Finance Budget SOP

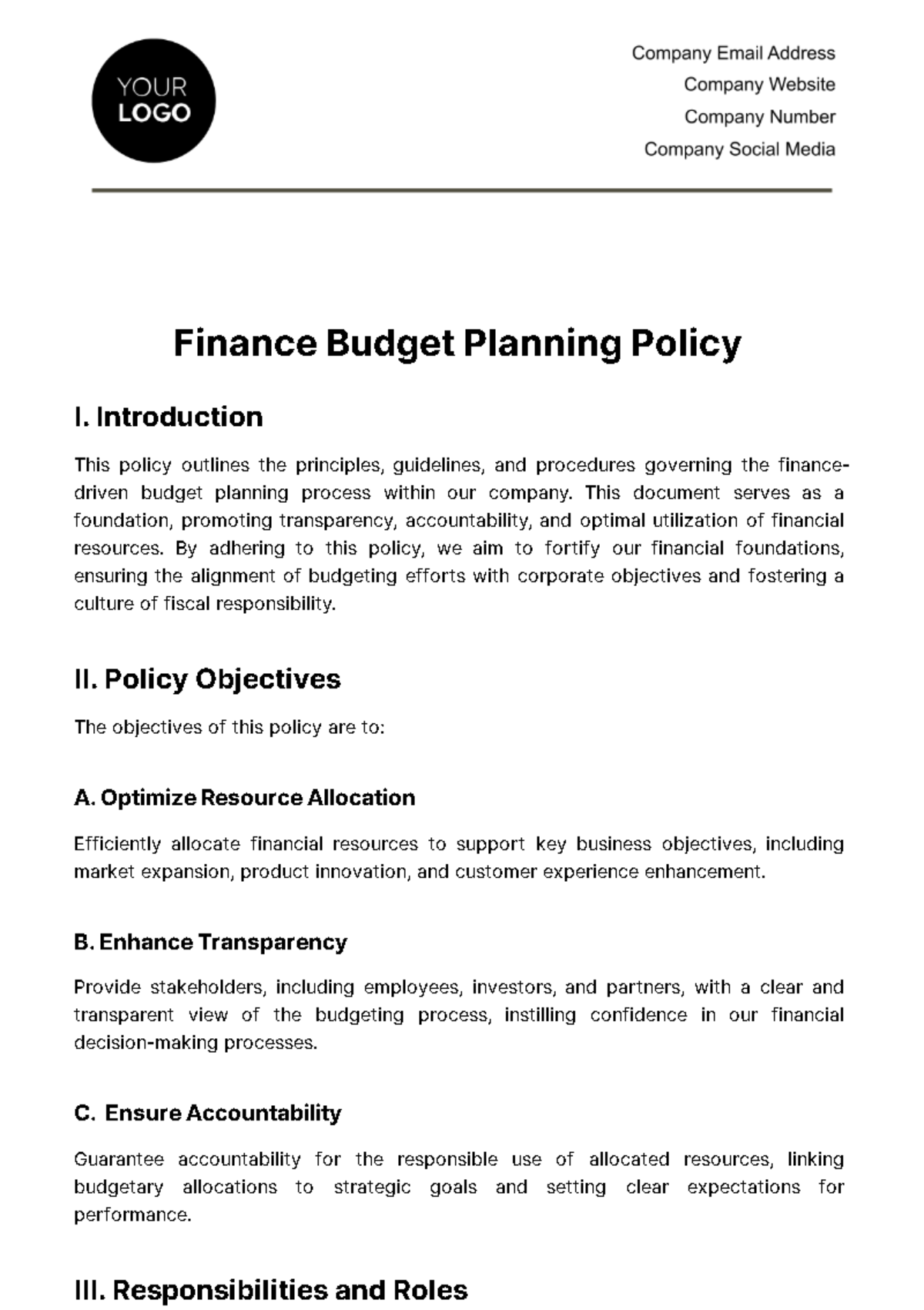

Introduction

Purpose of the SOP

This Standard Operating Procedure (SOP) is designed to guide the annual financial planning and budgeting process within the company. It serves as a foundational document that outlines the methodical approach to creating, reviewing, and implementing the financial budget. This SOP aims to ensure that all financial decisions are made consistently, transparently, and in alignment with the company's strategic objectives.

Scope

Applicable across all departments, this SOP is a critical tool for department heads, finance personnel, and the executive team. It encompasses every aspect of the budgeting process - from initial planning and forecasting to approval, allocation, and ongoing monitoring. By adhering to this SOP, the company ensures a unified approach to financial management, facilitating effective resource allocation, risk management, and strategic planning.

Budget Planning

Budget Timeline

The annual budget process follows a structured timeline to ensure timely preparation, review, and finalization.

Activity | Start Date | End Date | Description |

Initial Budget Call | June 10, 2050 | June 15, 2050 | Preliminary meetings to discuss strategic goals and budget expectations. |

Strategic Goals Alignment

Each department's budget must directly support the company's strategic goals for the year, which include:

Increasing Market Share: Aim to increase our market share in the tech sector by [0%].

Cost Reduction: Target a [0%] reduction in operational costs through process optimization.

Innovation and R&D: Allocate [0%] of the budget to research and development, focusing on AI and machine learning.

Revenue Forecasting

Sales Projections

The Sales Department is expected to provide a comprehensive forecast for the upcoming fiscal year. This forecast is based on several key factors:

Market Trends: Analyzing current market conditions and trends in the technology sector.

Historical Sales Data: Reviewing past sales performance to identify patterns and growth rates.

Growth Strategies: Incorporating the impact of new product launches and marketing campaigns.

Product Line | Q1 Forecast | Q2 Forecast | Q3 Forecast | Q4 Forecast | Notes |

Smartphones | $20M | $25M | $30M | $35M | Launch of new model in Q3 |

The Budget Planning and Revenue Forecasting sections ensure a comprehensive approach towards aligning financial resources with strategic company goals. This detailed planning facilitates informed decision-making and supports the company's growth trajectory.

Expense Budgeting

Operating Expenses

Each department within the company is responsible for managing its operating expenses. The budget must include detailed itemization of all projected costs, including salaries, supplies, utilities, and other overheads. Departments are also encouraged to identify areas for cost-saving and efficiency improvements.

Department | Salaries | Supplies | Utilities | Total Operating Expenses |

Sales | $500,000 | $50,000 | $10,000 | $560,000 |

Capital Expenditures

Significant investments in long-term assets such as technology upgrades, machinery, or facility expansions are carefully scrutinized. Each proposal must include a comprehensive ROI analysis and demonstrate alignment with the company's strategic objectives.

Project | Description | Cost Estimate | Expected ROI | Strategic Alignment |

New Manufacturing Plant | Expansion in Southeast Asia | $2M | 15% | Market Expansion |

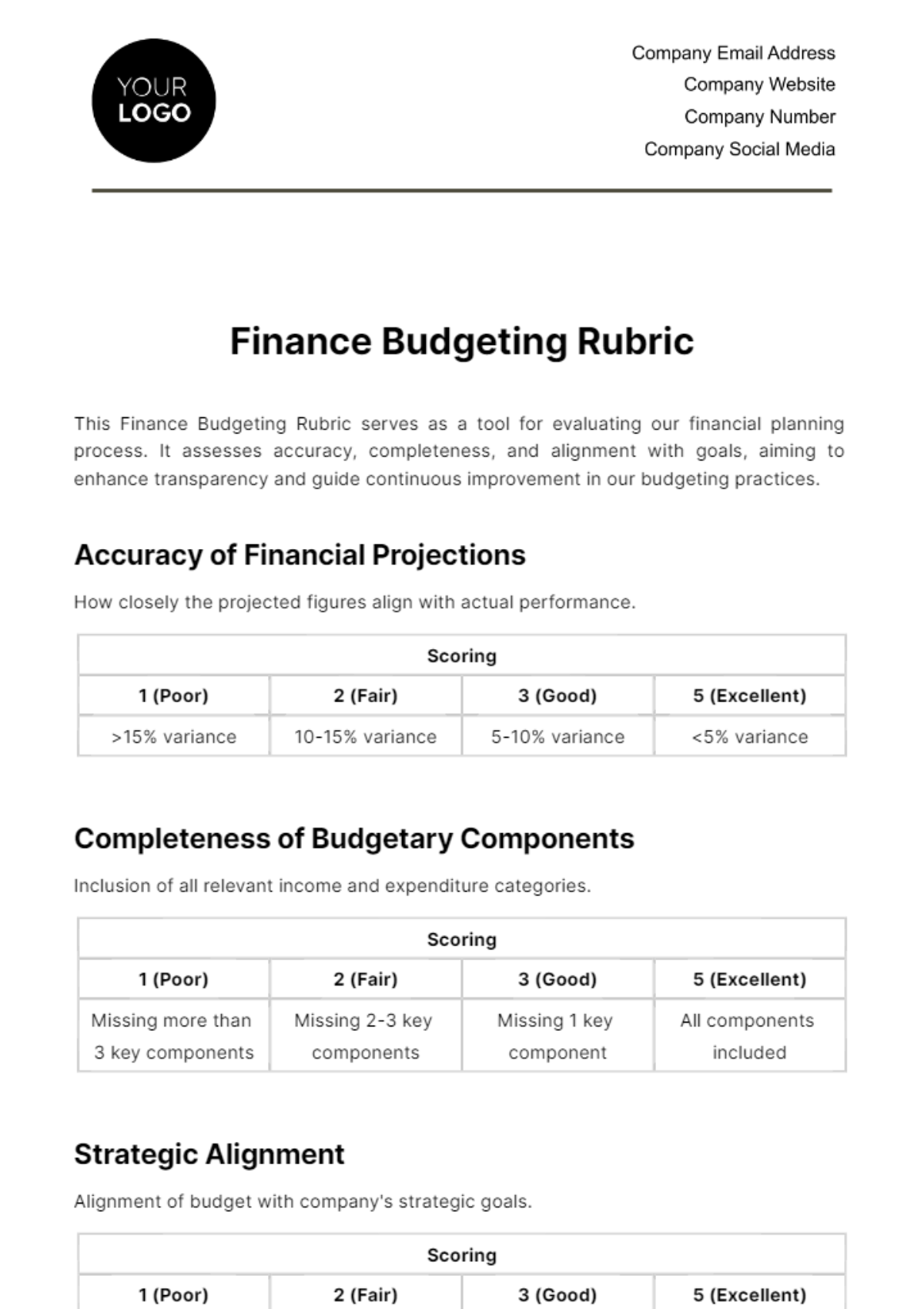

Risk Assessment

Financial Risks

The Finance Department conducts a thorough risk assessment to identify potential financial risks that could impact the budget. Key risks include market volatility, which could affect sales projections, and currency fluctuations impacting international transactions.

Mitigation Strategies

To mitigate these risks, the company has developed several strategies:

Market Volatility: Establishing a reserve fund to cushion against unforeseen market downturns.

Currency Fluctuations: Engaging in hedging activities to minimize the impact of currency risks.

Credit Risks: Implementing strict credit control measures and conducting regular credit reviews of clients.

Risk Category | Mitigation Strategy | Responsible Department |

Market Volatility | Reserve Fund Establishment | Finance |

The Expense Budgeting and Risk Assessment sections provide a comprehensive view of the company’s approach to managing its expenditures and financial risks. This detailed and proactive planning is crucial for maintaining financial health and supporting the company's strategic objectives.

Budget Review Process

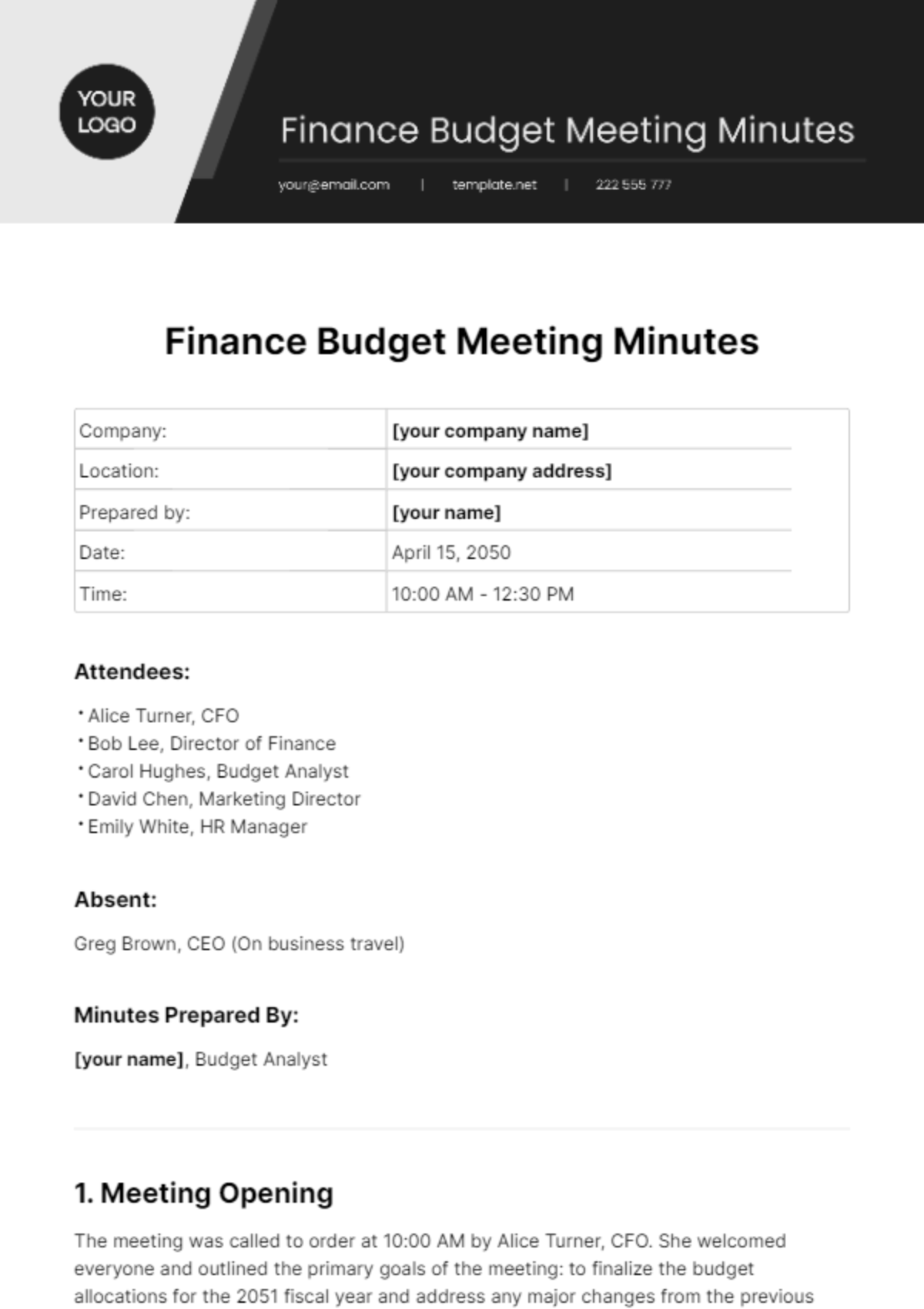

Internal Reviews

Each department’s proposed budget undergoes a rigorous internal review process. The Finance team collaborates with department heads to ensure that budget proposals align with strategic goals and are financially feasible.

Steps in the Internal Review Process:

Initial Review by Finance Team: Evaluating the proposed budgets against historical data and strategic objectives.

Departmental Discussions: Meetings with department heads to discuss and refine budget proposals.

Compliance Check: Ensuring all budget proposals comply with company policies and regulatory requirements.

Executive Review

The consolidated budget is then presented to the executive team. This review focuses on overall strategic alignment, potential for revenue growth, and effective cost management.

Key Focus Areas for Executive Review:

Strategic Alignment: Ensuring the budget supports long-term company goals.

Financial Health: Assessing the overall financial impact of the budget on the company’s profitability and liquidity.

Risk Management: Reviewing the provisions for unforeseen expenses and economic fluctuations.

Approval and Allocation

Board Approval

The final step in the budget process is approval by the Board of Directors. This includes a presentation of the consolidated budget, highlighting key initiatives and strategic alignments.

Allocation

Upon approval, the Finance Department allocates funds to each department according to the approved budget. This process is transparent and follows the principles of fairness and strategic necessity.

Department | Approved Budget | Notes |

Sales | $560,000 | Increased due to new market initiatives. |

The Budget Review Process and Approval and Allocation sections ensure that the company's financial resources are optimally distributed and aligned with both internal objectives and external compliance requirements. This comprehensive approach solidifies the foundation for the company's financial strategy and operational efficiency.

Monitoring and Reporting

Quarterly Reviews

The company implements a stringent monitoring system with quarterly budget reviews. These reviews are essential to track the actual spending against the budgeted figures and to make necessary adjustments.

Quarterly Review Process:

Data Collection: Each department submits actual spending and revenue data.

Variance Analysis: The Finance team analyzes variances between the budgeted and actual figures.

Review Meetings: Departments meet with the Finance team to discuss significant variances and their reasons.

Financial Reporting

Regular financial reports are prepared to provide insights into the company's financial health and to inform stakeholders.

Key Components of Financial Reports:

Income Statement: Detailed report on revenue and expenses.

Balance Sheet: Snapshot of the company’s financial position at the end of each quarter.

Cash Flow Statement: Overview of cash inflows and outflows.

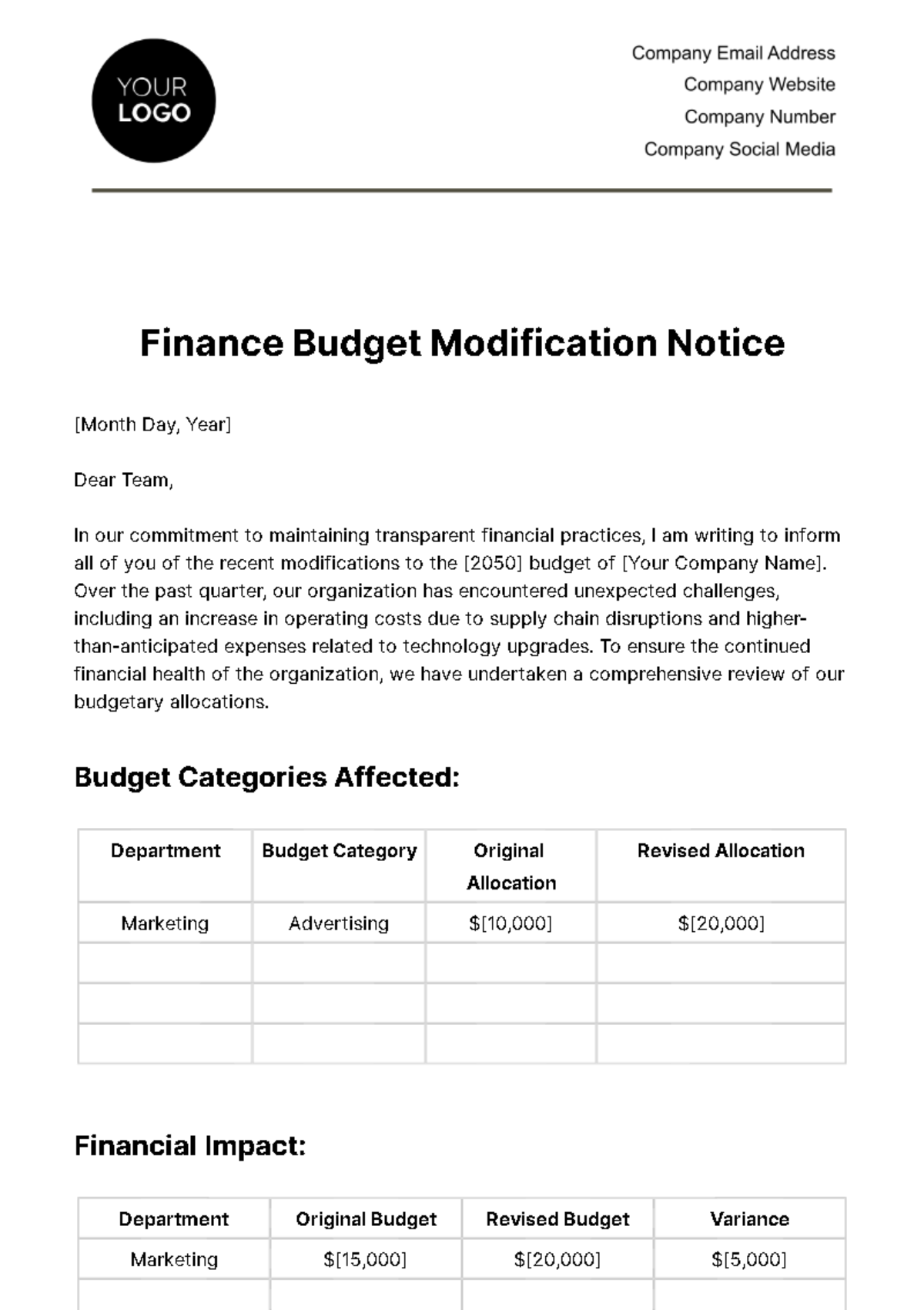

Amendments and Revisions

Amendment Process

The budget is a dynamic tool and may require amendments due to unforeseen circumstances or strategic shifts.

Steps for Budget Amendment:

Proposal Submission: Departments submit a detailed proposal for budget amendments.

Review and Analysis: The Finance team reviews the proposal for its impact on the overall budget.

Approval Process: Significant amendments require approval from the executive team and, in some cases, the Board of Directors.

Revision Justifications

Any request for a revision must be accompanied by a comprehensive justification, outlining the necessity and expected outcomes of the proposed changes.

Criteria for Budget Revisions:

Strategic Alignment: Changes must align with the company’s strategic objectives.

Financial Impact: Assessment of the revision’s impact on the company’s financial health.

Risk Assessment: Analysis of any new risks introduced by the budget changes.

The Monitoring and Reporting, and Amendments and Revisions sections underscore the company’s commitment to financial accountability and adaptability. This approach ensures not only compliance with the established budget but also the flexibility to respond to changing business landscapes.

Conclusion

This SOP serves as a comprehensive blueprint for the company's financial planning and analysis, ensuring a disciplined, strategic, and methodical approach to budget management. Its thorough structure, combining detailed guidelines, timelines, and accountability measures, supports the company's financial stability and growth.

The adherence to this SOP is not just a matter of compliance but a commitment to financial integrity and strategic foresight. It reflects our dedication to upholding the highest standards in financial management, aligning our resources with our strategic ambitions, and fostering a culture of transparency and accountability. Ultimately, this SOP is instrumental in driving the company towards its long-term objectives while maintaining financial health and resilience in a dynamic business environment.