Account Budget Status Report

Executive Summary

This report aims to provide an in-depth analysis of the financial status of specific accounts within [Your Company Name]. It intends to offer a transparent view to the stakeholders, empowering them with information about the allocation and utilization of resources, performance of varied departments, and decision-making patterns.

Situational Analysis

Overall Financial Status

As of January 2050, the total assets held by [Your Company Name] amount to $10,000,000. These funds have been evenly divided and allocated to various accounts to ensure smooth functioning within the organization. It is crucial that these resources are appropriately utilized to catalyze growth and returns.

Performance and Achievements

The performance of each department, project or initiative has been assessed concerning their financial management, adherence to budgetary constraints, and achievement of financial goals. It has been found that the marketing and sales departments have maintained a steady performance with reaching their set financial goals while the research and development department has larger variances.

Financial Analysis

Spending Patterns and Variances

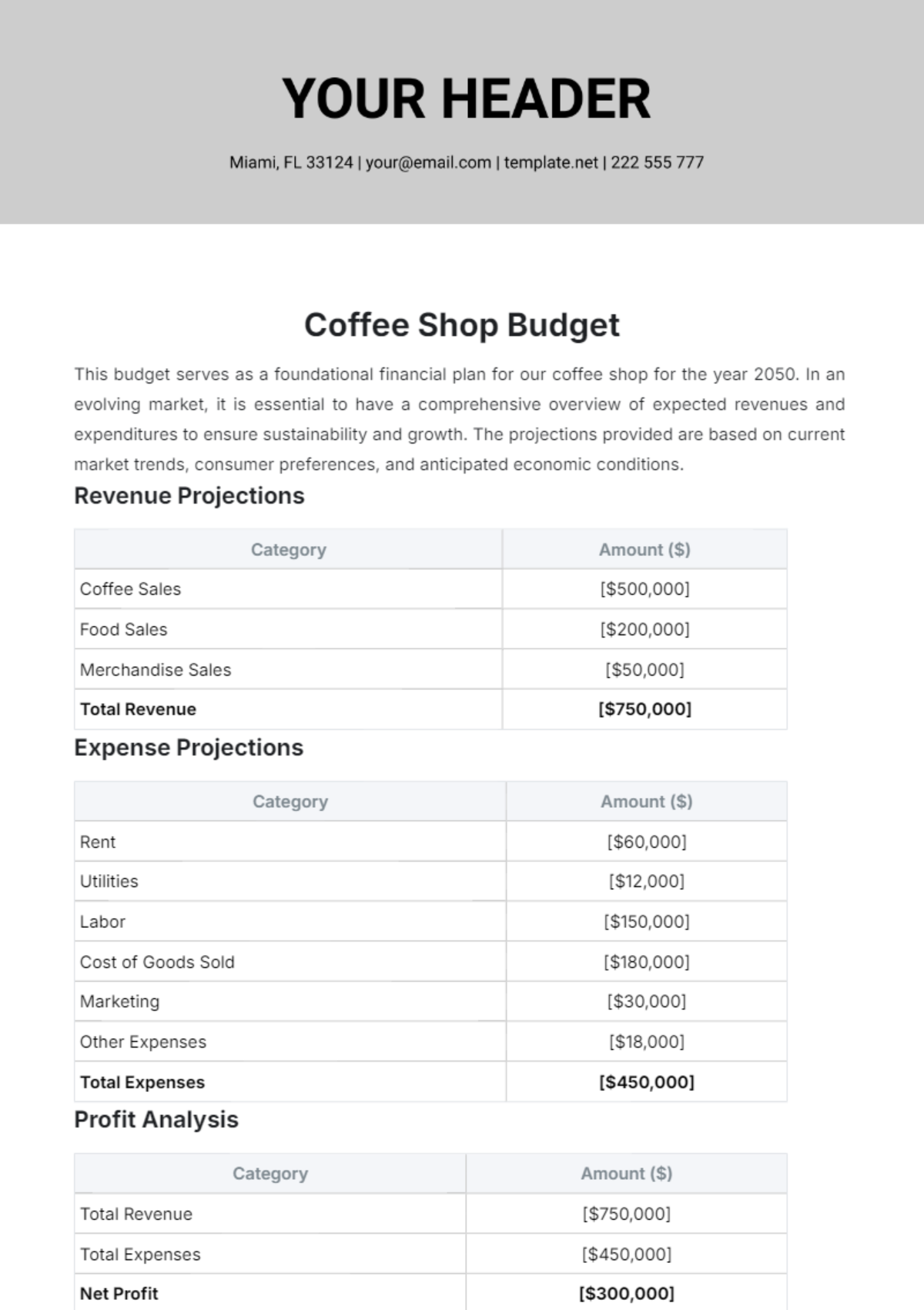

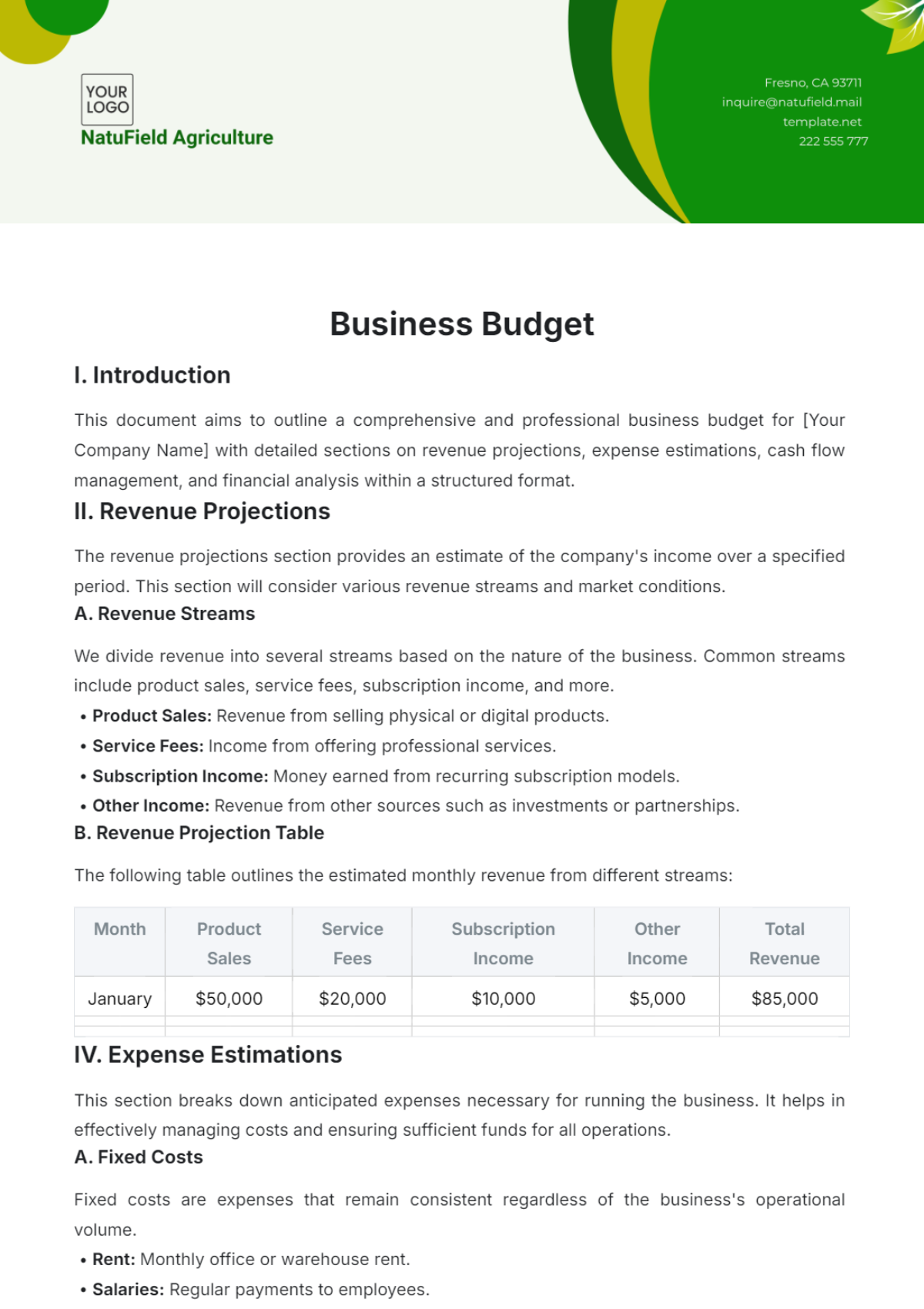

A comprehensive analysis of spending patterns in 2050 indicates that majority resources are utilized for supply chain management with a striking percentage of 60%, followed by marketing and advertising efforts which account for 30%, and remaining 10% in research and development. An identified variance of approximately 5% was found when comparing budgeted vs actual expenditures, suggesting a potential need for budget re-allocation.

Category | Percentage of Expenditure |

|---|---|

Supply Chain Management | 60% |

Marketing and Advertising | 30% |

Research and Development | 10% |

Opportunities for Improvement

Observing the current spending patterns, a scope for improving the allocation of resources has been identified. The resource allocation to the research and development department could be increased to optimize financial outcomes. Furthermore, financial planning for each department could improve adherence to budgetary constraints which shall consequently aid in reaching financial goals.

Conclusion and Recommendations

To conclude, the company has exhibited considerable strength in its financial management; however, room for improvement exists in the realm of resource distribution and enhancing financial results. A comprehensive evaluation described in this report gives way to the proposal that investing further in the research and development sector and tailoring financial strategies to suit the department’s requirements would be beneficial. Judging from the aforementioned analysis, it appears that the company can optimize its financial outcomes by reevaluating and modifying its current allocation of resources. Particularly, directing more funds towards the research and development department seems to be a promising avenue to follow for the overall financial improvement. Thus, it is recommended that the company reflects on its financial plans, and make necessary adjustments in light of the department's needs. This shift in focus should, in theory, position the company more advantageously in terms of its finances.