Annual Budget Project Specification

1. Overview

This document outlines the financial plan for the fiscal year at [Your Company Name], detailing how resources will be allocated and managed to ensure alignment with organizational goals and effective utilization of funds. It serves as a comprehensive guide for budgeting activities, financial management, and performance monitoring.

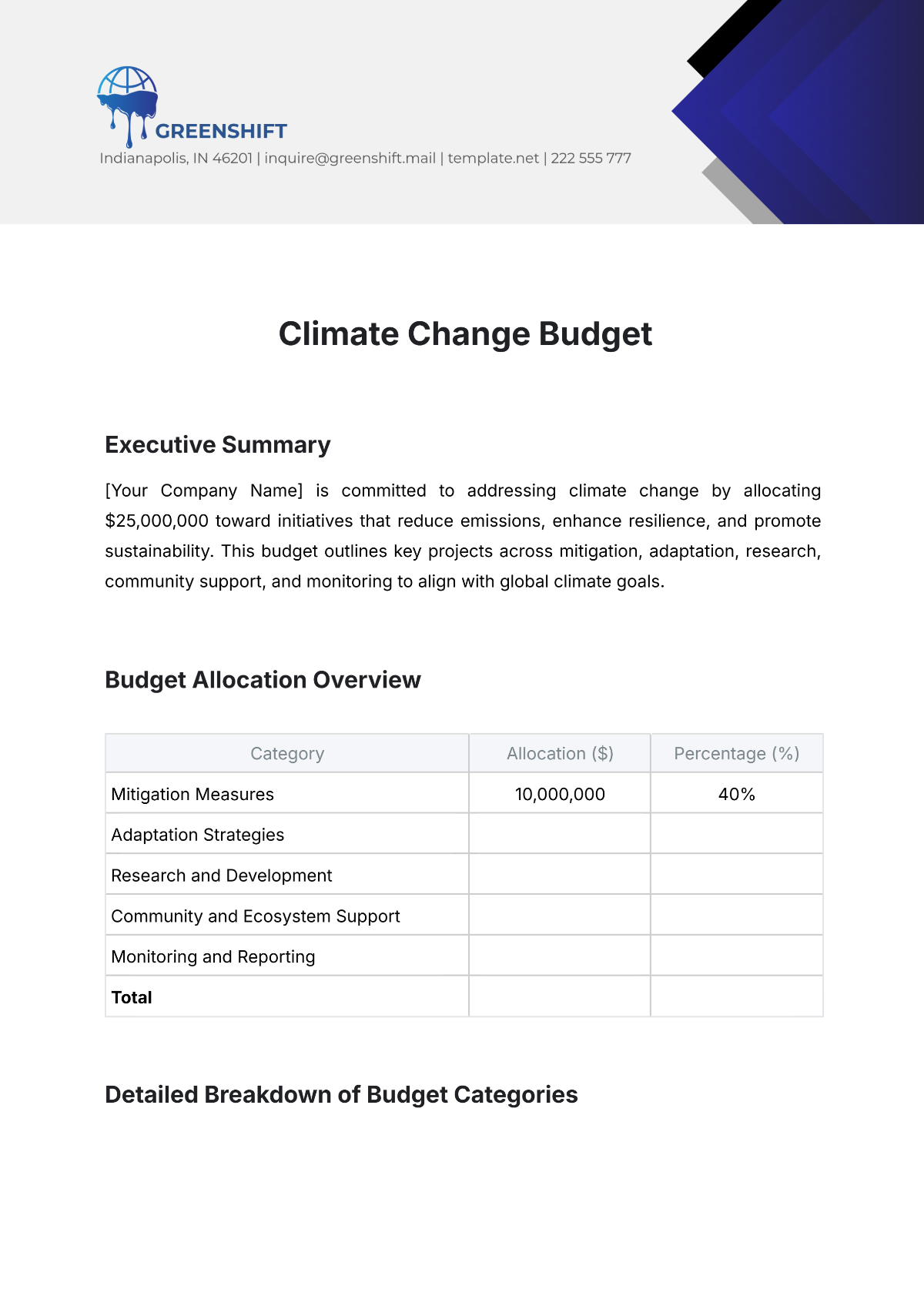

2. Executive Summary

Purpose: Provide a high-level overview of the budget’s objectives and key financial strategies.

Scope: Outline the areas covered by the budget, including revenue, expenses, and capital investments.

Financial Highlights: Summarize key figures such as total revenue, total expenses, and projected net income.

3. Revenue Forecast

3.1 Sources of Revenue

The following table presents a detailed breakdown of projected revenue from various sources for the fiscal year, illustrating how each revenue stream contributes to the overall financial plan:

Revenue Source | Projected Amount | Description |

|---|---|---|

Sales Revenue | $5,000,000 | Income from product sales and services. |

Grants and Donations | $1,200,000 | Funding was received from grants and charitable donations. |

Investment Income | $300,000 | Earnings from investments and financial instruments. |

Other Income | $150,000 | Miscellaneous sources of revenue. |

3.2 Revenue Projections

The following table outlines the projected revenue for each quarter of the fiscal year, detailing expected income across the four quarters:

Quarter | Projected Revenue |

|---|---|

Q1 | $1,200,000 |

Q2 | $1,300,000 |

Q3 | $1,400,000 |

Q4 | $1,800,000 |

4. Expense Breakdown

4.1 Operating Expenses

The following table details the projected operating expenses for the fiscal year, outlining the allocation of funds across various expense categories:

Expense Category | Projected Amount | Description |

|---|---|---|

Salaries and Wages | $2,000,000 | Compensation for employees. |

Rent and Utilities | $600,000 | Costs for office space and utility services. |

Supplies and Materials | $400,000 | Expenditures for office supplies and raw materials. |

Marketing and Advertising | $500,000 | Budget for marketing campaigns and promotional activities. |

Insurance | $200,000 | Coverage for business-related risks. |

4.2 Capital Expenditures

The following table outlines the projected capital expenditures for the fiscal year, detailing the planned investments in long-term assets and improvements:

Capital Expense | Projected Amount | Description |

|---|---|---|

Equipment Purchase | $750,000 | Investment in new machinery and technology. |

Facility Upgrades | $300,000 | Renovations and improvements to physical premises. |

5. Budget Allocation

The budget is allocated across different departments to support various organizational functions. The table below illustrates the distribution of funds for each department:

Department | Allocated Budget | Percentage of Total Budget |

|---|---|---|

Research & Development | $1,000,000 | 20% |

Sales and Marketing | $900,000 | 18% |

Operations | $1,200,000 | 24% |

Administration | $800,000 | 16% |

Human Resources | $500,000 | 10% |

IT and Systems | $600,000 | 12% |

6. Risk Assessment

6. 1 Economic Risks

Market Fluctuations: Potential impact on sales revenue due to economic downturns or market volatility.

Inflation: Rising costs of goods and services affecting budgeted expenses.

6.2 Operational Risks

Supply Chain Disruptions: Potential delays or shortages in materials affecting production schedules.

Project Execution: Risks associated with project delays or cost overruns.

6.3 Financial Risks

Investment Performance: Variability in returns on investments impacting overall income.

Liquidity: Ensuring sufficient cash flow to meet operational and financial obligations.

7. Funding Sources

Internal Funds: Utilizes existing reserves and operational savings for expenses and investments. Efficient reserve management is crucial.

External Funding: Includes loans, grants, and investments. Loans require repayment, grants do not, and investments provide capital in exchange for equity or other terms. Securing external funds involves careful planning.

8. Variance Analysis

Budget vs. Actual: Compares actual performance to budgeted figures to identify and address deviations. Regular reviews ensure financial alignment.

Adjustments: Involves revising the budget based on performance and unexpected changes. This may include reallocating funds and updating projections.

9. Approval and Signatures

Reviewed By:

[Reviewer's Name], [Position]

Approved by:

[Approver's Name], [Position]