Budget Progress Report

Reporting Period: January 1, 2050, to September 30, 2050

Prepared By: [Your Name]

Department/Project: Community Development Project

Date Prepared: October 15, 2050

I. Introduction

This Budget Progress Report provides a thorough overview of the financial performance of the Community Development Project against the projected budget for the fiscal year 2050. The report serves to track spending, identify variances, and propose strategic recommendations to maintain fiscal responsibility. It is structured in a hierarchical format, with detailed analyses presented in subsequent sections to facilitate decision-making and ensure accountability.

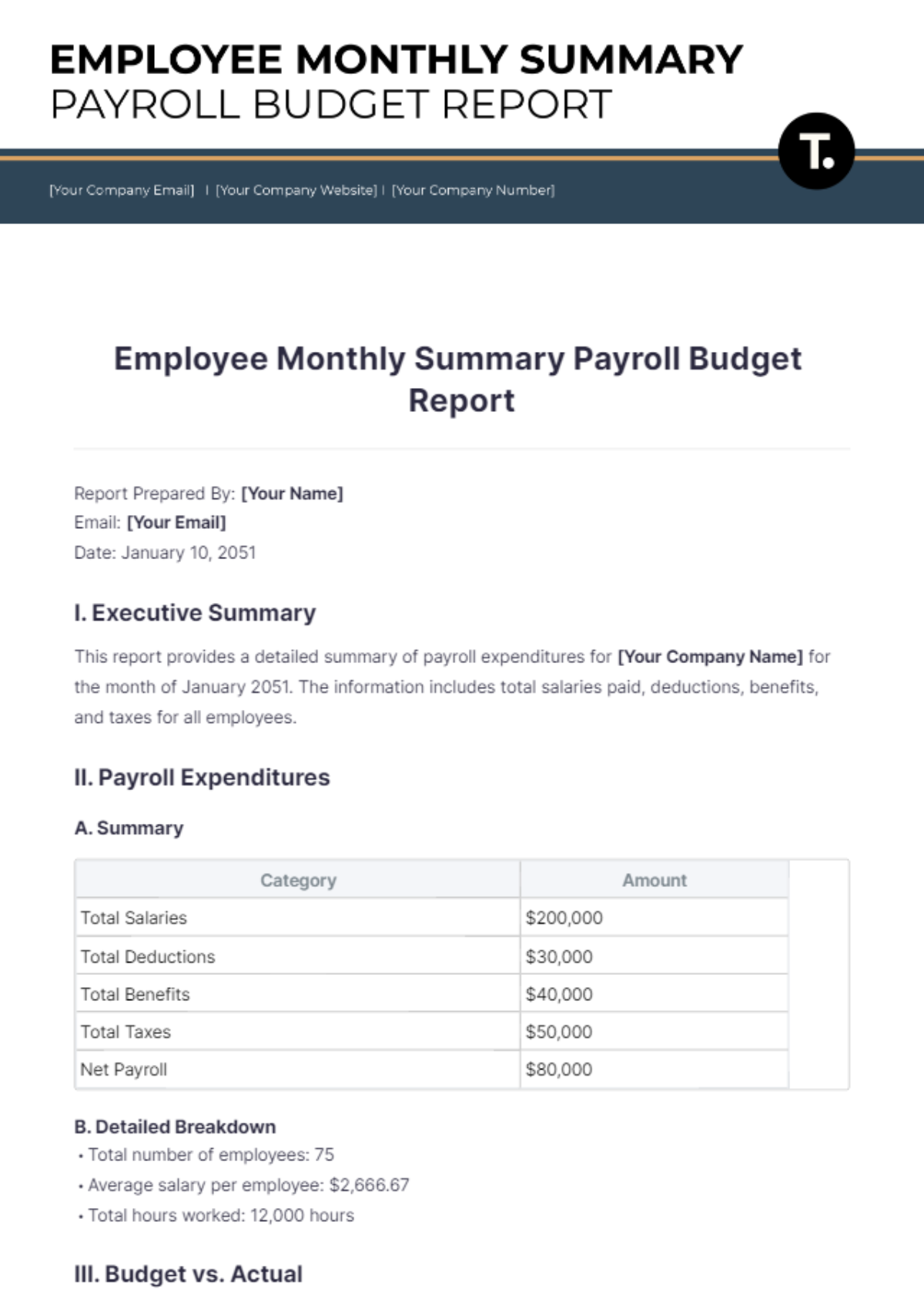

II. Overview of Financial Performance

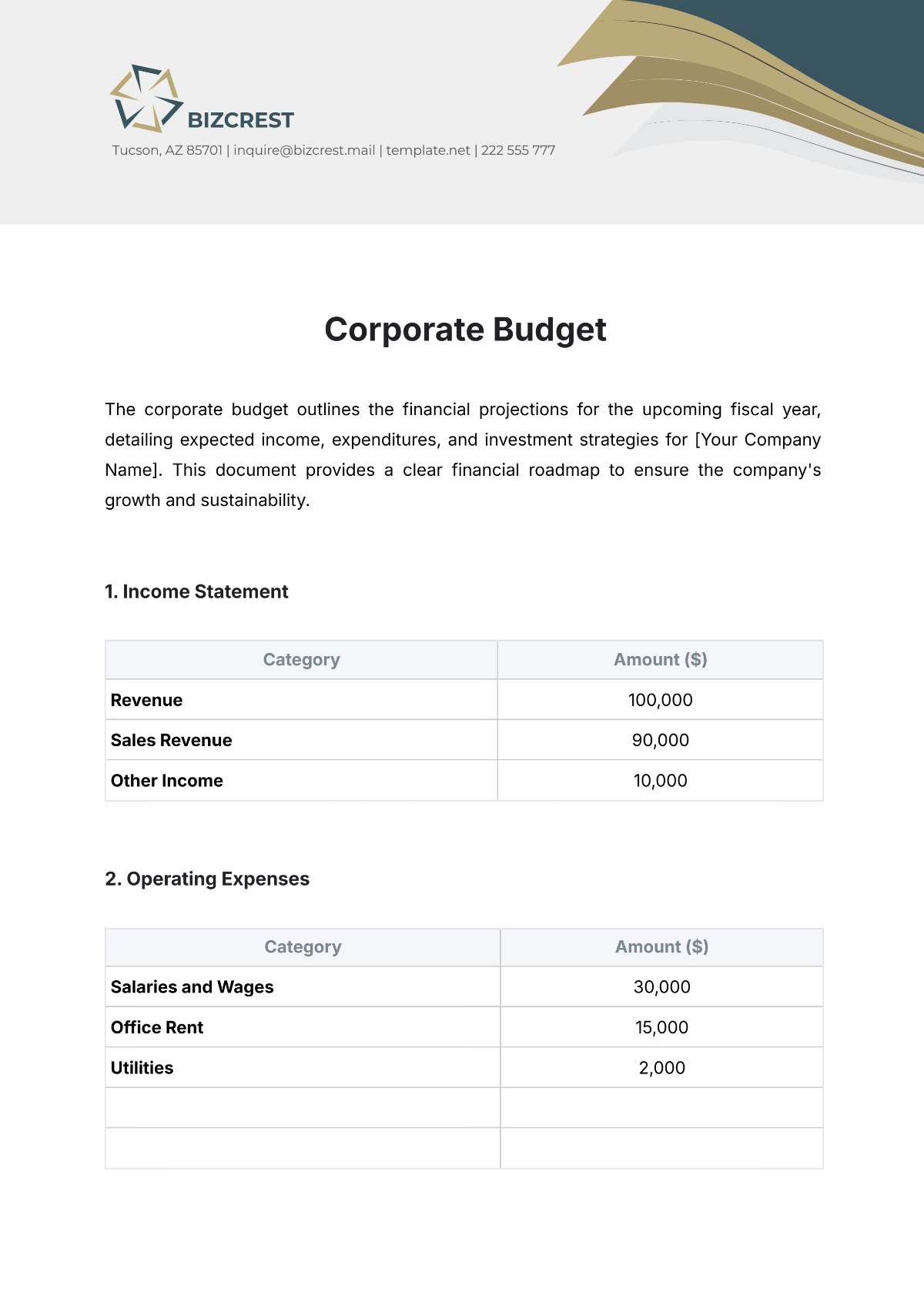

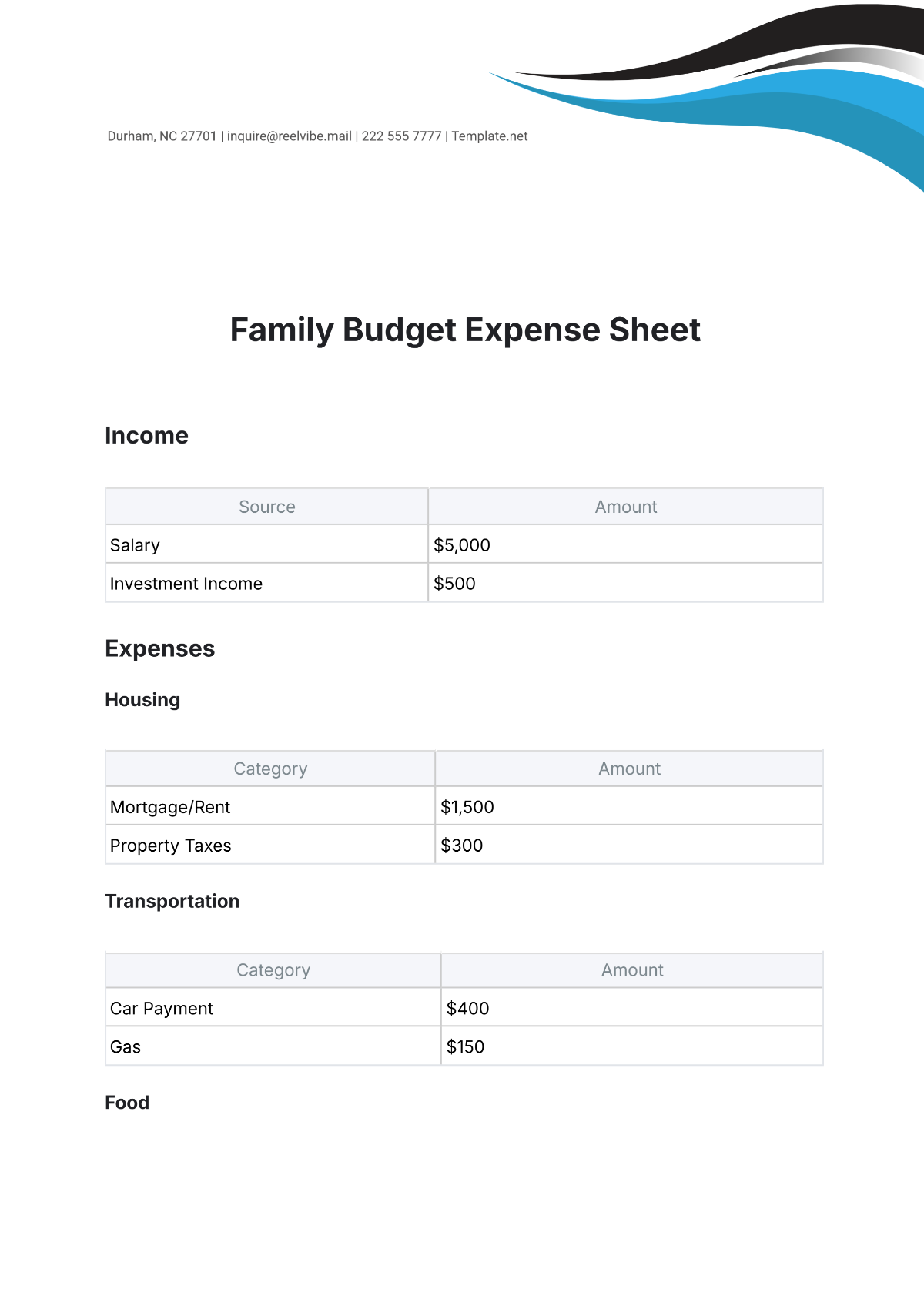

A. Revenue Analysis

The total revenue achieved during the current fiscal period has been evaluated against the anticipated budget. This analysis focuses on key revenue streams, identifying discrepancies and highlighting areas that exceed expectations.

Revenue Stream | Budgeted Amount | Actual Amount | Variance |

|---|---|---|---|

Product Sales | $500,000 | $520,000 | $20,000 (Over) |

Service Fees | $200,000 | $190,000 | -$10,000 (Under) |

Other Income | $50,000 | $55,000 | $5,000 (Over) |

Summary:

Total revenue for the reporting period amounted to $765,000, which is $15,000 (2%) above the projected revenue of $750,000. The strong performance in product sales and other income has mitigated the shortfall in service fees, emphasizing the need for focused strategies to enhance the underperforming segments.

