Free Budget Monthly Management Report

Date: [DATE]

Prepared by: [YOUR NAME]

Company: [YOUR COMPANY NAME]

I. Executive Summary

This Monthly Management Report presents a comprehensive overview of [YOUR COMPANY NAME]’s financial performance for the month ending [DATE]. The analysis focuses on key financial metrics, including revenues, expenses, profit and loss, and cash flow.

II. Revenues

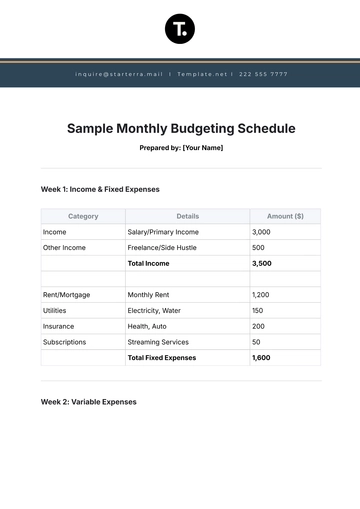

A. Overview

The revenue section provides a detailed analysis of the income generated for the month. This includes both recurring and non-recurring revenue streams. The performance in this section is measured against the projected revenues established at the beginning of the fiscal year.

B. Revenue Breakdown

Revenue Source | Projected | Actual | Variance |

|---|---|---|---|

Product Sales | $50,000 | $48,000 | -$2,000 |

Service Fees | $20,000 | $22,000 | $2,000 |

Subscription Fees | $10,000 | $10,500 | $500 |

II. Expenses

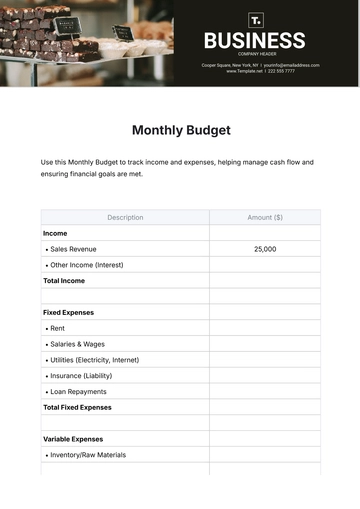

A. Overview

This section details the expenditures for the month, covering operational, capital, and miscellaneous expenses. Monitoring these expenditures against the budget ensures cost control and financial efficiency.

B. Expense Breakdown

Expense Category | Budgeted | Actual | Variance |

|---|---|---|---|

Salaries | $30,000 | $30,500 | $500 |

Rent | $5,000 | $5,000 | $0 |

Utilities | $3,000 | $2,800 | -$200 |

III. Profit & Loss Statement

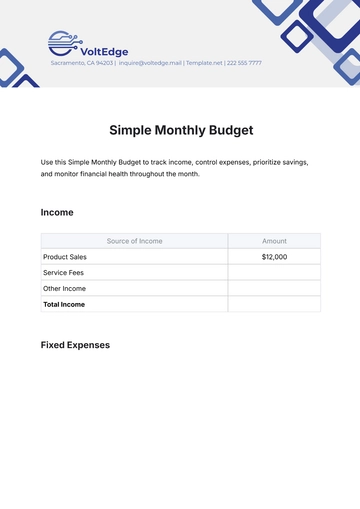

A. Summary

The Profit & Loss statement provides a snapshot of the company's financial performance for the month, detailing revenues, expenses, and net income. This section aims to identify trends and track progress towards financial goals.

B. Detailed Analysis

Category | Amount |

|---|---|

Total Revenue | $80,500 |

Total Expenses | $62,300 |

Net Income | $18,200 |

IV. Cash Flow

A. Overview

The cash flow statement illustrates the inflows and outflows of cash, ensuring that the business can cover its short-term liabilities. Cash flow management is critical to maintaining the liquidity and financial health of the company.

B. Cash Flow Breakdown

Cash Flow Category | Amount |

|---|---|

Operating Activities | $15,000 |

Investing Activities | $-5,000 |

Financing Activities | $2,000 |

Net Cash Flow | $12,000 |

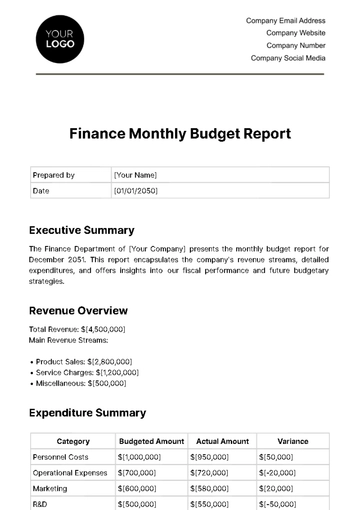

V. Forecast

A. Revenue Projections

Looking forward, this section projects the expected revenues for the upcoming month and quarter. It incorporates both market trends and internal performance metrics to provide a comprehensive forecast.

Projected Revenue for Next Month: $82,000

Projected Revenue for Next Quarter: $245,000

B. Expense Projections

This section forecasts the expected expenses for the upcoming month and quarter. These projections help in strategizing cost control measures and financial planning.

Projected Expenses for Next Month: $64,000

Projected Expenses for Next Quarter: $190,000

VI. Conclusion

In Conclusion, [YOUR COMPANY NAME] showed strong financial management in [DATE], overcoming a slight revenue dip by controlling expenses and achieving solid net income and positive cash flow. Moving forward, careful monitoring of finances and strategic decision-making are essential, with forecasts indicating growth potential and future success.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Efficiently track your finances with the Budget Monthly Management Report Template, designed for ease and clarity. This customizable template allows you to tailor each section to meet your specific needs. Downloadable and printable, it streamlines your budgeting process, ensuring you stay organized. Plus, it’s editable in our AI Editor Tool for effortless updates. Enhance your financial planning today, offered by Template.net!

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising