Budget List

Prepared by: [YOUR NAME]

Prepared on: August 14, 2050

Contact Information: [YOUR EMAIL]

Company: [YOUR COMPANY NAME]

Company Number: [YOUR COMPANY NUMBER]

Address: [YOUR COMPANY ADDRESS]

Website: [YOUR COMPANY WEBSITE]

Social Media: [YOUR COMPANY SOCIAL MEDIA]

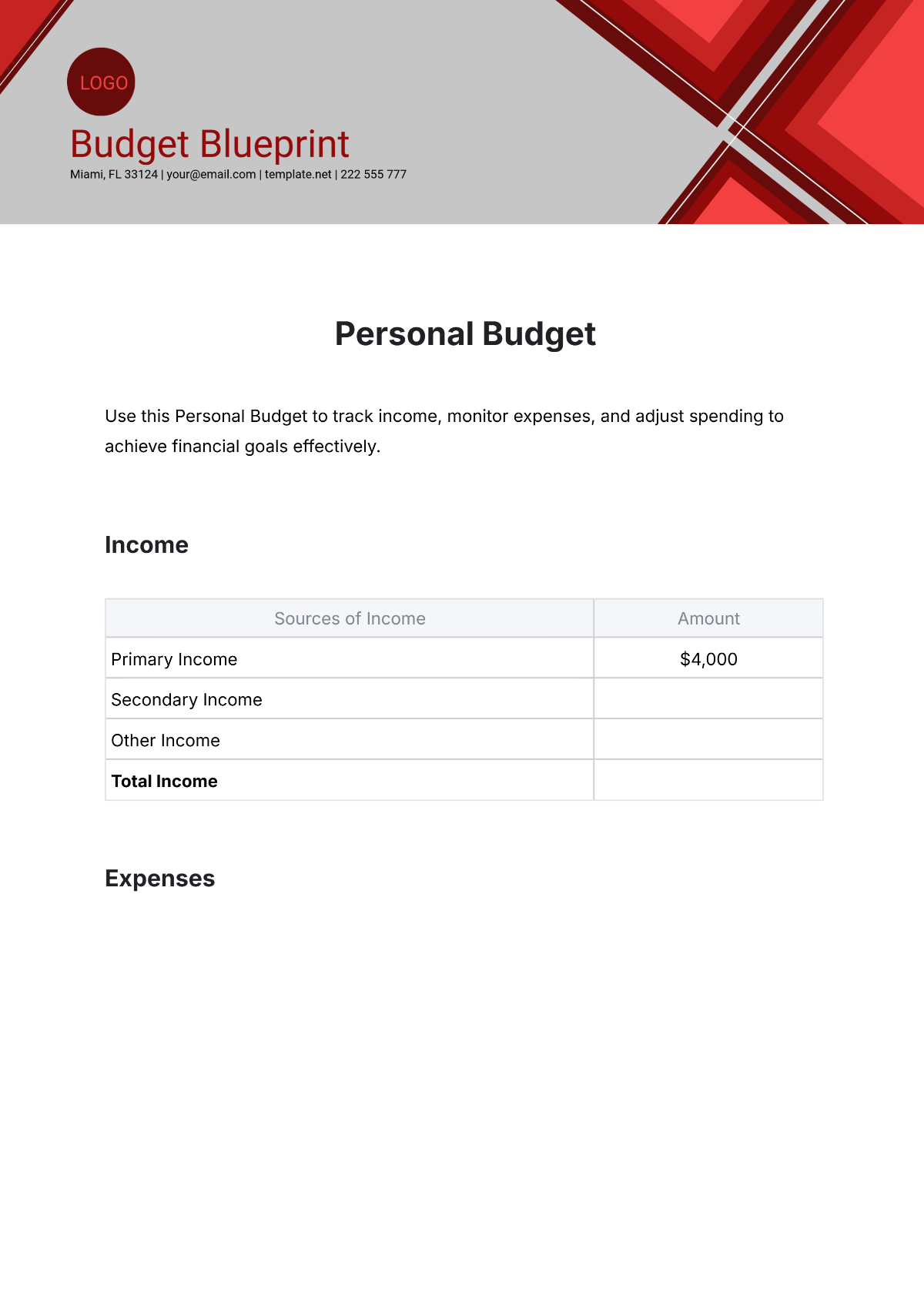

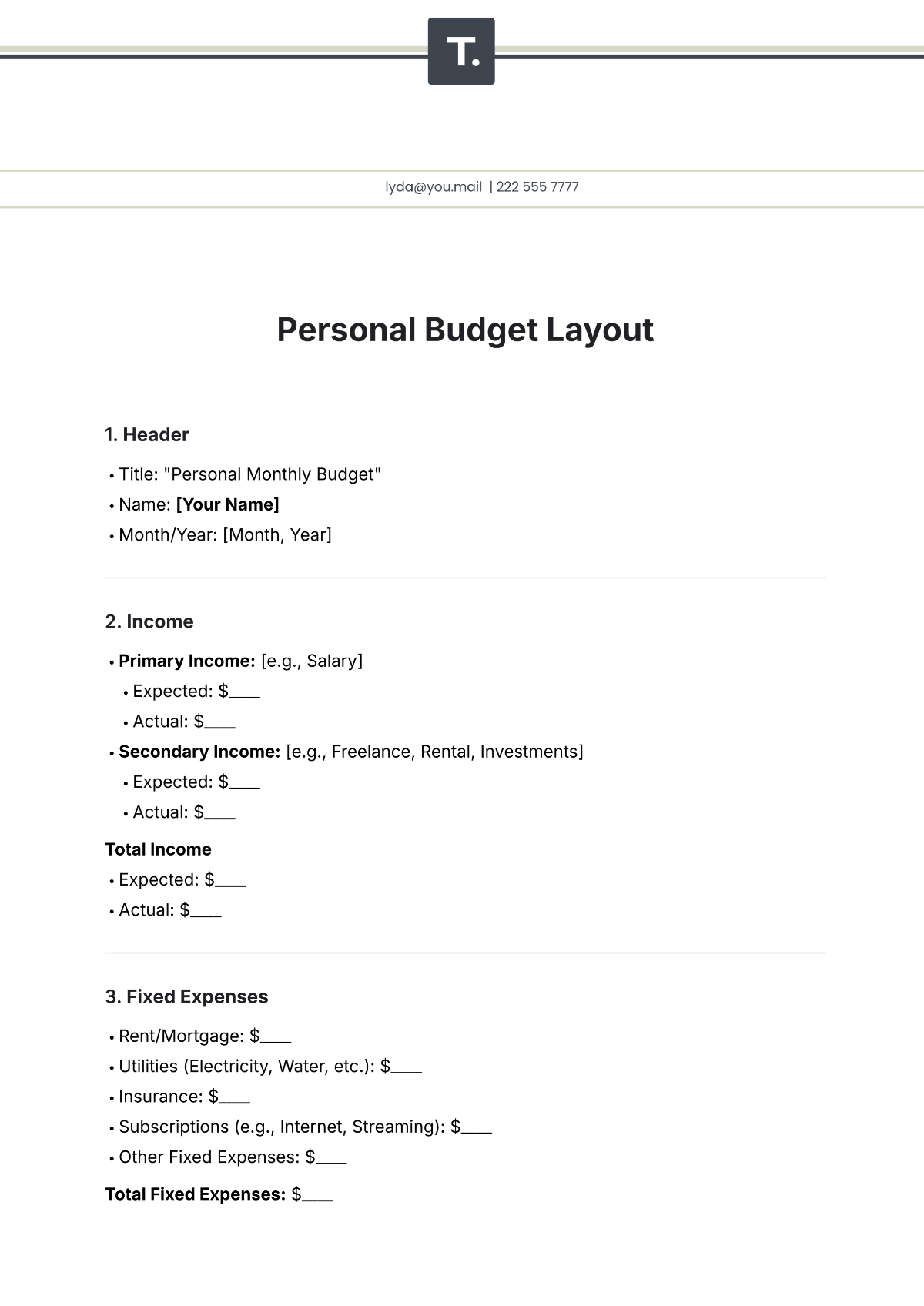

Introduction:

This Budget List is designed to help [YOUR COMPANY NAME] plan and manage its finances for the upcoming fiscal year, 2051. The purpose of this list is to outline the expected income, categorize expenses, allocate funds effectively, and ensure that financial goals are met. This budget will serve as a guiding document for making informed financial decisions and tracking the company's financial health throughout the year.

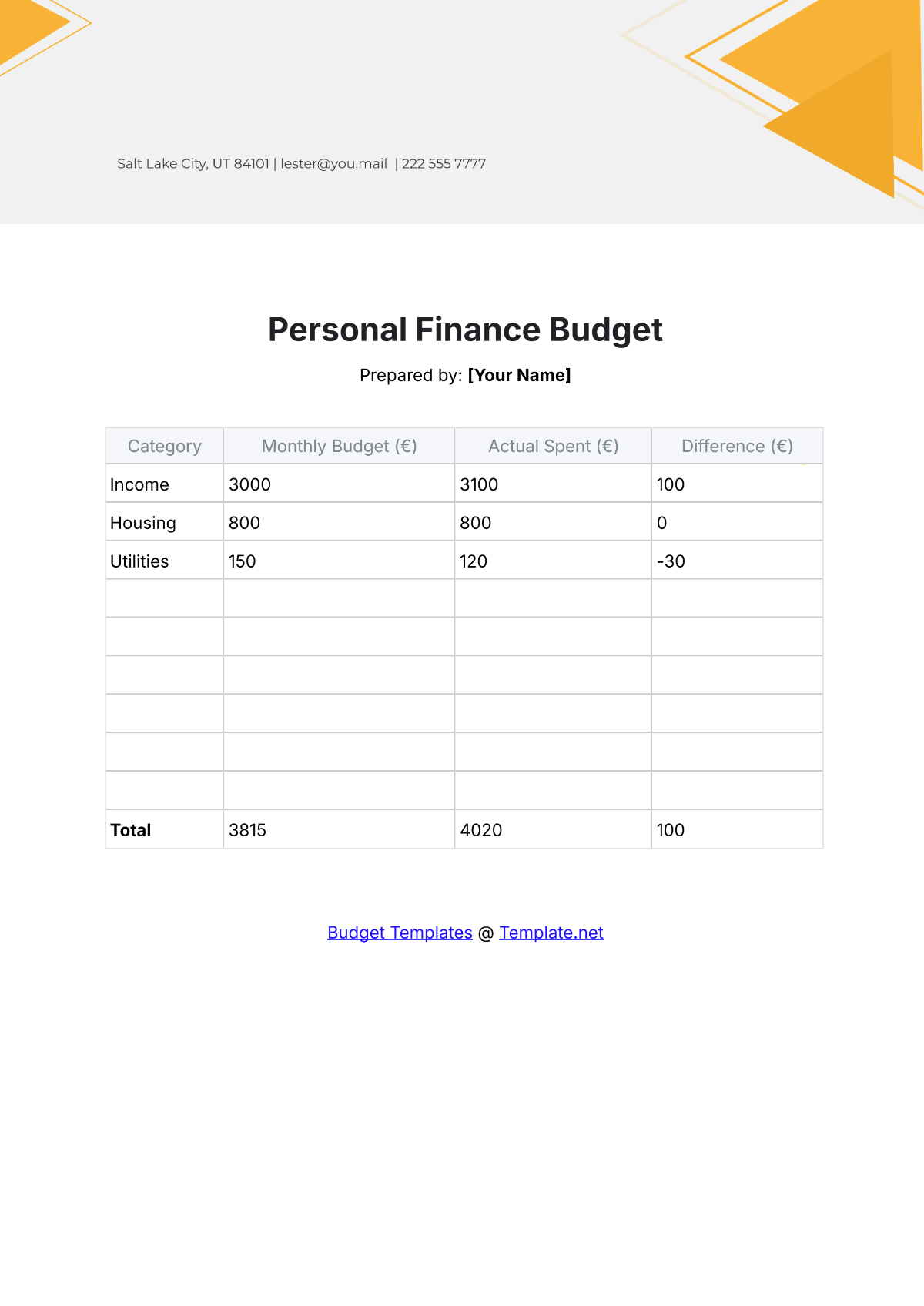

Budget List for Fiscal Year 2051

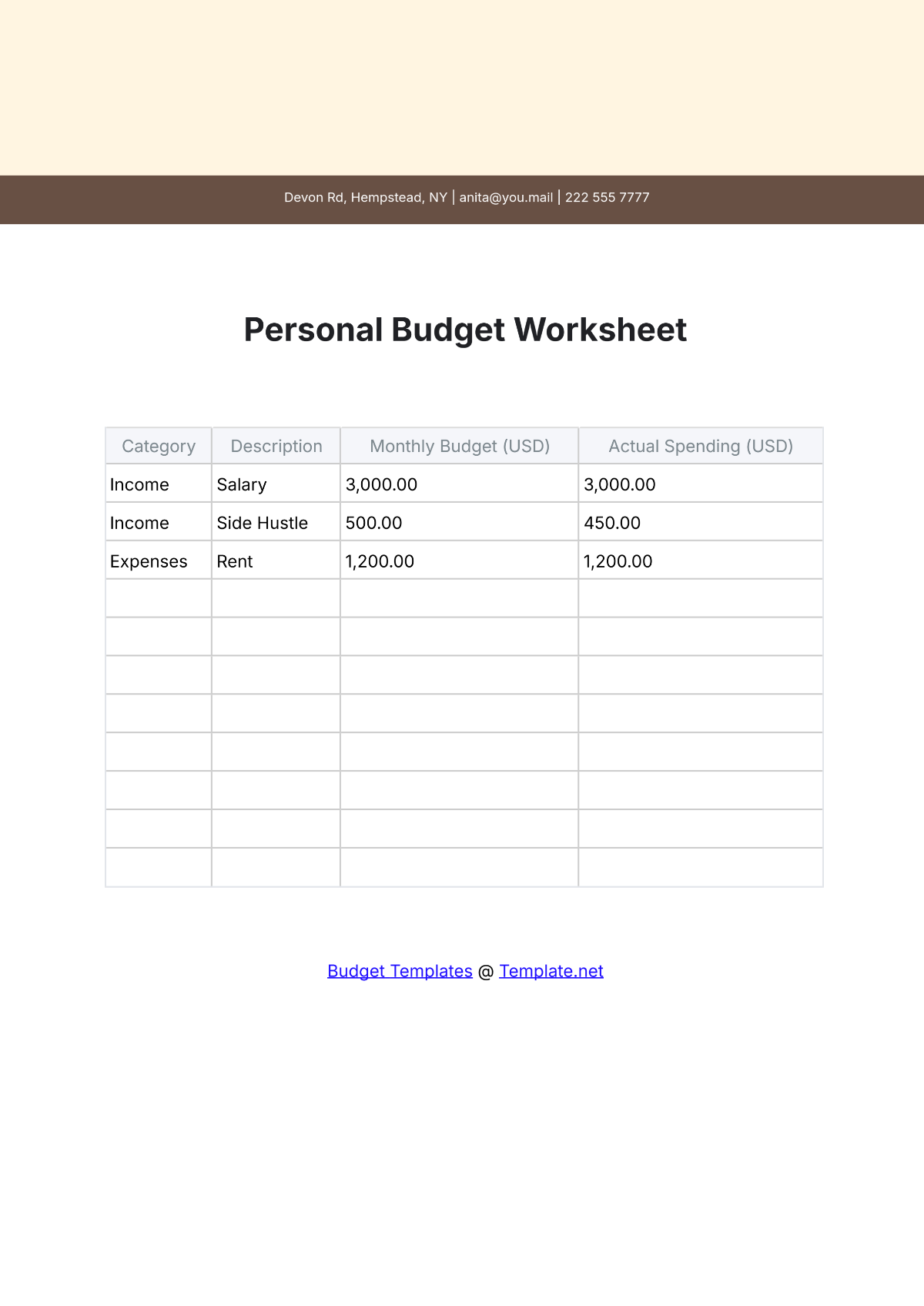

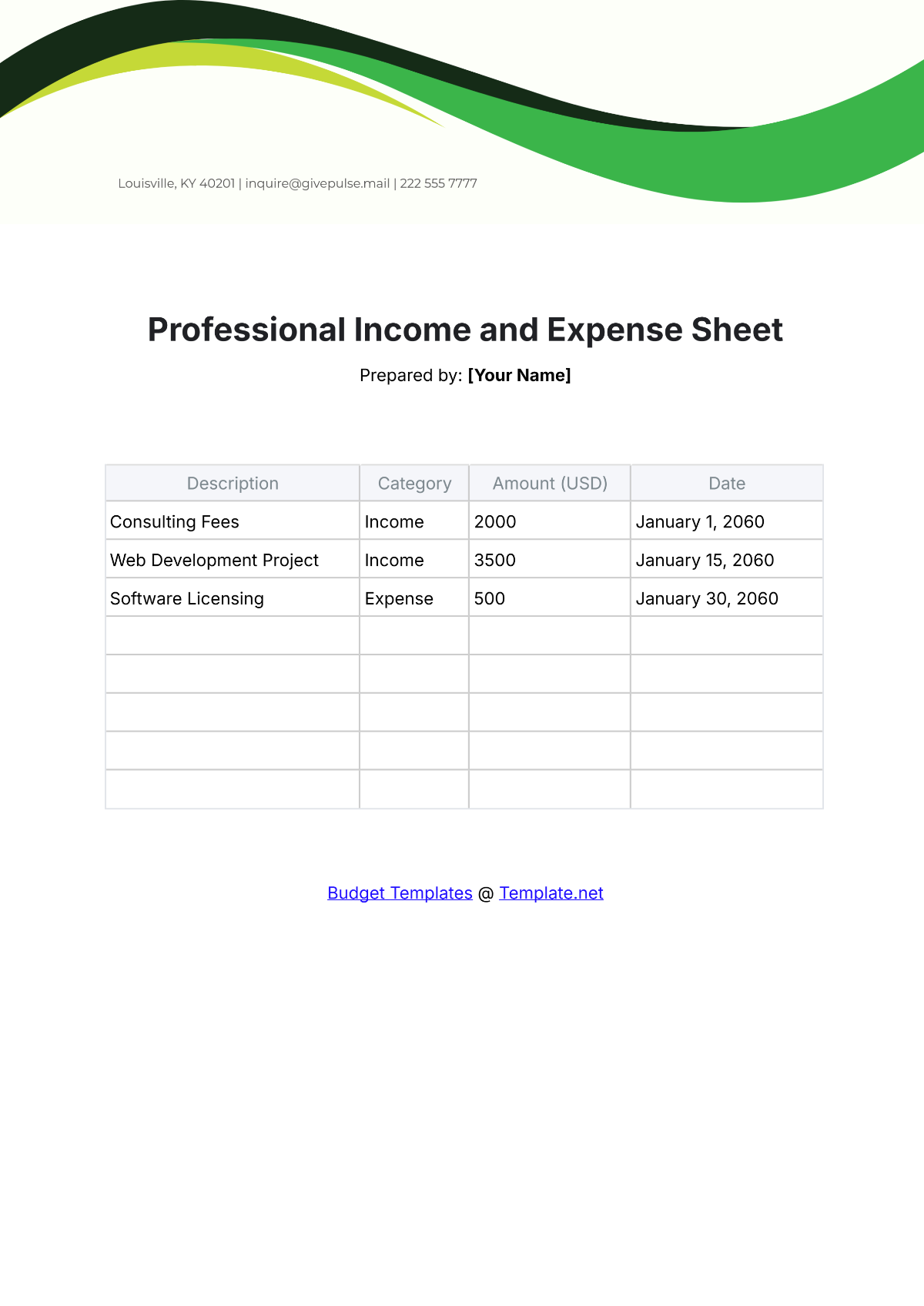

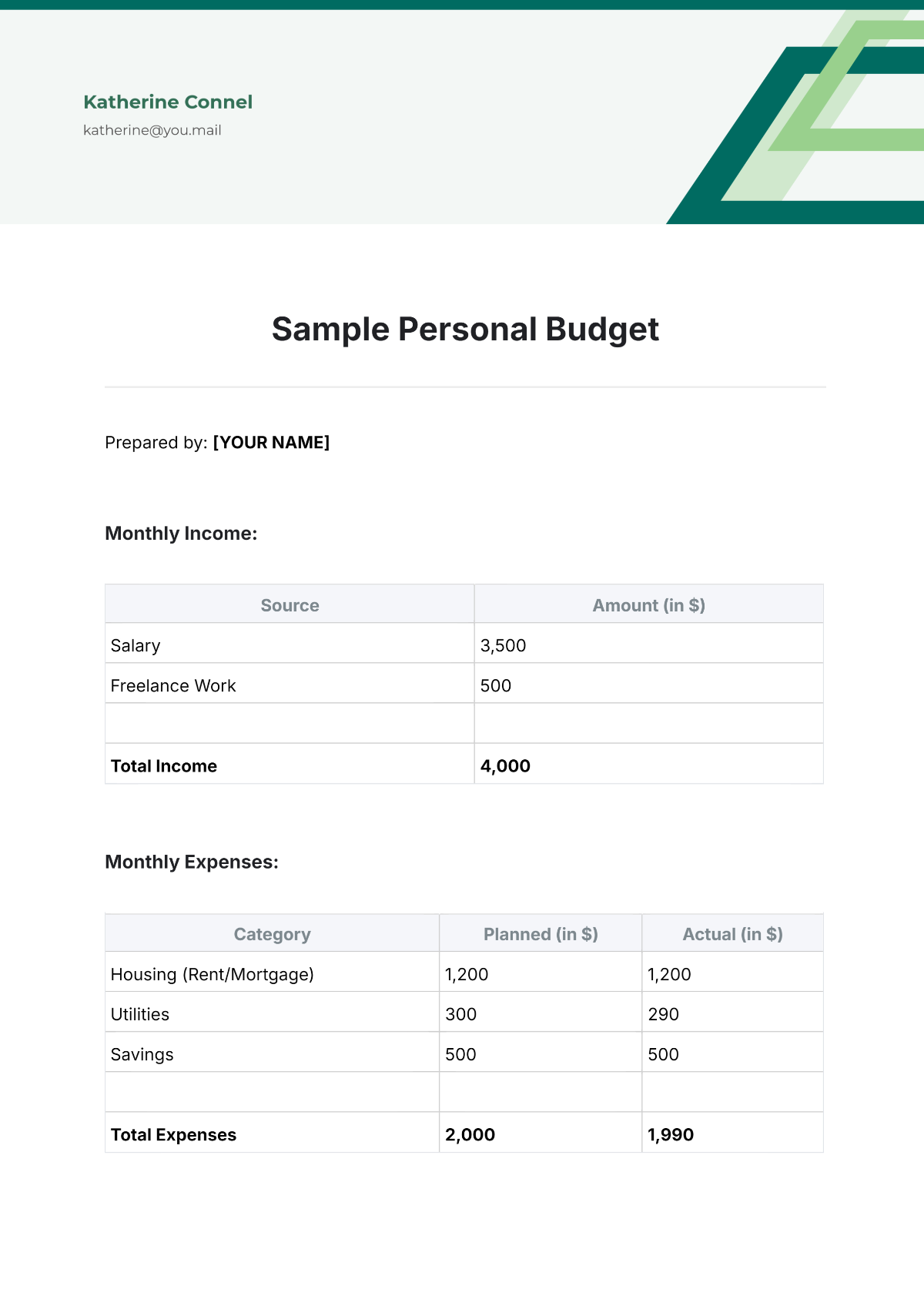

1. Expected Income

Revenue from Product Sales: $1,200,000

Service Income: $500,000

Investment Income: $100,000

Other Income: $50,000

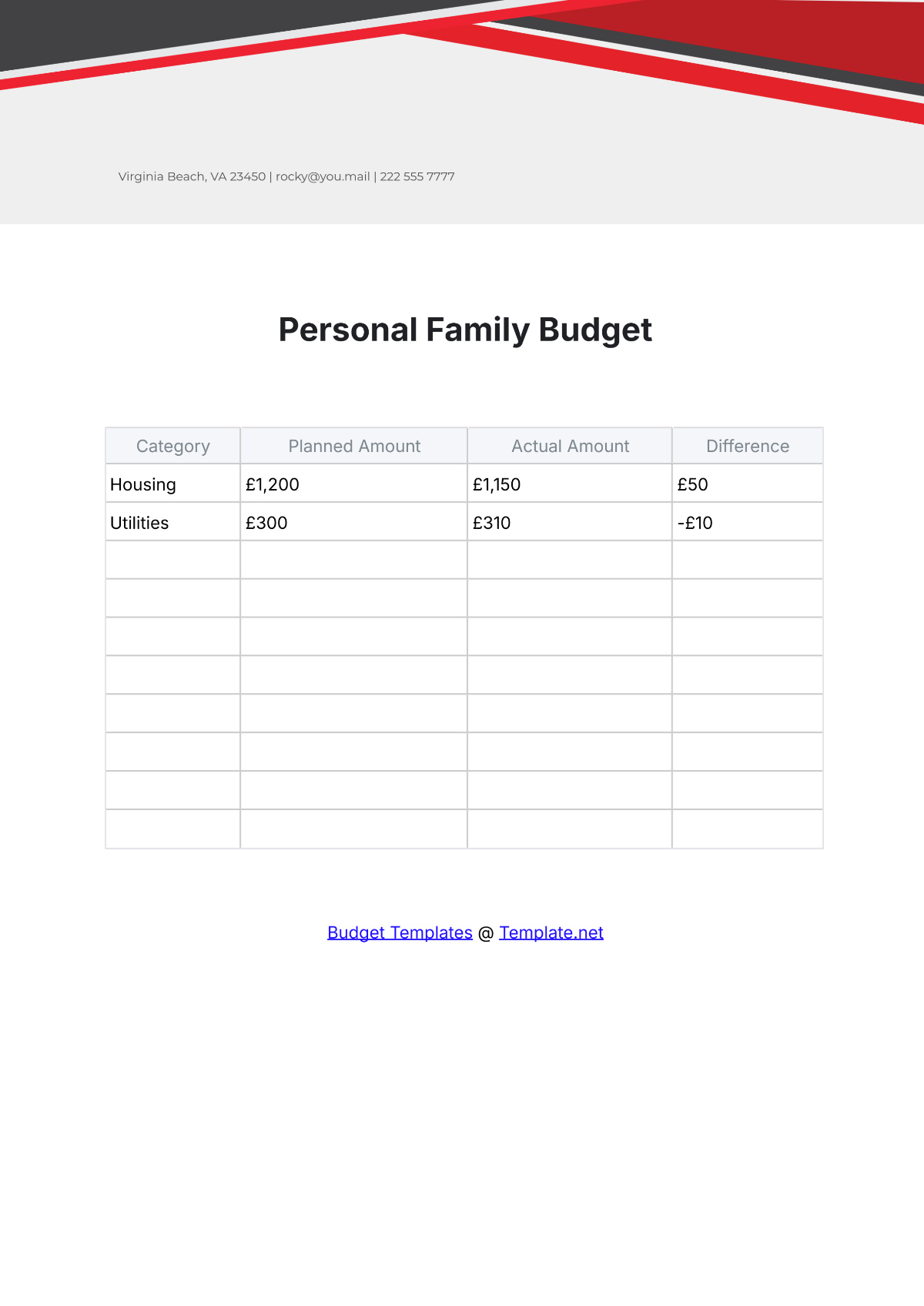

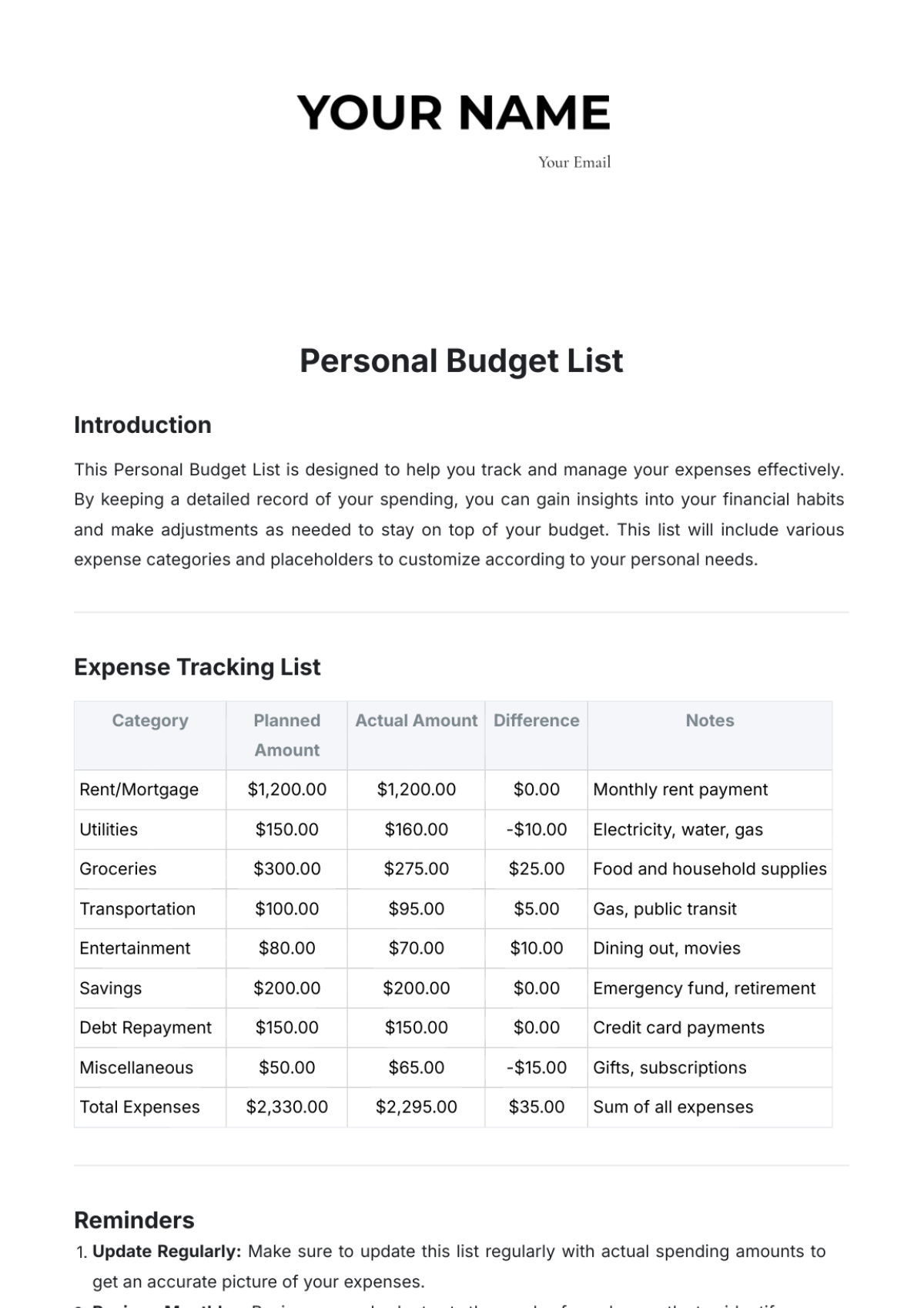

2. Fixed Expenses

Category | Monthly Amount | Annual Amount | Payment Due Date | Notes |

|---|---|---|---|---|

Rent/Lease | $10,000 | $120,000 | 1st of each month | Headquarters Office |

Salaries & Wages | $80,000 | $960,000 | Last Friday of each month | Includes all employees |

Insurance Premiums | $5,000 | $60,000 | January 15, 2051 | Full coverage for company assets |

Utilities (Electricity, etc.) | $2,500 | $30,000 | 20th of each month | Electricity, Water, Internet |

Loan Payments | $15,000 | $180,000 | March 1, 2051 | Equipment loan |

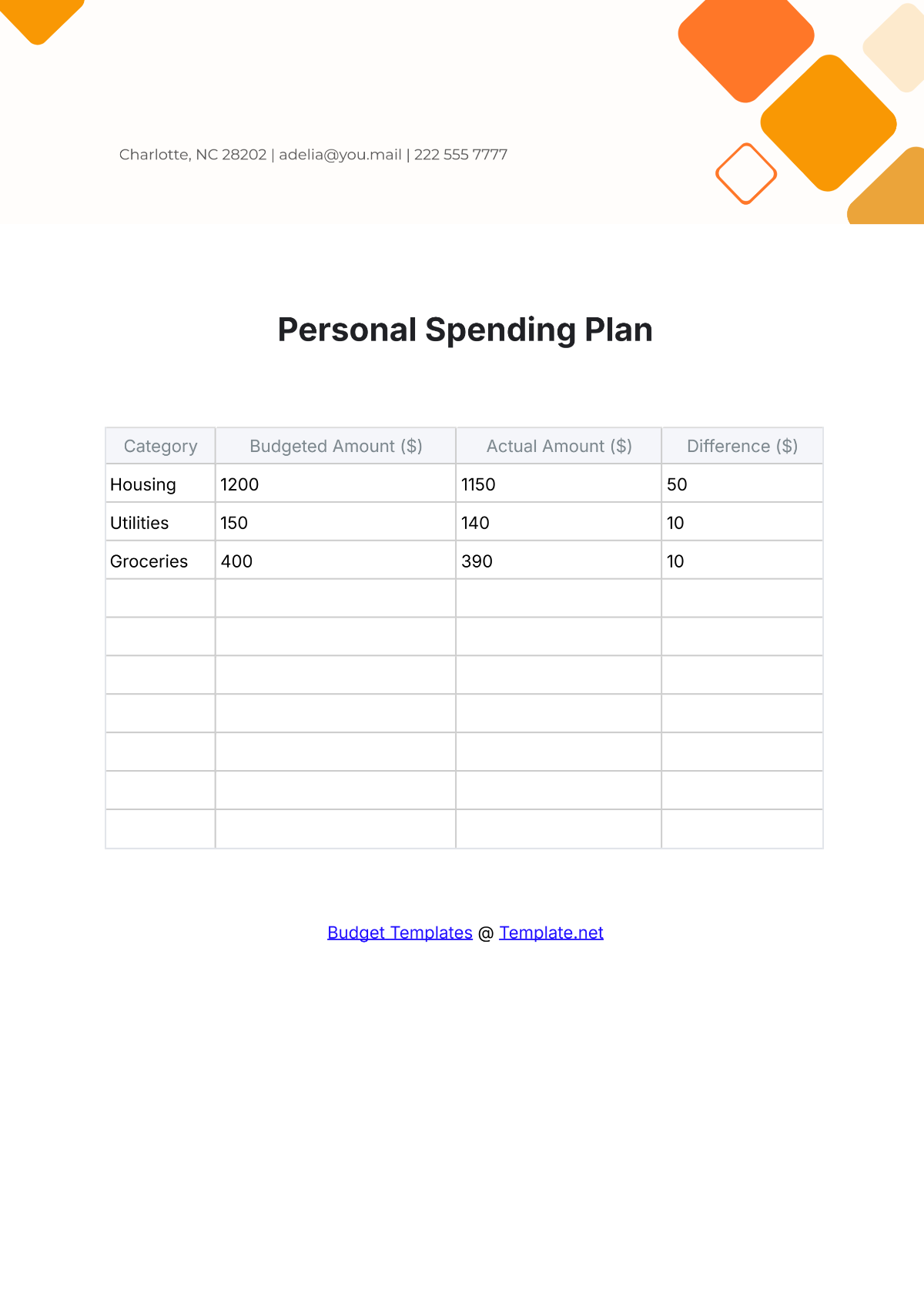

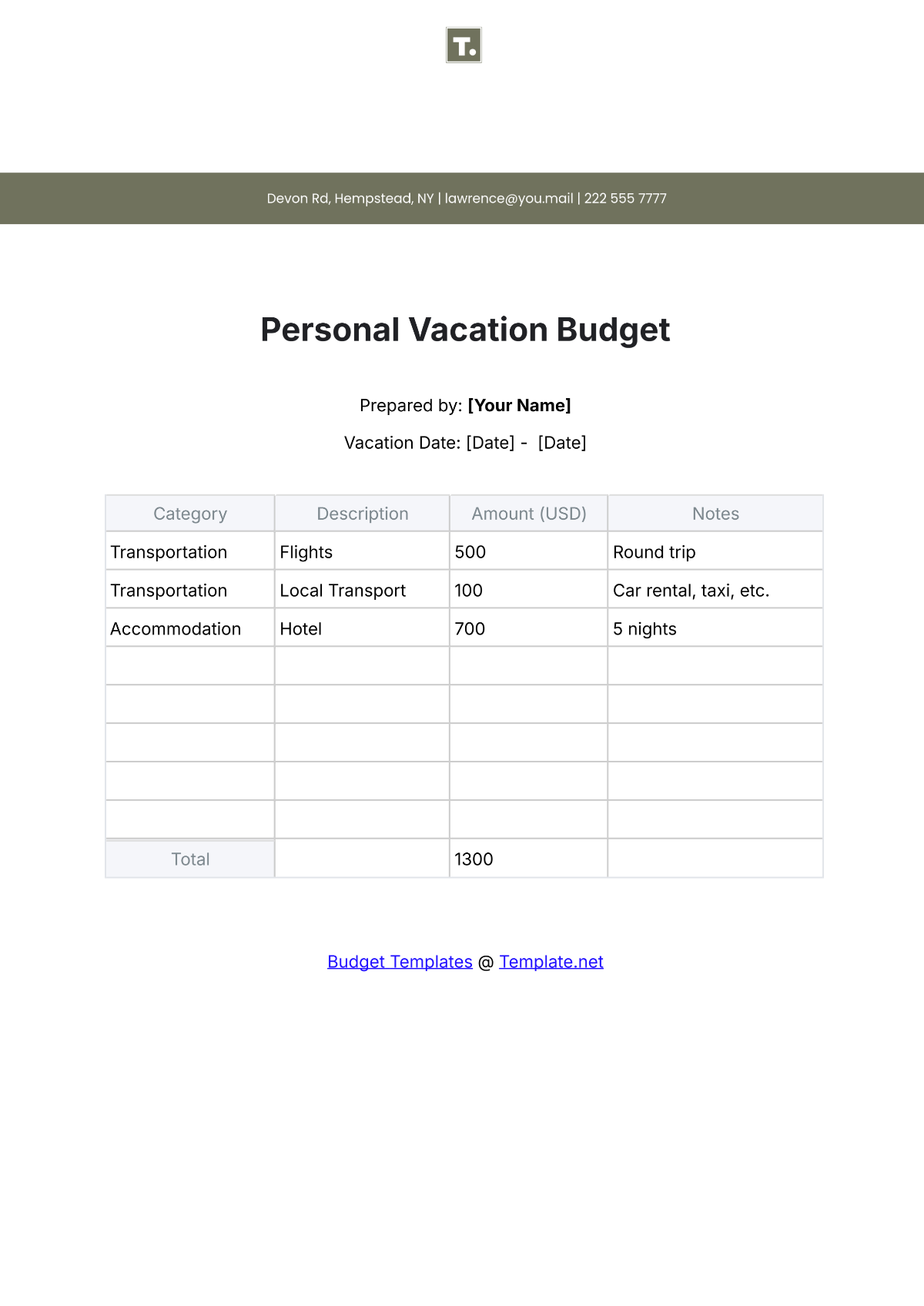

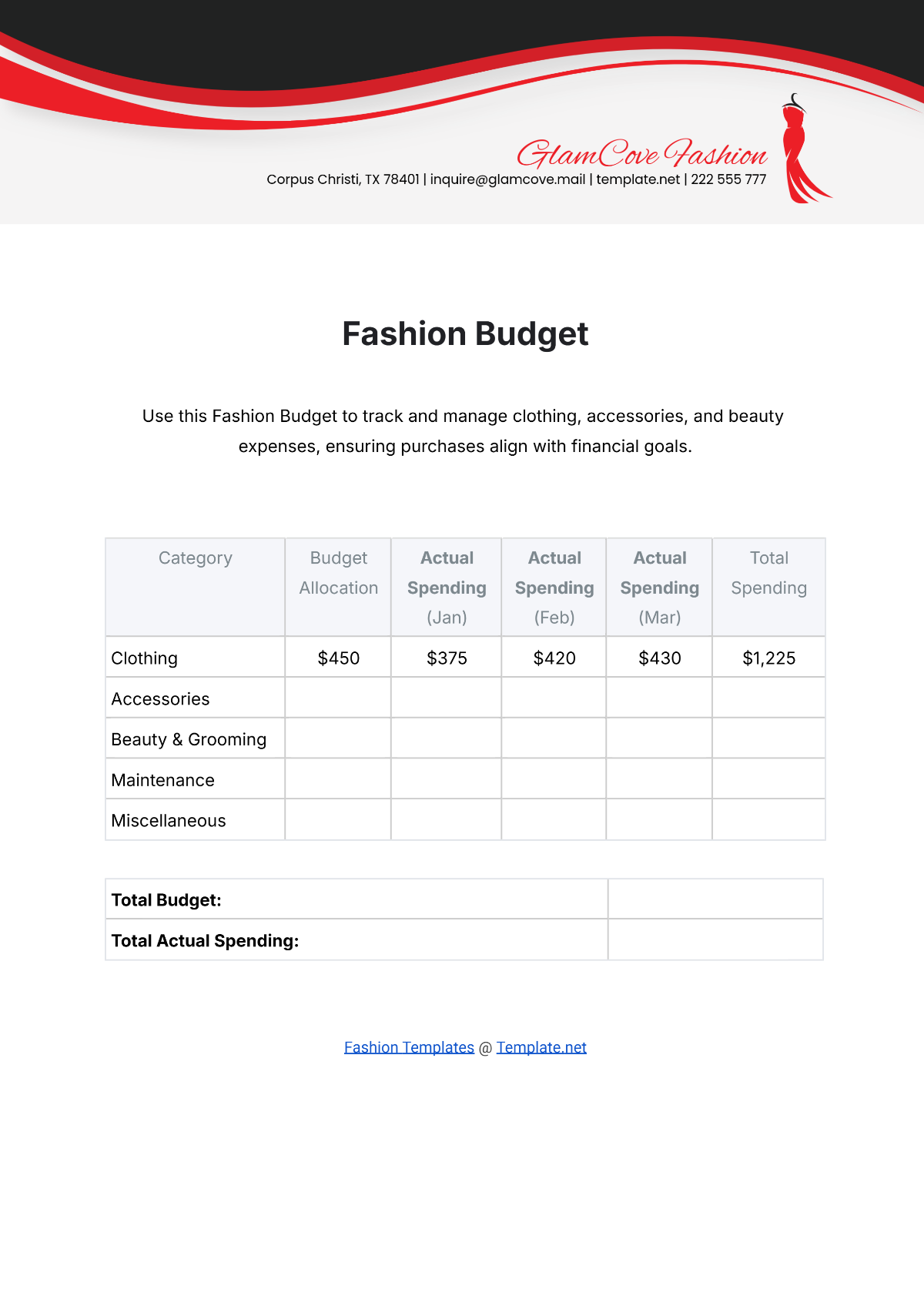

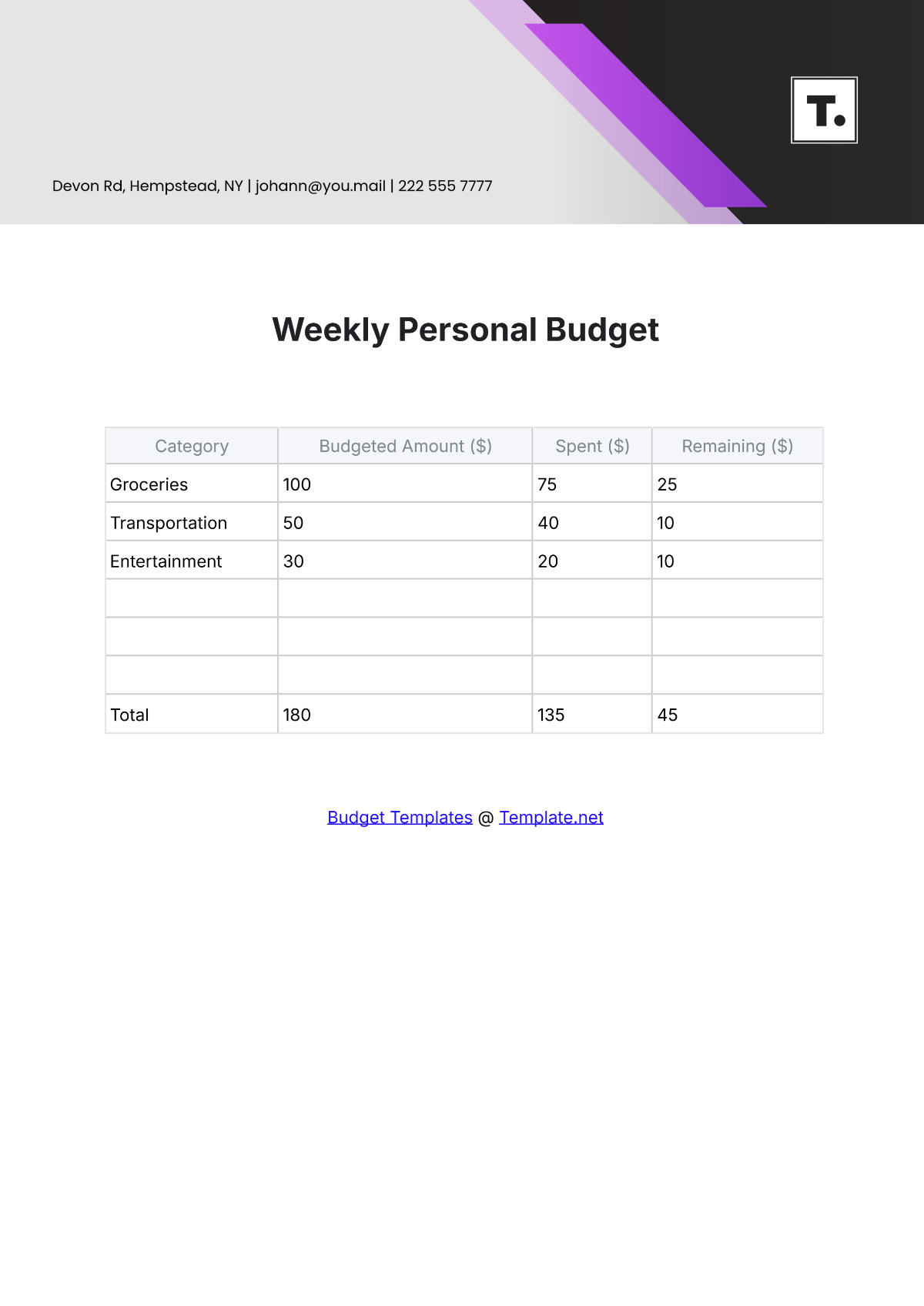

3. Variable Expenses

Category | Estimated Monthly Amount | Estimated Annual Amount | Allocation Period | Notes |

|---|---|---|---|---|

Marketing & Advertising | $15,000 | $180,000 | Ongoing | Online ads, billboards |

Office Supplies | $1,200 | $14,400 | As needed | Printer ink, paper, etc. |

Travel Expenses | $5,000 | $60,000 | As needed | Client meetings, conferences |

Research & Development | $10,000 | $120,000 | Quarterly | New product innovation |

Miscellaneous Expenses | $2,000 | $24,000 | As needed | Unexpected costs |

4. Savings and Investments

Emergency Fund Allocation: $50,000

Planned Investments: $200,000

Retirement Fund Contributions: $75,000

5. Debt Repayment Plan

Creditor | Balance Due | Monthly Payment | Final Payment Date | Notes |

|---|---|---|---|---|

Bank of Tech City | $500,000 | $15,000 | March 1, 2055 | Equipment loan |

Fintech Lenders Inc. | $150,000 | $5,000 | June 1, 2052 | Office renovation loan |

Reminders:

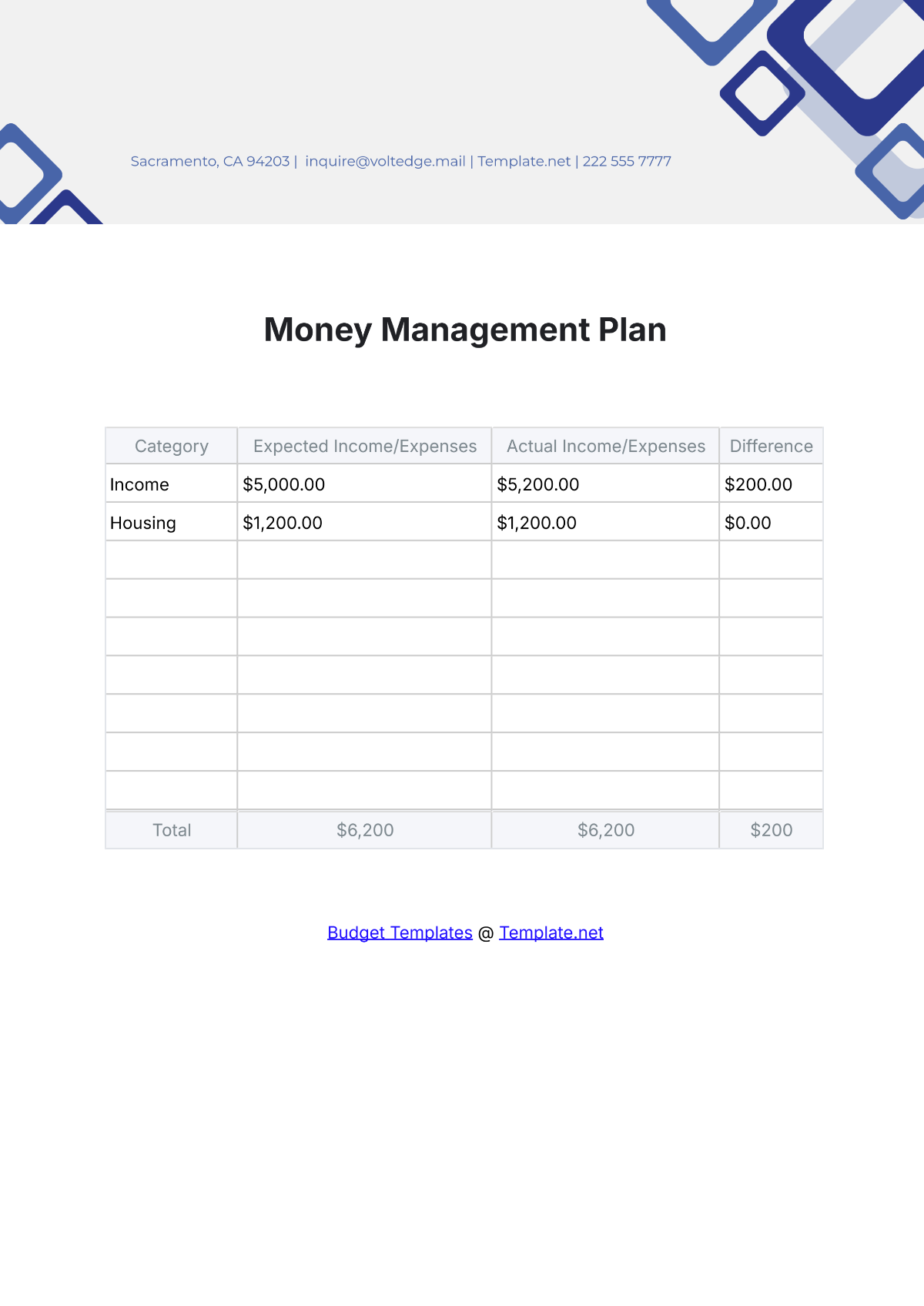

Review this budget regularly: Financial conditions and market environments can change, so it’s important to revisit this budget quarterly to make necessary adjustments.

Track actual expenses: Compare the budgeted amounts with actual spending to identify areas where the company may need to cut costs or where there is room for increased investment.

Plan for contingencies: Ensure that there is a contingency fund for unexpected expenses to prevent financial strain on the business.

By following this budget list, [YOUR COMPANY NAME] can effectively manage its financial resources, achieve its business goals, and ensure long-term financial stability.

Prepared by: [YOUR NAME]

Date: August 14, 2050