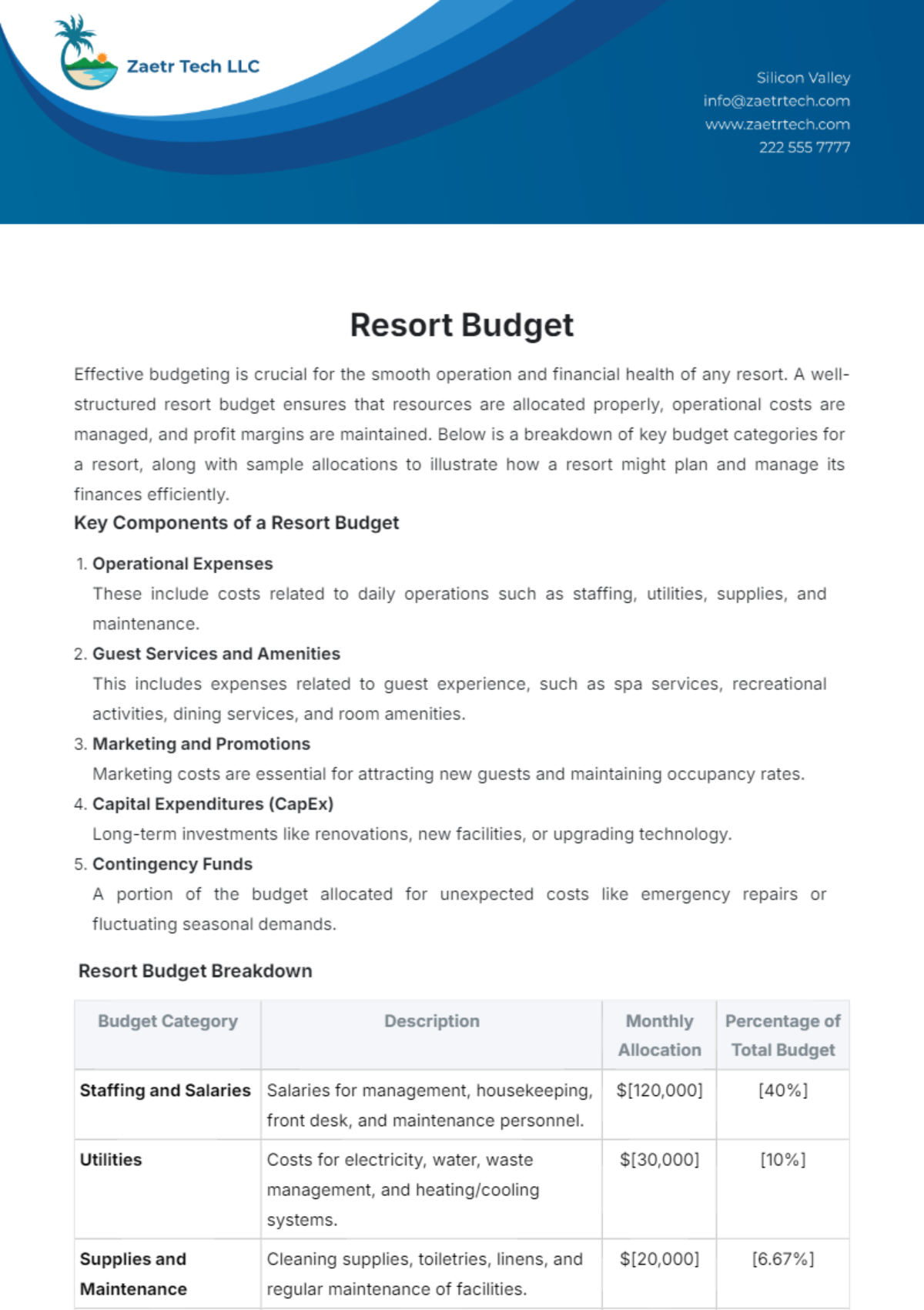

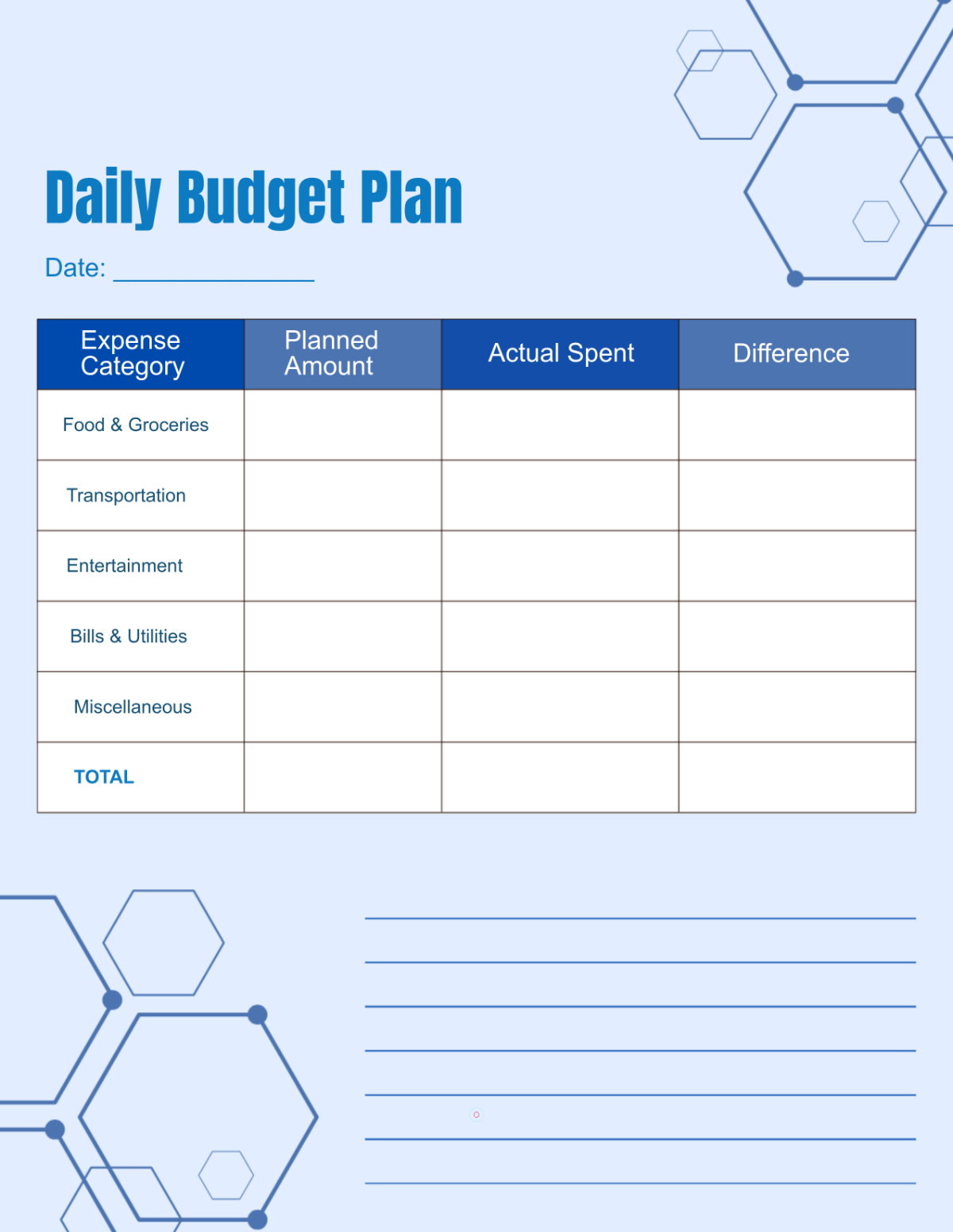

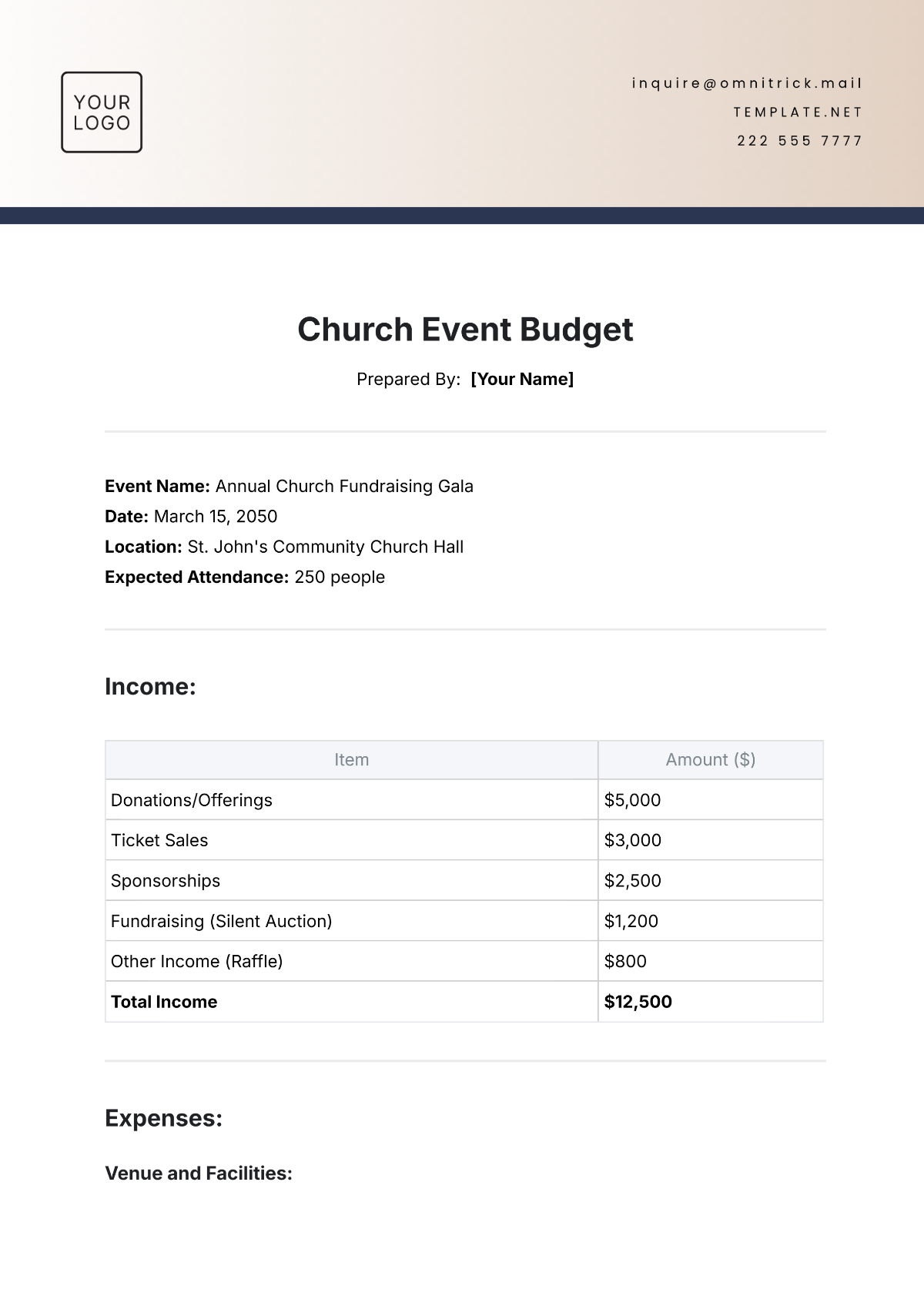

B. Expenditure Analysis

This section examines the expenditure side of the budget, analyzing specific categories to identify significant overspending or savings that could impact overall financial health.

Expenditure Category | Budgeted Amount | Actual Amount | Variance |

|---|---|---|---|

Staff Salaries | $300,000 | $310,000 | $10,000 (Over) |

Operating Costs | $150,000 | $130,000 | -$20,000 (Under) |

Advertising | $50,000 | $60,000 | $10,000 (Over) |

Summary:

Total expenditures for the period reached $500,000, leading to a budget surplus of $250,000. While operational costs remain under budget, concerns arise from the overages in staff salaries and advertising, which require further examination and strategic adjustments.

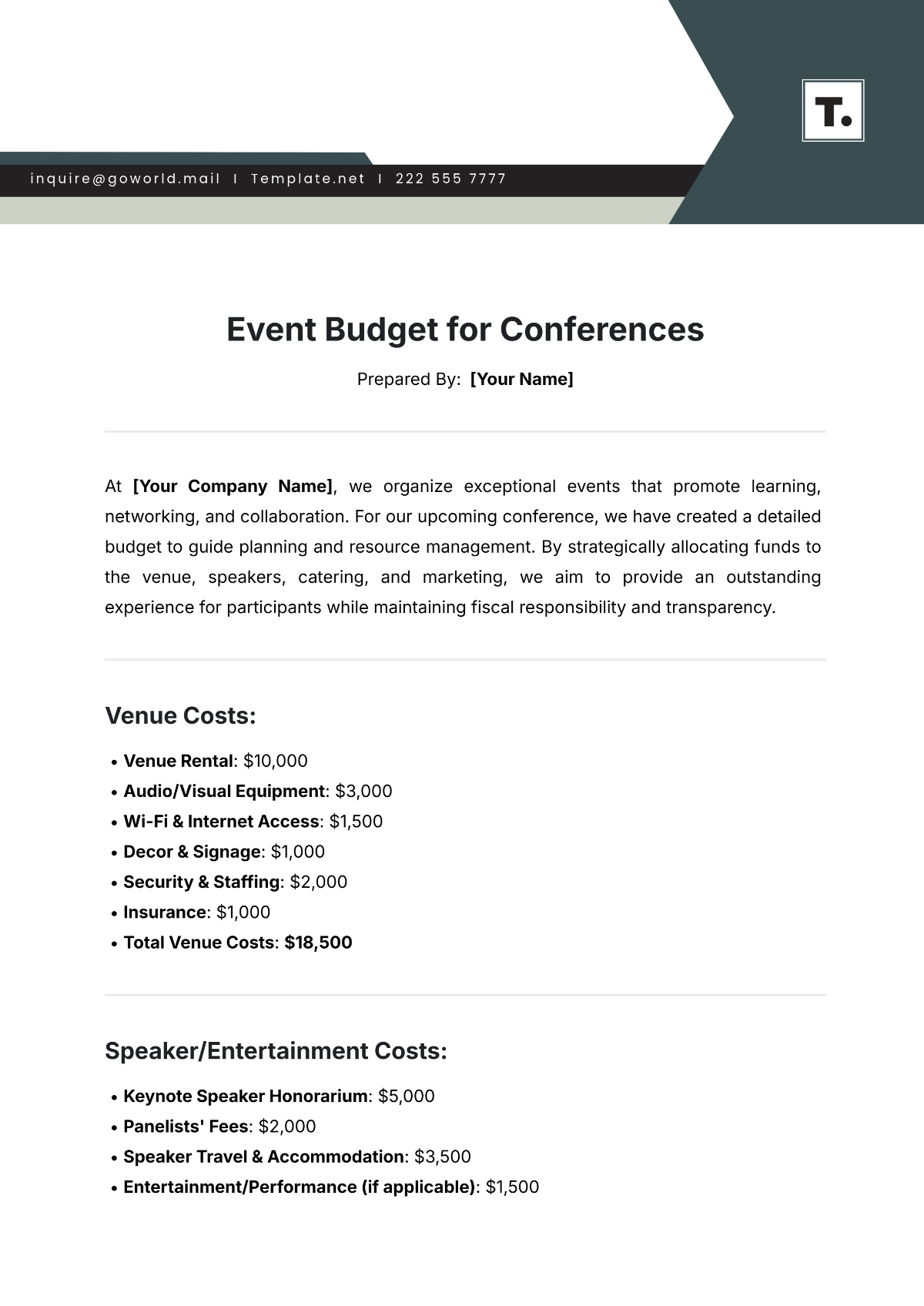

III. Budget Variance Analysis

A. Positive Variances

Identifying positive variances reveals opportunities for reinvestment or resource reallocation that can benefit the project.

Product Sales: Surpassed the budget by $20,000 due to increased market demand driven by recent marketing initiatives and community engagement efforts.

Other Income: Exceeded expectations by $5,000, primarily from unanticipated ancillary services, suggesting a potential avenue for further revenue enhancement.

B. Negative Variances

Recognizing negative variances is essential for effective financial management, as they highlight areas that may require corrective actions or operational improvements.

Service Fees: Fell short by $10,000; contributing factors include increased competition and service disruptions. Addressing these challenges should be a priority to regain lost revenue.

Staff Salaries: Exceeded budget by $10,000 due to unplanned overtime costs and additional hires. A review of staffing needs and overtime policies is necessary to prevent future overruns.

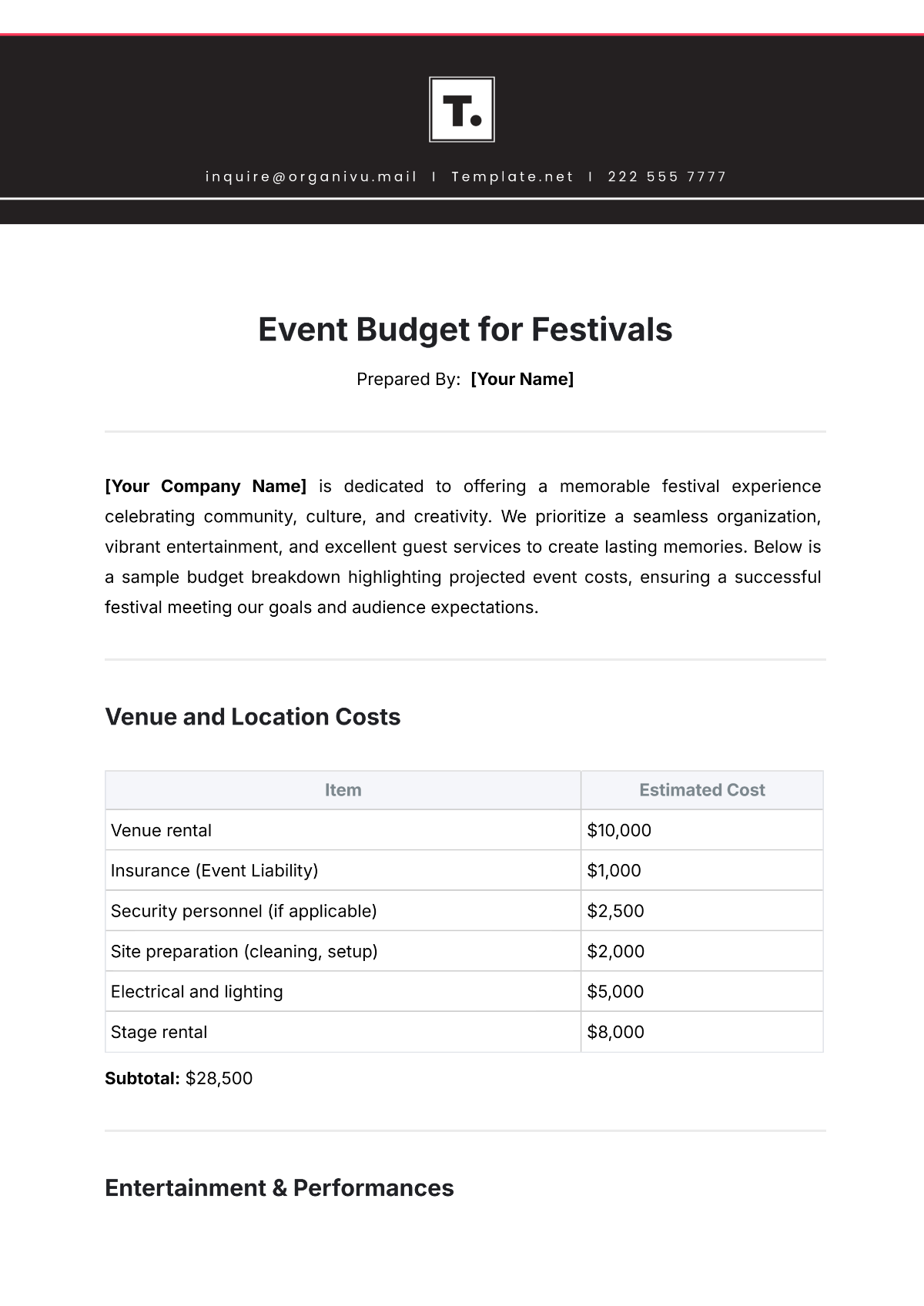

IV. Recommendations

A. Revenue Optimization

To enhance revenue streams and address shortfalls, the following strategies are recommended:

Targeted Marketing Campaigns: Enhance marketing efforts for underperforming service segments, focusing on unique selling propositions and community needs to attract new customers.

Diversification of Income Sources: Explore new market opportunities, including partnerships with local businesses, to develop additional revenue streams and reduce dependency on a few key areas.

B. Cost Management

To effectively manage expenditures and address overspending, consider implementing the following measures:

Operational Reviews: Conduct regular reviews of operational processes to identify areas for cost savings and efficiency improvements, ensuring that spending aligns with strategic goals.

Stricter Staffing Policies: Implement stricter overtime policies and evaluate staffing needs to control salary costs and improve overall budget adherence.

V. Conclusion

This Budget Progress Report highlights key financial performances, identifies variances, and provides actionable recommendations for ongoing budget management. With total revenues exceeding projections and expenditures being effectively managed, the Community Development Project is on a positive trajectory. Continued monitoring and proactive strategies are essential to achieving the financial goals set for the fiscal year. Future assessments will focus on refining strategies based on the evolving financial landscape to ensure sustained fiscal health.