Budget Efficiency Project Specification

I. Executive Summary

The Budget Efficiency Project for [Your Company Name] aims to optimize the organization's financial performance by reducing operational costs, improving resource allocation, and enhancing overall budget management. This project will deploy strategic cost-saving measures, thorough budget analysis, and effective implementation plans to achieve substantial financial benefits without compromising service quality.

II. Project Objectives

Reduce overall operational costs by 15% within the next fiscal year.

Improve budget forecasting accuracy by 20%.

Enhance financial control and accountability across all departments.

Streamline financial processes to reduce waste and increase efficiency.

Identify and implement at least five new cost-saving measures.

III. Scope of the Project

A. In Scope

Analysis of current budget allocations and expenditures.

Identification of cost-saving opportunities in all departments.

Implementation of new budget management tools and processes.

Training for staff on new budget efficiency strategies.

B. Out of Scope

Major capital investments require board approval.

Changes to the core business model.

Long-term strategic financial planning beyond the next fiscal year.

IV. Methodology

A. Data Collection

Review of financial statements and budget reports from the past three years.

Interviews with department heads and financial managers.

We are benchmarking against industry standards and best practices.

B. Analysis

Cost-benefit analysis of current spending and potential savings.

Identification of non-essential expenditures and redundant processes.

Financial modeling to forecast the impact of proposed changes.

C. Implementation

Development of an action plan with specific, measurable steps.

Allocation of responsibilities to relevant departments and personnel.

Regular progress reviews and adjustments as necessary.

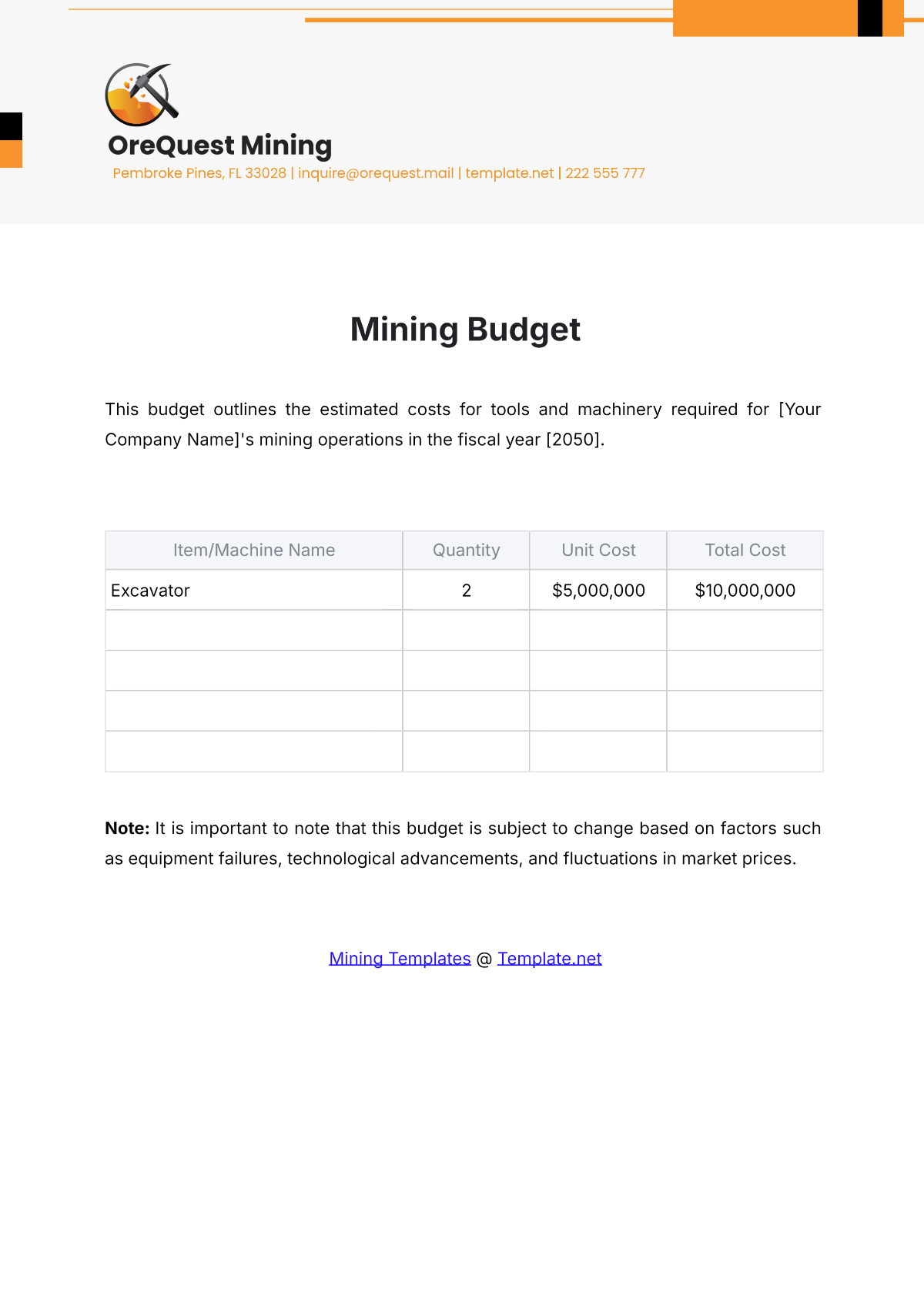

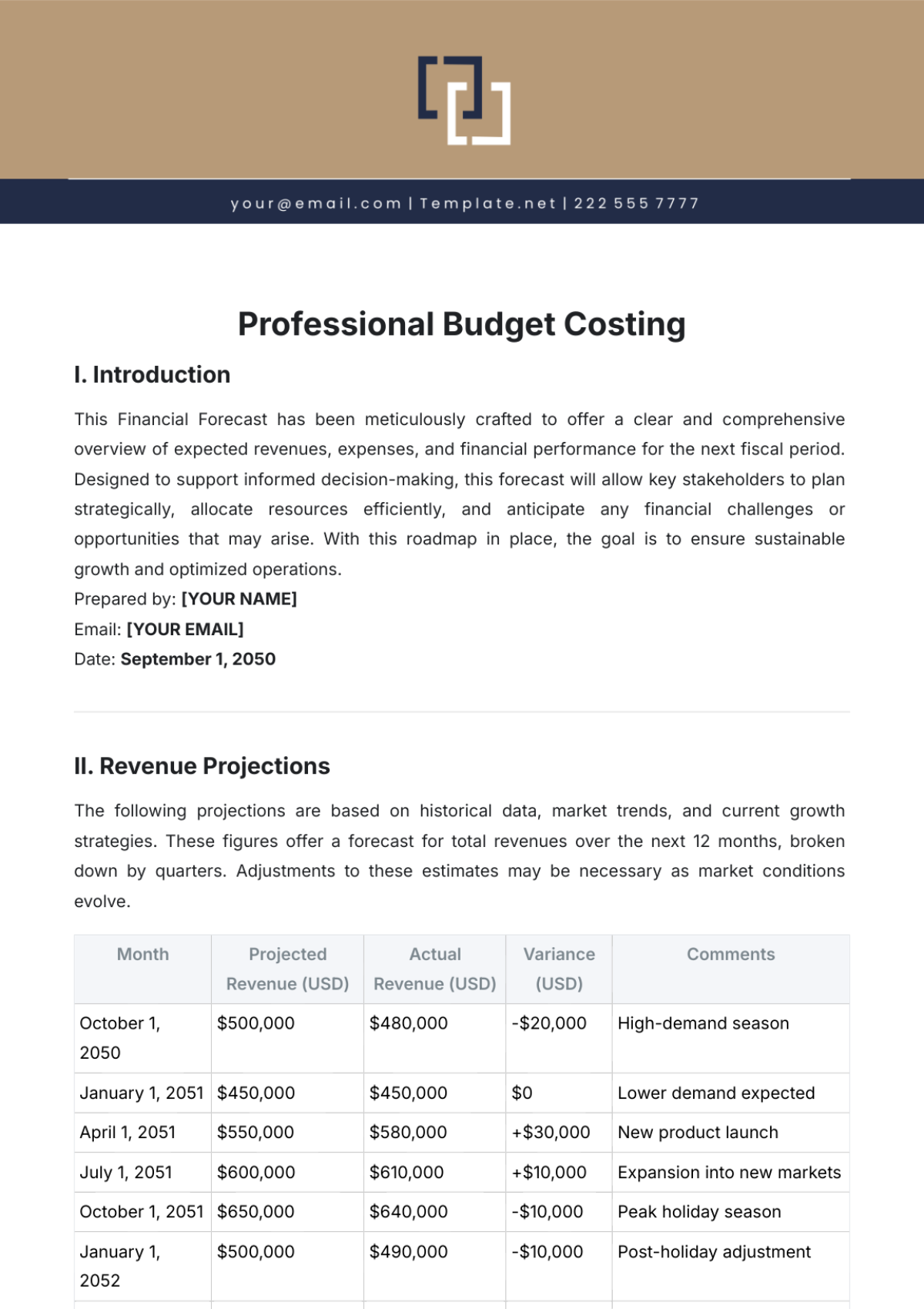

V. Budget Analysis

Category | Current Expenditure | Target Expenditure | Savings Target |

|---|---|---|---|

Personnel Costs | $5,000,000 | $4,250,000 | $750,000 |

Operational Costs | $2,000,000 | $1,700,000 | $300,000 |

Marketing and Advertising | $1,500,000 | $1,200,000 | $300,000 |

Travel and Entertainment | $500,000 | $375,000 | $125,000 |

Office Supplies | $200,000 | $150,000 | $50,000 |

Total | $9,200,000 | $7,675,000 | $1,525,000 |

VI. Cost-Saving Strategies

A. Personnel Costs

Implementing a hiring freeze on non-essential positions.

Offering voluntary early retirement packages.

We are streamlining workflows to reduce overtime expenses.

B. Operational Costs

Negotiating better terms with suppliers.

Implementing energy-saving initiatives.

Reducing office space and moving to a more flexible remote work model.

C. Marketing and Advertising

Shifting the focus to digital marketing to reduce traditional media costs.

Leveraging social media and influencer partnerships.

Conducting cost-benefit analysis on all marketing campaigns.

D. Travel and Entertainment

Reducing travel by increasing the use of video conferencing.

Implementing stricter travel approval processes.

Limiting entertainment expenses to essential activities only.

E. Office Supplies

Implementing a paperless office initiative.

Bulk purchasing of supplies to take advantage of discounts.

Encouraging recycling and reuse of office materials.

VII. Implementation Plan

A. Phase 1: Planning and Approval (Month 1-2)

Develop detailed action plans for each cost-saving strategy.

Obtain approval from senior management.

Communicate project objectives and plans to all stakeholders.

B. Phase 2: Data Collection and Analysis (Month 3-4)

Gather and analyze financial data.

Identify specific areas for cost reduction.

Develop financial models to forecast savings.

C. Phase 3: Execution (Month 5-8)

Implement cost-saving measures.

Provide training to staff on new processes and tools.

Monitor progress and make adjustments as needed.

D. Phase 4: Monitoring and Evaluation (Month 9-12)

Conduct regular reviews to measure the impact of changes.

Adjust strategies based on performance data.

Prepare a final report on project outcomes and savings achieved.

VIII. Risk Assessment

A. Potential Risks

Resistance to change from staff and management.

Inaccurate data leads to incorrect decisions.

Delays in implementation due to unforeseen challenges.

B. Mitigation Strategies

Engage stakeholders early and often to build support.

Use multiple data sources to ensure accuracy.

Develop contingency plans for potential delays.

IX. Performance Metrics

Key Performance Indicators (KPIs):

Percentage reduction in overall operational costs.

Improvement in budget forecasting accuracy.

The number of new cost-saving measures implemented.

Employee satisfaction with new processes.

Financial performance compared to previous fiscal years.

X. Conclusion

The Budget Efficiency Project is a critical initiative aimed at enhancing the financial health of our organization. By reducing costs, improving resource allocation, and streamlining financial processes, we expect to achieve significant savings and strengthen our financial position. The detailed plan outlined in this specification provides a clear roadmap for achieving these goals, with a focus on measurable outcomes and continuous improvement.