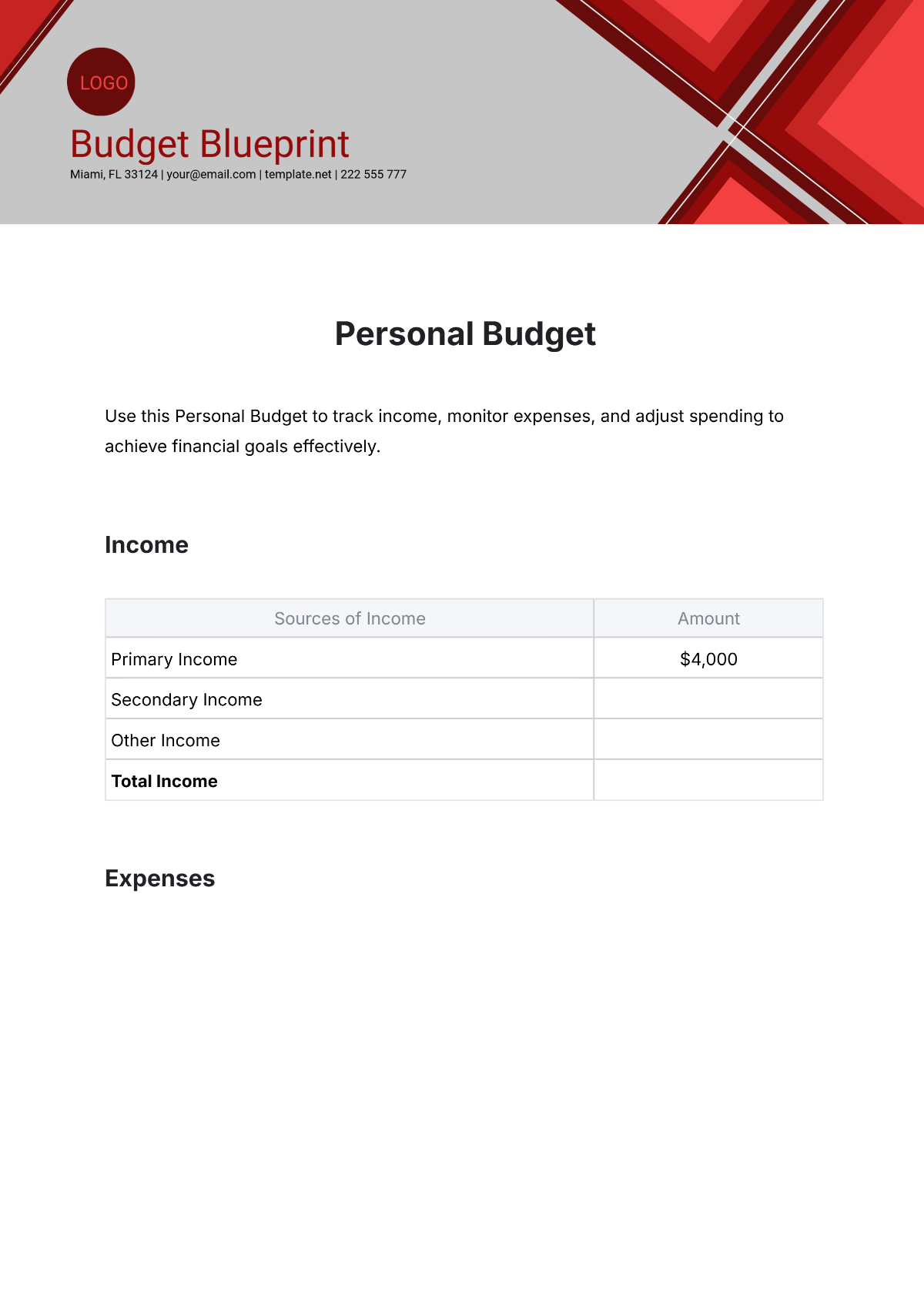

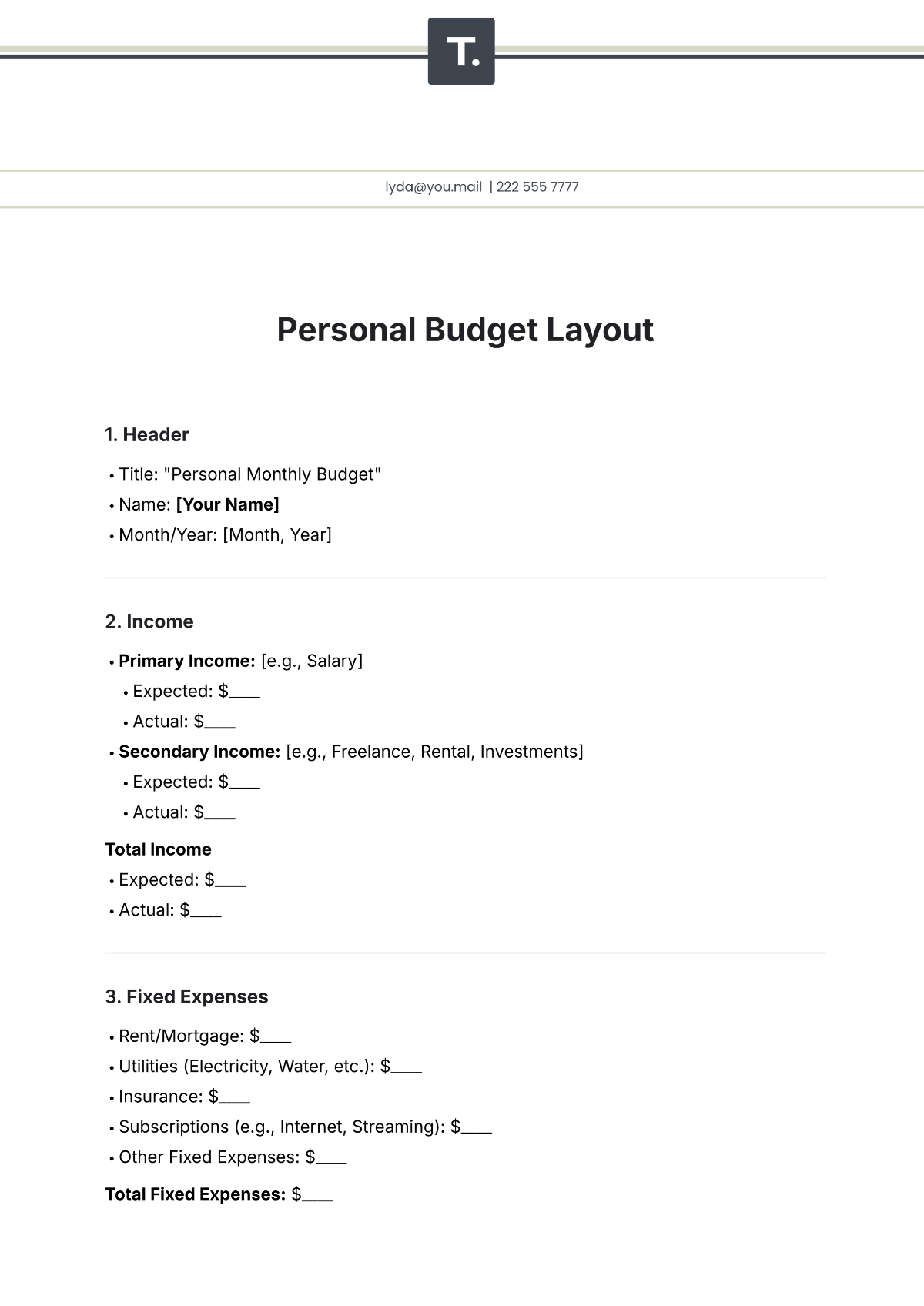

Personal Budget Summary Sheet

Overview

This Personal Budget Summary Sheet is designed to help individuals track their income, expenditures, and savings efficiently. By maintaining an organized budget, individuals can manage their finances better, plan for future expenses, and secure their financial well-being.

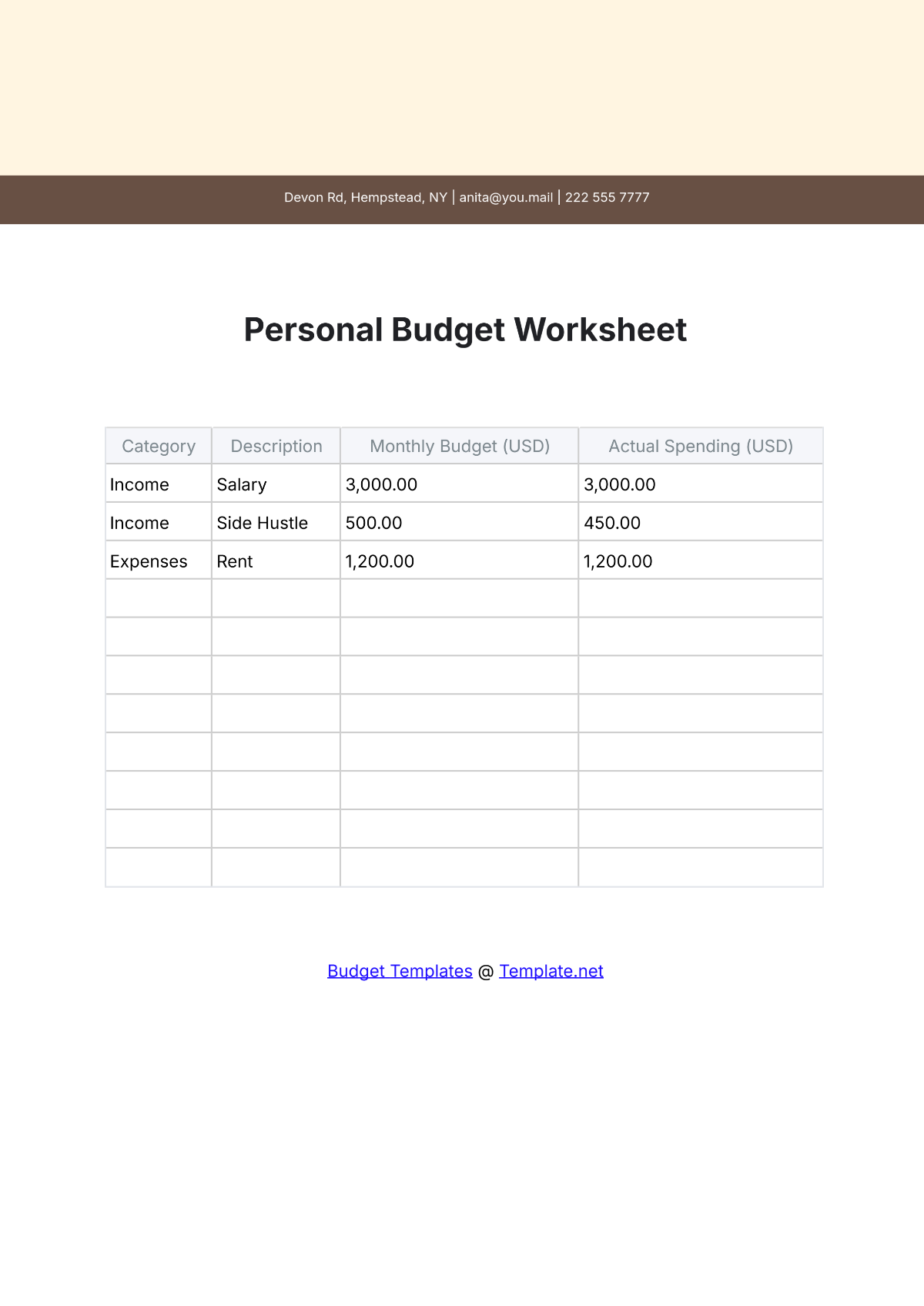

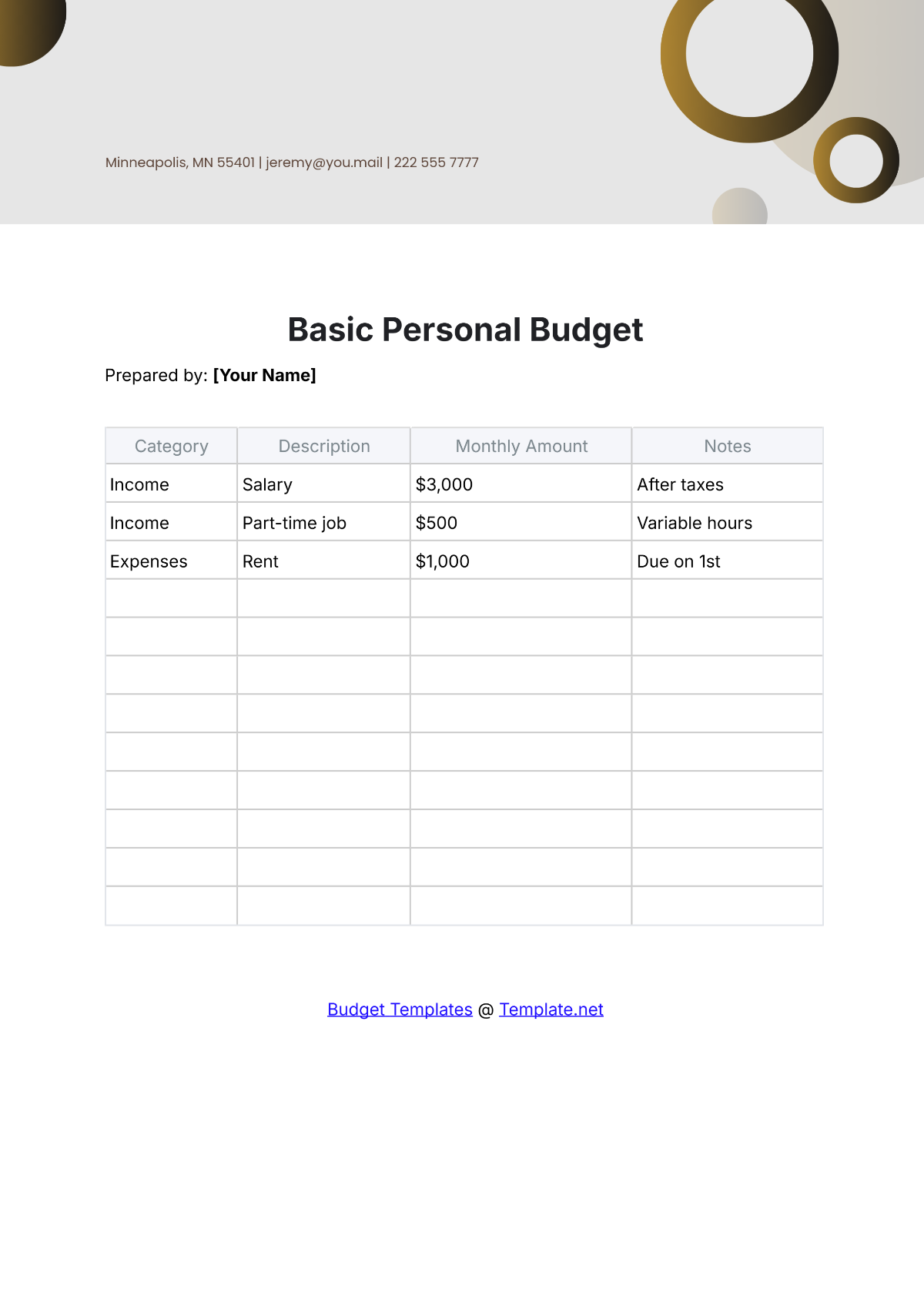

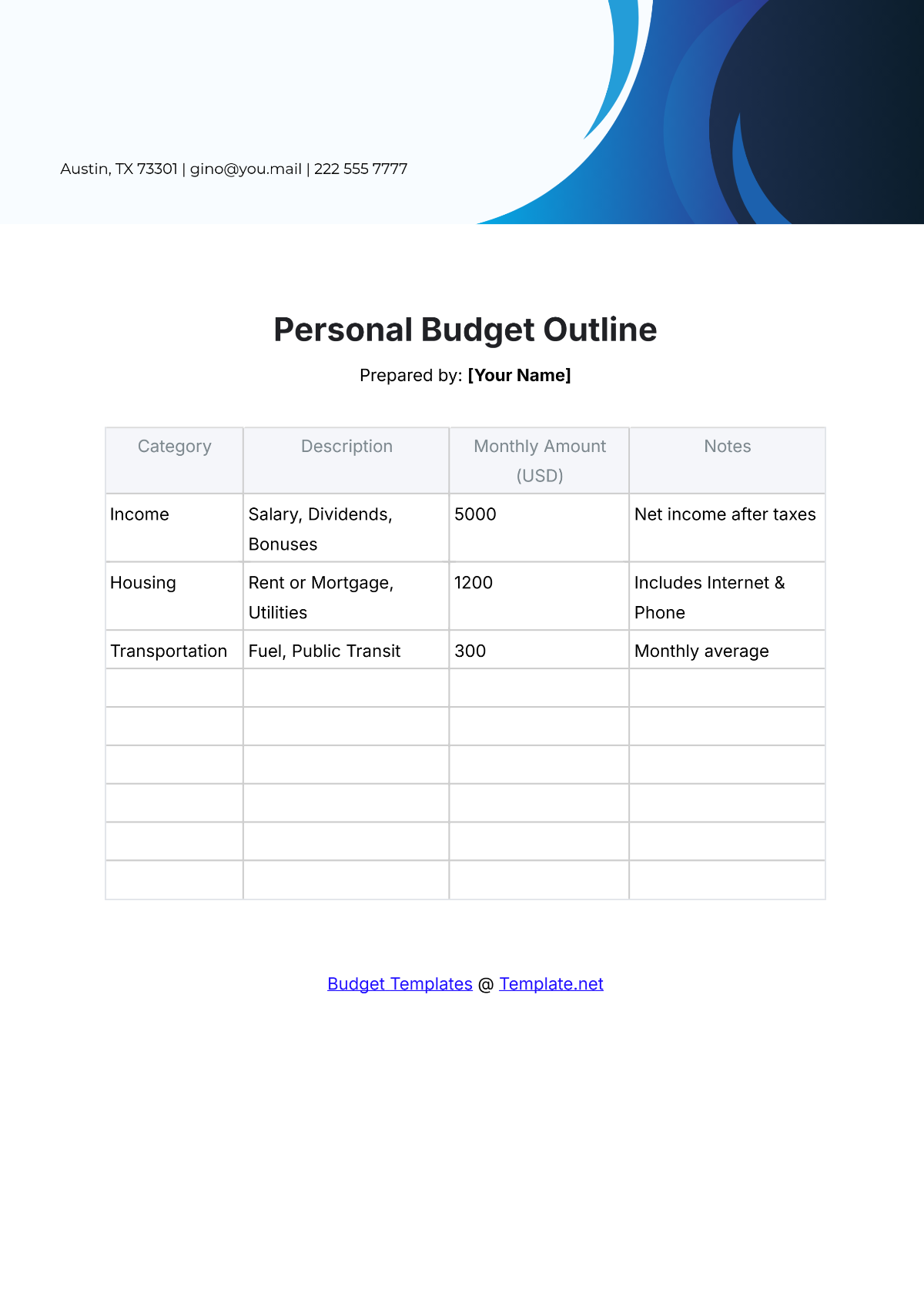

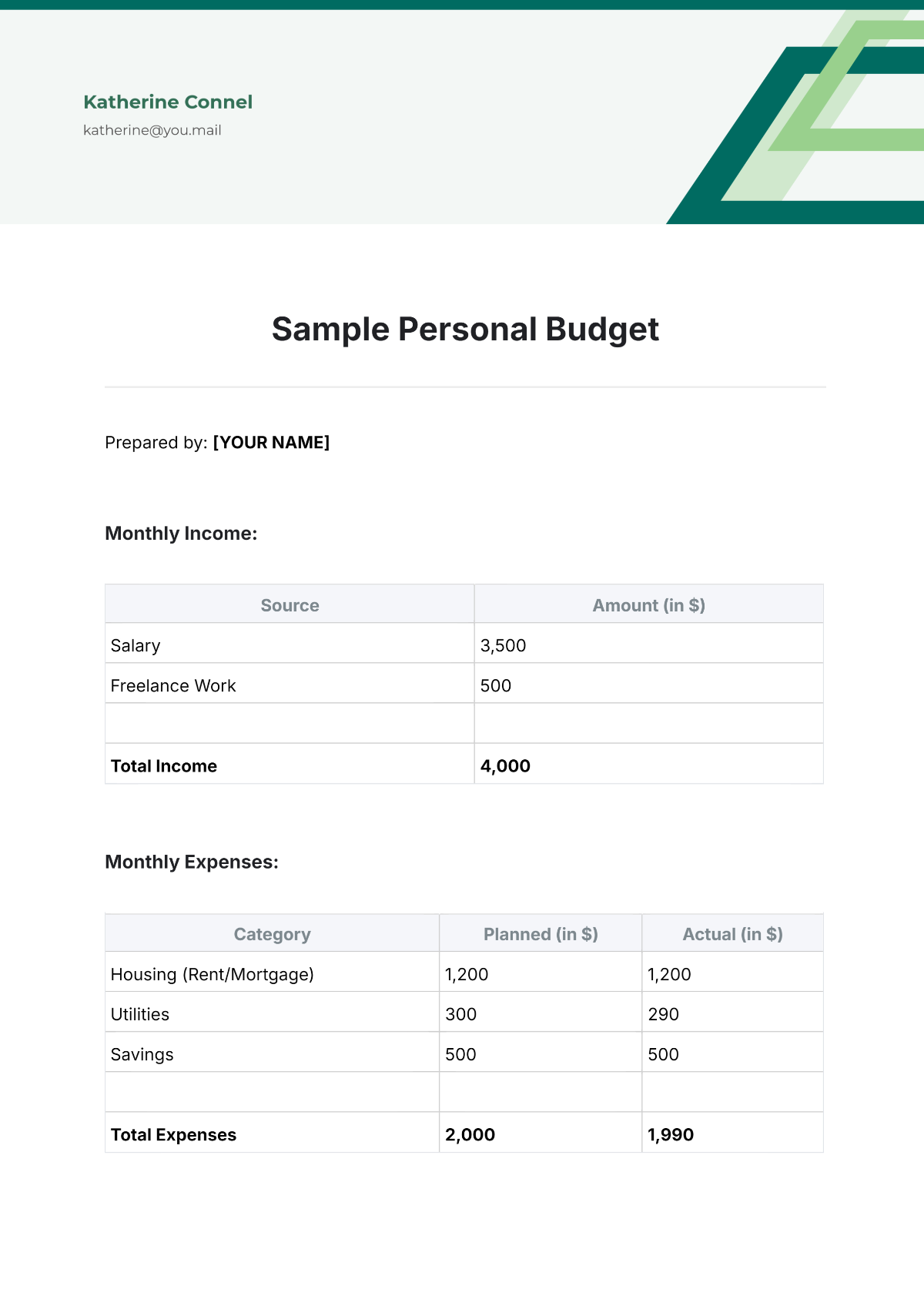

Monthly Income

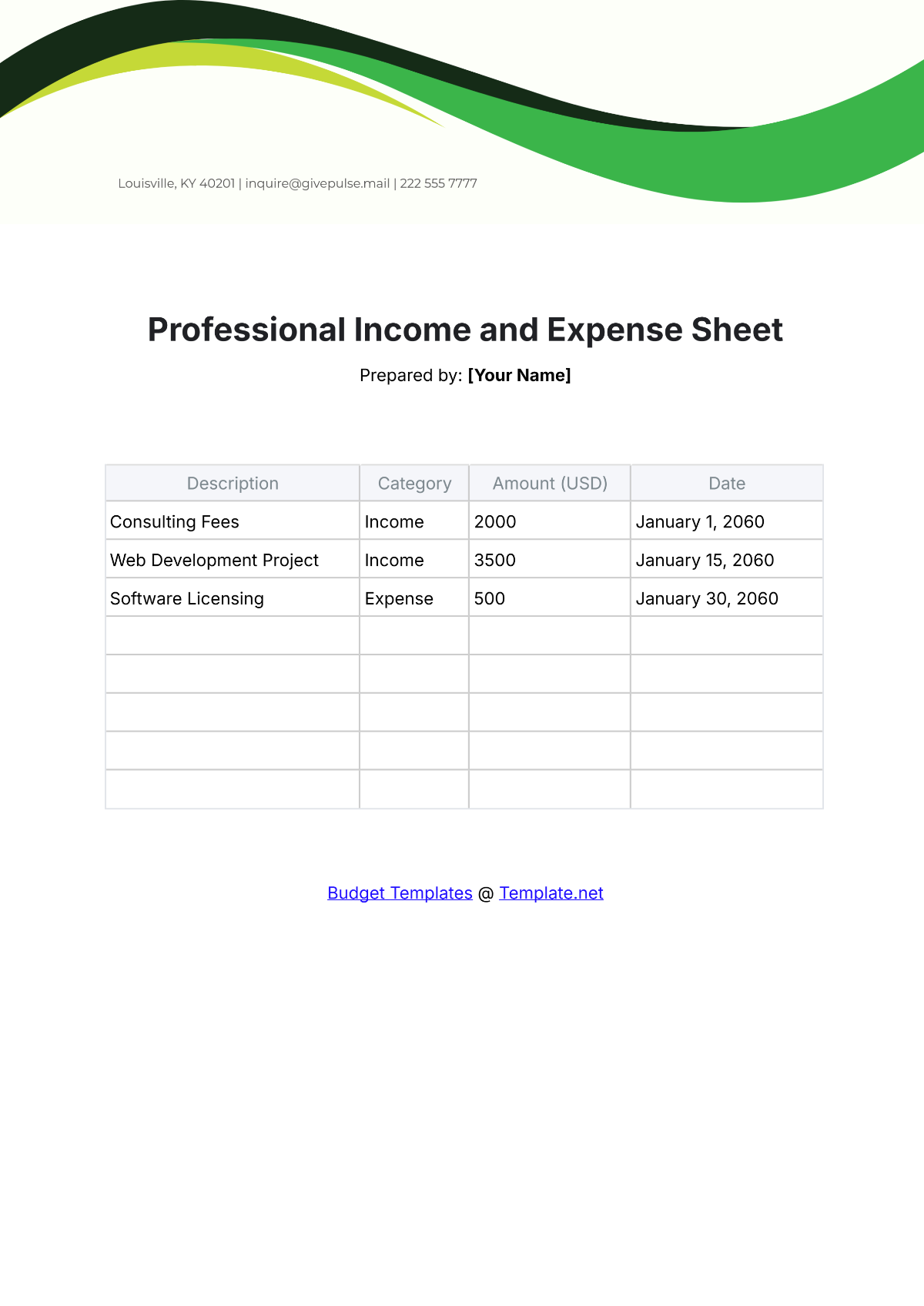

Understanding and documenting your income sources is the first step in building a comprehensive budget. List all regular streams of income received each month.

Salary/Wages

Investment Income

Rental Income

Other Income

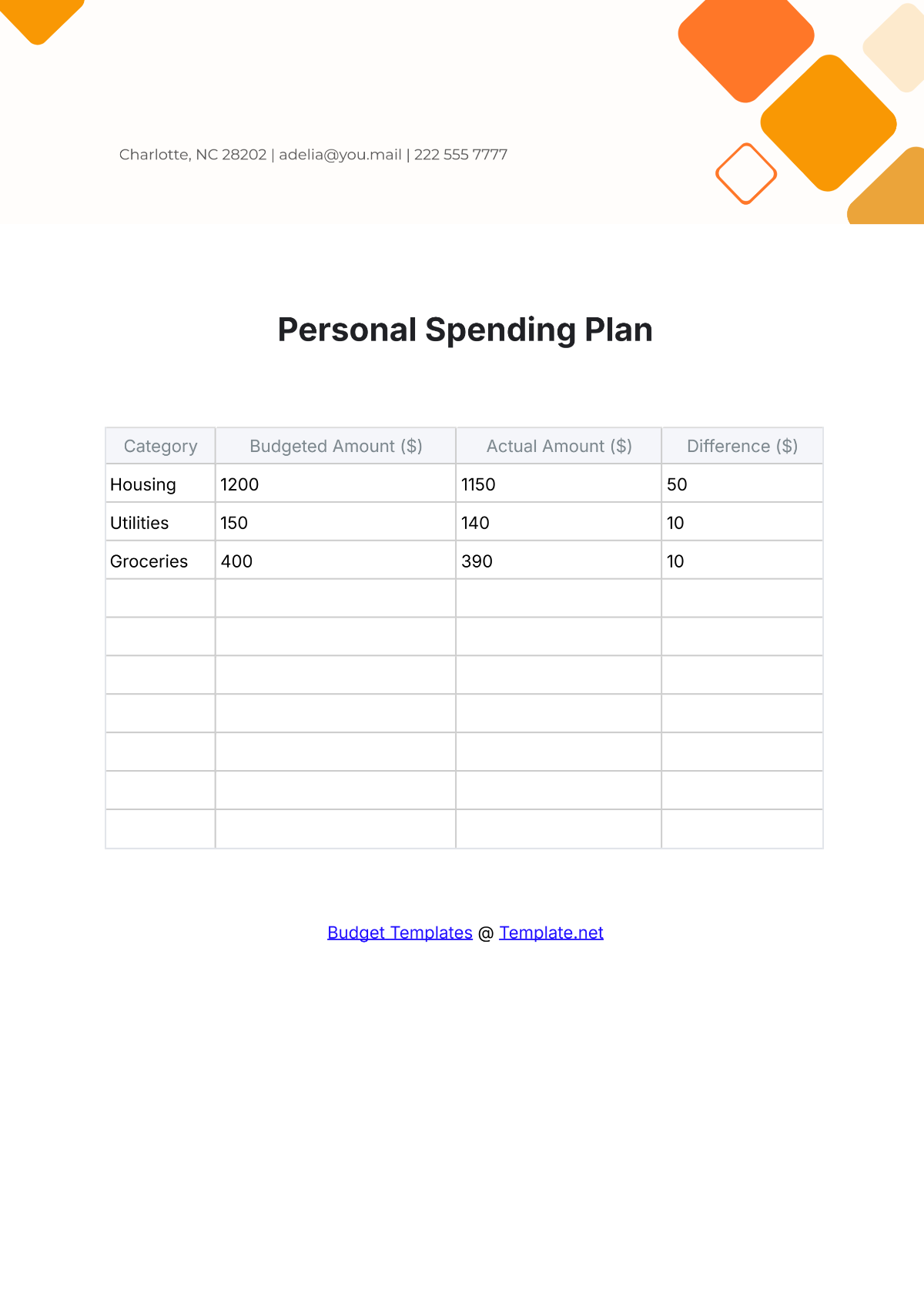

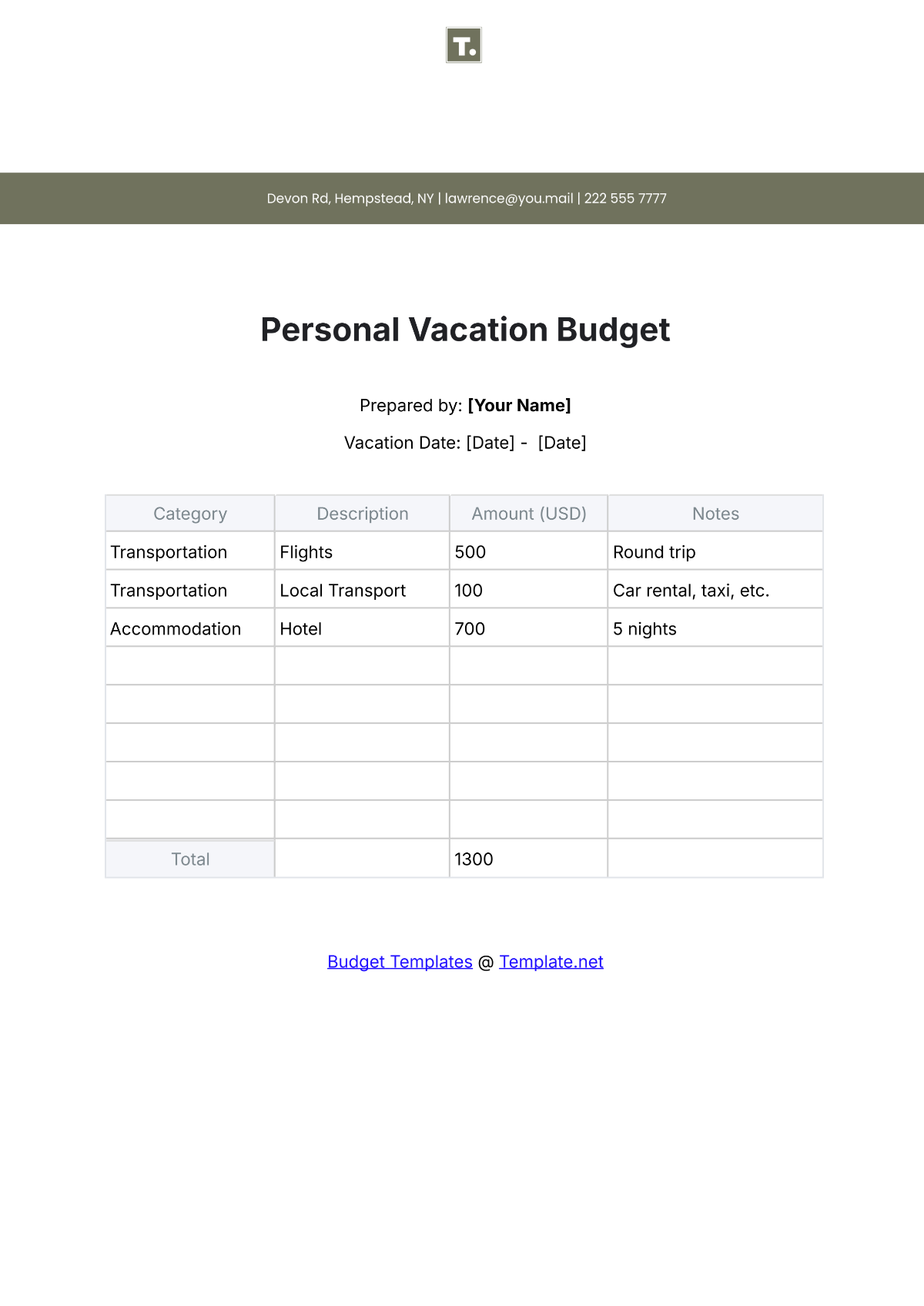

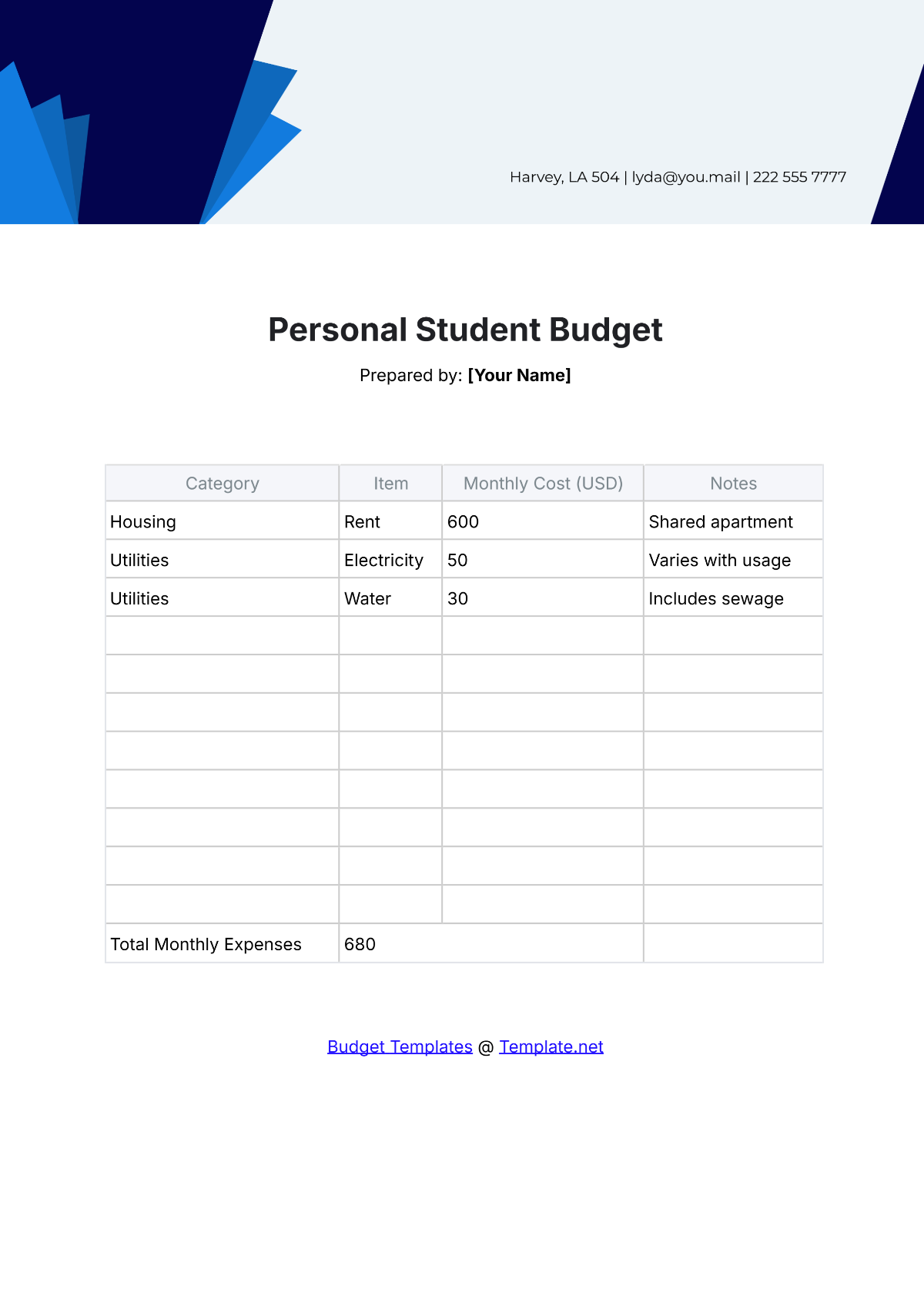

Monthly Expenses

Detailing monthly expenses helps in identifying spending habits and areas where one can save. Categorize the expenses into fixed and variable to better understand financial commitments.

Fixed Expenses

Rent/Mortgage

Utilities

Insurance

Loan Payments

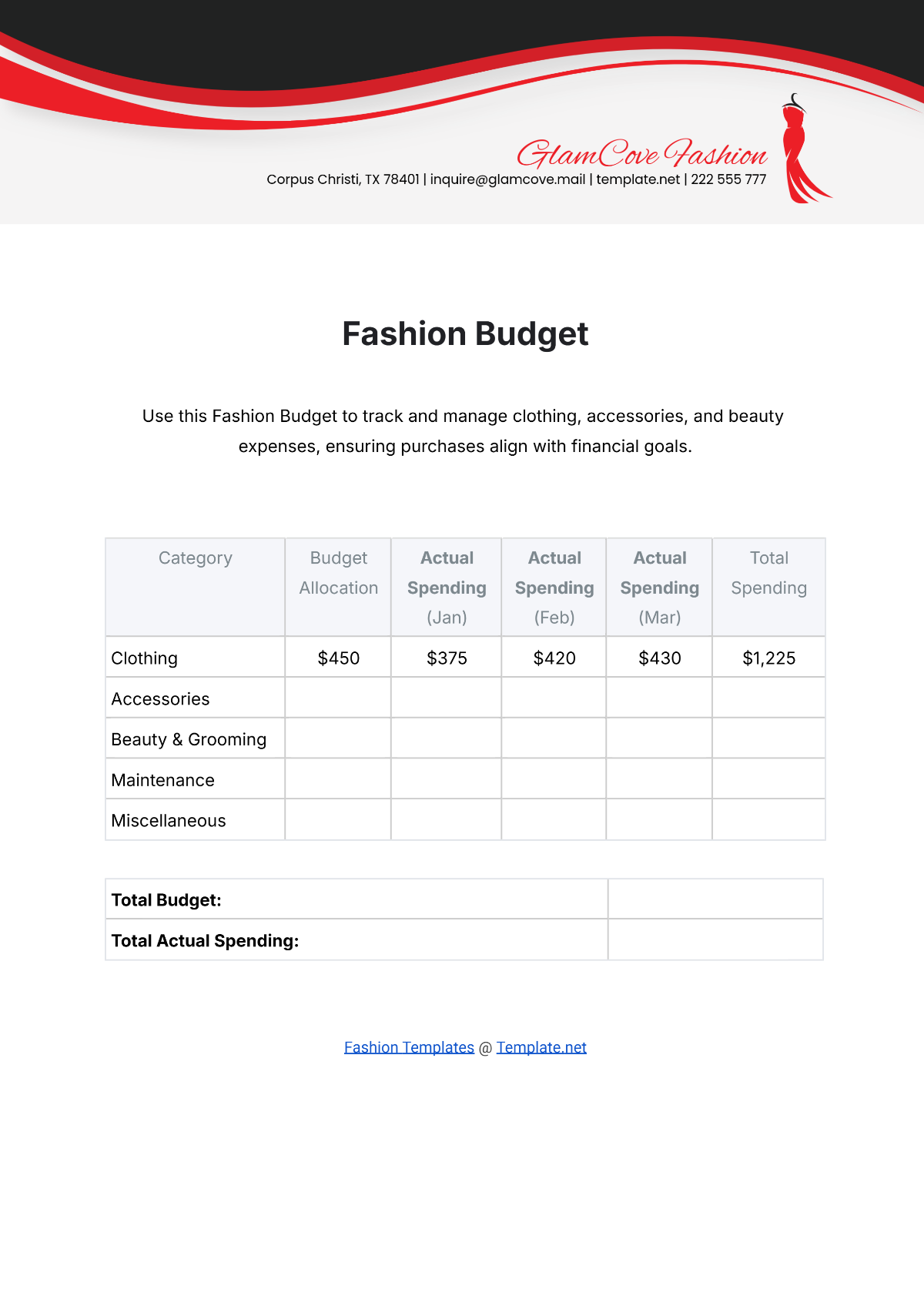

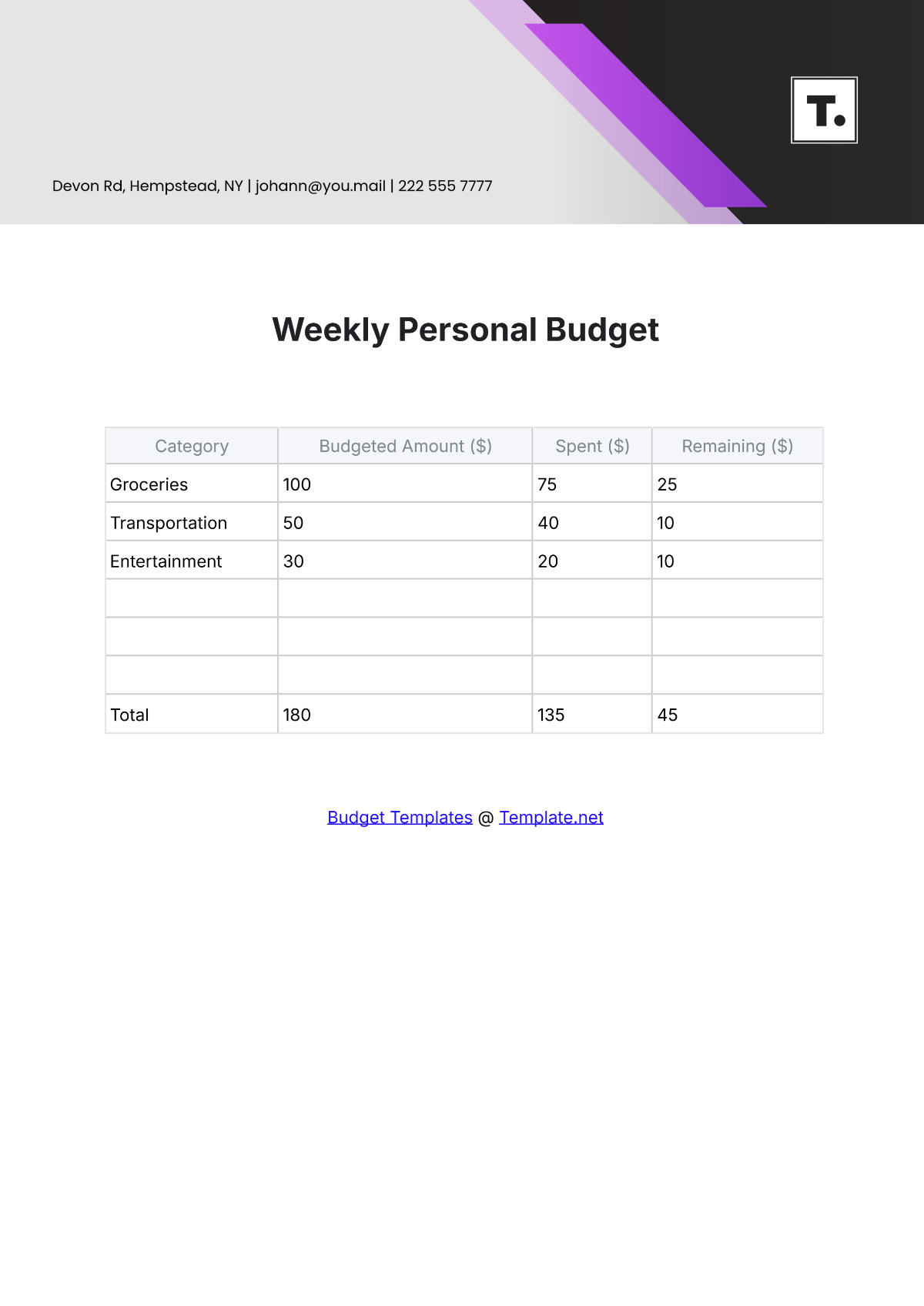

Variable Expenses

Groceries

Transportation

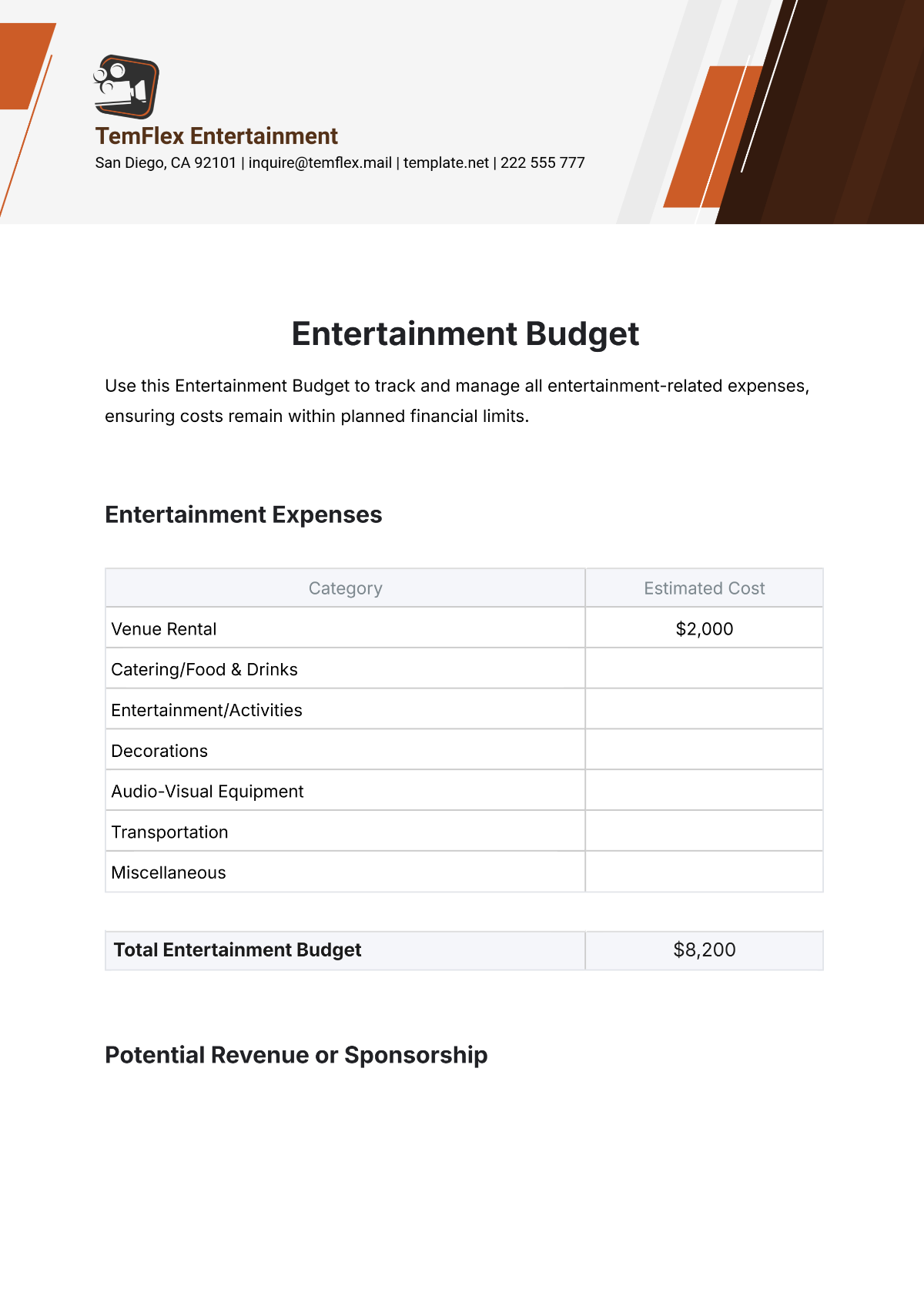

Entertainment

Dining Out

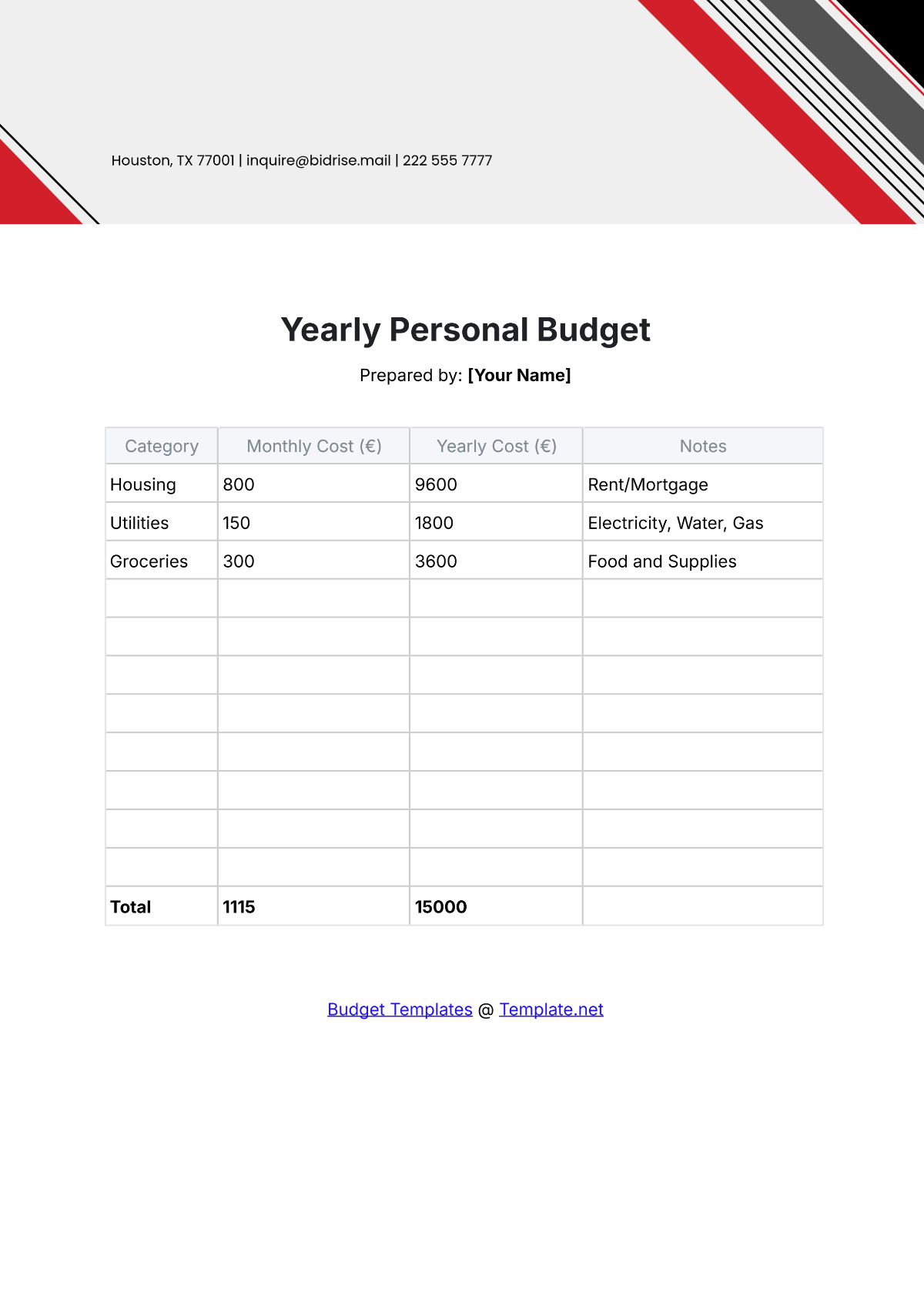

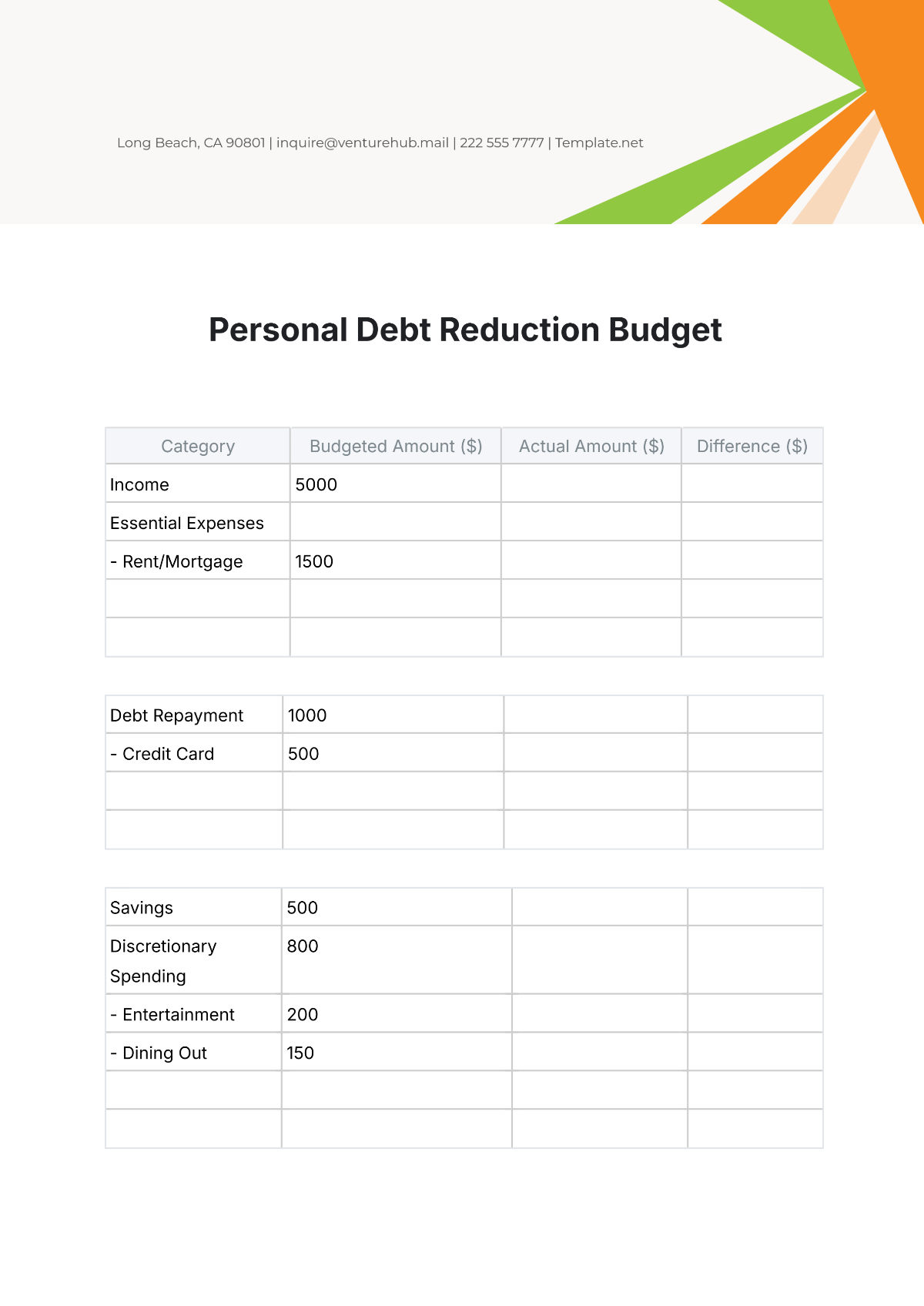

Savings and Investments

Allocating a portion of your monthly income towards savings and investments is crucial for financial security and achieving long-term goals. This section should capture regular contributions to savings accounts, retirement plans, and other investments.

Savings Account

Retirement Plan (e.g., 401k, IRA)

Stocks/Bonds

Emergency Fund

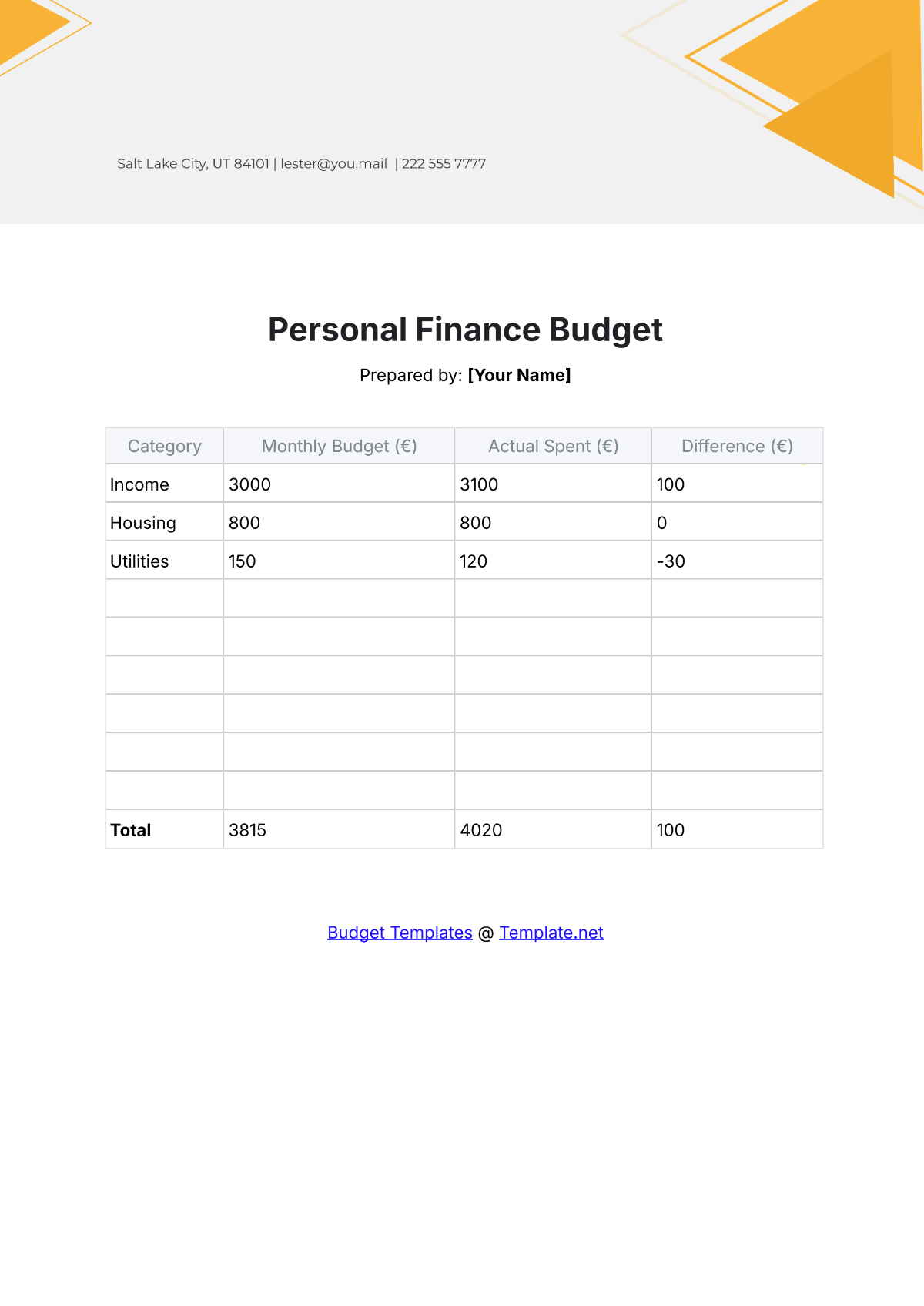

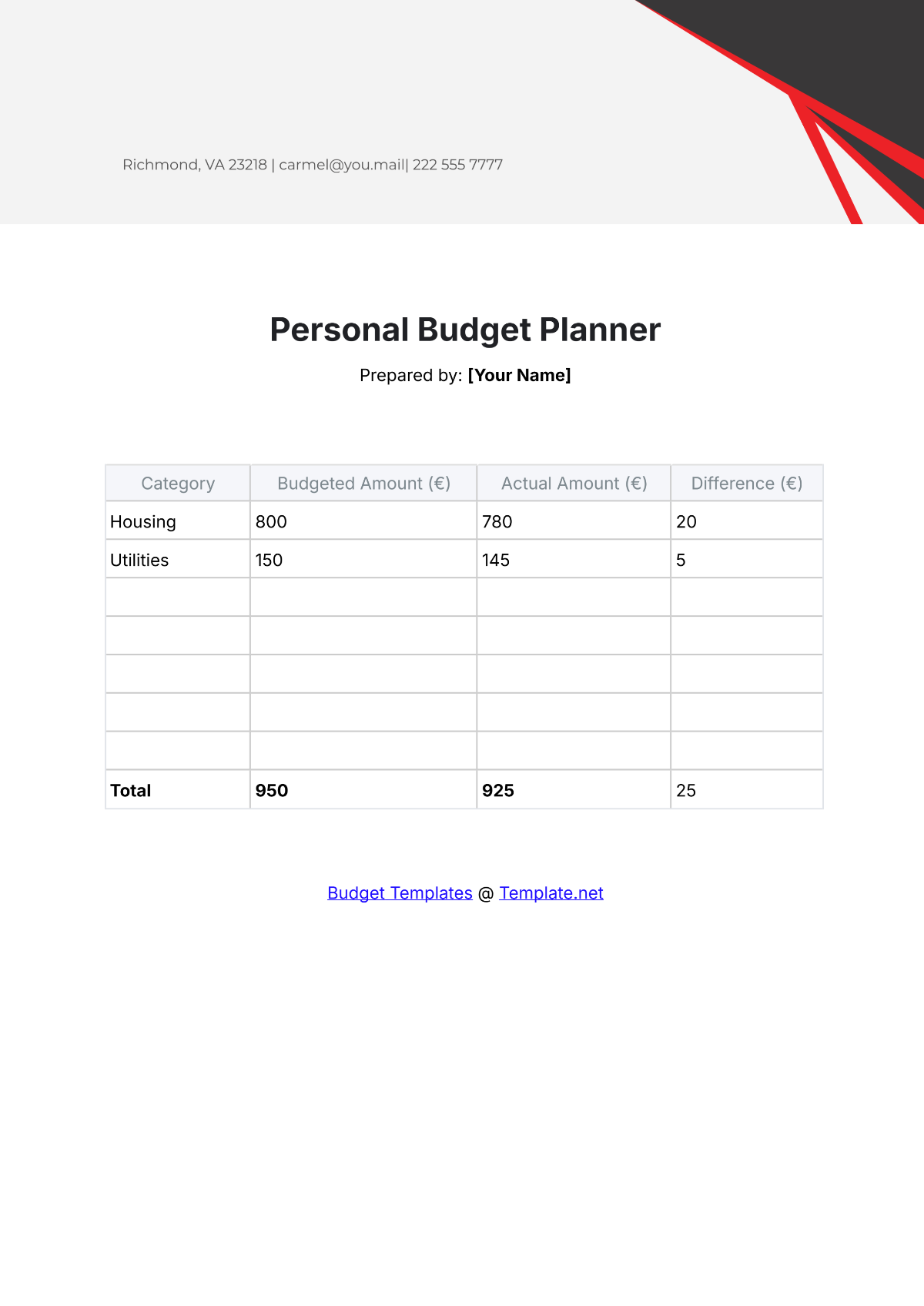

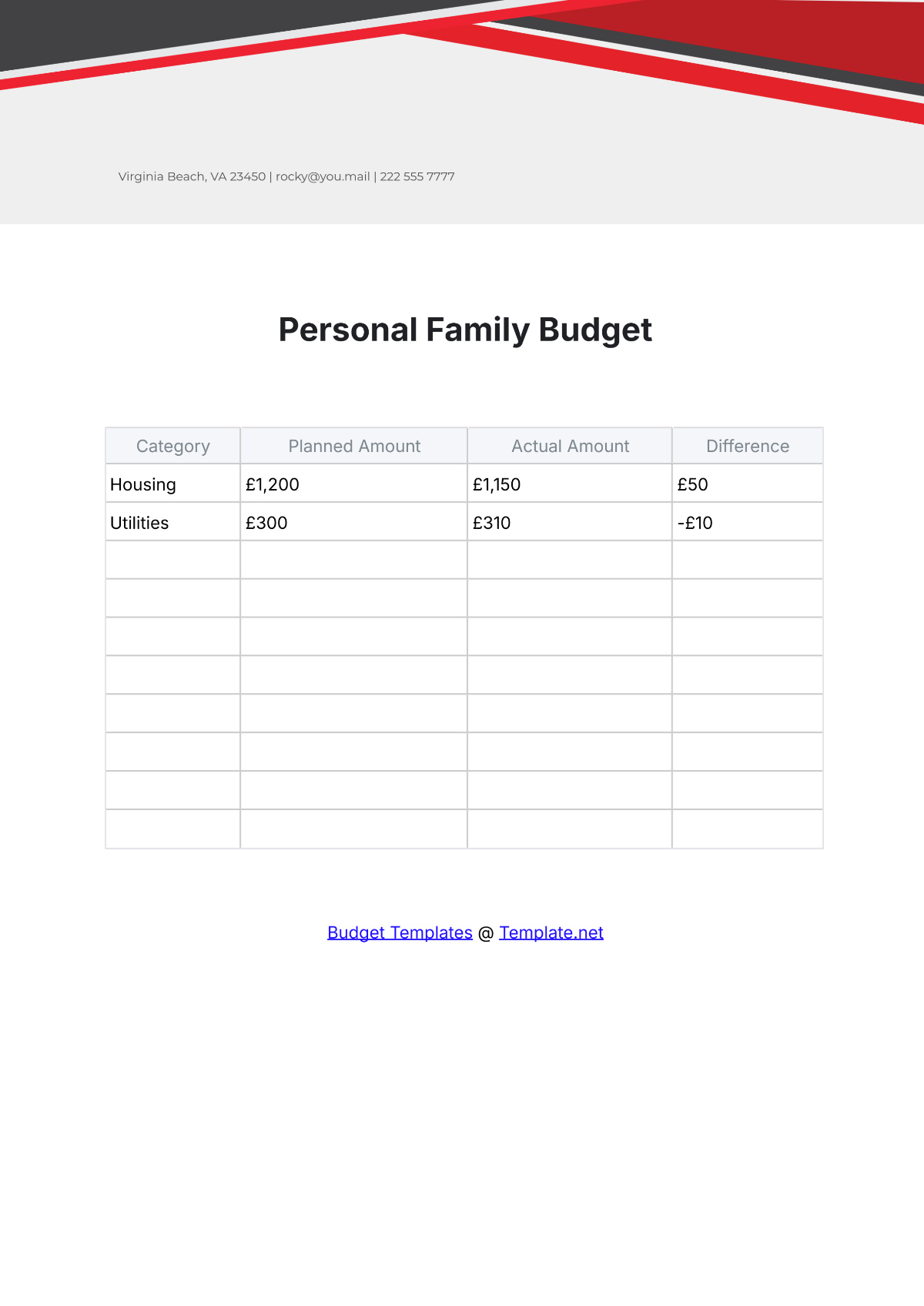

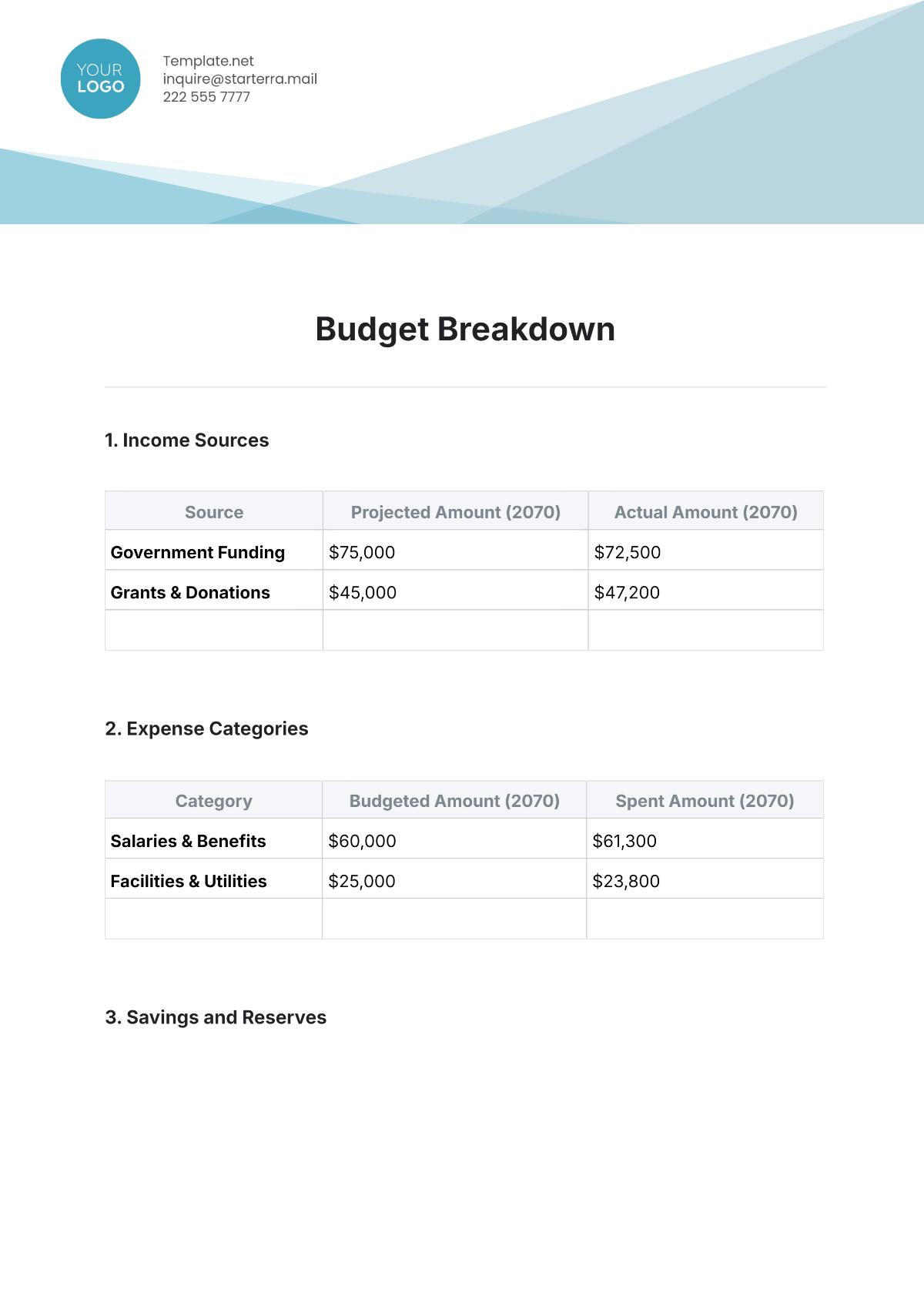

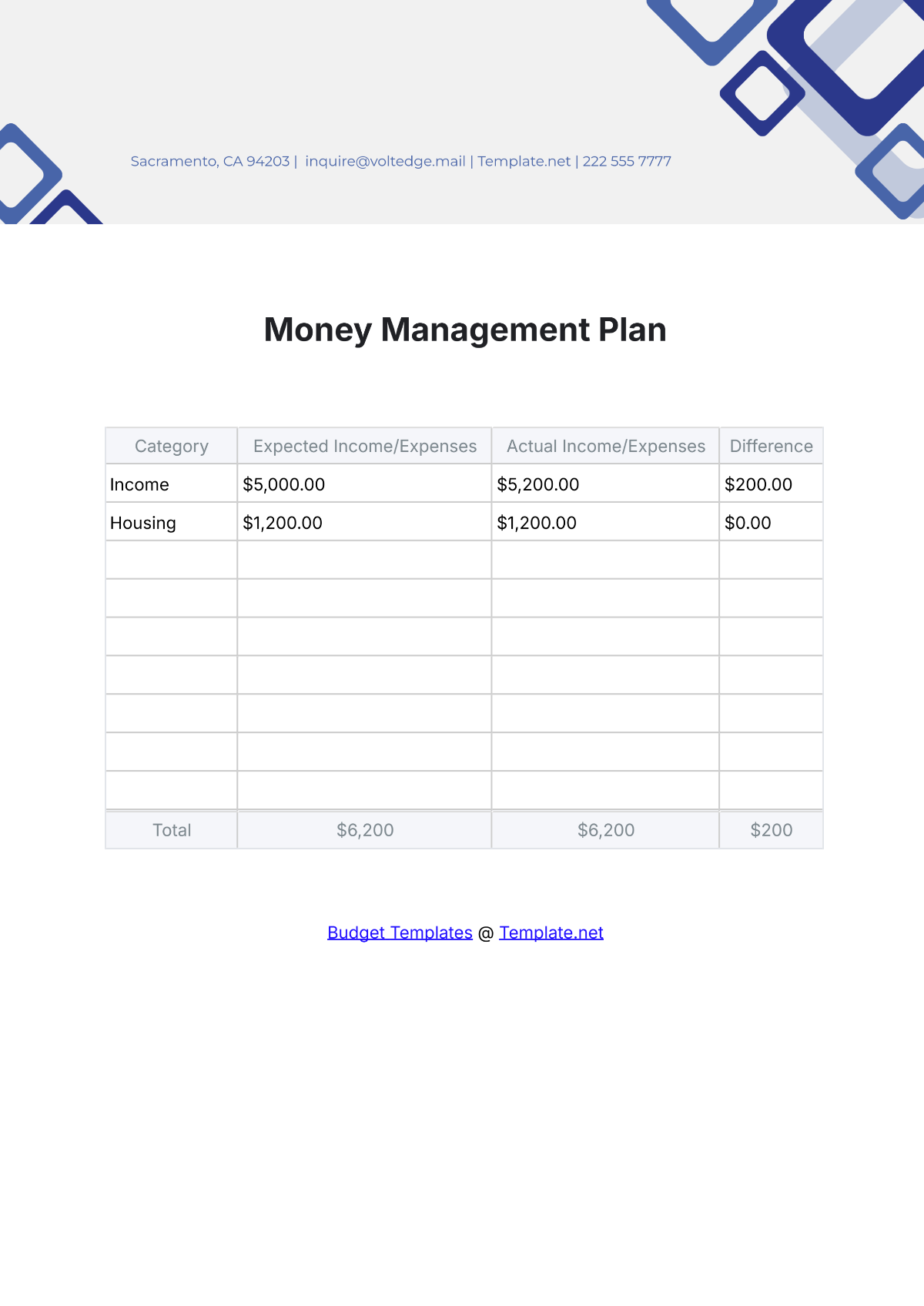

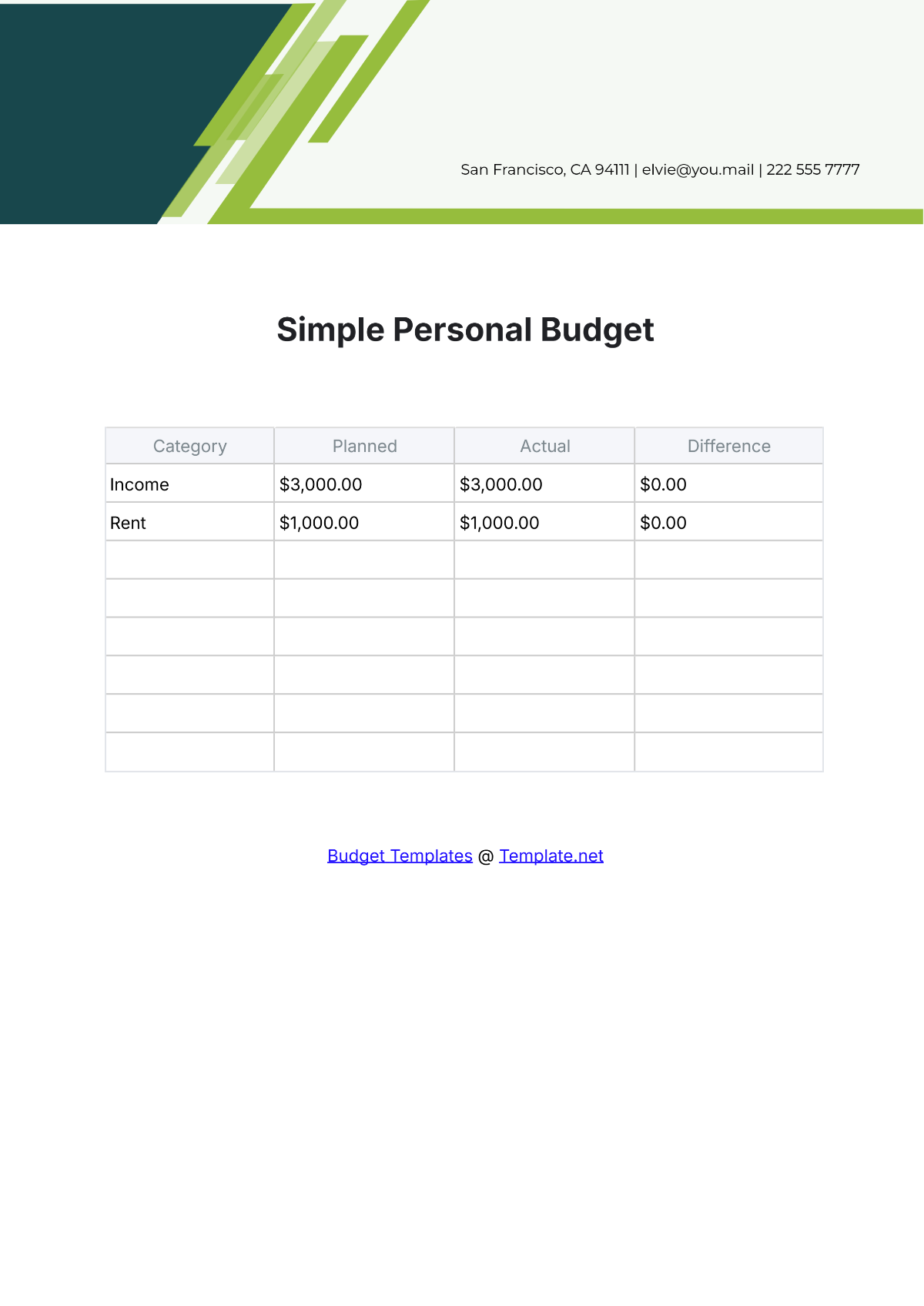

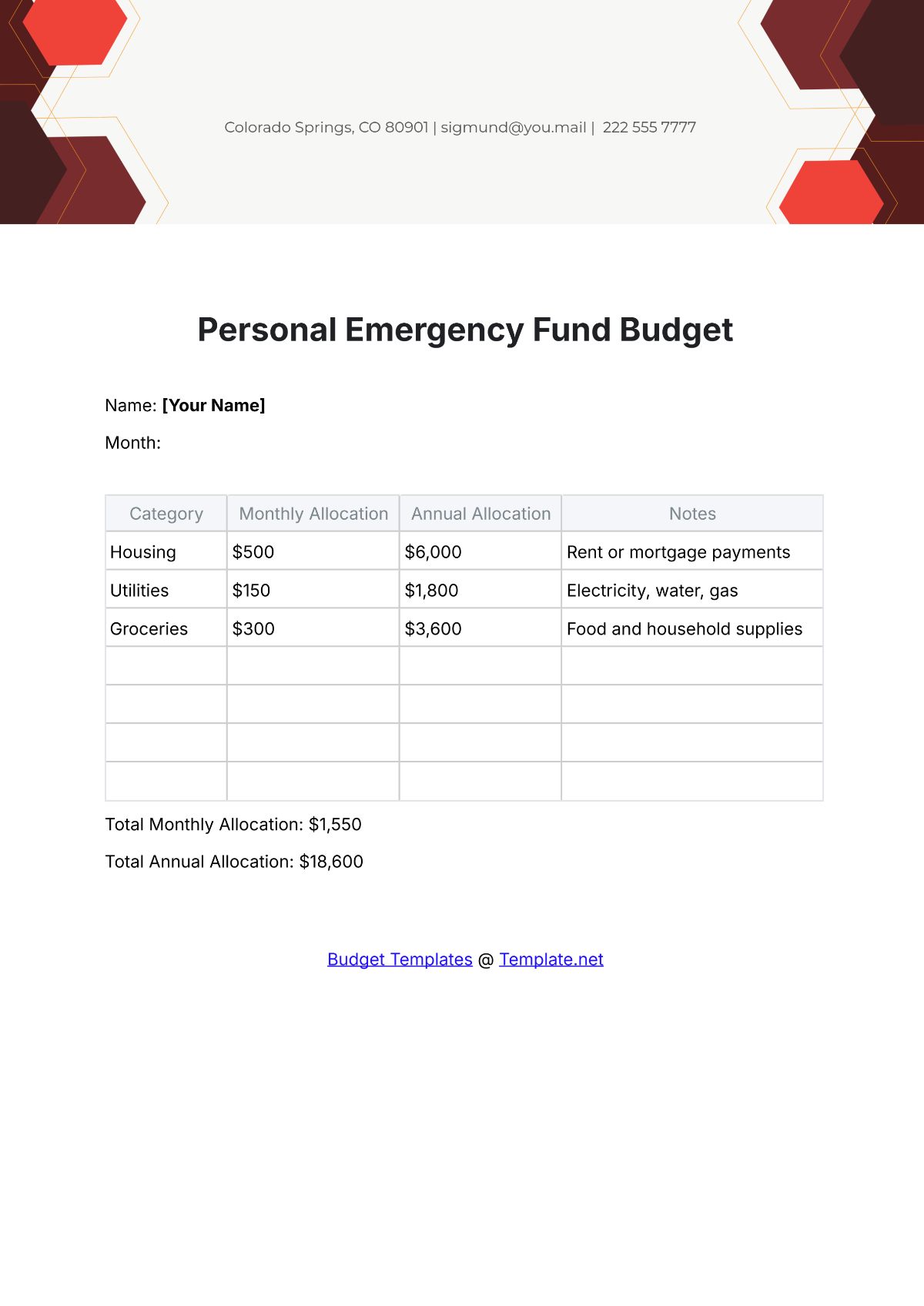

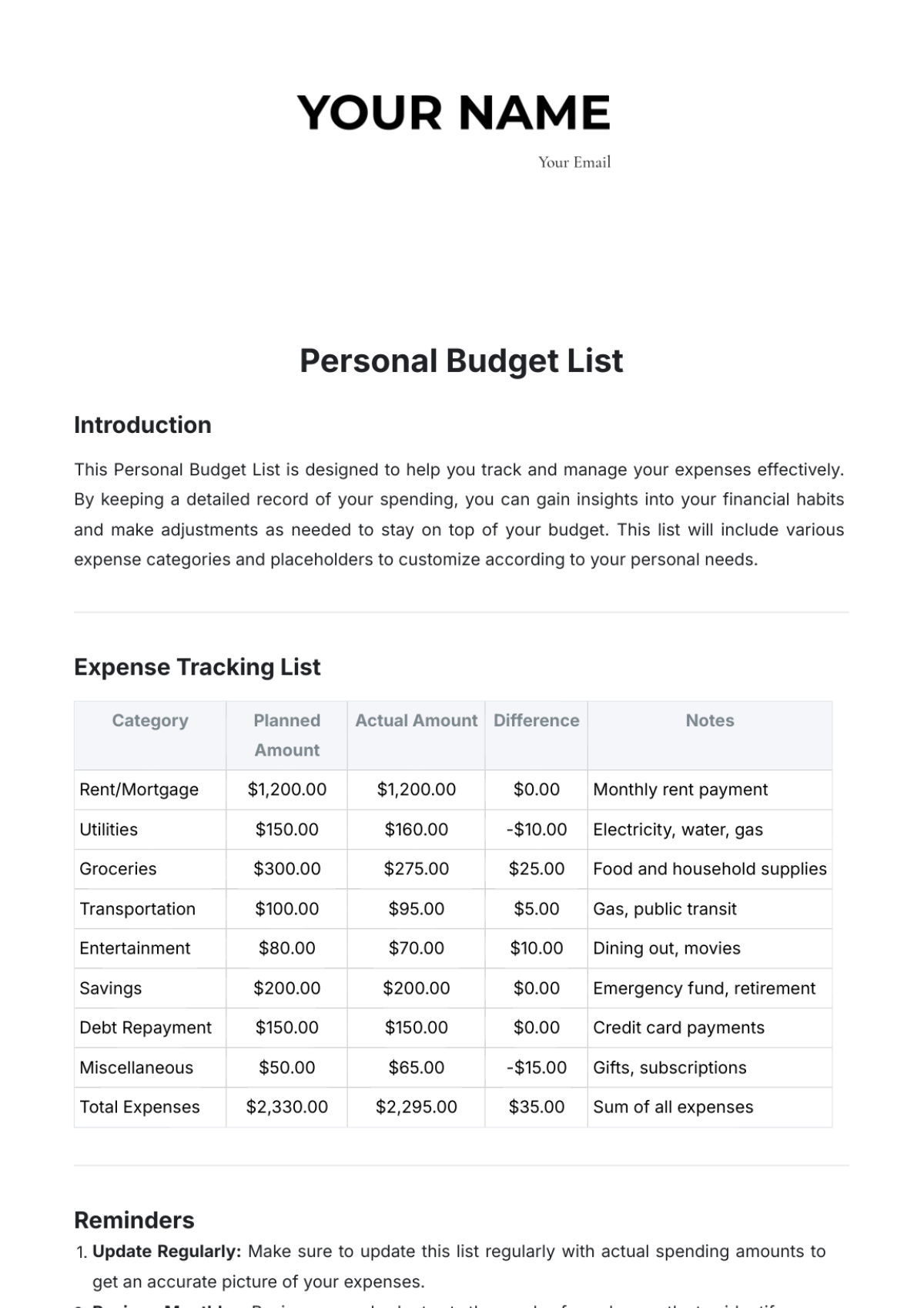

Budget Analysis

A thorough analysis of the budget allows for identifying discrepancies in income and spending. It helps in modifying habits to ensure income covers all expenses and leaves room for savings.

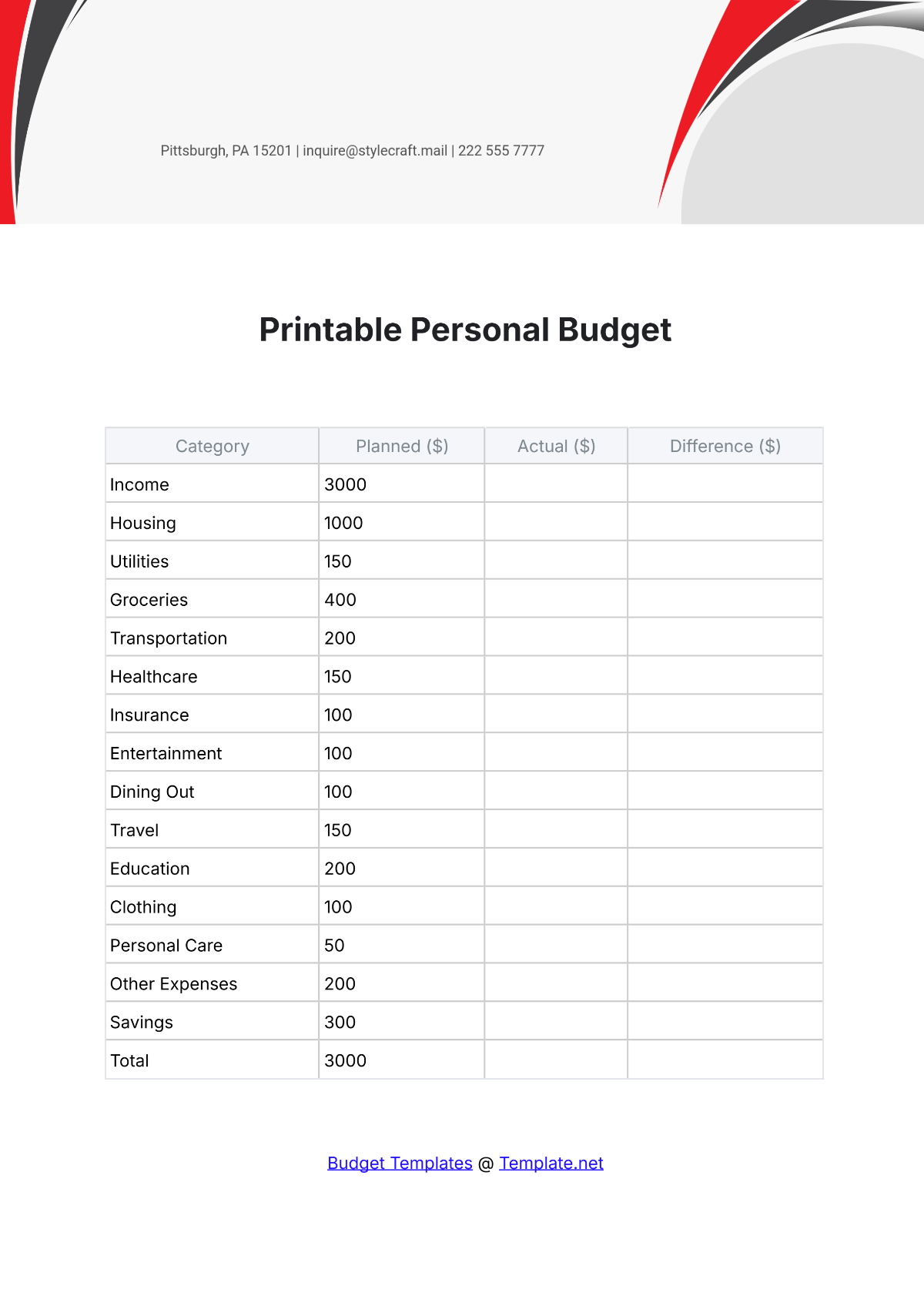

Budget Summary Table

Category | Planned Amount | Actual Amount | Difference |

|---|---|---|---|

Income | $5,000 | $5,200 | +$200 |

Fixed Expenses | $2,000 | $1,950 | +$50 |

Variable Expenses | $1,000 | $1,100 | -$100 |

Savings and Investments | $1,000 | $1,050 | +$50 |

Conclusion

Maintaining a personal budget summary sheet is crucial for financial management. By accurately documenting income, expenses, and savings, individuals are better equipped to make informed financial decisions, prioritize expenditures, and work towards their financial goals effectively.