Finance Budget Approval Process Outline

Introduction

A. Background

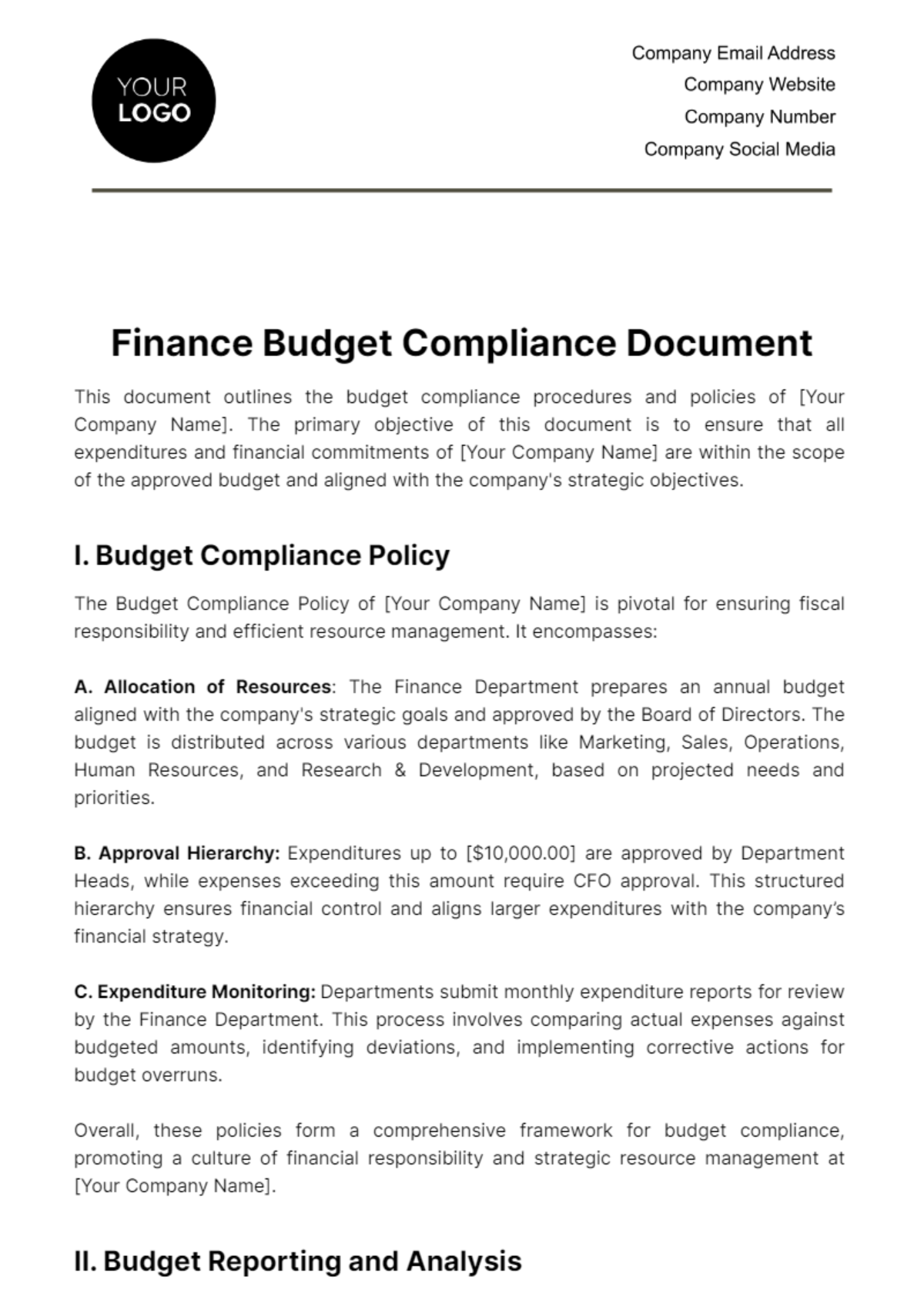

The finance budget approval process is a critical aspect of [Your Company Name]'s financial management strategy. It serves as the foundation for effective financial planning, ensuring that resources are allocated optimally to meet organizational objectives.

B. Purpose

The primary purpose of the finance budget approval process is to align financial goals with the broader objectives of [Your Company Name]. By systematically reviewing and approving budgets, we aim to enhance financial discipline, allocate resources efficiently, and drive overall business success.

C. Scope

This budget approval process encompasses all departments and projects within [Your Company Name], ensuring a comprehensive and cohesive approach to financial planning and decision-making.

Roles and Responsibilities

A. [Your Company Name] Finance Team

The internal finance team at [Your Company Name] plays a pivotal role in collecting and analyzing financial data, preparing budget proposals, and facilitating the entire approval process. This team includes financial analysts, accountants, and budgeting specialists.

B. [Your Partner Company Name] (if applicable)

In cases where [Your Partner Company Name] is involved, their responsibilities may include providing specific financial data, contributing to budget proposals, and collaborating in the decision-making process.

C. Approval Authorities

Key stakeholders involved in the budget approval process include [Your Name], Chief Financial Officer (CFO), [Your Partner Company Name], and any other relevant decision-makers. Their roles include reviewing proposals, providing feedback, and making the final approval decisions.

Budget Preparation

A. Data Collection

Financial data is collected from various sources, including historical records, market trends, and departmental forecasts. The finance team employs data analysis tools and software to ensure accuracy and reliability.

B. Assumptions and Justifications

Assumptions underlying budget projections are explicitly stated, and justifications for significant figures are provided. This includes factors such as market trends, economic conditions, and anticipated changes in business operations.

C. [Your Company Name] Budget Proposal

The budget proposal from [Your Company Name] is structured to include detailed line items for each department and project, providing a clear breakdown of anticipated expenditures and revenue projections.

Budget Review

A. Initial Review

The finance team conducts an initial review, examining the completeness and accuracy of the budget proposal. Any discrepancies or uncertainties are addressed in this stage.

B. Stakeholder Feedback

Stakeholder feedback is gathered through meetings, surveys, and discussions. This feedback is carefully considered and, where appropriate, incorporated into the budget proposal.

C. Revisions and Iterations

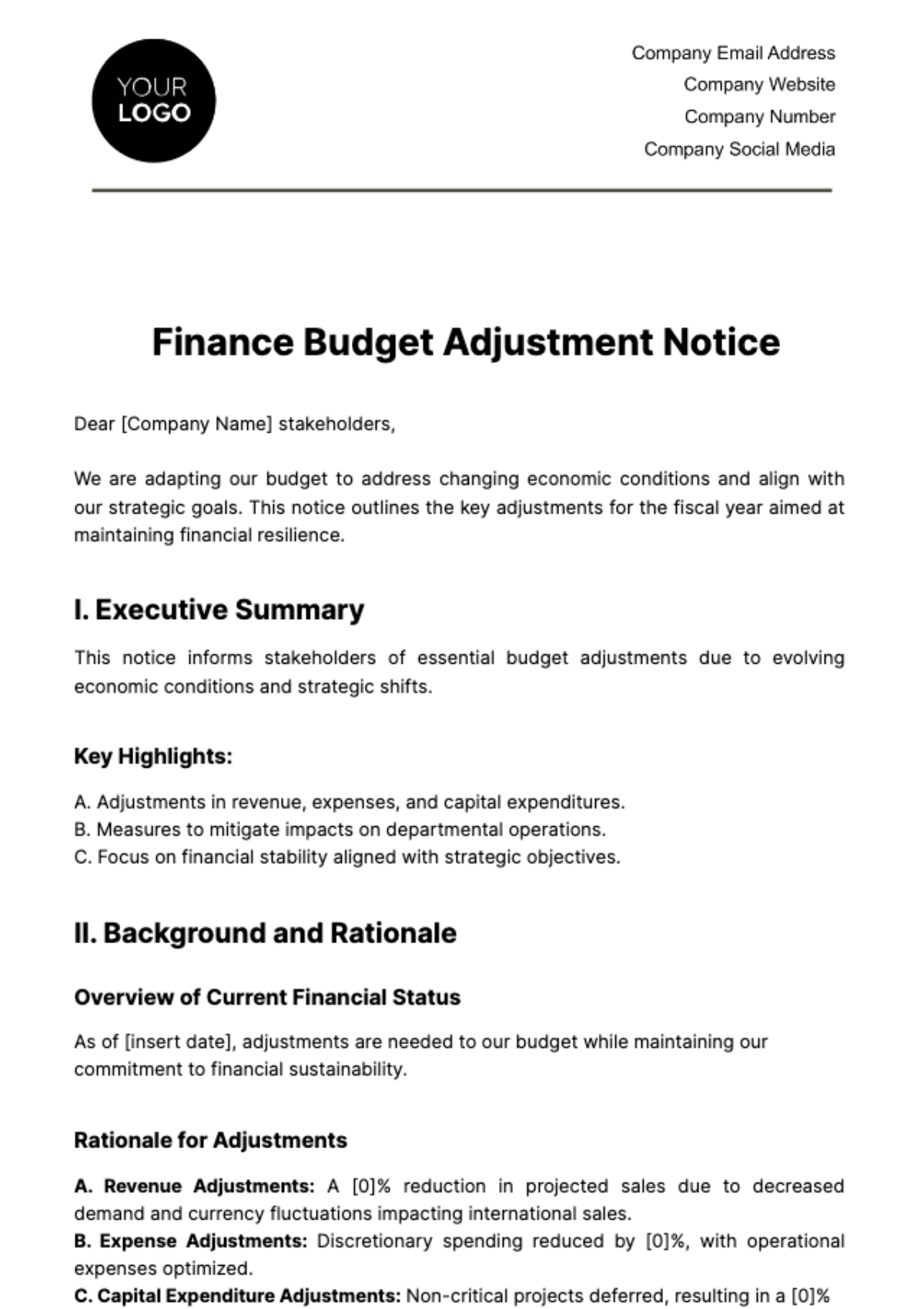

Based on feedback received, the finance team revises the budget proposal iteratively, ensuring that it reflects the collective input of key stakeholders.

Financial Analysis

A. [Your Company Name] Financial Health

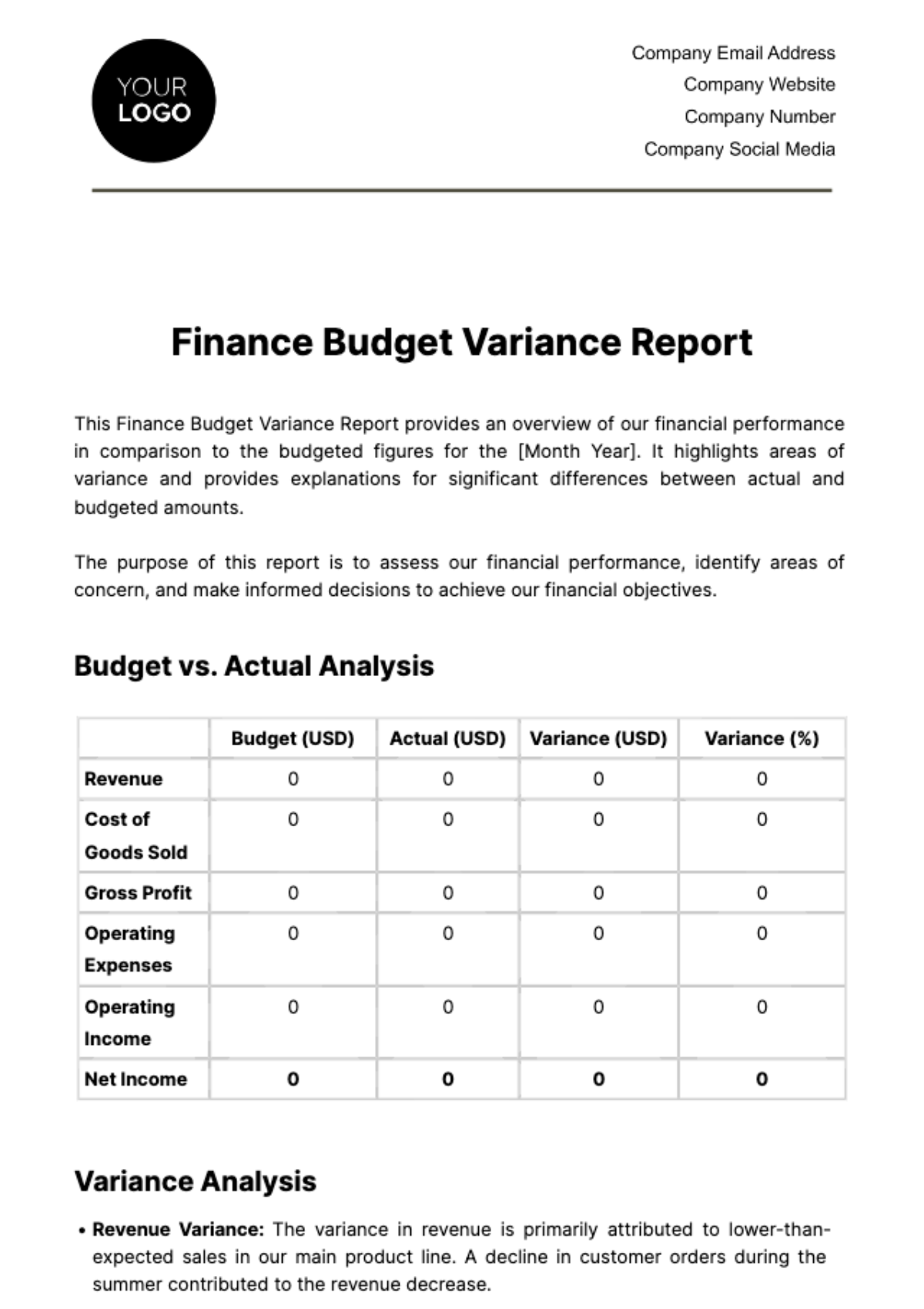

Key financial metrics, such as revenue growth, profit margins, and liquidity ratios, are analyzed to provide a comprehensive overview of [Your Company Name]'s financial health.

B. Comparative Analysis

A comparative analysis is conducted, benchmarking [Your Company Name] against industry standards and competitors. This provides valuable insights into the company's financial standing within the market.

Budget Approval Meeting

A. Meeting Agenda

The budget approval meeting agenda includes key discussion points, presentations by department heads, and opportunities for questions and clarifications.

B. Presentation

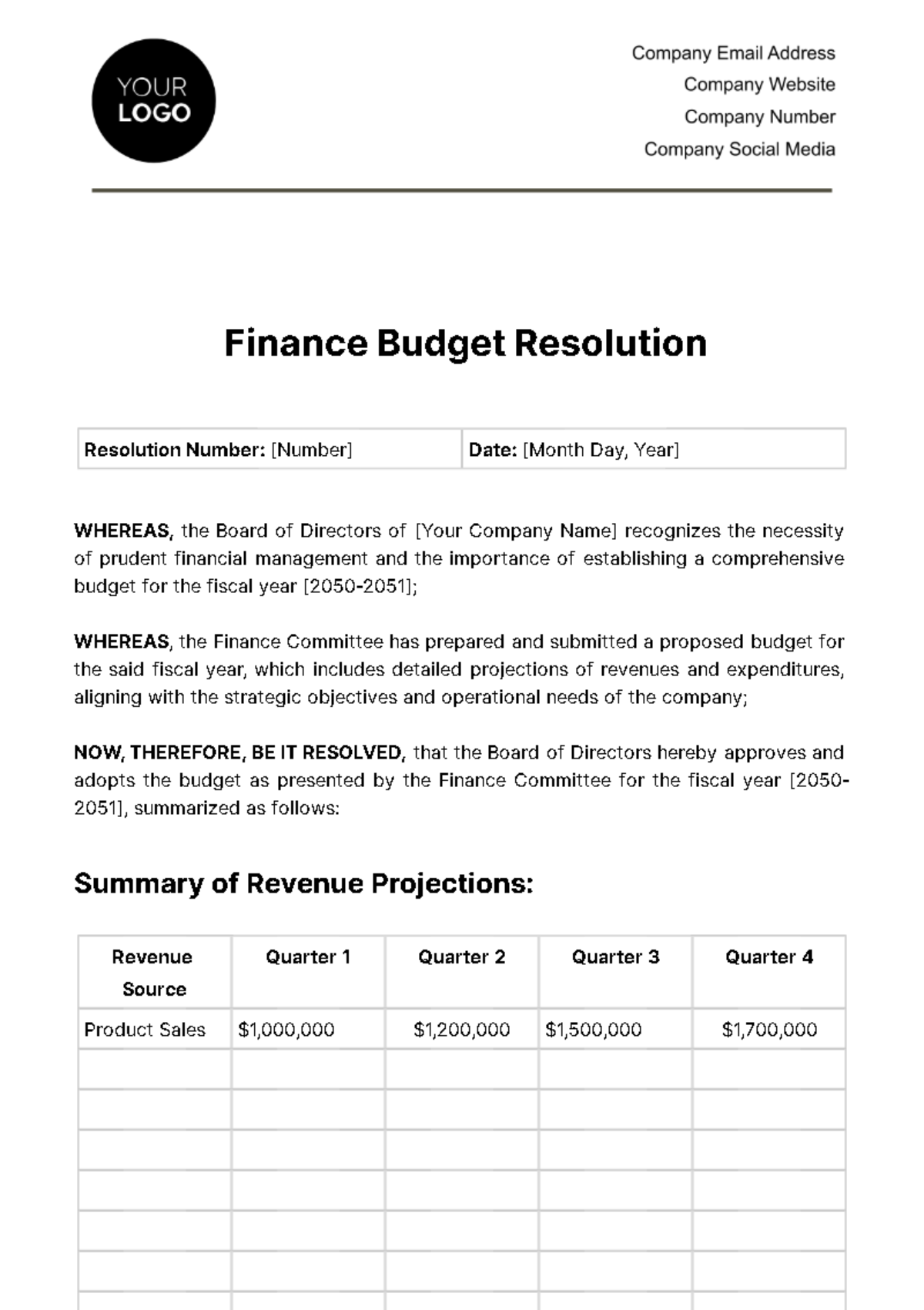

The budget proposal is presented during the meeting using visual aids, charts, and graphs to enhance understanding and facilitate informed decision-making.

C. Decision-Making Process

Decision-makers vote on the approval of the budget, considering factors such as financial feasibility, alignment with strategic goals, and stakeholder input.

Communication of Decision

A. Notification to Departments

Once the budget is approved, relevant departments are promptly notified, outlining any specific actions or adjustments required.

B. [Your Company Social Media]

[Your Company Social Media] platforms are utilized to communicate the approved budget to the public, fostering transparency and demonstrating [Your Company Name]'s commitment to responsible financial management.

Implementation and Monitoring

A. Implementation Plan

An implementation plan is developed, outlining timelines and responsibilities for executing the budget. This includes coordinating with department heads and ensuring adherence to the approved financial plan.

B. Performance Monitoring

Performance against the budget is regularly monitored using key performance indicators (KPIs) and reporting mechanisms. Any variances are investigated, and adjustments are made as needed.

Documentation and Archiving

A. Record-Keeping

Comprehensive records of the budget approval process, including meeting minutes, feedback reports, and revised proposals, are diligently maintained for auditing and reference purposes.

B. [Your Company Website]

Relevant information about the approved budget is made accessible on [Your Company Website], providing stakeholders and the public with transparency and insight into [Your Company Name]'s financial plans.