Free Charity Budget

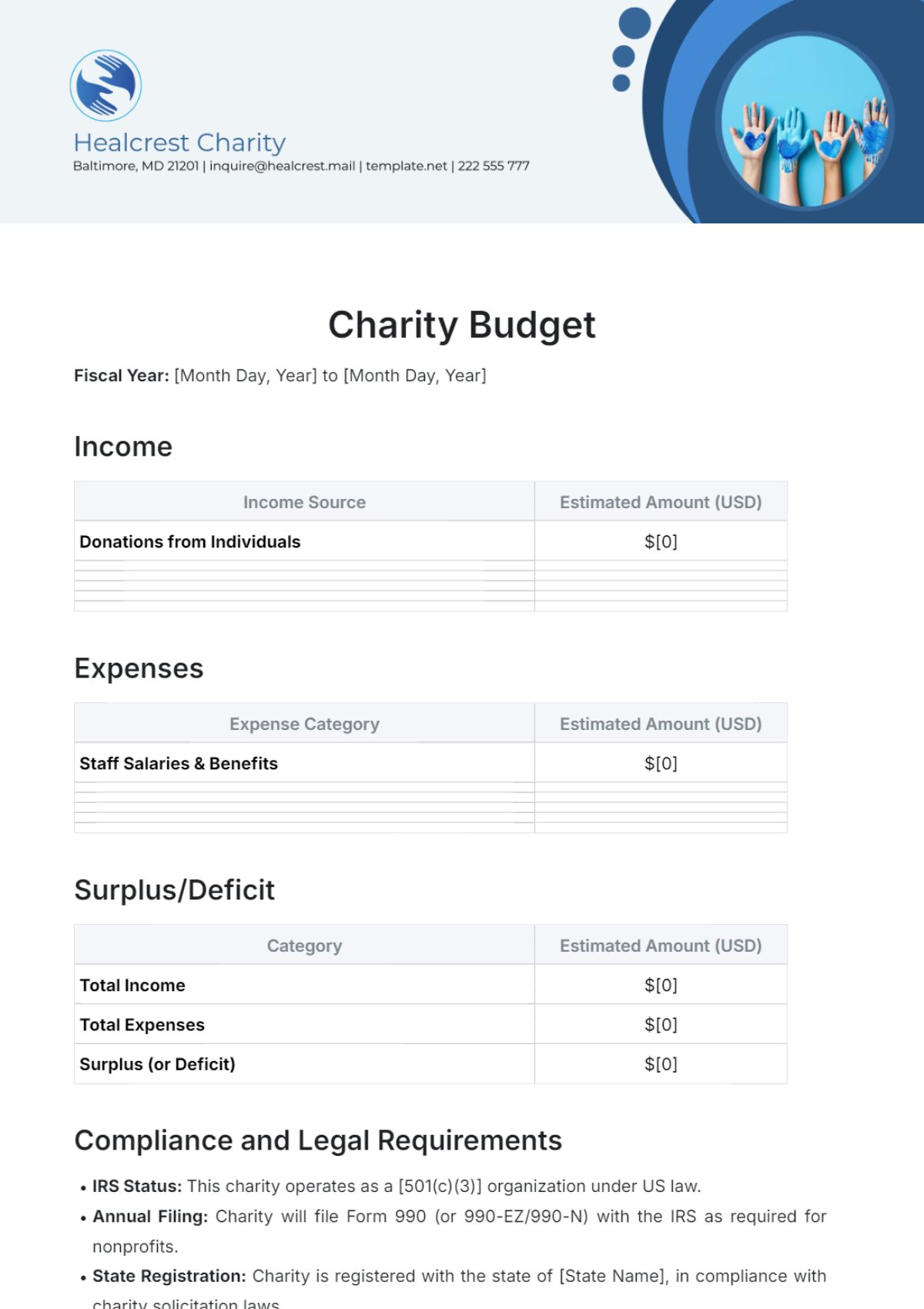

Fiscal Year: [Month Day, Year] to [Month Day, Year]

Income

Income Source | Estimated Amount (USD) |

|---|---|

Donations from Individuals | $[0] |

Expenses

Expense Category | Estimated Amount (USD) |

|---|---|

Staff Salaries & Benefits | $[0] |

Surplus/Deficit

Category | Estimated Amount (USD) |

|---|---|

Total Income | $[0] |

Total Expenses | $[0] |

Surplus (or Deficit) | $[0] |

Compliance and Legal Requirements

IRS Status: This charity operates as a [501(c)(3)] organization under US law.

Annual Filing: Charity will file Form 990 (or 990-EZ/990-N) with the IRS as required for nonprofits.

State Registration: Charity is registered with the state of [State Name], in compliance with charity solicitation laws.

Fundraising Licenses: Appropriate fundraising licenses have been acquired for all fundraising events and campaigns.

Financial Audits: Annual audits will be conducted by a certified public accountant if required (over $500,000 annual income for certain states).

Notes & Assumptions

Donation Assumptions: Based on historical data and upcoming campaigns.

Program Funding: Expenses reflect current plans, but may change based on funding availability or program expansion.

Administrative Overhead: Target is to keep administrative expenses under 15% of total income, following best practices for nonprofit efficiency.

Prepared by:

[Your Name]

[Your Name]

[Your Company Name]

[Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Manage your finances efficiently with the Charity Budget Template from Template.net. This editable and customizable document provides a structured format for tracking income, donations, and expenses, ensuring transparent and effective financial planning. Fully editable in our Ai Editor Tool, it allows you to tailor the budget to fit your charity’s specific needs, supporting responsible financial management and informed decision-making.

You may also like

- Budget Sheet

- Personal Budget

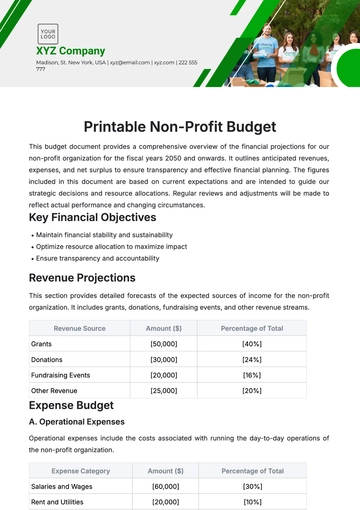

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising