Free Budget

Prepared by: [YOUR NAME]

Email: [YOUR EMAIL]

Managing your personal finances effectively is crucial for achieving your long-term financial goals. This budget template is designed to help you track your income and expenses, plan for savings, and ensure you stay on top of your financial health. Start by filling in the placeholders with your specific details to get a clear picture of your financial situation.

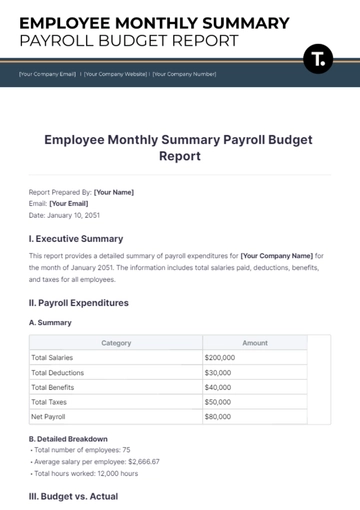

Income

Source | Amount | Frequency | Start Date | End Date |

|---|---|---|---|---|

Salary | $5,000 | Monthly | January 1, 2050 | December 31, 2050 |

Freelance Work | $1,500 | Monthly | January 1, 2050 | December 31, 2050 |

Investments | $500 | Quarterly | January 1, 2050 | December 31, 2050 |

Other Income | $200 | Annually | January 1, 2050 | December 31, 2050 |

Expenses

Category | Amount | Frequency | Start Date | End Date |

|---|---|---|---|---|

Rent/Mortgage | $1,500 | Monthly | January 1, 2050 | December 31, 2050 |

Utilities | $250 | Monthly | January 1, 2050 | December 31, 2050 |

Groceries | $400 | Monthly | January 1, 2050 | December 31, 2050 |

Transportation | $300 | Monthly | January 1, 2050 | December 31, 2050 |

Insurance | $200 | Monthly | January 1, 2050 | December 31, 2050 |

Entertainment | $150 | Monthly | January 1, 2050 | December 31, 2050 |

Savings | $500 | Monthly | January 1, 2050 | December 31, 2050 |

Miscellaneous | $100 | Monthly | January 1, 2050 | December 31, 2050 |

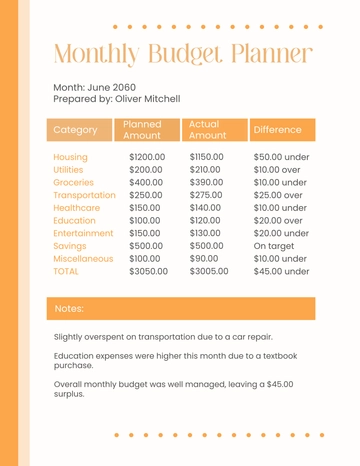

Summary

Category | Total Income | Total Expenses | Net Income |

|---|---|---|---|

Year 2050 | $7,200 | $3,900 | $3,300 |

Conclusion

Keeping track of your budget is a powerful way to manage your personal finances and achieve your financial goals. Regularly updating and reviewing your budget will help you stay disciplined and make informed financial decisions.

Reminders

Review your budget monthly to adjust for any changes in income or expenses.

Track all expenses to identify areas where you can cut costs.

Set realistic savings goals and ensure they are included in your budget.

Allocate funds for unexpected expenses to avoid financial strain.

Regularly update your budget with actual figures to see how well you are sticking to your plan.

Consider consulting a financial advisor for personalized advice.

Keep receipts and documentation for all transactions for accuracy.

Revisit your budget if you experience significant changes in income or expenses.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Manage your finances effortlessly with Template.net's Budget Template. This fully customizable and editable template simplifies budgeting, helping you stay on track. Use the AI Editor Tool to tailor it to your specific needs quickly. Perfect for personal or professional use, this template ensures clarity and control over your finances, making budgeting a breeze.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

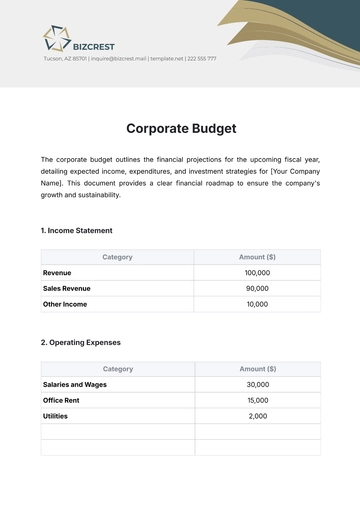

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

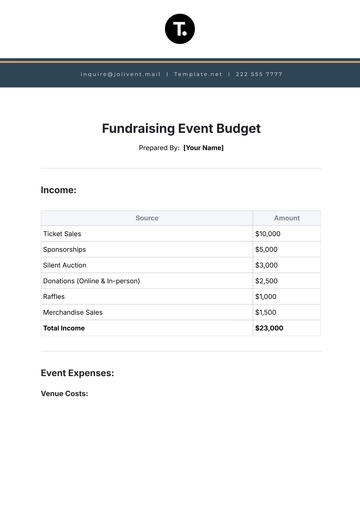

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising