In-Depth Financial Budgeting Guide

I. Understanding Budgeting Basics

In [Your Company Name], budgeting is recognized as a critical component of effective financial management. This process entails a detailed and disciplined approach to tracking and managing income and expenditures. It is not merely about balancing the books, but about strategically allocating financial resources to align with [Your Company Name]'s operational needs and strategic goals. The budgeting process at [Your Company Name] is rigorous and systematic, ensuring that every financial decision is data-driven and contributes to the overall efficiency and effectiveness of the organization's financial operations.

Importance of Budgeting in Finance

At [Your Company Name], budgeting is indispensable for maintaining fiscal discipline and ensuring financial stability. It is a fundamental tool that guides us in fulfilling our financial commitments, avoiding the pitfalls of overspending, and strategically channeling funds into key areas that drive growth and sustainability. The essence of budgeting within our organization is to create a financial roadmap that navigates us through the complexities of the business environment. By adhering to a well-structured budget, [Your Company Name] is able to make proactive financial decisions, ensuring long-term viability and success in an increasingly competitive marketplace.

II. Setting Financial Goals

In this section, we outline [Your Company Name]'s approach to setting clear financial goals and aligning budgeting strategies to achieve these objectives. It’s a systematic process that ensures every financial decision and allocation is purposefully directed towards our company's growth and success.

A. Identifying Goals

At [Your Company Name], our financial goal setting is stratified across various time horizons to ensure comprehensive growth and development. Short-term goals, such as increasing quarterly sales, are set to foster immediate revenue growth, crucial for sustaining day-to-day operations.

Medium-term goals, like expanding our market presence, involve a more strategic approach, including market research and the development of new marketing channels. For long-term sustainability, we aim to diversify our product line, tapping into new markets and customer segments. This multi-tiered goal structure allows us to focus on immediate needs while keeping an eye on future opportunities and challenges.

B. Aligning Budgeting Strategies

To achieve these varied goals, [Your Company Name]'s budgeting strategies are meticulously aligned with each set objective. For short-term sales growth, we allocate funds towards aggressive marketing and sales initiatives. In pursuit of our medium-term goal of market expansion, budget allocations are directed toward market research and the development of new channels and partnerships.

Long-term objectives, like product line diversification, require us to invest in research and development, as well as in scouting for potential mergers or acquisitions. This strategic alignment of our budget ensures that every dollar spent is a step towards realizing our broader corporate ambitions, driving [Your Company Name] towards a path of sustained growth and profitability.

III. Creating a Budget Plan

This section is dedicated to the structured process of developing [Your Company Name]'s budget, highlighting the use of advanced tools for effective management and offering practical tips for maintaining a robust budget. The aim is to ensure a comprehensive and strategic approach to financial planning.

A. Developing a Budget

The budgeting process at [Your Company Name] starts with a comprehensive analysis of our income streams and regular expenditures. We categorize expenses to understand where funds are allocated and identify areas for cost optimization.

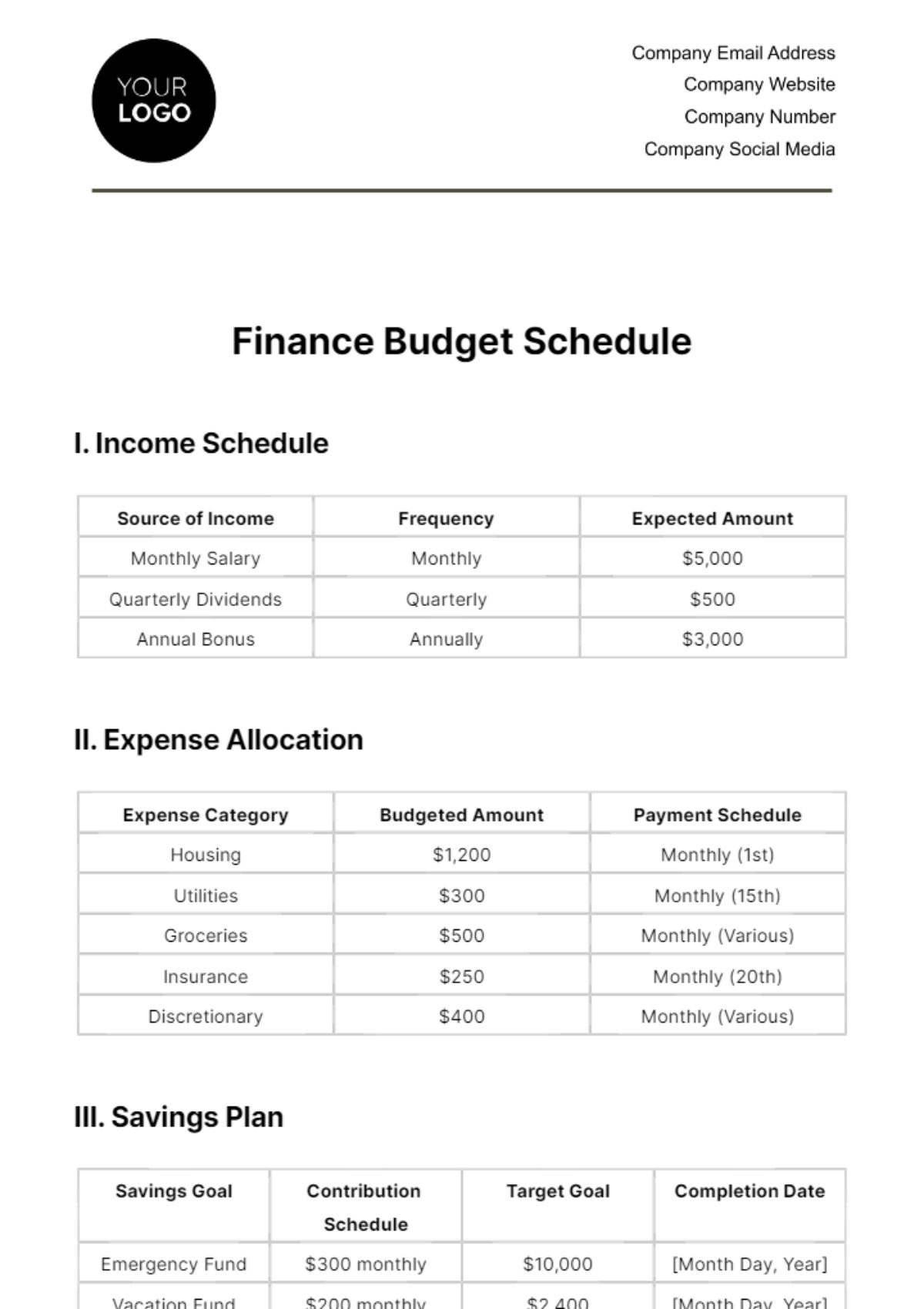

Step | Description | Implementation |

|---|---|---|

Analyze Income Streams | Compile and assess all sources of income | Include revenue from sales, services, investments |

Categorize Expenditures | Divide expenses into fixed and variable | Fixed: rent, salaries; Variable: marketing, R&D |

Allocate Funds | Distribute income to cover expenditures | Ensure alignment with strategic objectives |

Identify Cost Optimization Areas | Analyze spending for potential savings | Target areas with high expenditure for optimization |

Project Future Expenses | Estimate upcoming financial needs | Plan for upcoming projects, expansions, etc. |

B. Budgeting Tools

We use advanced budgeting software for accurate tracking and management, providing real-time financial insights.

Tool | Function | Benefit |

|---|---|---|

Advanced Budgeting Software | Track income and expenses in real-time | Provides accurate financial insights, facilitates analysis |

Forecasting Tools | Project future financial trends | Helps in planning for upcoming fiscal periods |

Expense Tracking Applications | Monitor and categorize spending | Identifies patterns and potential areas for savings |

C. Budget Management Tips

Regular budget updates, prioritizing spending based on strategic importance, and maintaining a contingency reserve are key practices at [Your Company Name].

Tip | Description | Benefit |

|---|---|---|

Regular Budget Reviews | Periodic assessment of the budget | Ensures adherence to financial plans, identifies variances |

Prioritize Strategic Spending | Allocate funds based on priority | Aligns expenditures with company goals and growth plans |

Maintain a Contingency Reserve | Set aside funds for unexpected costs | Provides financial buffer for unforeseen expenses |

IV. Monitoring and Adjusting the Budget

This section focuses on the continuous monitoring and adjustment of [Your Company Name]'s budget. It outlines the structured approach we follow for regular reviews, addressing variances, and adapting to changes, ensuring the budget remains dynamic and responsive to our evolving business needs.

A. Regular Review

Monthly financial meetings are held to review the budget, ensuring we stay on track with our financial targets.

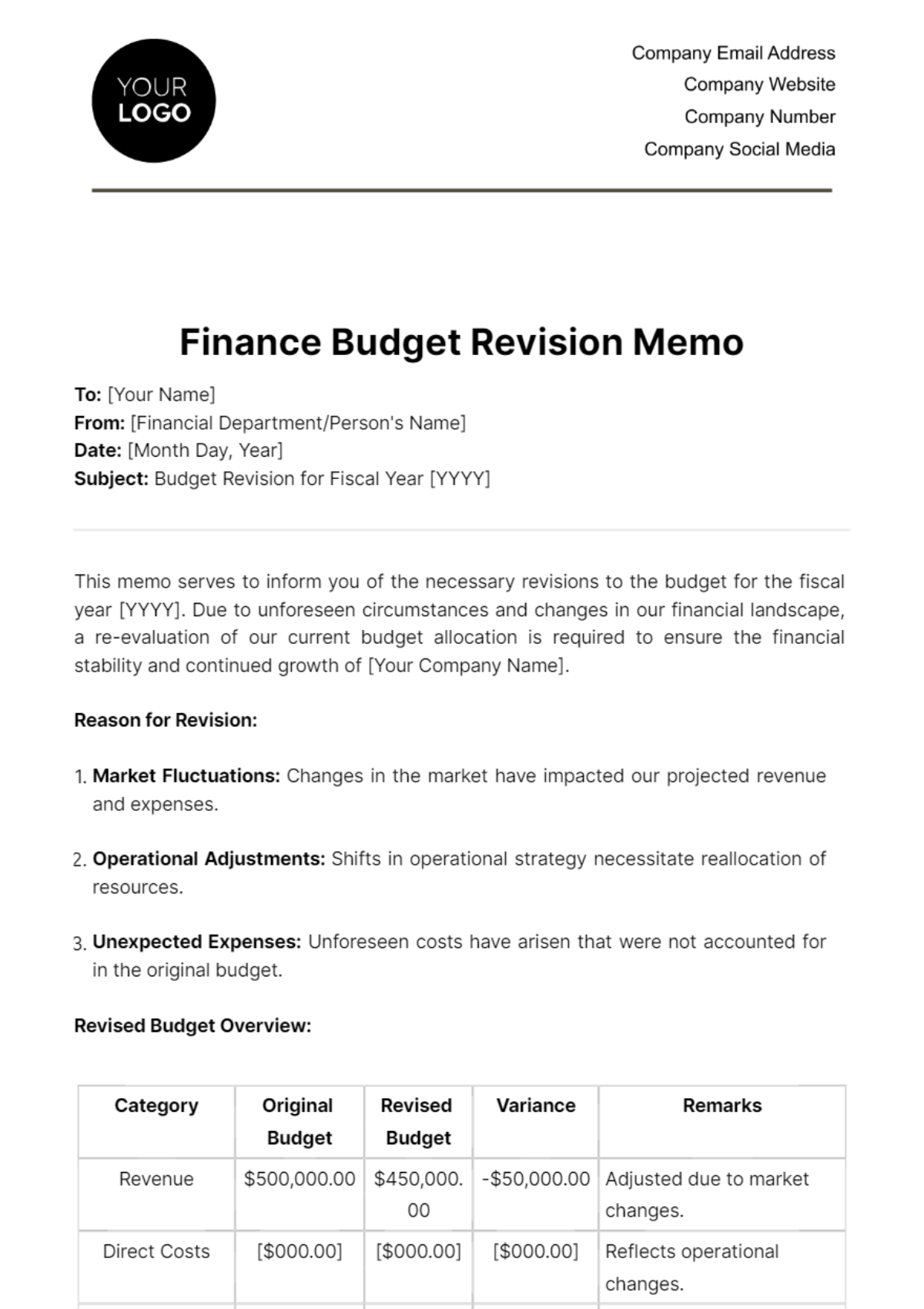

Activity | Frequency | Purpose |

|---|---|---|

Budget Performance Review | Monthly | Assess financial performance against the budget |

Departmental Expenditure Review | Monthly | Evaluate spending patterns in each department |

Revenue Tracking | Monthly | Monitor and analyze revenue streams against forecasts |

B. Addressing Variances

We actively monitor variances between projected and actual figures, investigating discrepancies and adjusting our strategies accordingly.

Variance Type | Action Steps | Expected Outcome |

|---|---|---|

Revenue Shortfalls | Explore new revenue opportunities, adjust spending | Minimize impact on profitability |

Expenditure Overruns | Identify causes, implement cost-saving measures | Control and reduce unnecessary spending |

Cash Flow Discrepancies | Adjust payment terms, manage receivables and payables | Improve liquidity management |

C. Adapting to Change

[Your Company Name] remains agile, ready to modify our budget in response to market changes, new opportunities, or unexpected challenges.

Change Scenario | Adaptive Strategy | Implementation |

|---|---|---|

Market Dynamics | Adjust marketing and sales strategies | Respond to market trends and consumer behavior |

Economic Fluctuations | Review and revise financial forecasts | Align budget with current economic conditions |

Unexpected Opportunities | Allocate resources for new projects | Capitalize on growth opportunities in a timely manner |

V. Advanced Budgeting Strategies

This section introduces [Your Company Name] to advanced budgeting methods, emphasizing the importance of emergency funds and long-term financial planning. These strategies are integral for enhancing our financial management, preparing for uncertainties, and ensuring sustainable growth.

A. Advanced Methods

At [Your Company Name], we adopt innovative budgeting techniques like zero-based budgeting, where every expense must be justified for each new period, ensuring maximum efficiency in resource allocation. We also implement the 50/30/20 rule as a guideline for balancing needs, wants, and savings. This method allocates [50%] of the budget to essential expenses, [30%] to discretionary spending, and [20%] to savings and debt repayment. These advanced techniques allow us to optimize our financial management practices, ensuring each dollar is spent with purpose and aligns with our overall financial goals.

B. Emergency Funds

Recognizing the importance of financial resilience, [Your Company Name] maintains a robust emergency fund. This fund is a critical safeguard against unforeseen expenses, such as unexpected market downturns, emergency repairs, or sudden operational challenges. We consistently allocate a portion of our profits to this fund, aiming to cover at least six months' worth of operating expenses. This practice provides a financial cushion, enabling [Your Company Name] to navigate through potential financial disruptions without compromising our operational integrity or strategic initiatives.

C. Long-term Planning

Long-term financial planning is a cornerstone of [Your Company Name]'s strategic approach. We engage in comprehensive financial forecasting, projecting revenues, expenses, and cash flows over multiple years. This planning includes investments in growth opportunities such as market expansion, research and development, and technological advancements. By doing so, we ensure that [Your Company Name] is not only positioned for immediate success but also prepared for future growth and development.