Free Household Budget

Creating a household budget is a crucial step toward achieving financial stability and planning for a secure future. By mapping out income and expenses, this budget serves as a roadmap for managing finances, saving for long-term goals, and preparing for unforeseen expenses. This budget, prepared by [YOUR NAME], is tailored to provide a comprehensive overview of the household's financial situation.

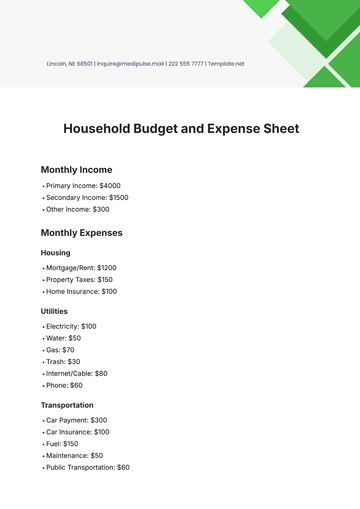

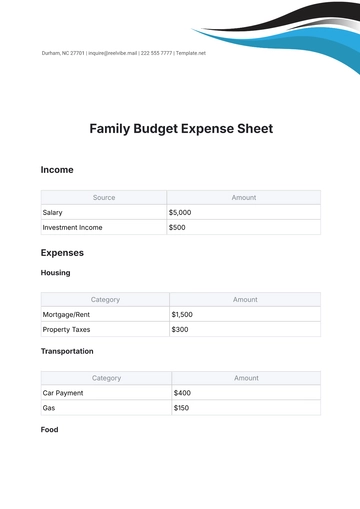

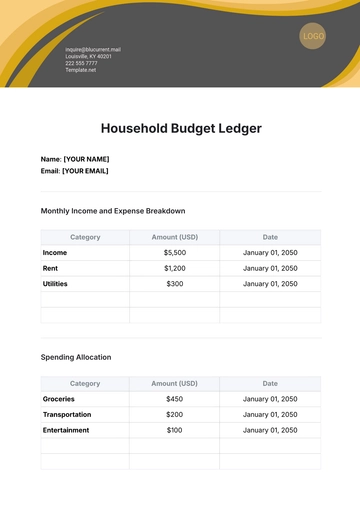

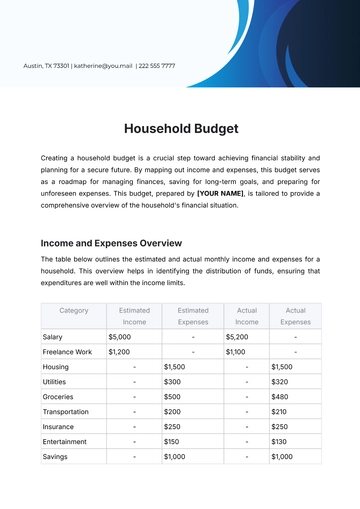

Income and Expenses Overview

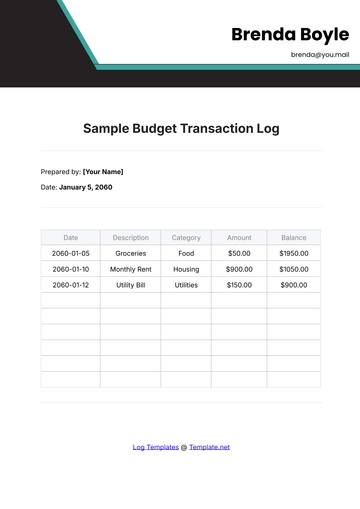

The table below outlines the estimated and actual monthly income and expenses for a household. This overview helps in identifying the distribution of funds, ensuring that expenditures are well within the income limits.

Category | Estimated Income | Estimated Expenses | Actual Income | Actual Expenses |

|---|---|---|---|---|

Salary | $5,000 | - | $5,200 | - |

Freelance Work | $1,200 | - | $1,100 | - |

Housing | - | $1,500 | - | $1,500 |

Utilities | - | $300 | - | $320 |

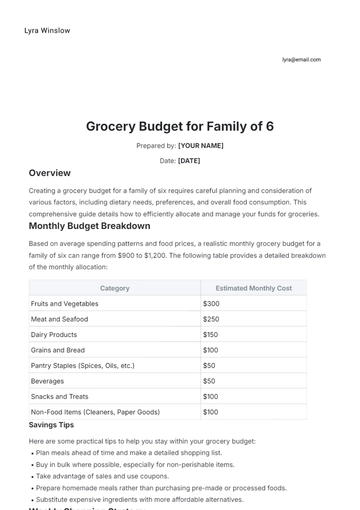

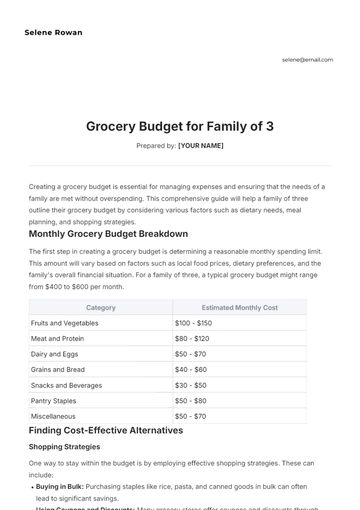

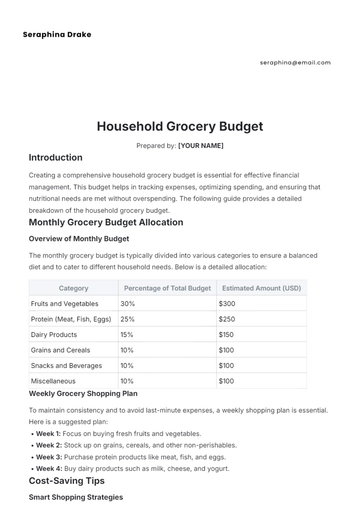

Groceries | - | $500 | - | $480 |

Transportation | - | $200 | - | $210 |

Insurance | - | $250 | - | $250 |

Entertainment | - | $150 | - | $130 |

Savings | - | $1,000 | - | $1,000 |

Fixed and Variable Expenses

Understanding the nature of expenses is key to effective budgeting. Fixed expenses, such as rent or mortgage, remain consistent each month, while variable expenses can fluctuate. This distinction helps in identifying potential areas for adjustment.

Fixed Expenses: Housing, Insurance, Savings

Variable Expenses: Utilities, Groceries, Transportation, Entertainment

Financial Goals

Setting financial goals is vital for guiding budgeting efforts. This section focuses on prioritizing short-term and long-term goals, such as building an emergency fund, saving for a significant purchase, or investing in retirement accounts.

Short-Term Goals (by December 2050): Save $3,000 for an emergency fund, Reduce monthly entertainment expenses by 20%

Long-Term Goals (by December 2055): Pay off mortgage, Save $50,000 for retirement

Action Plan

To achieve the outlined financial goals, a clear action plan is necessary. This plan includes setting aside a portion of the monthly income towards savings and investments while actively monitoring and adjusting spending habits.

Allocate 20% of monthly income to savings

Review and adjust the budget quarterly to reflect changes in income or expenses

Automate savings transfers to ensure consistency

Contact Information

For further assistance or to discuss this budget in detail, feel free to reach out.

Prepared by: [YOUR NAME]

Email: [YOUR EMAIL]

Phone: 260-433-0824

Reminders

To maximize the effectiveness of this household budget, keep these reminders in mind:

Review and update the budget every month to accommodate any changes in income or expenses.

Keep track of all receipts and payments to ensure accuracy in the actual expenses column.

Avoid unnecessary expenditures by distinguishing between needs and wants.

Set up automatic payments to avoid late fees and improve credit standing.

Regularly assess financial goals and adjust the action plan as needed.

Use budgeting apps or software for more streamlined tracking and analysis.

Stay committed to the budget but remain flexible to adjust as life's circumstances change.

Seek financial advice if struggling to meet financial goals or manage debt.

With careful planning and regular monitoring, this budget can serve as a powerful tool for financial growth and security, guiding you toward a more stable financial future.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize financial control with our Household Budget Template from Template.net. This customizable and editable template simplifies budgeting, helping you track expenses effortlessly. Designed for ease of use, it integrates seamlessly with the AI Editor Tool, ensuring a tailored fit for your needs. Perfect for managing household finances efficiently and effectively.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising