Free Startup Budget

I. Introduction

A. Purpose of the Startup Budget

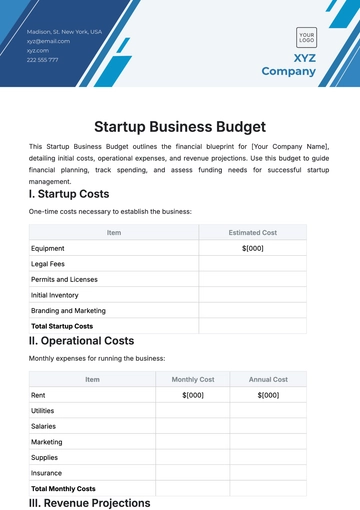

The purpose of this startup budget is to provide a comprehensive financial framework for [Your Company Name] as it embarks on establishing its operations. The budget outlines the expected costs and projected revenues associated with the launch and initial phase of the business, ensuring that adequate financial resources are allocated to each aspect of the startup process. A well-structured startup budget is crucial for identifying funding requirements, managing cash flow, and making informed decisions about resource allocation.

B. Scope of the Budget

This startup budget encompasses all the financial requirements from the inception of [Your Company Name] in the year 2050 through the first year of operations. The scope includes initial investments in infrastructure, equipment, marketing, personnel, and other essential expenses necessary to establish the business. The budget also covers anticipated revenues and operational costs during the first year to ensure financial stability and the ability to sustain growth.

C. Importance of a Detailed Startup Budget

Creating a detailed startup budget is critical to the success of [Your Company Name]. It provides a roadmap for managing finances, helps in identifying potential financial risks, and enables the business to set realistic financial goals. By outlining all expected expenses and revenue streams, the budget ensures that the company is prepared for any financial challenges that may arise during the startup phase. Furthermore, a detailed budget is essential when seeking funding from investors or financial institutions, as it demonstrates the company’s commitment to financial responsibility and long-term sustainability.

II. Initial Capital Requirements

A. Capital Investment

The initial capital investment for [Your Company Name] includes the funds required to cover all startup expenses before the business begins generating revenue. This section outlines the necessary investments in various areas critical to the launch of the business.

Real Estate and Office Space

Purchase of Property or Lease: The cost of acquiring or leasing office space is a significant expense for any startup. For [Your Company Name], a prime location is essential to attract clients and employees. The budget for purchasing or leasing office space in 2050 is projected to be approximately $500,000. This includes a down payment for purchasing a property or the first year’s lease payments.

Renovations and Customization: If the office space requires renovations or customization to meet the company’s needs, an additional $100,000 is allocated. This covers construction costs, interior design, and any necessary permits.

Equipment and Technology

Office Furniture and Fixtures: The startup will require ergonomic office furniture, including desks, chairs, conference tables, and storage units. The budget for office furniture is estimated at $50,000.

Computers and IT Infrastructure: Technology is a critical component of [Your Company Name]. The budget allocates $150,000 for purchasing computers, servers, networking equipment, and software licenses. This also includes setting up a secure IT infrastructure to protect company data.

Communication Systems: To facilitate effective communication, $20,000 is budgeted for telecommunication systems, including phone lines, video conferencing tools, and internet services.

Legal and Professional Fees

Legal Services: To ensure compliance with local regulations and to protect intellectual property, $30,000 is allocated for legal services. This includes fees for business registration, patent filings, and drafting contracts.

Consulting and Advisory Services: [Your Company Name] plans to hire business consultants and financial advisors to assist with strategic planning. The budget for these services is set at $25,000.

Licenses and Permits

Business Licenses: Acquiring the necessary licenses to operate in the chosen industry is essential. The budget allocates $10,000 for this purpose, covering both local and state licensing fees.

Permits: Depending on the nature of the business, permits related to health, safety, and environmental regulations may be required. An additional $5,000 is set aside for permits.

B. Working Capital

Working capital is essential for covering day-to-day operational expenses during the first few months of business. This section outlines the allocation of funds for working capital.

Operational Expenses

Salaries and Wages: A key component of working capital is payroll. [Your Company Name] plans to hire a small team initially, with a budget of $300,000 for the first year’s salaries and wages. This includes payroll taxes and benefits.

Rent and Utilities: If the office space is leased, the budget allocates $60,000 for rent. An additional $20,000 is set aside for utilities, including electricity, water, and internet services.

Insurance: The startup will need various insurance policies to protect against risks. The budget allocates $25,000 for general liability, property, and health insurance.

Inventory and Supplies

Initial Inventory: If [Your Company Name] is a product-based business, $100,000 is allocated for purchasing initial inventory. This ensures that the company can meet customer demand from day one.

Office Supplies: $10,000 is budgeted for purchasing office supplies such as stationery, printers, and other essential items.

C. Contingency Fund

A contingency fund is set aside to cover unexpected expenses or financial shortfalls during the startup phase. This fund ensures that the business can navigate unforeseen challenges without jeopardizing its financial stability.

Emergency Expenses

Unexpected Repairs: In case of unforeseen damage to the office space or equipment, $20,000 is allocated for emergency repairs.

Market Fluctuations: The startup may face unexpected market conditions that impact sales. A $50,000 contingency fund is reserved to offset potential revenue shortfalls.

Buffer for Operational Costs

Additional Working Capital: An additional $30,000 is set aside as a buffer to cover any operational costs that exceed initial projections.

Marketing Adjustments: If initial marketing efforts require adjustments, $15,000 is allocated to modify strategies or increase advertising spend.

III. Revenue Projections

A. Sales Forecast

Revenue projections are based on a detailed analysis of the market, customer demand, and the company’s sales strategy. This section outlines the expected revenue streams for [Your Company Name] during the first year of operations.

Product Sales

Pricing Strategy: The pricing strategy for [Your Company Name] is designed to balance profitability with market competitiveness. The average price per unit is set at $50, with an expected monthly sales volume of 1,000 units.

Revenue from Product Sales: Based on the pricing strategy and sales volume, projected monthly revenue from product sales is $50,000. Over 12 months, this totals $600,000.

Service Revenue

Consulting Services: If [Your Company Name] offers consulting services, a rate of $200 per hour is set. With an expectation of 500 billable hours in the first year, revenue from consulting services is projected at $100,000.

Subscription-Based Services: For any subscription-based offerings, a monthly fee of $100 is established. With an expected 100 subscribers in the first year, revenue from subscriptions is projected at $120,000.

Total Revenue Projections

Cumulative Revenue: Combining product sales, consulting services, and subscriptions, the total revenue projection for the first year is $820,000. This projection is based on conservative estimates to ensure financial stability.

B. Cash Flow Projections

Cash flow management is crucial for maintaining the financial health of the startup. This section outlines the expected cash inflows and outflows during the first year of operations.

Monthly Cash Inflows

Product Sales: Monthly cash inflows from product sales are expected to be $50,000.

Consulting Services: Consulting services are expected to generate an additional $8,333 per month.

Subscriptions: Monthly cash inflows from subscriptions are projected at $10,000.

Monthly Cash Outflows

Operational Expenses: Monthly expenses, including salaries, rent, utilities, and inventory, are expected to total $45,000.

Loan Repayments: If the startup has taken out loans, $5,000 per month is allocated for loan repayments.

Marketing Expenses: Monthly marketing expenses are projected at $5,000, covering online advertising, content creation, and promotional events.

Net Cash Flow

Positive Cash Flow: Based on the projections, [Your Company Name] expects to maintain a positive cash flow, with net cash inflows of approximately $13,333 per month.

Cumulative Cash Flow: By the end of the first year, cumulative net cash flow is projected to be $160,000, providing a solid financial foundation for future growth.

IV. Funding Requirements

A. Sources of Funding

To cover the initial capital and working capital requirements, [Your Company Name] will need to secure funding from various sources. This section outlines potential funding options.

Equity Financing

Venture Capital: [Your Company Name] plans to approach venture capital firms to raise $500,000 in exchange for equity. This funding will be used to cover capital investments and initial operational costs.

Angel Investors: An additional $200,000 is sought from angel investors. In return, these investors will receive a minority stake in the company.

Debt Financing

Bank Loans: The startup will apply for a $300,000 loan from a financial institution. The loan will be used to finance equipment purchases and working capital needs. Repayment is planned over five years at an interest rate of 5%.

Personal Loans: The founders may contribute an additional $100,000 through personal loans. These funds will be used as a contingency reserve.

B. Funding Timeline

Securing funding is a critical milestone in the startup process. This section outlines the timeline for acquiring the necessary funds.

Pre-Launch Funding

Initial Fundraising: The first round of fundraising, targeting venture capital and angel investors, is scheduled for Q1 2050. The goal is to secure $700,000 by the end of the quarter.

Loan Applications: Bank loan applications will be submitted in Q2 2050, with the aim of securing funds by the beginning of Q3 2050.

Post-Launch Funding

Additional Rounds: If needed, a second round of equity financing will be initiated in Q4 2050. The goal is to raise an additional $200,000 to support growth and expansion.

Revenue Reinvestment: Profits generated during the first year of operations will be reinvested into the business, reducing the need for external funding.

V. Marketing Budget

A. Marketing Strategy

An effective marketing strategy is essential for driving sales and establishing brand awareness. This section outlines the budget allocated for various marketing activities.

Digital Marketing

Online Advertising: $60,000 is allocated for online advertising, including pay-per-click (PPC) campaigns, social media ads, and search engine marketing (SEM).

Content Marketing: To attract and engage customers, $30,000 is budgeted for content creation, including blog posts, videos, and infographics.

Email Marketing: A budget of $10,000 is set aside for email marketing campaigns, targeting potential customers and nurturing leads.

Traditional Marketing

Print Advertising: $20,000 is allocated for print ads in industry magazines and local newspapers.

Direct Mail: To reach potential customers, $15,000 is budgeted for direct mail campaigns, including brochures and postcards.

Public Relations: $25,000 is allocated for public relations efforts, including press releases, media outreach, and event sponsorships.

B. Marketing Channels

The success of [Your Company Name]'s marketing efforts depends on the selection of the right channels. This section outlines the primary channels through which marketing efforts will be directed.

Social Media

Platform Selection: [Your Company Name] will focus on platforms such as Instagram, LinkedIn, and Twitter to engage with target audiences. The budget allocates $20,000 for social media management and advertising on these platforms.

Content Strategy: An additional $10,000 is budgeted for developing a robust content strategy, including daily posts, stories, and sponsored content.

Search Engine Optimization (SEO)

Keyword Research: $5,000 is allocated for keyword research to identify high-traffic, low-competition keywords.

On-Page SEO: An additional $5,000 is set aside for optimizing website content, meta tags, and images to improve search engine rankings.

Link Building: To increase domain authority, $10,000 is budgeted for link-building activities, including guest posting and influencer partnerships.

Events and Sponsorships

Industry Events: $15,000 is allocated for participating in industry conferences, trade shows, and networking events.

Sponsorships: An additional $10,000 is budgeted for sponsoring relevant industry events and organizations to increase brand visibility.

C. Marketing Budget Allocation

The following table summarizes the marketing budget allocation for [Your Company Name] in 2050:

Marketing Activity | Budget Allocation ($) |

|---|---|

Online Advertising | 60,000 |

Content Marketing | 30,000 |

Email Marketing | 10,000 |

Print Advertising | 20,000 |

Direct Mail | 15,000 |

Public Relations | 25,000 |

Social Media Management | 20,000 |

Content Strategy | 10,000 |

SEO (Keyword Research) | 5,000 |

SEO (On-Page Optimization) | 5,000 |

SEO (Link Building) | 10,000 |

Events and Sponsorships | 25,000 |

Total Marketing Budget | 235,000 |

VI. Break-Even Analysis

A. Fixed Costs

Fixed costs are expenses that remain constant regardless of the level of production or sales. This section outlines the fixed costs for [Your Company Name] during its first year of operations.

Rent and Utilities

Office Rent: The annual cost of renting office space is $60,000, which remains unchanged throughout the year.

Utilities: Utilities, including electricity, water, and internet, are expected to cost $20,000 annually.

Salaries and Wages

Employee Salaries: The budget allocates $300,000 for employee salaries, including payroll taxes and benefits, which are fixed costs.

Administrative Staff: An additional $50,000 is budgeted for administrative staff salaries, ensuring smooth operations.

Insurance

General Liability Insurance: The annual cost of general liability insurance is $10,000, providing coverage against potential risks.

Health Insurance: An additional $15,000 is budgeted for employee health insurance.

B. Variable Costs

Variable costs fluctuate based on the level of production or sales. This section outlines the variable costs for [Your Company Name].

Cost of Goods Sold (COGS)

Raw Materials: If [Your Company Name] produces physical products, $100,000 is budgeted for raw materials. This cost varies depending on the number of units produced.

Packaging: An additional $20,000 is allocated for packaging materials, which also varies with production volume.

Sales Commissions

Sales Team Commissions: A budget of $30,000 is set aside for sales commissions, which are paid based on the revenue generated by the sales team.

Affiliate Commissions: If [Your Company Name] uses affiliate marketing, $15,000 is allocated for affiliate commissions, based on the number of sales generated through affiliate partners.

Marketing Costs

Performance-Based Advertising: $20,000 is allocated for performance-based advertising, including PPC campaigns. This cost varies depending on the success of the campaigns.

Content Creation: An additional $10,000 is budgeted for content creation, which fluctuates based on the frequency and scope of marketing campaigns.

C. Break-Even Point Calculation

The break-even point is the level of sales at which total revenue equals total costs, resulting in neither profit nor loss. This section calculates the break-even point for [Your Company Name].

Fixed Costs: The total fixed costs for the first year are $455,000.

Variable Costs per Unit: The variable cost per unit is calculated by dividing the total variable costs by the projected number of units sold. With total variable costs of $175,000 and 12,000 units sold, the variable cost per unit is $14.58.

Break-Even Point: [Your Company Name] needs to sell approximately 12,840 units to break even during the first year.

VII. Risk Assessment and Mitigation

A. Financial Risks

Financial risks are inherent in any startup. This section outlines potential financial risks and the strategies to mitigate them.

Revenue Shortfall

Risk: A significant risk is the potential for revenue to fall short of projections due to lower-than-expected sales or market conditions.

Mitigation: To mitigate this risk, [Your Company Name] will maintain a contingency fund of $50,000 and adopt a flexible marketing strategy that can be adjusted based on real-time performance data.

Cost Overruns

Risk: Unexpected increases in costs, such as higher material prices or additional regulatory compliance expenses, could impact profitability.

Mitigation: A buffer of $30,000 is allocated within the budget to cover potential cost overruns. Additionally, regular financial reviews will be conducted to monitor expenses closely.

Funding Challenges

Risk: Delays in securing funding or unfavorable terms from investors could strain cash flow and delay the launch.

Mitigation: [Your Company Name] plans to engage multiple potential investors simultaneously and prepare alternative funding plans, such as short-term loans or crowdfunding.

B. Operational Risks

Operational risks can disrupt the smooth functioning of the startup. This section identifies key operational risks and mitigation strategies.

Supply Chain Disruptions

Risk: Disruptions in the supply chain, such as delays in receiving raw materials or equipment, could impact production schedules.

Mitigation: [Your Company Name] will establish relationships with multiple suppliers and maintain a safety stock of critical materials to mitigate supply chain risks.

Talent Acquisition and Retention

Risk: Difficulty in attracting and retaining skilled employees could hinder operations and growth.

Mitigation: A competitive salary and benefits package, along with professional development opportunities, will be offered to attract and retain top talent.

Technology Failures

Risk: Technology failures, such as software crashes or cybersecurity breaches, could disrupt operations and result in data loss.

Mitigation: [Your Company Name] will invest in reliable technology infrastructure, implement regular system backups, and establish a cybersecurity protocol to mitigate technology risks.

VIII. Conclusion

Creating a comprehensive startup budget is essential for the success of [Your Company Name]. This document outlines the anticipated expenses and funding strategies required to launch and sustain the business in its early stages. The detailed analysis of costs, funding, marketing, and risks provides a clear roadmap for financial planning and decision-making. By adhering to the budget and continuously monitoring financial performance, [Your Company Name] can navigate the challenges of the startup phase and work towards achieving its long-term goals.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Plan and manage your startup finances effectively with the Startup Budget Template available on Template.net. This editable template helps you outline and track your budget to keep your finances on track. Editable in our AI Editor Tool, it’s perfect for ensuring your startup stays within budget. Download now and get your financial planning started!

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising