Free Operational Budget

I. Executive Summary

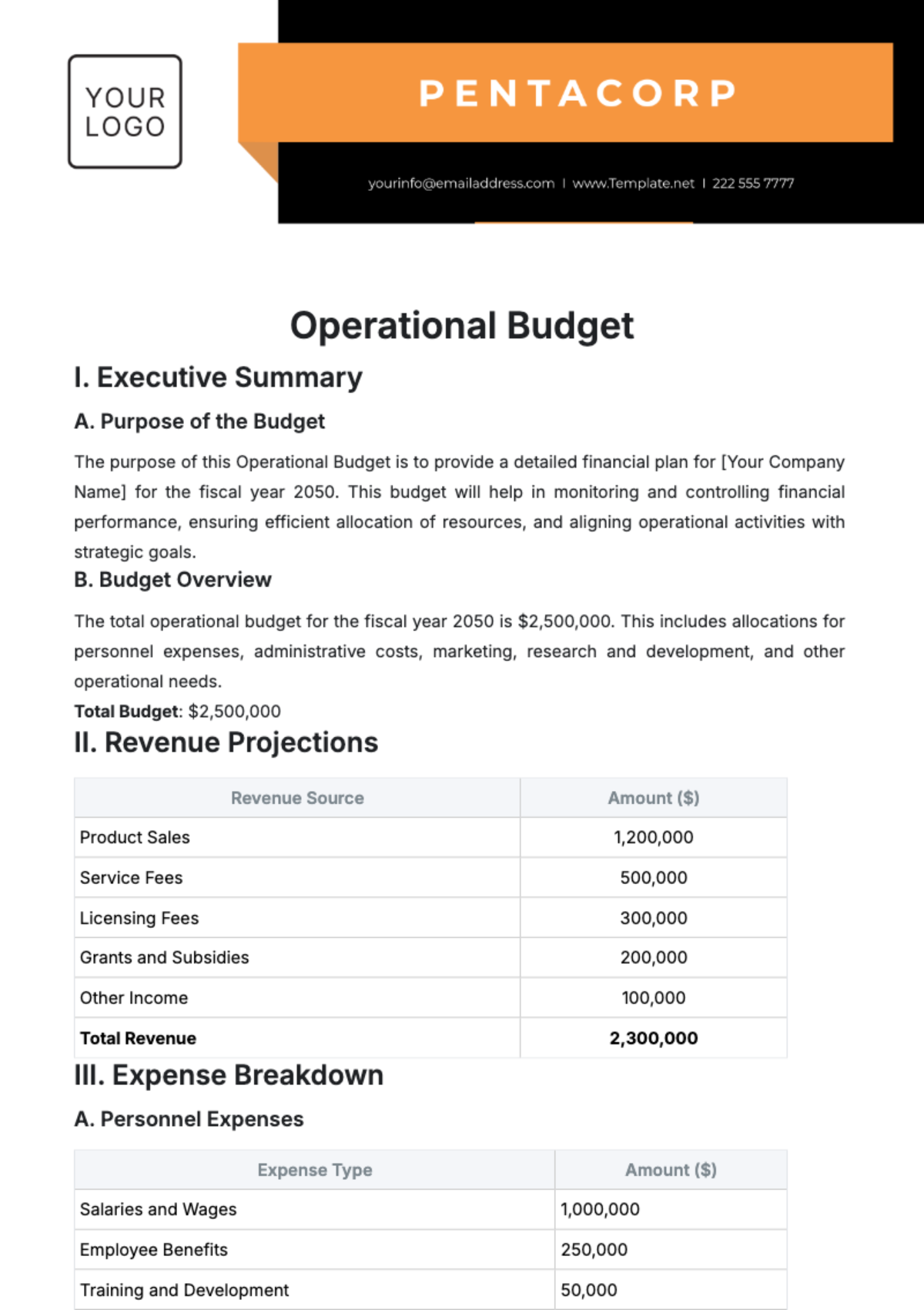

A. Purpose of the Budget

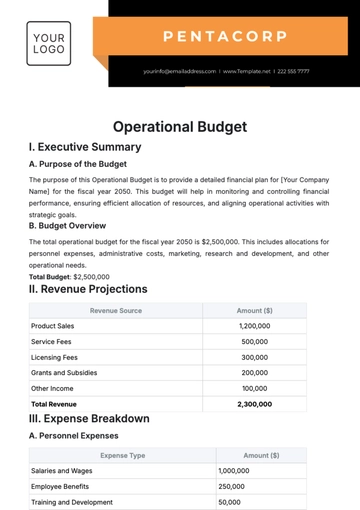

The purpose of this Operational Budget is to provide a detailed financial plan for [Your Company Name] for the fiscal year 2050. This budget will help in monitoring and controlling financial performance, ensuring efficient allocation of resources, and aligning operational activities with strategic goals.

B. Budget Overview

The total operational budget for the fiscal year 2050 is $2,500,000. This includes allocations for personnel expenses, administrative costs, marketing, research and development, and other operational needs.

Total Budget: $2,500,000

II. Revenue Projections

Revenue Source | Amount ($) |

|---|---|

Product Sales | 1,200,000 |

Service Fees | 500,000 |

Licensing Fees | 300,000 |

Grants and Subsidies | 200,000 |

Other Income | 100,000 |

Total Revenue | 2,300,000 |

III. Expense Breakdown

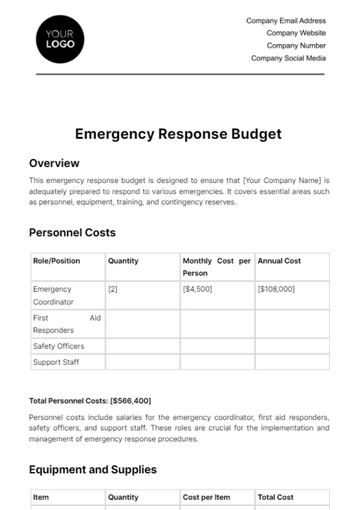

A. Personnel Expenses

Expense Type | Amount ($) |

|---|---|

Salaries and Wages | 1,000,000 |

Employee Benefits | 250,000 |

Training and Development | 50,000 |

Recruitment Costs | 30,000 |

Total Personnel Expenses | 1,330,000 |

B. Administrative Costs

Expense Type | Amount ($) |

|---|---|

Office Rent | 120,000 |

Utilities | 30,000 |

Office Supplies | 20,000 |

Insurance | 15,000 |

Total Administrative Costs | 185,000 |

C. Marketing and Advertising

Expense Type | Amount ($) |

|---|---|

Digital Marketing | 75,000 |

Print Advertising | 30,000 |

Events and Sponsorships | 40,000 |

Public Relations | 20,000 |

Total Marketing and Advertising | 165,000 |

D. Research and Development

Expense Type | Amount ($) |

|---|---|

R&D Salaries | 80,000 |

Laboratory Supplies | 40,000 |

External Research Collaborations | 30,000 |

Total Research and Development | 150,000 |

E. Other Operational Costs

Expense Type | Amount ($) |

|---|---|

Travel and Transportation | 25,000 |

Legal and Professional Fees | 20,000 |

Depreciation | 15,000 |

Miscellaneous Expenses | 15,000 |

Total Other Operational Costs | 75,000 |

IV. Financial Analysis

A. Budget Variance Analysis

Compare actual expenditures to budgeted amounts to identify discrepancies and take corrective actions.

B. Cash Flow Projection

Month | Cash Inflows ($) | Cash Outflows ($) | Net Cash Flow ($) |

|---|---|---|---|

January | 200,000 | 150,000 | 50,000 |

February | 180,000 | 160,000 | 20,000 |

... | ... | ... | ... |

December | 250,000 | 200,000 | 50,000 |

Total | 2,500,000 | 2,200,000 | 300,000 |

C. Break-Even Analysis

Description | Amount ($) |

|---|---|

Fixed Costs | 1,000,000 |

Variable Costs per Unit | 50 |

Selling Price per Unit | 100 |

Break-Even Point | 20,000 units |

V. Budget Approval

A. Approval Process

The operational budget must be reviewed and approved by the senior management team. This process includes evaluating the alignment of the budget with strategic goals, assessing the feasibility of revenue projections, and ensuring cost control measures are in place.

B. Budget Revisions

Any necessary revisions to the budget should be documented and justified, considering factors such as unexpected changes in revenue or expenses. Revisions should be submitted for approval by the relevant stakeholders.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Plan and manage your operational expenses with the Operational Budget Template from Template.net. This customizable template helps you create detailed budgets to control costs and optimize spending. Editable in our AI Editor Tool, it’s essential for financial planning. Download now and take control of your operational budget!

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising