Free Finance Budget Sustainability Study

TABLE OF CONTENTS

I. Financial Health Assessment

II. Revenue and Expenditure Analysis

A. Revenue Analysis

B. Expenditure Analysis

III. Risk and Opportunity Assessment

A. Market and Economic Risks

B. Opportunities for Growth

IV. Sustainability Evaluation

A. Long-Term Viability

B. Alignment with Strategic Goals

V. Recommendations and Action Plan

A. Strategies for Sustainable Growth Recommendations

B. Implementation Roadmap

VI. Conclusion

I. Financial Health Assessment

Current Financial Status

The financial status of [Your Company Name] currently stands on a robust foundation characterized by a healthy balance sheet. Our assets are well-diversified, ranging from liquid cash reserves to long-term investments, providing a buffer against unforeseen financial challenges. Liabilities, primarily in the form of short-term and long-term debts, are within manageable levels, maintaining a healthy debt-to-equity ratio. Revenue streams show a healthy mix, with a significant contribution from core business operations, supplemented by service income and returns from investments.

However, a detailed review of our expenditure patterns reveals a disproportionate allocation towards operational costs, including payroll, utilities, and maintenance, suggesting potential areas for cost optimization. Streamlining these operational expenses, without compromising on quality or efficiency, could free up resources for strategic reinvestments or bolstering our reserve funds.

Historical Financial Performance

Analyzing the financial performance of [Your Company Name] over the past five years presents a narrative of resilience and steady growth. Revenue figures have consistently trended upwards, though not without some variability reflective of changing market conditions and competitive pressures. Profitability margins have remained stable, underlining effective cost management and pricing strategies.

However, cash flow analyses bring to light certain challenges, particularly in the third and fourth quarters, where we observe tighter cash flows. This pattern suggests a seasonal impact on our business, necessitating a more strategic approach to cash flow management. Improved forecasting, coupled with proactive measures such as adjusting payment terms with suppliers or considering short-term financing options, could mitigate these seasonal strains. Understanding these historical financial trends is crucial in guiding our future financial planning, ensuring we build on our strengths and address any areas of vulnerability.

II. Revenue and Expenditure Analysis

This section provides a detailed analysis of [Your Company Name]'s revenue sources and expenditure patterns. Understanding these elements is crucial for identifying areas of strength and potential improvement, guiding strategic decisions to optimize financial performance.

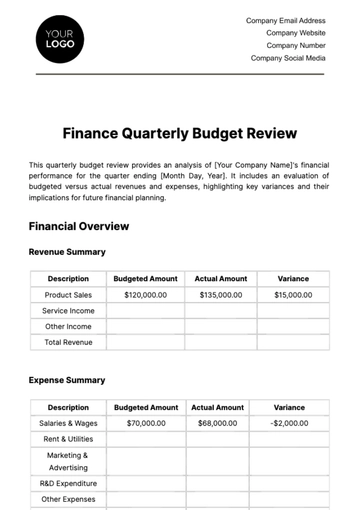

A. Revenue Analysis

Our primary revenue sources have shown resilience, with a consistent upward trajectory in sales. Service revenues are growing but at a slower pace. The analysis suggests exploring new markets or service areas to bolster this segment.

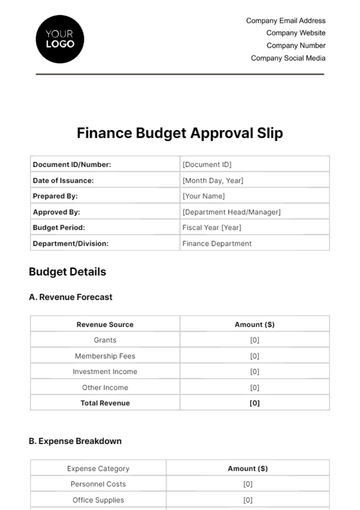

Revenue Source | Current Contribution | Trend Analysis | Growth Potential | Strategic Notes |

Product Sales | 50% | Steady increase | High | Expand product lines; explore new market segments |

Service Revenue | 20% | Slow growth | Moderate | Innovate service offerings; enhance customer experience |

Online Sales | 15% | Rapid increase | High | Invest in digital marketing; optimize e-commerce platform |

Licensing Fees | 10% | Stable | Moderate | Seek new licensing opportunities; expand IP portfolio |

Investment Returns | 5% | Variable | Low | Diversify investment portfolio; risk management |

B. Expenditure Analysis

Expenditure analysis reveals a high proportion of costs tied to production and marketing. While necessary, there is scope for efficiency improvements. Investment in technology has been moderate, which might limit future growth potential.

Expenditure Category | Percentage of Total Expenses | Cost Trend | Efficiency Opportunities | Strategic Actions |

Production Costs | 40% | Increasing | Automate processes; renegotiate supplier contracts | Invest in cost-effective technologies; lean management |

Marketing and Advertising | 25% | Steady | Optimize ad spending; focus on digital channels | Strategic marketing planning; target ROI analysis |

R&D Expenditure | 15% | Increasing | Prioritize high-impact projects | Streamline R&D processes; focus on innovation ROI |

Administrative Costs | 10% | Stable | Improve operational efficiencies | Automate administrative tasks; staff training |

Technology Investments | 10% | Moderate | Leverage emerging technologies | Increase investment in technology for long-term growth |

III. Risk and Opportunity Assessment

In this section, we evaluate the market and economic risks that [Your Company Name] might face and identify potential opportunities for growth. Understanding these risks and opportunities is vital for strategic planning and ensuring long-term sustainability.

A. Market and Economic Risks

Key risks include market volatility, especially in international markets, and potential economic downturns affecting consumer spending. Additionally, technological advancements in the industry pose a risk if not adequately addressed.

Risk Category | Likelihood | Potential Impact | Mitigation Strategies | Monitoring Indicators |

International Market Volatility | High | High | Diversify market presence; currency risk management | Global economic indicators, Currency exchange rates |

Economic Downturns | Medium | High | Build financial reserves; flexible cost structure | GDP growth rates, Consumer spending trends |

Technological Disruptions | High | Moderate | Invest in R&D; continuous innovation | Industry tech developments, Patent filings |

Regulatory Changes | Medium | Moderate | Regular compliance reviews; legal advisories | Regulatory announcements, Legal environment changes |

Competitive Pressure | High | High | Market differentiation; continuous improvement | Market share, Competitor analysis |

B. Opportunities for Growth

Opportunities identified include expansion into emerging markets, leveraging new technologies for product development, and enhancing digital marketing strategies to reach broader audiences.

Opportunity Area | Potential Impact | Realization Strategy | Growth Indicators |

Emerging Market Expansion | High | Market research; strategic partnerships | Market share in new regions, Sales growth |

Technology Utilization | High | Invest in new tech; staff training | Product innovation, Operational efficiency |

Digital Marketing | Moderate to High | Enhanced online presence; targeted campaigns | Online traffic, Conversion rates |

Product Diversification | High | R&D in new product lines; customer feedback | Sales diversification, Customer base expansion |

Sustainable Practices | Moderate | Adopt eco-friendly processes; green branding | Brand reputation, Regulatory compliance |

IV. Sustainability Evaluation

This section assesses the sustainability of [Your Company Name]'s financial strategy, focusing on its long-term viability and alignment with strategic business goals. The evaluation is essential for ensuring that the financial planning not only supports current operations but also positions the company for future growth and success.

A. Long-Term Viability

The current financial strategy at [Your Company Name] shows potential for long-term viability, but it hinges on our ability to adapt and evolve in response to changing market conditions. While our fundamental financial structure is sound, we must focus on mitigating risks associated with market volatility and economic fluctuations. The key to sustained growth lies in diversifying our market presence and investing more robustly in technology.

These investments will not only safeguard us against future disruptions but also enable us to stay competitive in a technology-driven business environment. Strategic diversification of our revenue streams, particularly in emerging markets and innovative product lines, will reduce our dependence on any single market or product, thereby enhancing our financial resilience.

B. Alignment with Strategic Goals

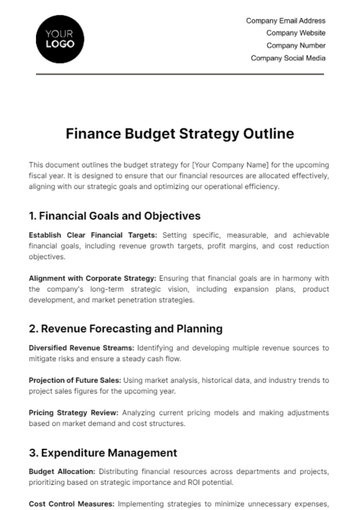

Our financial planning demonstrates a strong alignment with [Your Company Name]'s overarching strategic goals, particularly in achieving market leadership and fostering a culture of innovation. However, to fully realize these ambitions, a more focused approach is needed in certain areas. Increased investments in research and development (R&D) are crucial to drive innovation and maintain our competitive edge.

Similarly, accelerating our digital transformation efforts is vital to keep pace with the rapidly evolving technological landscape. By aligning our financial resources more closely with these strategic goals, we can ensure that our investments not only yield immediate financial returns but also contribute to the long-term strategic success and market positioning of [Your Company Name].

V. Recommendations and Action Plan

To secure the future growth and sustainability of [Your Company Name], this section outlines strategic recommendations and a detailed implementation roadmap. These are designed to enhance financial resilience, foster innovation, and ensure the company's adaptability to changing market conditions.

A. Strategies for Sustainable Growth Recommendations

Diversifying Revenue Streams: To mitigate risks associated with over-reliance on specific products, diversifying our revenue streams is crucial. This can be achieved by exploring new market segments, developing additional product lines, and expanding service offerings. Diversification will buffer the company against market fluctuations and ensure a steady revenue flow from multiple sources.

Increasing Investment in R&D: Investing more in research and development is essential for fostering long-term innovation and maintaining a competitive edge. This will involve allocating more resources to R&D activities, encouraging creative solutions, and staying ahead of industry trends.

Implementing Cost-Optimization Measures: Identifying and implementing cost-saving opportunities in production and operations will enhance our financial efficiency. This includes streamlining processes, adopting lean manufacturing principles, and leveraging technology for operational improvements.

B. Implementation Roadmap

This roadmap for [Your Company Name] outlines a strategic approach for implementing recommendations aimed at sustainable growth. Each phase is designed to build upon the previous one, ensuring a cohesive and effective execution of the plan.

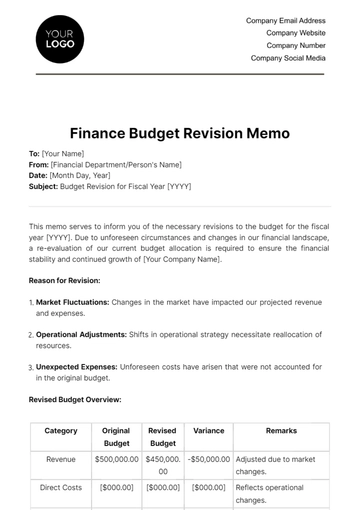

Timeframe | Key Actions | Objectives | Expected Outcomes |

Short-term (0-6 months) | Initiate cost-optimization projects in production and operations. Conduct market research for diversification opportunities. | Reduce unnecessary expenditures. Identify new market segments and product opportunities. | Improved financial efficiency. Strategic plan for revenue diversification. |

Medium-term (6-12 months) | Launch new marketing campaigns targeting current and potential markets. Incrementally increase the R&D budget allocation. | Enhance market presence and brand awareness. Foster innovation and development of new products/services. | Growth in market share and customer base. Pipeline of innovative products/services. |

Long-term (1-3 years) | Establish presence in new markets through partnerships and product launches. Continuously evaluate and adjust strategies based on market feedback and performance. | Expand market reach and diversify income sources. Adapt and refine strategies for sustained growth. | Strong foothold in new markets. Agile and responsive business model. |

VI. Conclusion

This Finance Budget Sustainability Study offers a holistic and detail-oriented assessment of the financial health of an organization. The integration of Financial Health Assessment, Revenue and Expenditure Analysis, Risk and Opportunity Assessment, and sustainability appraisal forms a comprehensive framework that beholds the business’s unique financial identity.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Unlock your financial sustainability potential with our Finance Budget Sustainability Study from Template.net. This customizable, professionally designed template is editable in our AI Editor Tool. Immerse yourself in financial clarity as you intuitively plot your path to monetary stability. Turbocharge your budget planning now with our solidly built, user-friendly tool.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising