Free Simple 50/30/20 Budget

Introduction

Congratulations on your new income! Crafting a well-structured 50/30/20 Budget is a smart way to ensure you manage your finances effectively and make the most of your increased earnings. This budget will help you maintain balance between your needs, wants, and savings, setting you up for financial success.

Budget Overview

Prepared by: [YOUR NAME]

Email: [YOUR EMAIL]

Income Allocation

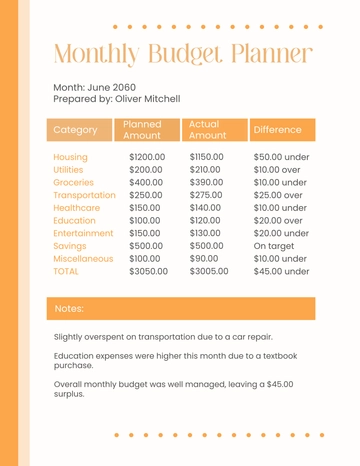

Category | Percentage | Amount |

|---|---|---|

Total Monthly Income | - | $4,000 |

50% Needs

Expense | Percentage | Amount |

|---|---|---|

Housing | 25% | $1,000 |

Utilities | 5% | $200 |

Groceries | 10% | $400 |

Transportation | 5% | $200 |

Insurance | 5% | $200 |

Total Needs | 50% | $2,000 |

30% Wants

Expense | Percentage | Amount |

|---|---|---|

Dining Out | 10% | $400 |

Entertainment | 10% | $400 |

Hobbies | 5% | $200 |

Non-Essential Shopping | 5% | $200 |

Total Wants | 30% | $1,200 |

20% Savings and Debt Repayment

Expense | Percentage | Amount |

|---|---|---|

Emergency Fund | 10% | $400 |

Retirement Savings | 5% | $200 |

Debt Repayment | 5% | $200 |

Total Savings and Debt | 20% | $800 |

Conclusion

Using the 50/30/20 Budget is a fantastic way to effectively allocate your new income, ensuring that your essential needs are met, you have room for enjoyment, and you’re also saving for the future. Stick to this budget to maintain financial health and achieve your financial goals.

Reminders

Regularly review and adjust your budget as your income or expenses change.

Track your spending to ensure you stay within the allocated percentages.

Reassess your savings goals periodically to stay on target.

Keep an eye on your discretionary spending to avoid overspending in the "Wants" category.

Consider setting up automatic transfers for savings and debt repayment to simplify your budgeting process.

Use financial tools or apps to help monitor your budget effectively.

Plan for occasional large expenses by setting aside extra funds in your budget.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Master your finances effortlessly with the Simple 50/30/20 Budget Template from Template.net. This fully customizable and editable budget tool is designed to help you manage your income and expenses with ease. Utilize the AI Editor Tool for a seamless, personalized experience that adjusts to your financial goals. Optimize your budget strategy today.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

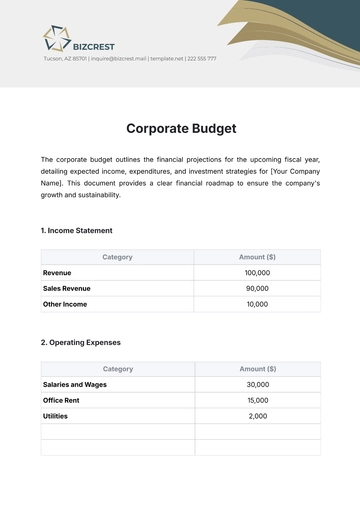

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

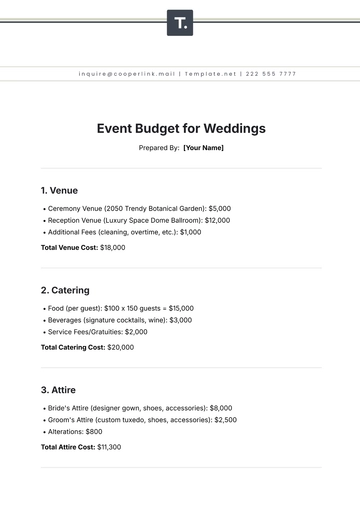

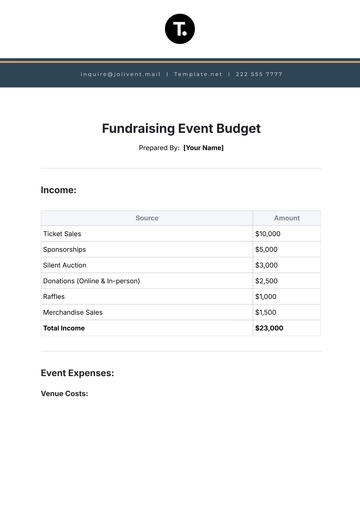

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising