Monthly Budget List

Name | [Your Name] |

Month | [Month Name] |

Overview

This List provides a detailed and structured outline for planning and tracking monthly income, expenses, savings, and goals. It serves as a practical tool for individuals, families, or financial advisors to monitor financial health, budgeting resources effectively, and working towards financial objectives.

Monthly Financial Planning and Tracking Outline

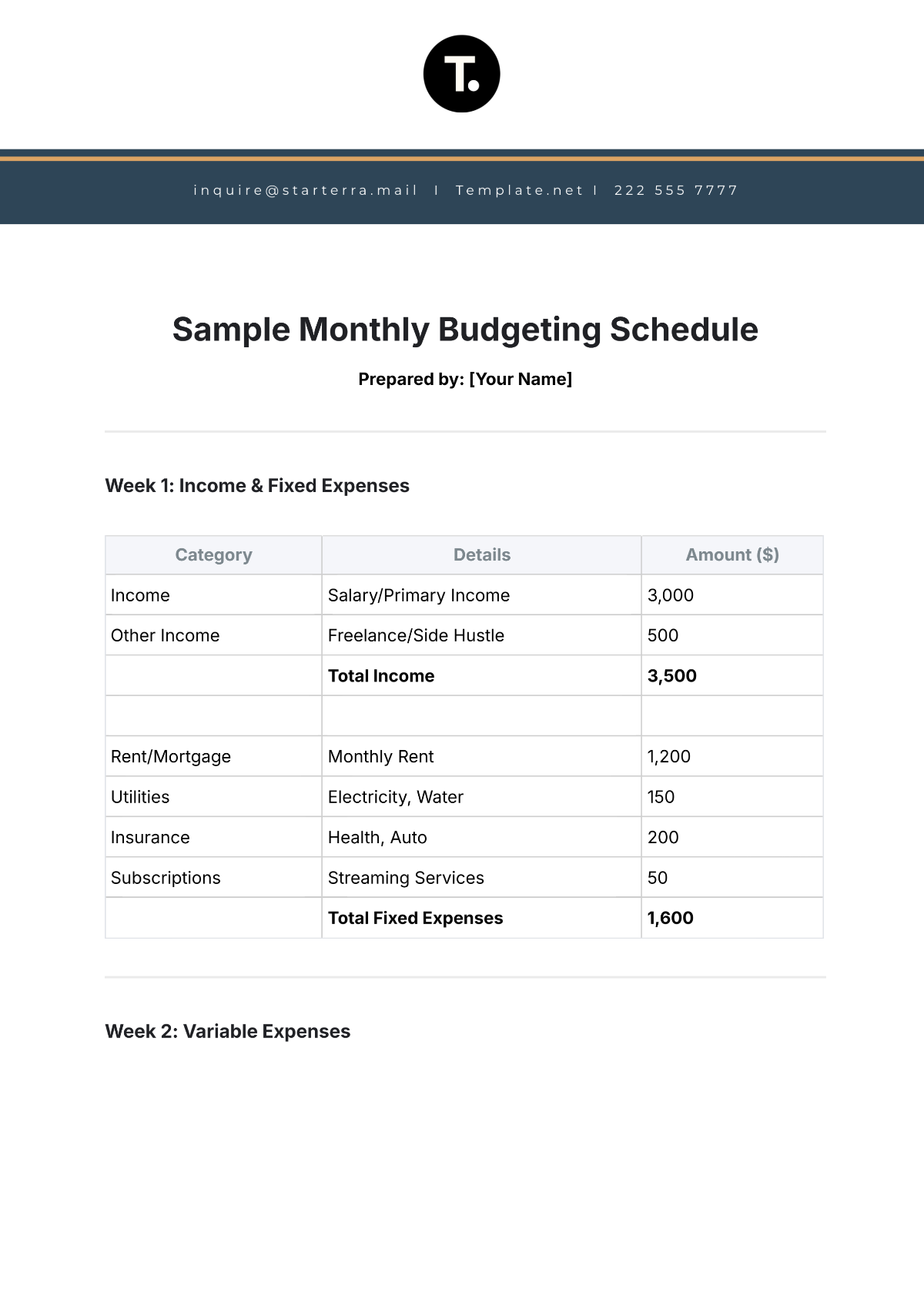

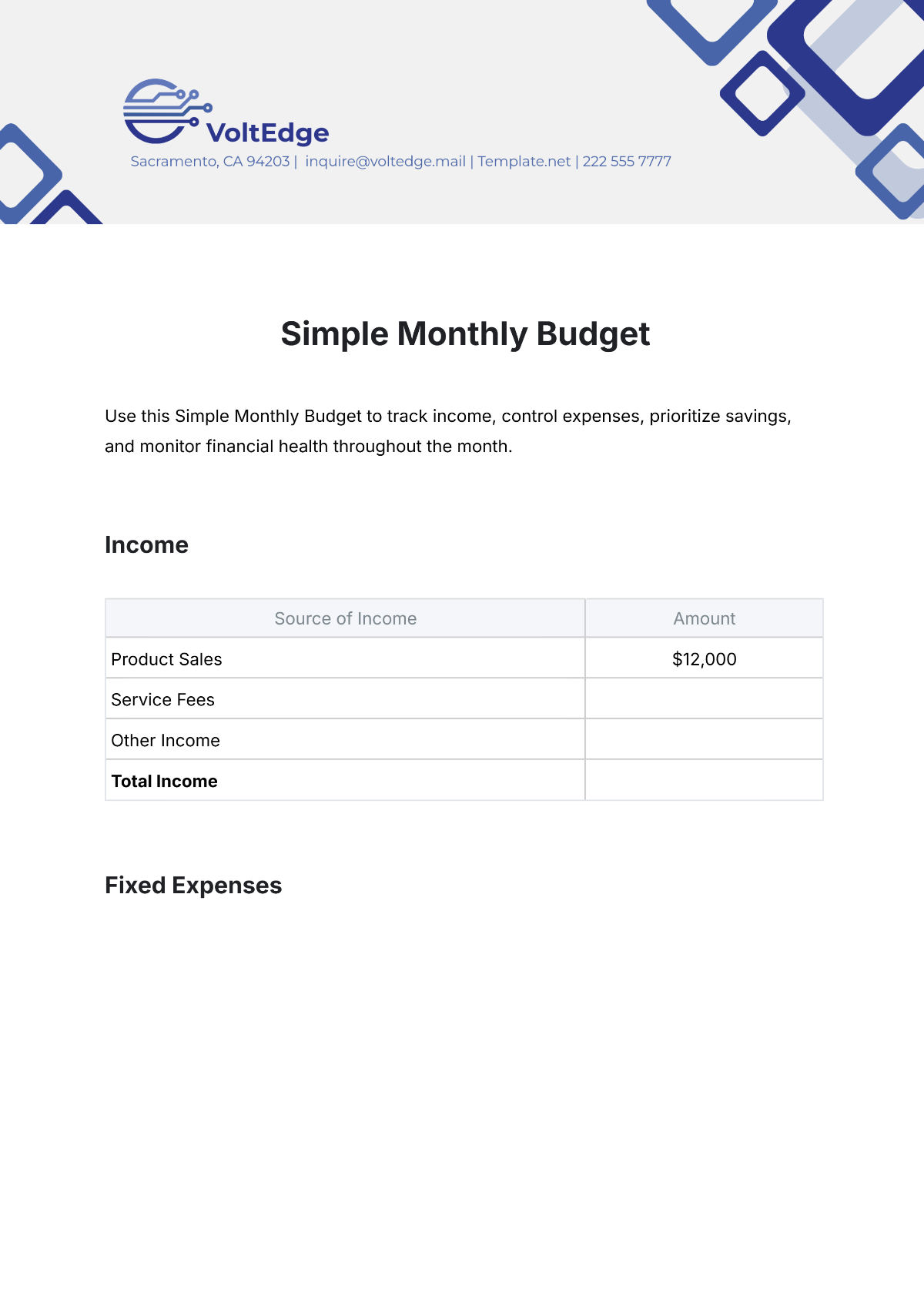

Income Tracking:

Category | Description |

|---|---|

Primary Income | Salary or wages from main employment. |

Secondary Income | Additional sources of income such as freelance work, rental income. |

Investment Income | Income generated from investments such as dividends, interest, or capital gains. |

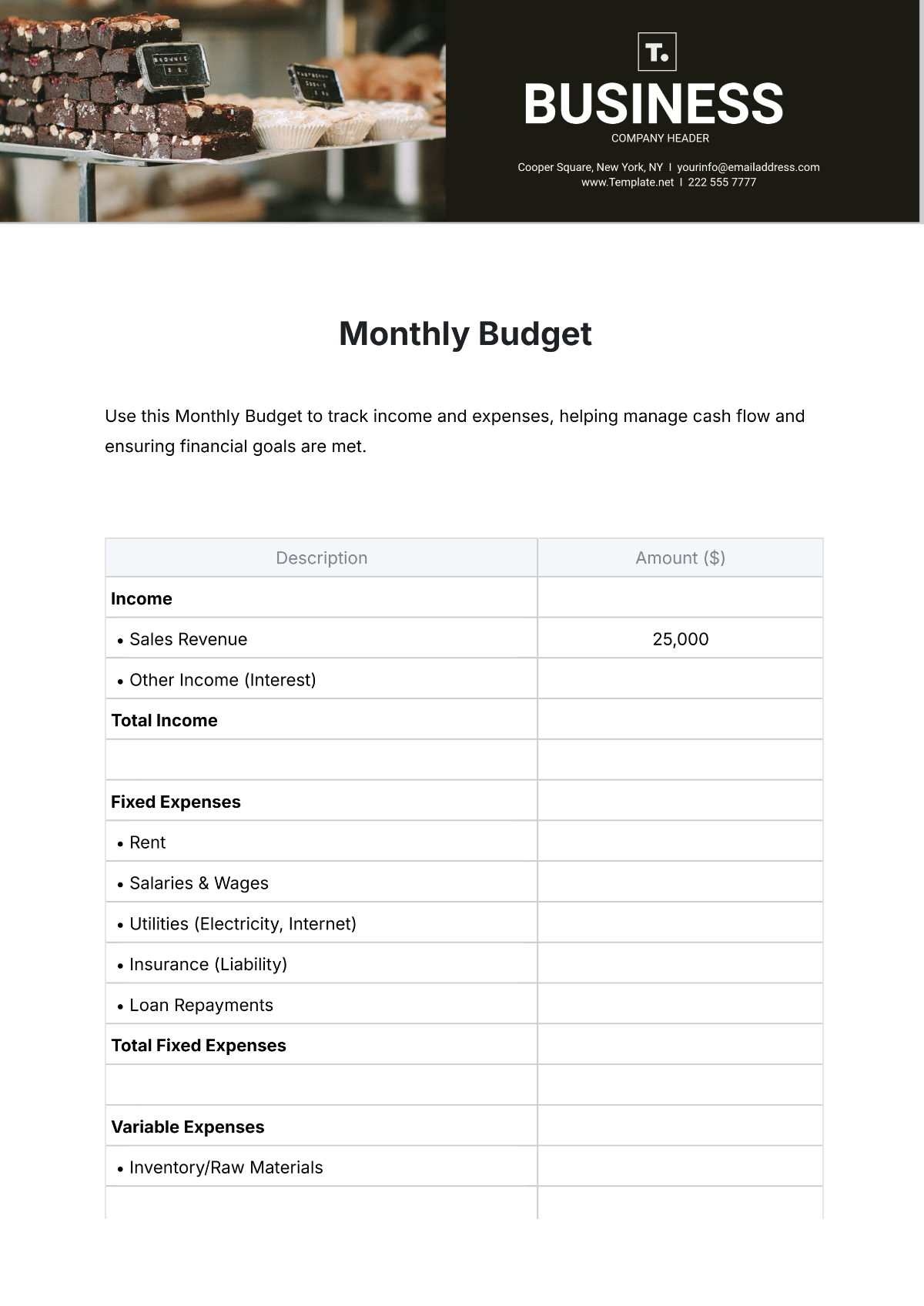

Expense Tracking:

Category | Description |

|---|---|

Housing Expenses | Rent, mortgage, utilities. |

Transportation | Car payments, gas, maintenance. |

Food | Groceries, dining out. |

Healthcare | Insurance premiums, medical bills. |

Debt Repayment | Credit card payments, loans. |

Entertainment | Movies, dining out. |

Personal Care | Toiletries, grooming. |

Education | Tuition, school supplies. |

Miscellaneous | Other expenses not covered by the above categories. |

Savings Tracking:

Category | Description |

|---|---|

Emergency Fund | Savings set aside for unexpected expenses or emergencies. |

Retirement Savings | Contributions to retirement accounts such as 401(k), IRA. |

Education Savings | Savings for education expenses such as tuition fees. |

Vacation Fund | Savings for future vacations or travel. |

Other Savings Goals | Savings for specific financial goals such as a down payment on a house. |

Financial Goals:

Category | Description |

|---|---|

Debt Payoff | Paying off a certain amount of debt. |

Savings Targets | Saving a specific percentage of income. |

Retirement Planning | Investing in retirement accounts. |

Emergency Savings | Building an emergency fund to cover 3-6 months of expenses. |

Short-Term Goals | Meeting specific savings targets for short-term objectives. |

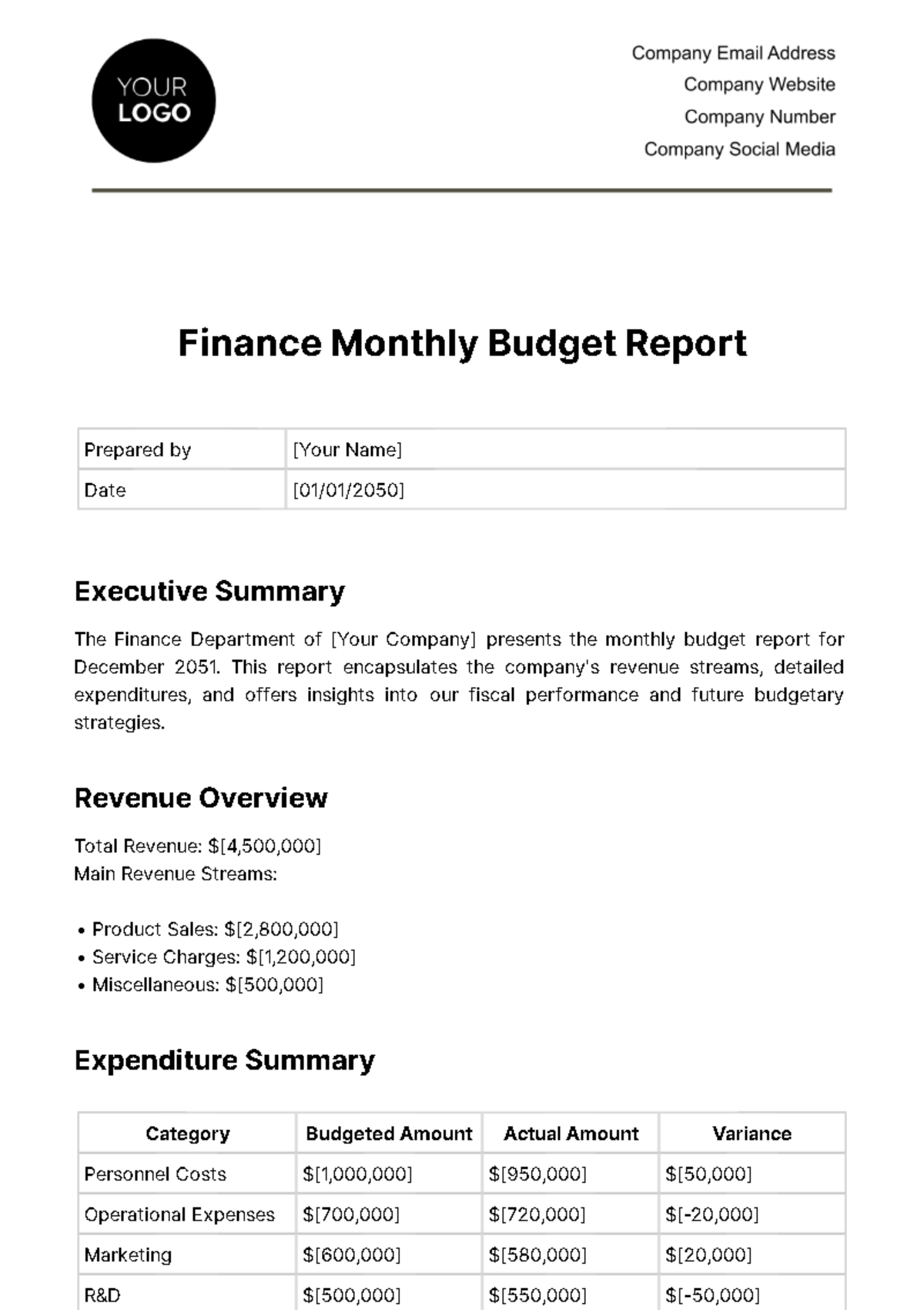

Review and Adjust:

Category | Description |

|---|---|

Assess Income and Expenses | Identify areas for improvement in spending habits. |

Monitor Savings Progress | Track progress towards financial goals and adjust savings accordingly. |

Adjust Budget and Goals | Make necessary changes to budget and goals based on financial review. |

Celebrate Achievements | Recognize milestones and achievements in financial progress. |

Seek Professional Advice:

Category | Description |

|---|---|

Financial Advisor | Consult with a financial advisor for personalized guidance. |

Long-Term Planning | Discuss strategies for long-term financial planning. |

Investment Review | Review investment portfolios and retirement plans. |

Financial Optimization | Receive advice on optimizing financial health and achieving goals. |

Additional Information

Remember to update the list as your income, expenses, savings, and goals change.

Try to keep your expenses less than your income to avoid financial stress.

Do regular check-ups of your list to ensure you're staying within your budget and on track with your financial goals.

Reach out to a financial advisor for personalized assistance should you need help managing your finances.

Consistency is key. Make sure you're maintaining your budget list regularly to get the most out of it.