Finance Budget Implementation Protocol

Introduction

This Finance Budget Implementation Protocol is designed to provide a comprehensive roadmap for managing our financial resources efficiently and strategically, aligning with our overarching corporate vision. The protocol encapsulates our commitment to sustainable growth, innovation, and stakeholder value creation. It integrates cutting-edge financial tools, data-driven decision-making, and a holistic approach to risk management.

By balancing agility with meticulous planning, we are poised to adapt to market changes while pursuing ambitious growth objectives. This document serves as a guide to navigate the fiscal challenges and opportunities of [Year], laying out a structured approach to budget creation, allocation, monitoring, and adjustment.

Strategic Planning Alignment

Objective Setting

Our financial objectives revolve around achieving sustainable growth, maximizing shareholder value, and enhancing technological innovation. We aim to achieve a [0%] increase in annual revenue and a [0%] rise in profit margins. To support these goals, we plan to invest heavily in emerging technologies and expand our global market presence.

Financial Objectives for [Year]:

Objective | Target | Time Frame |

Increase annual revenue | 15% growth | June 10, 2050 |

Market Analysis

The market analysis highlights significant trends such as the rise of artificial intelligence in financial services, increasing emphasis on sustainable practices, and the growth of the [Target Region] markets. We anticipate a shift towards more automated financial processes and a demand for eco-friendly business practices.

Key Market Trends:

Trend | Description | Impact on Budget |

Artificial Intelligence in Finance | Increased use of AI for automation and decision-making | Higher allocation for tech upgrades |

Budget Preparation

Revenue Forecasting

For revenue forecasting, we are utilizing advanced AI algorithms that take into account variables such as customer behavior patterns, economic indicators, and global market trends. We forecast a substantial increase in revenue streams from our digital services and a steady growth in traditional sectors.

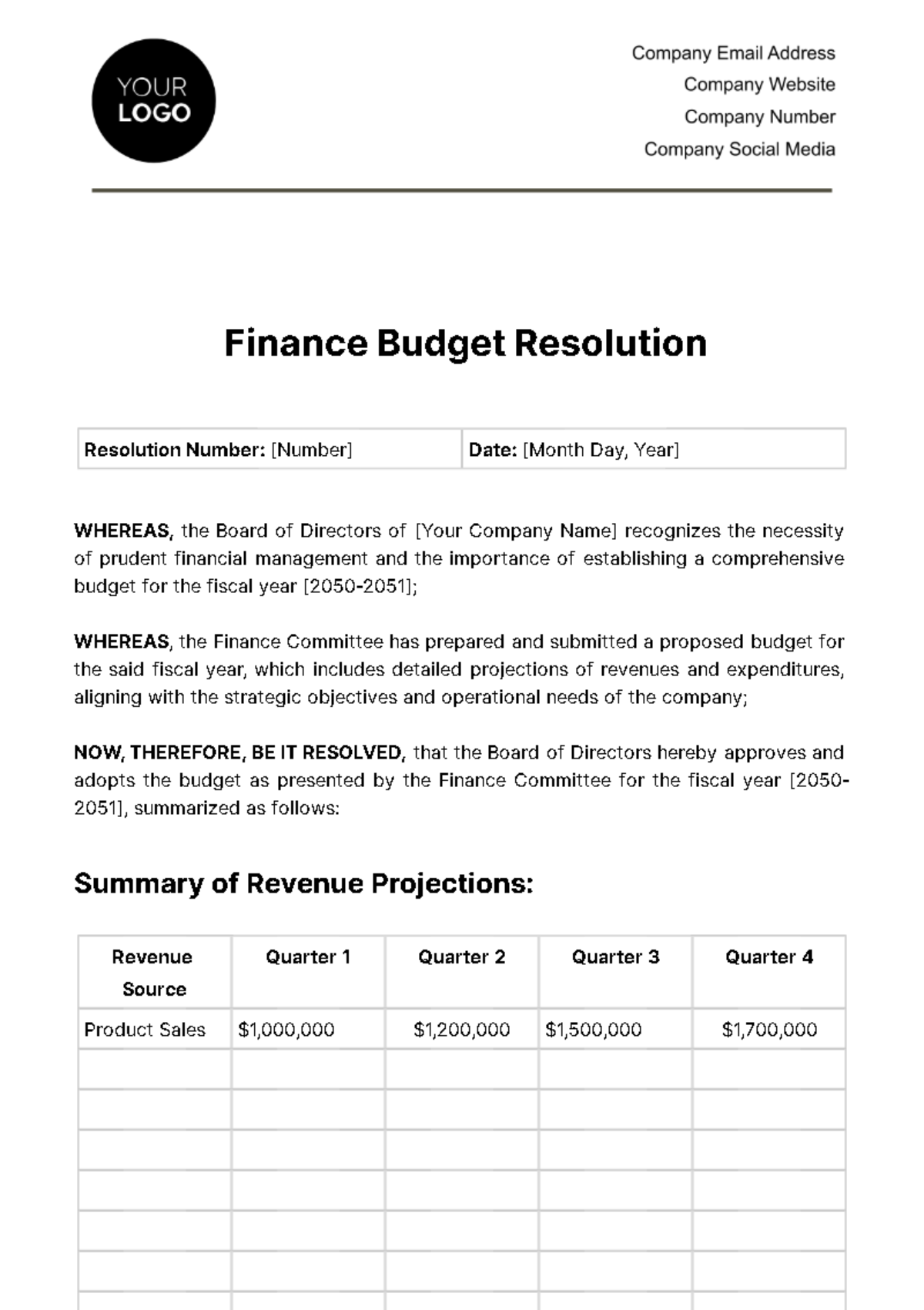

Revenue Forecast for [Year]:

Business Unit | Forecasted Revenue | Growth |

Digital Services | $800M | 20% increase |

Expense Estimation

Our expense estimation focuses on optimizing operational efficiency while investing in strategic areas such as research and development, and marketing. Major expenses include technology upgrades, employee training programs, and expansion into new markets.

Projected Expenses for [Year]:

Expense Category | Estimated Cost | Notes |

Technology Upgrades | $200M | AI and automation systems |

Resource Allocation

Capital Allocation

The capital allocation is strategically designed to support our key business initiatives and technological advancements. Major allocations include investment in AI and machine learning technologies, expansion into new markets, particularly in the [Target Region], and enhancing our digital infrastructure.

Capital Allocation for [Year]:

Department/Project | Allocation Amount | Purpose |

AI and Machine Learning Development | $300M | To advance our tech capabilities |

Risk Management

Risk management focuses on mitigating financial risks associated with technological investments, market volatility, and geopolitical factors. Our approach includes diversifying investments, maintaining a strong liquidity position, and employing advanced predictive analytics for risk assessment.

Risk Management Strategies:

Risk Type | Strategy | Implementation Detail |

Technological Risks | Diversification of Tech Investments | Avoid over-reliance on a single technology |

Performance Metrics

Key Performance Indicators (KPIs)

To measure the effectiveness of our budget implementation, we have established several KPIs. These include Return on Investment (ROI) for our technology upgrades, customer satisfaction scores, market share growth, and operational cost efficiency.

Key Performance Indicators:

KPI | Target | Measurement Frequency |

ROI from Tech Upgrades | 20% increase | Bi-annually |

Benchmarking

Benchmark Category | Our Target Position | Comparative Analysis Period |

Technological Innovation | Top 25% in industry | Annually |

Stakeholder Communication

Internal Communication

A robust internal communication strategy is crucial for ensuring transparency and engagement with all team members regarding our financial strategies and performance. We will implement regular departmental meetings, digital newsletters, and an interactive internal portal for updates and feedback.

Internal Communication Plan:

Communication Method | Frequency | Purpose |

Departmental Meetings | Monthly | Discuss financial performance and adjustments |

External Reporting

Our external reporting will be designed to ensure compliance, transparency, and accountability. We will publish annual reports, engage in quarterly earnings calls, and maintain an updated investor relations website. These reports will include financial statements, performance highlights, and future outlooks.

External Reporting Schedule:

Report Type | Frequency | Content Focus |

Annual Reports | Annually | Comprehensive financial statements and analysis |

Technology Integration

Financial Software Utilization

To enhance our financial processes, we will integrate advanced financial software solutions. These include AI-driven analytics for forecasting, blockchain for secure transactions, and cloud-based platforms for real-time financial data access.

Key Financial Software Tools:

Software Tool | Purpose | Benefit |

AI-Driven Analytics | Revenue and expense forecasting | Increased accuracy and predictive capabilities |

Data Security

Data security in financial operations is paramount. We will implement cutting-edge cybersecurity measures, conduct regular data audits, and ensure compliance with global data protection regulations.

Data Security Measures:

Security Measure | Implementation Detail | Compliance Standard |

Cybersecurity Protocols | Advanced encryption and intrusion detection | Adherence to international cybersecurity norms |

Continuous Monitoring and Adjustment

Ongoing Review

We will implement a continuous review process to ensure our financial plans remain aligned with market dynamics and company objectives. This process involves monthly performance reviews, quarterly strategic reassessments, and annual audits. Adjustments will be made based on these reviews to address any discrepancies or to capitalize on new opportunities.

Continuous Review Schedule:

Review Type | Frequency | Focus Area |

Performance Review | Monthly | Assess financial performance against budget |

Agile Response Strategies

To address unforeseen financial challenges and opportunities, we will develop agile response strategies. These strategies include maintaining a contingency fund, rapid reallocation of resources where necessary, and a cross-departmental task force to manage unexpected scenarios.

Agile Response Framework:

Strategy Component | Description | Implementation Detail |

Contingency Fund | Reserved funds for unexpected expenses | Allocation of 5% of annual budget |

Employee Training and Development

Financial Literacy Programs

Recognizing the importance of financial literacy, we will launch comprehensive training programs for all employees. These programs will cover topics like budget management, financial forecasting, and understanding financial reports. The objective is to enhance decision-making at all levels and foster a financially informed culture.

Financial Literacy Training Topics:

Training Topic | Description | Target Audience |

Budget Management | Techniques for effective budget handling | All department heads and team leads |

Professional Development

We are committed to the continuous professional development of our finance team. This includes sponsoring certifications and advanced courses in finance, data analysis, and emerging technologies, as well as attending global finance conferences and seminars.

Professional Development Opportunities:

Opportunity Type | Description | Beneficiaries |

Certifications | Specialized finance and tech certifications | Finance team members |

Conclusion

This protocol underscores our dedication to financial integrity, transparency, and accountability, ensuring that every financial decision supports our strategic objectives. It fosters a culture of financial literacy and continuous learning, equipping our team with the skills and knowledge to excel in this fast-paced environment. As we implement this protocol, we are confident that it will steer our financial operations towards efficiency, innovation, and sustained growth, securing our position as a leader in our industry. By embracing this approach, we are not just preparing for the fiscal year of [Year]; we are setting the foundation for decades of success and innovation.