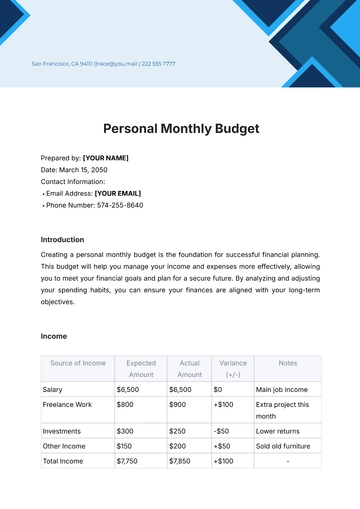

Free Personal Monthly Budget

Prepared by: [YOUR NAME]

Date: March 15, 2050

Contact Information:

Email Address: [YOUR EMAIL]

Phone Number: 574-255-8640

Introduction

Creating a personal monthly budget is the foundation for successful financial planning. This budget will help you manage your income and expenses more effectively, allowing you to meet your financial goals and plan for a secure future. By analyzing and adjusting your spending habits, you can ensure your finances are aligned with your long-term objectives.

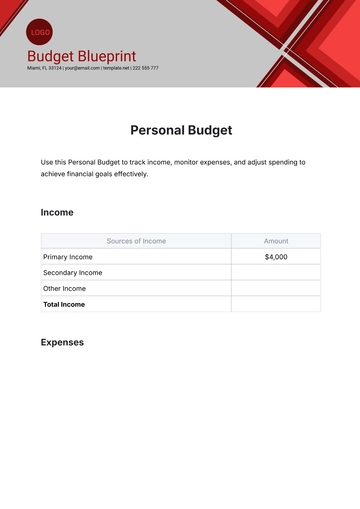

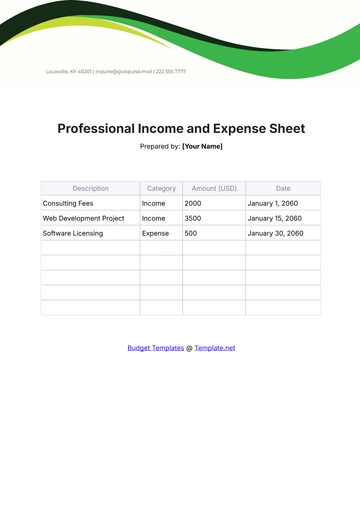

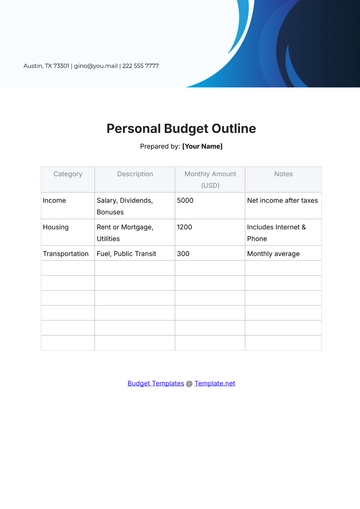

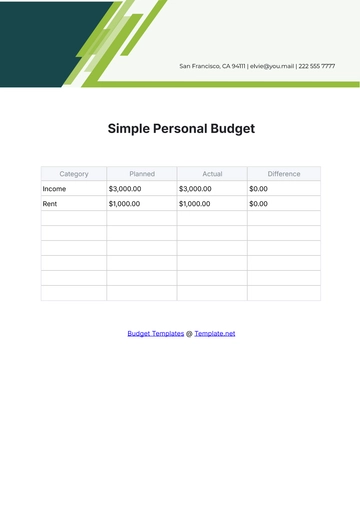

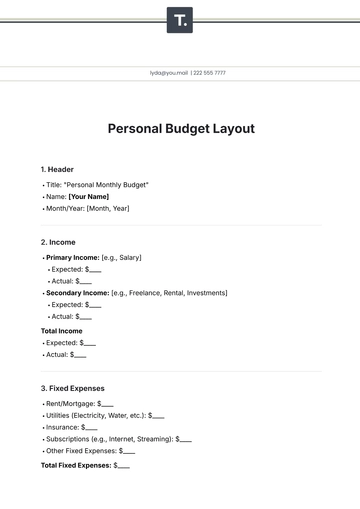

Income

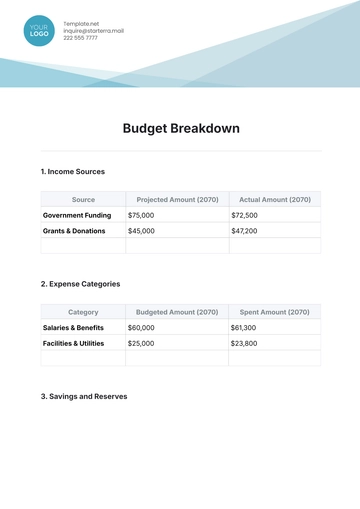

Source of Income | Expected Amount | Actual Amount | Variance (+/-) | Notes |

|---|---|---|---|---|

Salary | $6,500 | $6,500 | $0 | Main job income |

Freelance Work | $800 | $900 | +$100 | Extra project this month |

Investments | $300 | $250 | -$50 | Lower returns |

Other Income | $150 | $200 | +$50 | Sold old furniture |

Total Income | $7,750 | $7,850 | +$100 | - |

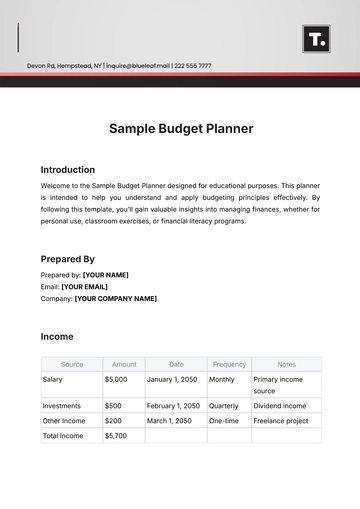

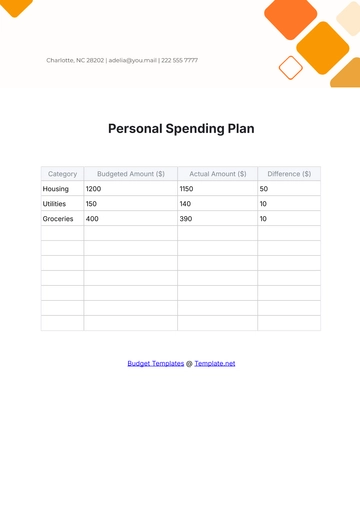

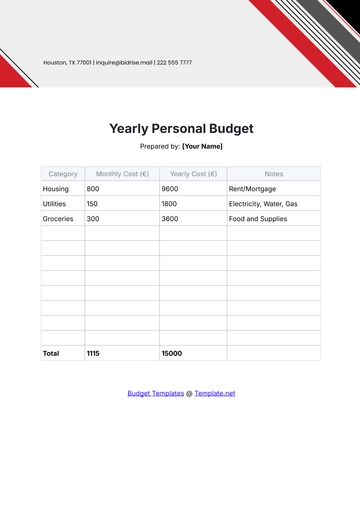

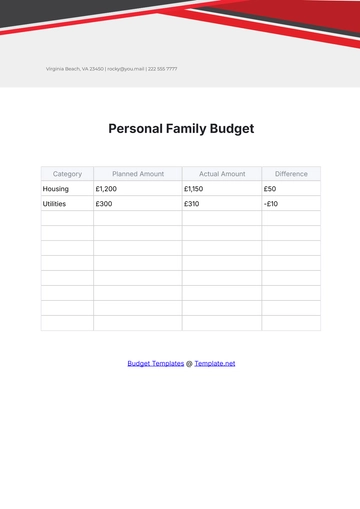

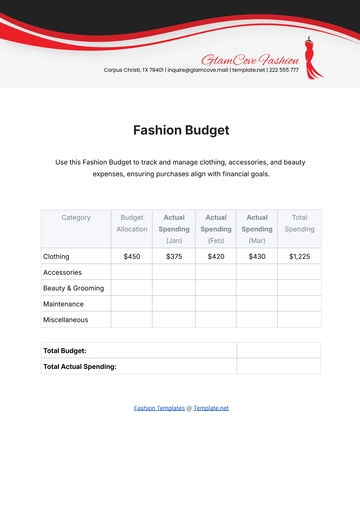

Expenses

Expense Category | Budgeted Amount | Actual Amount | Variance (+/-) | Notes |

|---|---|---|---|---|

Housing (Rent/Mortgage) | $2,000 | $2,000 | $0 | Apartment rent |

Utilities | $350 | $320 | -$30 | Lower utility bills |

Groceries | $500 | $550 | +$50 | Stocked up on sales |

Transportation | $300 | $280 | -$20 | Less travel |

Entertainment | $200 | $150 | -$50 | Stayed in more |

Insurance | $250 | $250 | $0 | Health & auto |

Debt Repayment | $400 | $400 | $0 | Credit card debt |

Savings & Investments | $1,000 | $1,000 | $0 | Monthly savings |

Total Expenses | $5,000 | $4,950 | -$50 | - |

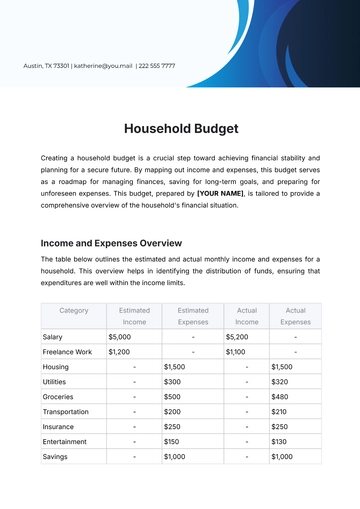

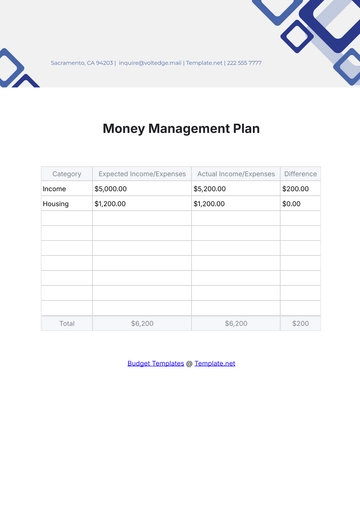

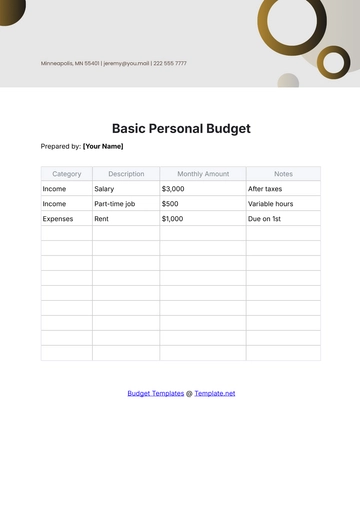

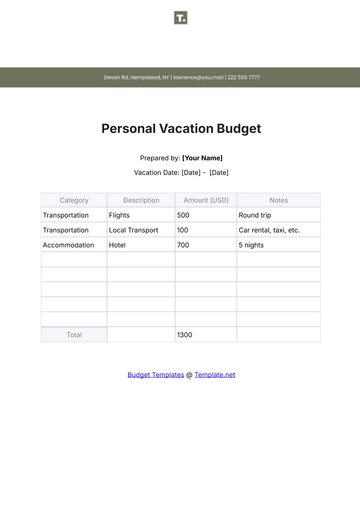

Summary

Category | Amount | - | - |

|---|---|---|---|

Total Income | $7,750 | $7,850 | +$100 |

Total Expenses | $5,000 | $4,950 | -$50 |

Net Balance | $2,750 | $2,900 | +$150 |

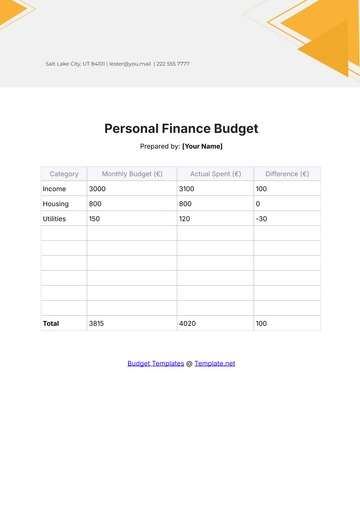

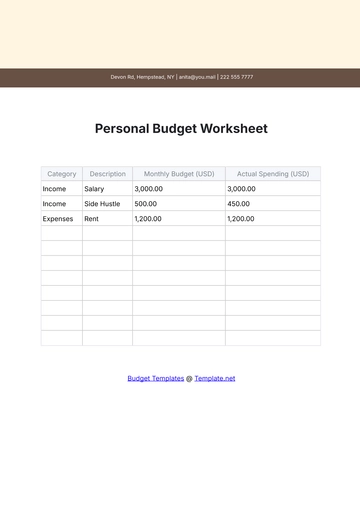

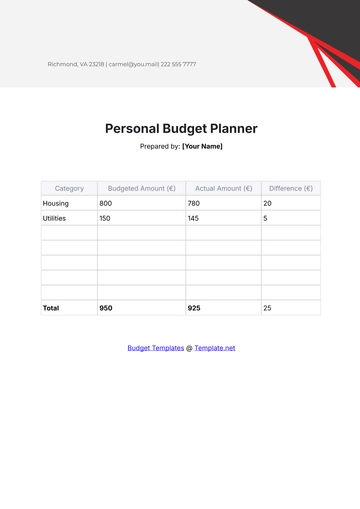

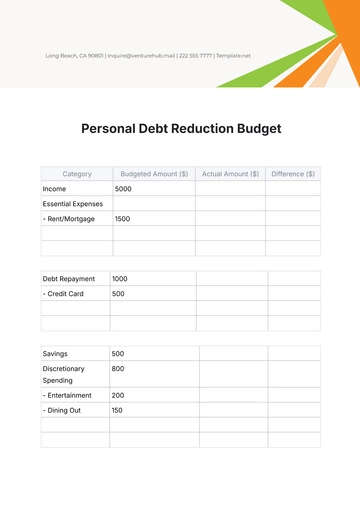

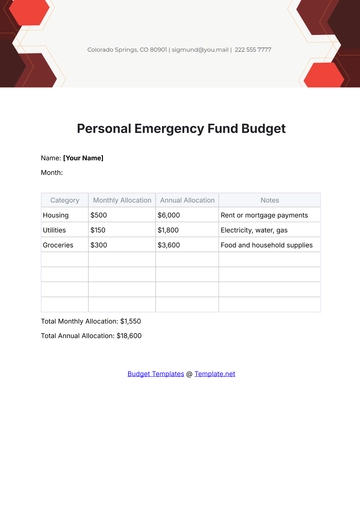

Financial Goals

Emergency Fund: Save at least $1,000 each month until a 6-month emergency fund is established.

Debt Reduction: Pay an additional $100 towards credit card debt to accelerate payoff.

Retirement Savings: Allocate $200 monthly to a retirement account to ensure a secure future.

Investment Growth: Invest $100 monthly in a diversified portfolio for long-term wealth building.

Reminders

Track Your Spending: Regularly update your actual spending to stay on top of your financial health.

Adjust as Needed: Life changes, and so should your budget. Adjust categories if you notice consistent variances.

Review Monthly: Take time at the end of each month to review your budget and plan for the next month.

Emergency Fund: Aim to have at least three to six months of living expenses saved in an easily accessible account.

Stay Disciplined: Sticking to your budget will help you achieve your financial goals faster.

Conclusion

By maintaining this personal monthly budget, you take a proactive step towards achieving financial stability and long-term prosperity. Effective financial planning requires consistent tracking, disciplined spending, and regular evaluation of your financial goals. Use this budget as a guide to help you make informed financial decisions and stay on the path to a secure future.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Take control of your finances with the Personal Monthly Budget Template from Template.net. This customizable and editable template is designed to help you manage your expenses effortlessly. With the integrated AI Editor Tool, you can tailor your budget to fit your unique needs. Optimize your spending and savings strategy today.

You may also like

- Budget Sheet

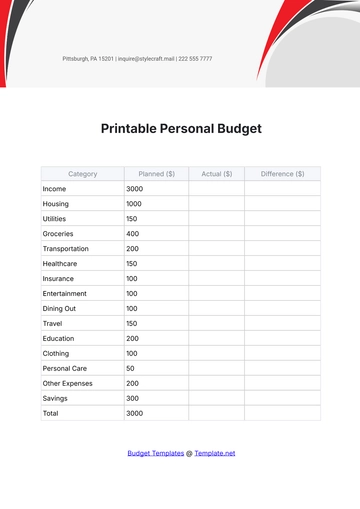

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

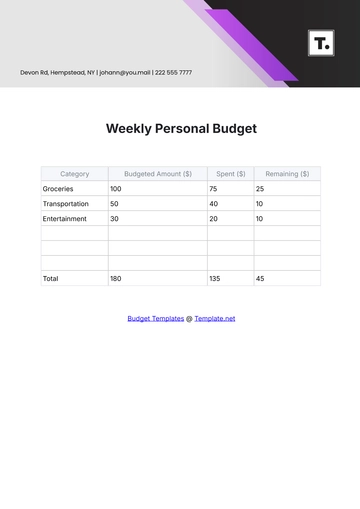

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

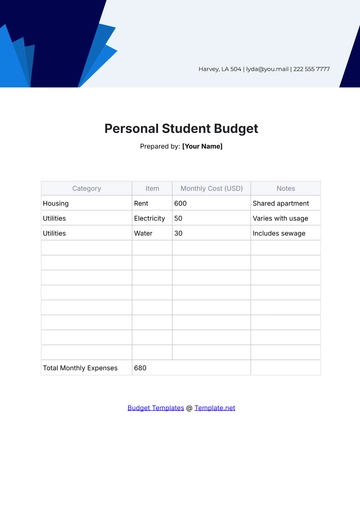

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising