Employee Monthly Summary Payroll Budget Report

Report Prepared By: [Your Name]

Email: [Your Email]

Date: January 10, 2051

I. Executive Summary

This report provides a detailed summary of payroll expenditures for [Your Company Name] for the month of January 2051. The information includes total salaries paid, deductions, benefits, and taxes for all employees.

II. Payroll Expenditures

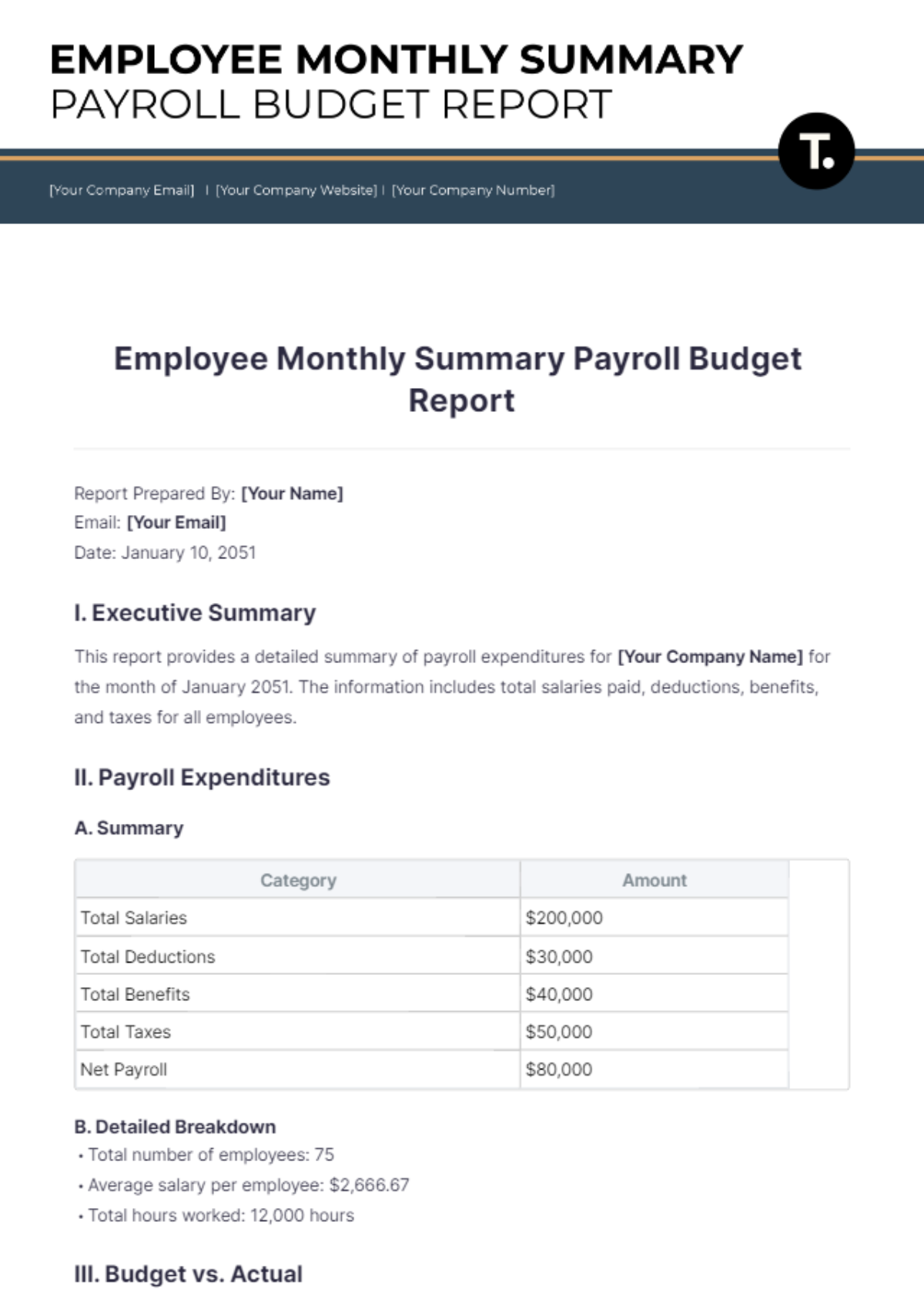

A. Summary

Category | Amount |

|---|---|

Total Salaries | $200,000 |

Total Deductions | $30,000 |

Total Benefits | $40,000 |

Total Taxes | $50,000 |

Net Payroll | $80,000 |

B. Detailed Breakdown

Total number of employees: 75

Average salary per employee: $2,666.67

Total hours worked: 12,000 hours

III. Budget vs. Actual

A. Budget

The overall payroll budget for the month was $220,000. This includes all salaries, benefits, and tax-related expenses.

B. Actual

The actual payroll expenditure for the month amounted to $320,000, which is $100,000 over the budget.

IV. Recommendations

Implement quarterly reviews to ensure that payroll expenditures remain within budget.

Consider adjusting benefits packages to better align with budget constraints.

Explore options for optimizing tax-related expenses.

V. Contact Information

For any questions or further information, please contact:

[Your Name], Payroll Administrator

[Your Company Name]

Email: [Your Email]

Website: [Your Company Website]

Social Media: [Your Company Social Media]