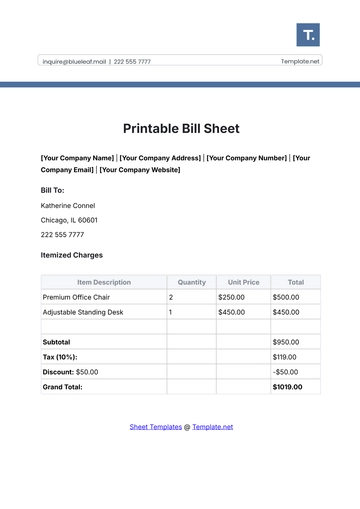

- Bill Sheet

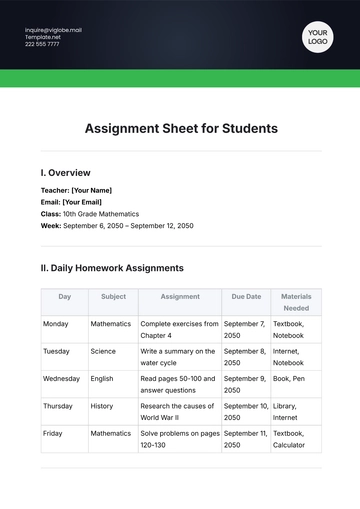

- Assessment Sheet

- Task Sheet

- School Sheet

- Work From Home Sheet

- Summary Sheet

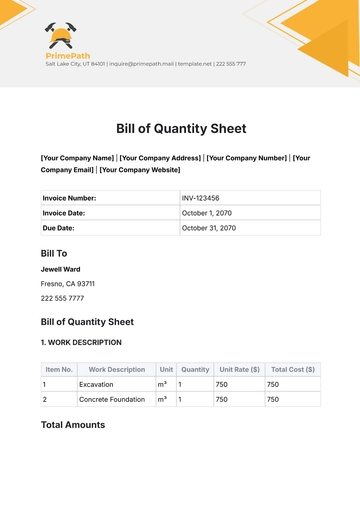

- Construction Sheet

- Cover Sheet

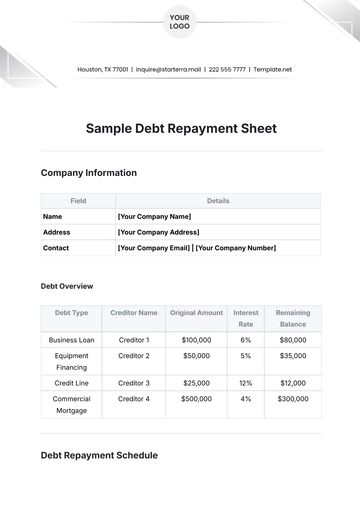

- Debt Spreadsheet

- Debt Sheet

- Client Information Sheet

- University Sheet

- Freelancer Sheet

- Bookkeeping Sheet

- Itinerary Spreadsheet

- Scorecard Sheet

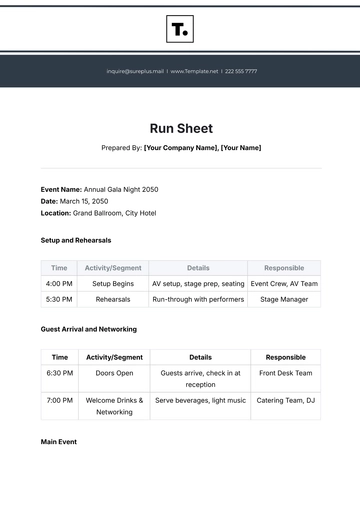

- Run Sheet

- Monthly Timesheet

- Event Sheet

- Advertising Agency Sheet

- Missing Numbers Worksheet

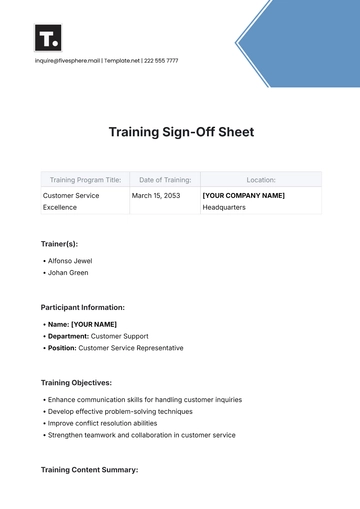

- Training Sheet

- Production Sheet

- Mortgage Sheet

- Answer Sheet

- Excel Sheet