Internal Budget Variance Report

Date: October 25, 2064

[Your Company Name]

For the Year Ending December 31, 2060

Report Prepared By: [Your Name]

1. Executive Summary

Purpose:

This report provides a comprehensive analysis of the budget performance of the Marketing Department for the fiscal year 2060. It aims to identify the variances between the budgeted and actual financial figures, assess the impact of these variances on overall performance, and propose actionable recommendations to enhance financial management moving forward.

Key Highlights:

Total Budget: $2,000,000

Actual Expenditure: $2,250,000

Variance: -$250,000

Percentage of Variance: -12.5%

Major Areas of Concern:

Overspending in Salaries & Wages due to unexpected overtime.

Increased Marketing Expenses resulting from aggressive campaign initiatives.

Overall Assessment:

The department’s financial performance reflects both successes in strategic investments and areas requiring better cost control.

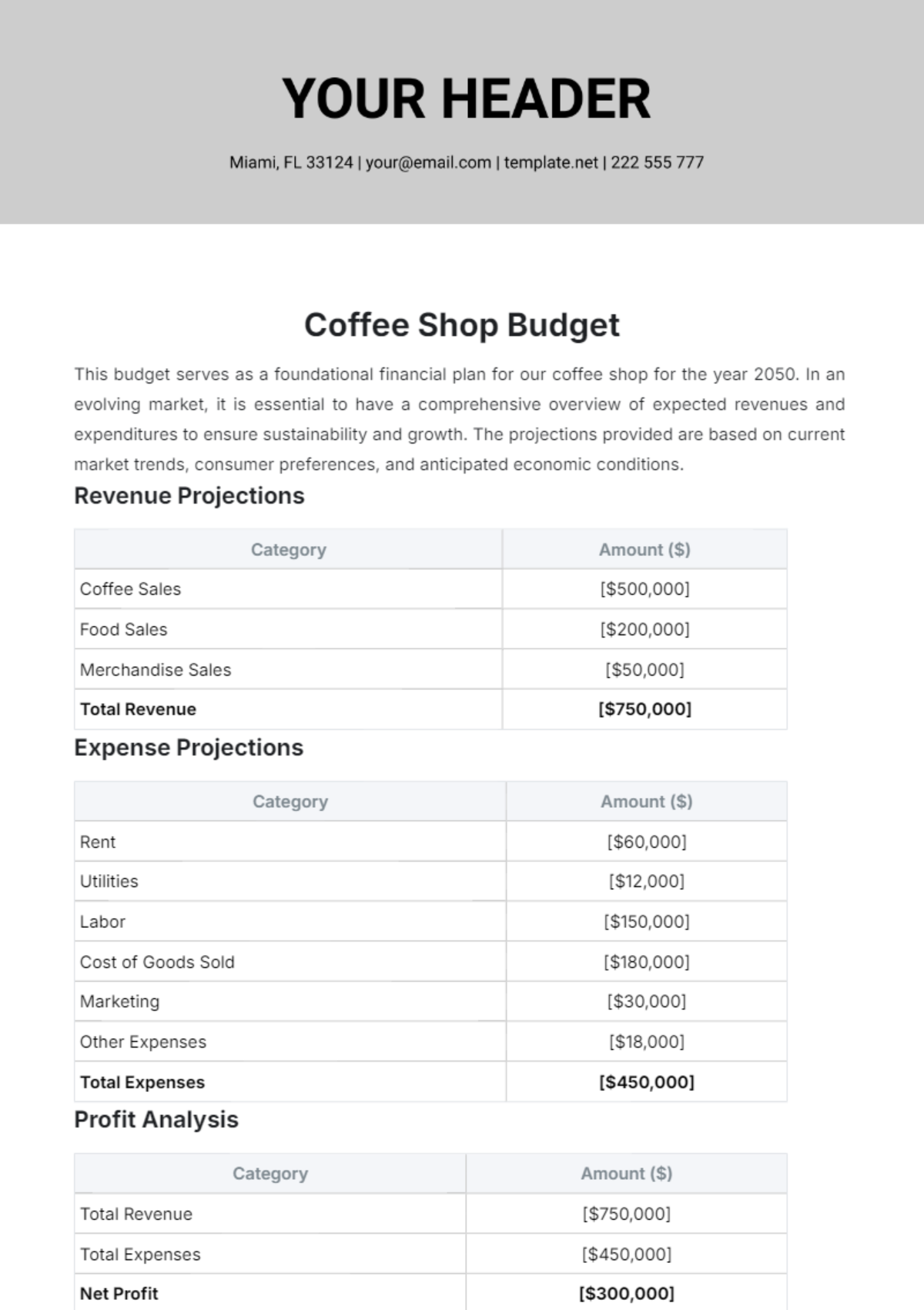

2. Budget Overview

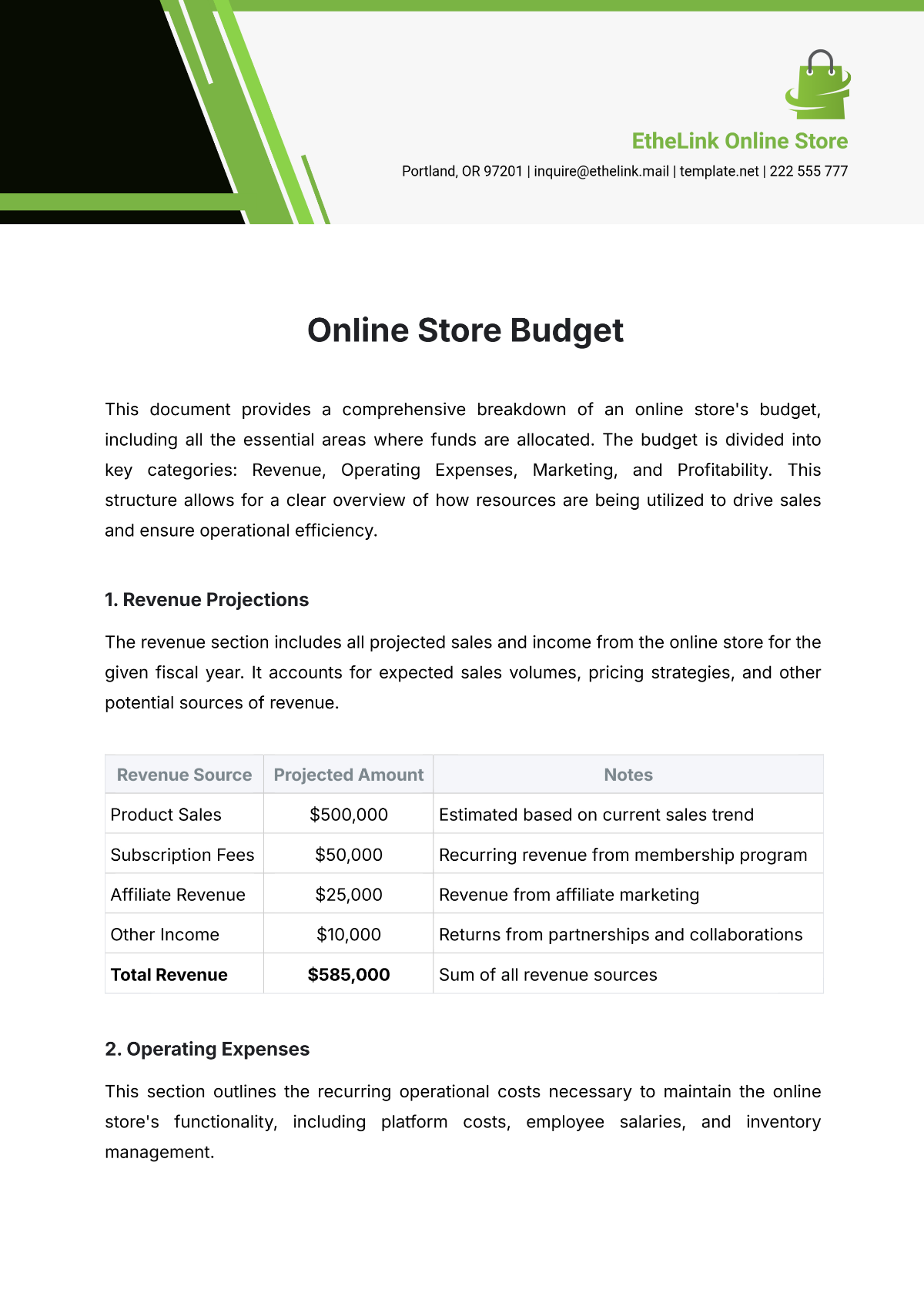

Category | Budgeted Amount | Actual Amount | Variance | Variance Percentage |

|---|---|---|---|---|

Salaries & Wages | $1,000,000 | $1,150,000 | -$150,000 | -15% |

Operating Expenses | $500,000 | $550,000 | -$50,000 | -10% |

Marketing Expenses | $400,000 | $500,000 | -$100,000 | -25% |

Research & Development | $80,000 | $40,000 | $40,000 | 50% |

Miscellaneous | $20,000 | $10,000 | $10,000 | 50% |

Total | $2,000,000 | $2,250,000 | -$250,000 | -12.5% |

3. Detailed Variance Analysis

3.1 Salaries & Wages:

Budgeted: $1,000,000

Actual: $1,150,000

Variance: -$150,000

Analysis:

The variance of -$150,000 is primarily due to increased overtime costs incurred during the peak season for product launches. The staff turnover rate also led to higher hiring costs as temporary staff were brought in to manage workloads.Recommendation: Implement stricter overtime approval processes and consider hiring temporary staff during peak periods to manage workload without incurring excessive overtime.

3.2 Operating Expenses:

Budgeted: $500,000

Actual: $550,000

Variance: -$50,000

Analysis:

Operating expenses exceeded the budget by -$50,000 due to unexpected maintenance costs and a rise in utility rates related to office facilities.Recommendation: Conduct a quarterly review of utility contracts and explore energy efficiency initiatives to lower future expenses.

3.3 Marketing Expenses:

Budgeted: $400,000

Actual: $500,000

Variance: -$100,000

Analysis:

The marketing budget overage of -$100,000 resulted from an increase in digital advertising and promotional campaigns aimed at launching two new product lines. The cost of influencer partnerships also contributed significantly to this increase.Recommendation: Establish clear ROI metrics for each campaign to evaluate effectiveness and make data-driven decisions on future spending.

3.4 Research & Development:

Budgeted: $80,000

Actual: $40,000

Variance: $40,000

Analysis:

The positive variance of $40,000 stems from several projects being postponed, leading to reduced expenditure on R&D initiatives this year. While these savings are beneficial, it may affect long-term innovation.Recommendation: Reassess project timelines and ensure adequate allocation of budgets for critical research initiatives to avoid potential delays in product

development.

3.5 Miscellaneous Expenses:

Budgeted: $20,000

Actual: $10,000

Variance: $10,000

Analysis:

The miscellaneous category showed a favorable variance due to lower-than-expected travel and training expenses, which were reduced by transitioning to virtual platforms.Recommendation: Create a separate budget line for training and events to better track and manage these expenses.

4. Conclusions and Recommendations

The budget performance for the Marketing Department in 2060 highlights both strengths and challenges in our financial management. To improve future budget adherence, we recommend the following actions:

Enhanced Monitoring: Implement a centralized budget tracking system that provides real-time updates and alerts for significant variances.

Regular Reviews: Establish a schedule for monthly budget review meetings to proactively address discrepancies and adjust spending strategies.

Training for Budget Managers: Provide ongoing training sessions for department heads on budget management best practices to enhance accountability and awareness.

Performance Metrics: Develop key performance indicators (KPIs) related to budget adherence to foster a culture of financial responsibility across all departments.

5. Appendices

Appendix A: Detailed Expenditure Breakdown

Appendix B: Graphical Representation of Budget vs. Actual Spending

Appendix C: Supporting Documentation (e.g., invoices, contracts)

Appendix D: Historical Budget Comparisons (if applicable)