Free Budget for Married Couples

Prepared by: [YOUR NAME]

Email: [YOUR EMAIL]

Introduction

Investment planning is a crucial step for married couples looking to build a secure financial future. This budget template is designed to help couples strategically allocate their income toward different investment avenues while balancing other essential expenses. By following this plan, couples can work together to achieve their long-term financial goals and enjoy a comfortable lifestyle.

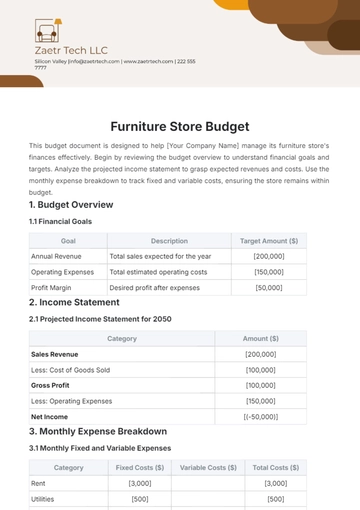

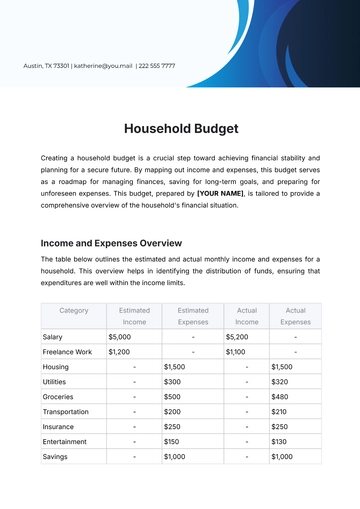

Monthly Income and Savings Allocation

[YOUR NAME] and the spouse's combined monthly income is allocated across various essential and investment categories. This distribution ensures they meet their daily needs while making steady progress toward their financial goals

Income/Expense Category | Monthly Income ($) | % of Income | Investment Amount ($) | Notes |

|---|---|---|---|---|

Total Monthly Income | 10,000 | 100% | - | Combined salaries |

Essential Expenses | 4,000 | 40% | - | Mortgage, utilities, etc. |

Discretionary Spending | 1,500 | 15% | - | Dining, entertainment |

Emergency Fund | 500 | 5% | 500 | 6-month reserve goal |

Short-term Investments | 1,000 | 10% | 1,000 | Stocks and bonds |

Retirement Savings | 2,000 | 20% | 2,000 | 401(k), IRA contributions |

Education Fund | 500 | 5% | 500 | 529 Plan for children |

Long-term Investments | 500 | 5% | 500 | Real estate investment |

Total Allocation | - | 100% | - | Matches total income |

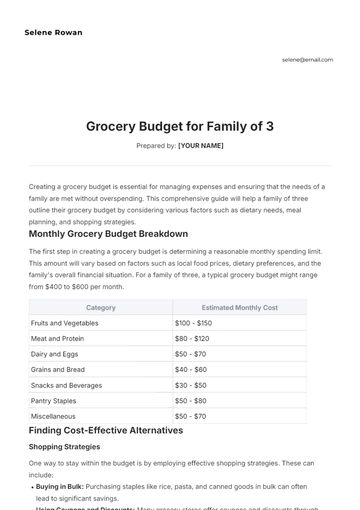

Investment Goals and Timeline

Establishing clear investment goals with a defined timeline helps ensure you stay on track. Outline your short-term, mid-term, and long-term investment objectives.

Short-term Goals (1-5 years): Save $25,000 by June 1, 2055, for a new car and family vacation.

Mid-term Goals (5-15 years): Accumulate $150,000 by August 1, 2060, for children's education expenses.

Long-term Goals (15+ years): Build a retirement fund of $1,000,000 by January 1, 2070, to retire comfortably at age 65.

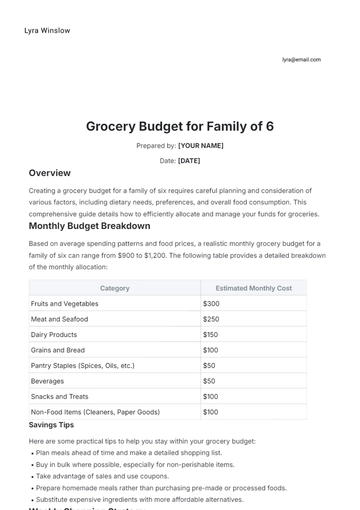

Investment Portfolio Distribution

Diversifying your investment portfolio is key to managing risk. Here is a suggested breakdown of your investment distribution:

Investment Type | Percentage | Target Amount ($) | Current Amount ($) | Notes |

|---|---|---|---|---|

Stocks | 40% | 80,000 | 25,000 | High-growth potential |

Bonds | 20% | 40,000 | 15,000 | Stability and income |

Mutual Funds | 15% | 30,000 | 10,000 | Diversified portfolio |

Real Estate | 10% | 20,000 | 5,000 | Long-term growth |

Retirement Accounts | 10% | 20,000 | 8,000 | Tax-advantaged savings |

Education Savings | 5% | 10,000 | 2,000 | For children's education |

Total Investments | 100% | 200,000 | 65,000 | On track for goals |

Expense Management

By monitoring their monthly expenses, [YOUR NAME] and the spouse can ensure they have sufficient funds for both essential needs and investment contributions. They review their expenses quarterly to identify areas for potential savings and reallocation to investments.

Reminders for Successful Investment Planning

Review Budget Semi-Annually: Adjust the budget every six months to reflect changes in income or expenses.

Automate Savings: Automate transfers to investment accounts to ensure consistent growth.

Emergency Fund Priority: Maintain a six-month emergency fund to avoid dipping into investments.

Stay Informed: Regularly monitor market conditions and adjust investments as needed.

Seek Advice: Consult with a financial advisor annually to refine their investment strategy.

Conclusion

Investment planning as a married couple requires careful budgeting and collaboration. By setting clear goals, diversifying investments, and managing expenses wisely, you can work together towards a secure and prosperous future. Regular reviews and adjustments will keep the couple aligned with their long-term objectives.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Simplify your finances with the Budget Template for Married Couples from Template.net. This customizable and editable tool is designed to help couples track and manage their expenses efficiently. Use the AI Editor Tool to personalize categories and set budget goals with ease. This template ensures both partners stay on the same page.

You may also like

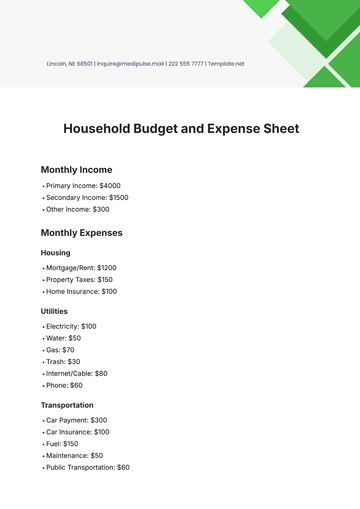

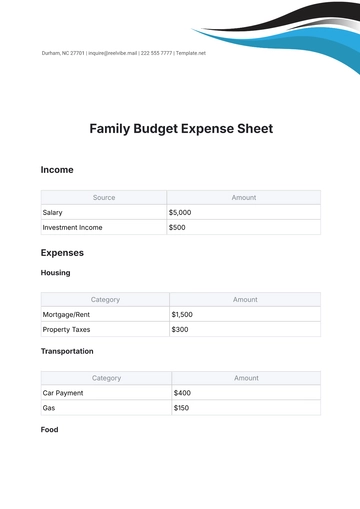

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

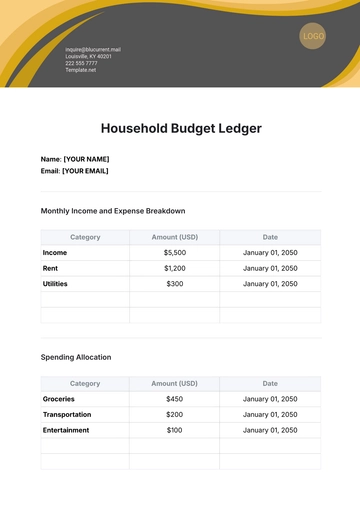

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising